2011 Q4Q Winners: OCEAN CARRIERS

Latest Logistics News

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week More News

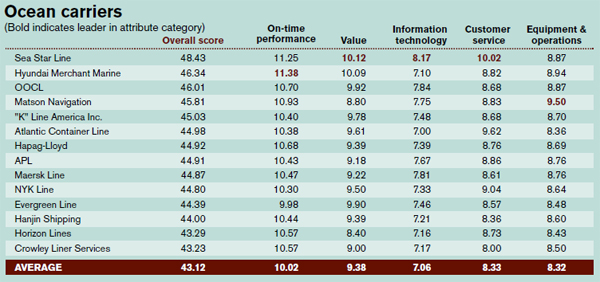

Source: Logistics Management, Peerless Media Research Group

Tops on the high seas

Much has changed on the high seas over the past three years. In fact, the analysts at IHS Global Insight report that world trade has mostly recovered from the Great Recession—news that that should put a smile on the occupants of any ocean carrier boardroom.

Analysts estimate that after plunging 10 percent in 2009, global trade volume measured in tons increased 8.5 percent in 2010. Over the course of 2011 it’s expected to grow 6.9 percent. But as Executive Editor Patrick Burnson reported in last month’s State of Logistic Report, those smiling ocean carrier executives aren’t taking anything for granted, and the tired old cliché “thinking outside the box” takes on new meaning when expressed by some of the world’s leading container shipping companies.

In our 2011 Ocean Roundtable, Burnson and his panel mention that the container shipping industry may be standing on the brink of an “era-defining moment” as it faces fundamental challenges with growing equipment and capacity constraints. To overcome this pending storm, the panel believes that there needs to be greater dialogue between carriers and ocean shippers over the next 12 months in an effort to create more mutual, economic partnerships.

And while this new period of collaboration is evolving, we can report with some confidence that shippers have established valuable relationships with the 14 carriers sailing away with Quest for Quality gold this year. It’s these carriers, say the readers of Logistics Management, that have delivered world-class service over the past 12 months.

Leading the group of winners to port this year and posting and impressive 48.43 weighted average is Sea Star Line. Sea Star put up top marks in Value (10.12), IT (8.17), and Customer Service (10.02). It’s important to note that while Sea Star was among our winners in 2010, the line jumped up 16 points in its weighted average score this year.

Hyundai Merchant Marine pulled in second this year after missing the cut in 2010. Hyundai posted a 46.34 weighted average and put up the best On-time Performance score (11.38). Matson Navigation rounds out our key attribute winners in the ocean category this year with an inspiring 9.50, a clear half a point higher than the field.

We had a number of repeat winners from 2010 in this category including OOCL (46.01), “K” Line America, Inc. (45.03), Atlantic Container Line (44.98), APL (44.91), Maersk Line (44.87), Evergreen (44.39), Hanjin Shipping (44.00), Horizon Lines (43.29), and Crowley Liner Services (43.23). Hapag-Lloyd (44.92) and NYK Line (44.80) are welcomed back to the winner’s circle this year after missing the cut in 2010.

2011 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL |  home page |

Article Topics

Latest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources