2011 Q4Q Winners: RAIL/INTERMODAL

Latest Logistics News

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report More News

Source: Logistics Management, Peerless Media Research Group

Steady rise to the top

As group news editor Jeff Berman wrote in last month’s State of Logistics Report, rail and intermodal have been two of the most stable sectors in freight transportation over the past two years—although volumes have a way to go to get back to pre-recession levels witnessed in 2007.

And while those levels may not be back for a while, industry experts say that since the first half of 2010, the railroad industry appears to be maintaining its steady course, with solid earnings and strong pricing clearly intact. As for volumes, rail carloads and intermodal containers and trailers are up roughly 4 percent and 10 percent, respectively, year-over-year for the first half of 2011.

Couple that solid financial performance and demand with the fact that, according to our Annual Study of Logistics and Transportation Trends (Masters of Logistics), service levels on the rails have been on the rise for the past three years, and you can picture a pretty happy group of rail executives. And for 10 rail and intermodal service and marketing companies, the news is about to get a little sweeter.

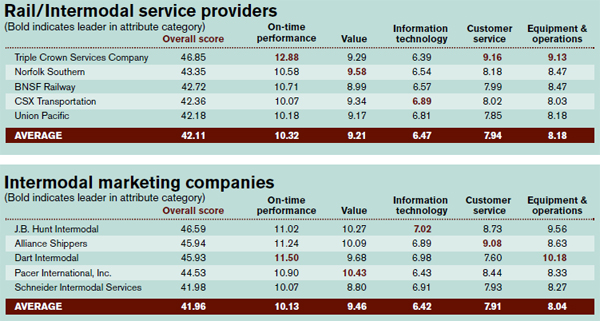

Leading the pack in our Rail/Intermodal Service Provider category with the highest weighted average for the second year in a row is Triple Crown Services (46.85). Triple Crown took honors in On-time Performance (12.88), Customer Service (9.16), and Equipment & Operations (9.13).

Pulling in first in Value was Norfolk Southern (9.58), and CSX Transportation put up an impressive 6.89 in IT to for Quality gold last year as well—and in just about the exact order.

Our Intermodal Marketing category found three winners who didn’t make the cut last year along with two repeats from 2010. J.B. Hunt Intermodal tops the list again this year, putting up a 46.59 weighted average, but only scored highest in one attribute category, IT (7.02). In fact, attribute top scores were well dispersed in this category this year.

Alliance Shippers put up the second best weighted average (45.94) and lead the way in Customer Service (9.08). Dart International posted the third best overall average (45.93) but took top spot in On-time Performance (11.50) and Equipment & Operations (10.18). Pacer International, Inc. rang in fourth with a 44.53 and was top in Value with a 10.43.

2011 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL |  home page |

Article Topics

Latest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources