11th Annual Software Users Survey: Caution lingers

Our new reader survey reveals a cautious approach to supply chain software investment and some lingering uncertainty over the place cloud computing will hold in the greater supply chain solution hierarchy.

According to the findings of Logistics Management’s 11th Annual Software User Survey, more shippers are scrutinizing their investments, moving forward cautiously, and upgrading existing solutions versus acquiring new software packages.

Conducted annually by Peerless Research (PRG), the survey explores intentions of Logistics Management readers regarding supply chain software, the key solutions they’re using and considering, and offers insight into how their habits and intentions have changed in the past two years.

Over the next few pages, we’ll look at the results of this year’s survey, identify how shippers are allocating their budgets in 2014, and talk to two analysts about their observations on the current adoption of supply chain software and where it’s headed.

Wanted: More visibility, fewer disruptions

Shippers may say they’re focused on improving supply chain visibility and avoiding potential disruptions in their end-to-end supply chains, but those efforts have yet to show up in their companies’ software acquisition strategies.

More than 50 percent of survey respondents say that their use of supply chain software has stayed the same for the last two years, while 45 percent cite an increase. About 70 percent of firms have been using the same software packages for the last two years, while 26 percent are now using more than they were in 2012.

Those companies that have added software to their arsenals over the last two years say that they’ve been able to win new business, improve inventory controls, and gain better transportation visibility as a result.

When asked why they aren’t using more solutions, respondents largely blamed the presence of disparate systems and integration challenges for curtailing their software investments. “It’s interesting to see a common theme around integration challenges,” says Belinda Griffin, global supply chain executive program manager at Capgemini Consulting.

According to Griffin, the problem can become especially onerous for companies that take a piecemeal approach to software adoption. In such cases, she says that companies look at their existing technology footprints and decide to either replace one aspect of those footprints or add something new on top of them.

“The plus side is that this approach costs less than ripping everything out and doing a greenfield deployment,” says Griffin. “The downside is that you’re going to deal with integration challenges.”

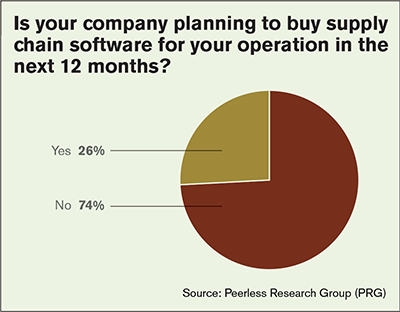

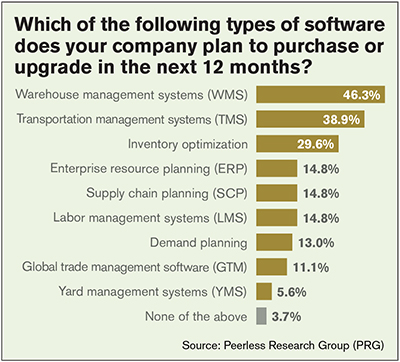

According to the survey, just 26 percent of shippers plan to buy supply chain software in the next 12 months, while 74 percent say their firms have no such intentions. Warehouse management systems (WMS/46 percent), transportation management systems (TMS/39 percent), and inventory optimization applications (30 percent), rank as the top three solutions that the 26 percent are planning to purchase or upgrade.

Of those firms currently using or planning to upgrade enterprise resource planning (ERP) software, 78 percent say it will include WMS and 56 percent say it will include TMS.

Dwight Klappich, Gartner’s research vice president, says he’s also seeing this “good enough” attitude among shippers that don’t necessarily need all of the full features and functions associated with best-of-breed WMS and TMS. “We’re seeing a growing trend towards shippers using ERPs from Oracle, SAP, or Infor, for certain logistics components,” says Klappich. “They’re basically saying ‘good enough is good enough’ when investing in ERP systems that come with their own versions of TMS and WMS.”

From their WMS, the survey found that most shippers want real-time control (65 percent), inventory deployment (50 percent), and labor management (46 percent). When purchasing TMS, companies are looking for routing and scheduling (73 percent), routing and rating (68 percent), carrier selection and load tendering (55 percent), and shipment consolidation capabilities (55 percent).

In terms of supply chain planning (SCP) as a whole, shippers invest in software in order to gain better inventory visibility (56 percent), order management (56 percent), and demand planning (56 percent).

Cloudy skies

For the survey, Logistics Management also asked respondents about their use of cloud computing options in the supply chain software space.

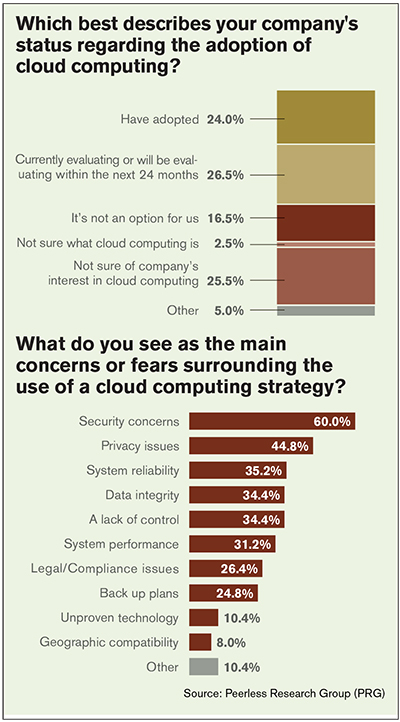

Twenty-seven percent of shippers say they’re currently evaluating cloud options or that they plan to do so within the next 24 months; 26 percent say they’re not sure if their companies are interested in cloud computing; and 24 percent have already adopted such solutions.

Another 17 percent checked the “it’s not an option for us” choice when asked about their cloud computing intentions. Security concerns, privacy issues, system reliability, and data integrity topped shippers’ lists of cloud-related concerns.

In reviewing the results of the past year’s results, Griffin says that there’s been very little change year-over-year in the number of shippers that are considering or using cloud supply chain solutions.

So, while the cloud has clearly changed the way individual users acquire and integrate software and data storage in the mainstream, the supply chain sector has largely remained a traditional purchase-and-install environment. A combination of security concerns and heightened sensitivity around privacy in the wake of several highly publicized data breaches, have made shippers wary of “putting it all out there” in the cloud.

“We’re of course seeing this more in the financial systems arena, but there’s probably also a spillover effect that’s pushed companies to consider the vulnerabilities of cloud computing,” says Griffin-Cryan, who has tracked a 6 percent positive shift among firms that are planning to purchase a cloud solution and those that have actually adopted it.

“At this point you can basically divide the universe into two halves: those that are dead set against cloud and those that are open to it,” says Griffin. “Of those that are open to it, we’re seeing a higher percentage move off the fence and actually put in cloud-based solutions.”

Show me the money

In assessing their software budgets for the next 12 months, 52 percent of survey respondents plan to spend less than $99,999 on supply chain software (including license, integration, and training), while another 23 percent say they’ll shell out between $100,000 and $499,999. Nine percent of companies will spend $1 million to $1.9 million, and another 8 percent have budgets of $500,000 to $999,999 for software investment.

When gauging expected return on investment (ROI) from their supply chain software, 67 percent of shippers say that they perform analyses to determine that ROI, while 33 percent say that they don’t. The largest portion of shippers expect ROI in 12 months to 18 months (39 percent), while 29 percent say 6 months to 12 months, and 23 percent cite more than 18 months as their expected payback timeframe.

The majority of companies (55 percent) are handling integrations in-house, while 19 percent are turning to their software suppliers, and 14 percent are using systems integrators.

According to this year’s results, most shippers (84 percent) are using buying teams to make supply chain software purchase decisions, with another 16 percent saying that they rely on one individual to handle the task. In most cases, individuals from corporate management (69 percent), warehousing, distribution, and logistics (62 percent), and purchasing (56 percent), fill out those buying teams and make the decisions.

When acquiring software, logistics professionals say that compatibility with existing systems, configurability, service and support, right features for the operations, the supplier’s financial stability, and ease of installation are all “very important” factors.

Room for improvement

The national economy may be closely creeping back up to affable levels, but that doesn’t mean companies’ technology purse strings are loosening yet.

In fact, Klappich says a common theme across this year’s users study is “replacing or upgrading what’s already there, versus focusing on new and more innovative investments.” This frugal mindset may give way to different approaches as the economy continues to improve, but for now it’s the name of the game.

“We’re definitely seeing more companies double down on the supply chain software they’ve already invested in,” says Klappich.

Shippers are also looking for more value-added opportunities—or, ways to enhance their existing systems without having to invest in new solutions or infrastructure. Expect this interest in software optimization to continue, says Klappich, particularly in areas like WMS and TMS, where many shippers are only using the systems’ basic functions.

In reviewing respondents’ individual survey comments, Klappich zeroed in on the fact that many shippers are concerned about a lack of IT talent and support. “This is the first time I’ve seen anyone call out the fact that IT talent is a challenge,” says Klappich, “and it’s likely because that type of talent is in demand right now across the board. Shippers are feeling the impact of that dearth.”

Finally, Klappich says that the survey revealed distrust, dishonesty, and a lack of communication between users and software vendors. He says the fact that supply chain software vendors have in some cases moved away from offering flexible applications could be driving some of that disenchantment with their offerings and service levels.

“At this point, it looks like some customers just don’t feel like they always have open and honest lines of communication with their vendors when conveying information around schedule delays, for example,” says Klappich. “We’re hearing the same thing from the companies that we work with, and it’s an area that could use some improvement.”

Article Topics

Latest in Logistics

Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources