2011 Q4Q Winners: 3PL

Latest Logistics News

Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains More 3PL

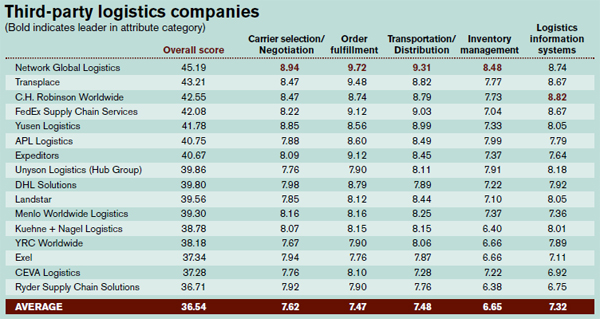

Source: Logistics Management, Peerless Media Research Group

Back on the rise

According to our reporting over the past eight months, the third-party logistics (3PL) industry is surging again after seeing flat growth in the heart of the Great Recession.

However, those closest to the 3PL market agree that this growth trend could reach a plateau in the coming years due to a number of looming economic uncertainties, not the least of which is the price of oil—which could, in fact, send global trade numbers tumbling and increase domestic and cross-border moves.

But, for the time being, the 3PL market is enjoying a resurgence. According to Armstrong & Associates’ most recent market analysis, revenues and profitability increased over the course of 2010 in all four of 3PL segments it covers. Gross revenue increases ranged from 12.9 percent to 30.1 percent and were up 19.4 percent overall from 2009, while overall net income increased 23.4 percent in 2010 over 2009 levels.

In fact, Armstrong analysts say that 2009 was the only negative growth year since the firm began tracking the results in 1995. While the latest numbers are very encouraging, the market needs to keep in mind that 2009 was a bad a year for just about every player in logistics and transportation services.

Improved global trade has certainly had a lot to do with the improved numbers, yet market analysts also contend that domestic and cross-border activity is a key driver to current 3PL growth—and could become an even bigger part of the 3PL services market as more U.S.-based multinationals consider shifting sourcing strategies closer to home.

And while shippers are considering new global and domestic networks, we can be sure that the 3PLs making the grade on our list below will most certainly be part of the strategy. This year, the readers of Logistics Management have voted 16 3PLs into the 2011 Quest for Quality winners’ circle.

Leading our list of providers this year is first-time winner Network Global Logistics with an impressive weighted average of 45.19. Network also took top spot in four of the five attribute categories, scoring 8.94 in Carrier Selection/ Negotiation, 9.72 in Order Fulfillment, 9.31 in Transportation/Distribution, and 8.48 in Inventory Management. C.H. Robinson posted a 8.82 in Information Systems to lead the pack in this increasingly important category.

It’s interesting to note that only six out of this year’s 16 are repeat winners from our 2010 results. Making the cut after missing last year are Network Global, C.H. Robinson, Yusen Logistics (41.78), Expeditors (40.67), DHL Solutions (39.80), Landstar (39.56), Menlo Worldwide (39.30), Kuehne + Nagel Logistics (38.78), YRC (38.18), and CEVA Logistics (37.28).

Repeating this year are second best weighted average scorer Transplace (34.21), FedEx Supply Chain Services (42.08), APL Logistics (40.75), Unyson Logistics (39.86), Exel (37.34), and Ryder Supply Chain Solutions (36.71). This year marks the third year in a row for Ryder, FedEx, and Exel.

2011 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL |  home page |

Article Topics

3PL News & Resources

Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline More 3PLLatest in Logistics

Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources