2011 Q4Q Winners: REGIONAL LTL

Latest Logistics News

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report More News

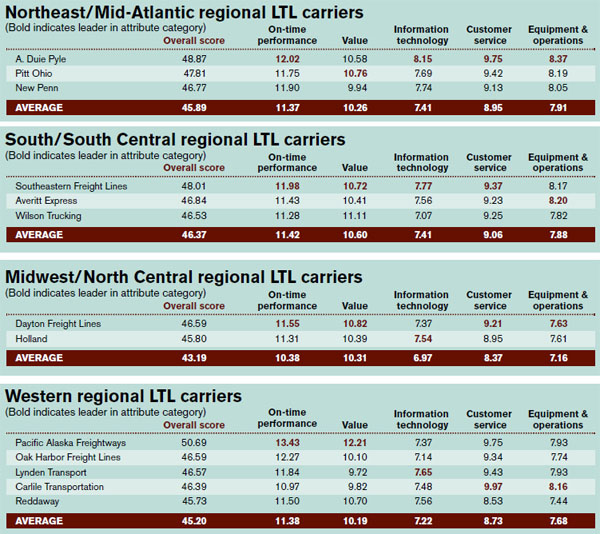

Source: Logistics Management, Peerless Media Research Group

Staying nimble and quick

The mantra for profitability in the LTL market remains freight density, cost control, and pricing discipline. However, the nimblest regional LTL carriers can often understand their costs better than the more broad-reaching nationals and, therefore, price business to earn an appropriate return.

According to the readers of Logistics Management, not only have these 13 LTL’s figured out a sustainable business model, but also rank far and away the best in servicing their particular regions. In the Northeast/Mid-Atlantic region, A. Duie Pyle (48.87), Pitt Ohio (47.81), and New Penn (46.77) scored above the weighted average this year. Of note, A. Duie Pyle’s impressive 48.87 was the second highest weighted average in the entire regional LTL category.

In the South/South Central region, shippers gave highest marks to Southeastern Freight Lines (48.01), Averitt Express (46.84), and Wilson Trucking (46.53). In the Midwest/North Central region, Dayton Freight Lines (46.59) and Holland (45.80) repeat as the only two scoring above the weighted average.

Out West, Oak Harbor Freight Lines (46.59) and Lynden Transport (46.57), the only two winners from our 2010 results, are joined by leading scorer Pacific Alaska (50.69), Carlile Transportation (46.39), and Reddaway (45.73).

2011 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL |  home page |

Article Topics

Latest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources