2014 State of Ocean Cargo: Rate hikes, dead ahead

Pent-up demand, depleted inventories, and a greater overall sense of economic security are converging in 2014. If so, ocean cargo carriers will be determined not to miss that opportunity to make rate hikes stick.

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsFrom the Issue of

Logistics Management

Will this be the year ocean cargo carriers finally return to profitability? Many industry analysts think so, and logistics managers are scrambling to readjust forecasts and budgets accordingly.

Transpacific cargo demand posted steady growth coming off a healthy holiday season last year, and container lines serving the Asia-U.S. trade lane say that the gains are so far reflected in freight rates. In fact, a January 15 general rate increase (GRI) taken by member lines in the Transpacific Stabilization Agreement (TSA) has added an average $300 per 40-foot container (FEU) to rate levels.

Strong forward bookings proved that the increase would hold through the important Lunar New Year period, with carriers building on that momentum with another $300 per FEU increase effective March 15. Furthermore, shippers may expect yet another rate boost on May 1, separate from adjustments planned for 2014-2015 contracts.

“Carriers have left a lot of money on the table in this market as partially successful increases have been eroded over time,” says Brian Conrad, TSA executive administrator. “There’s now a growing sense that pent-up demand, depleted retail and business inventories, and a greater overall sense of economic security are converging in 2014. Lines are determined not to miss that opportunity.”

At the same time, TSA also announced its 12 month revenue and cost recovery program for 2014-2015 contracts that recommends increases to contract rates of $300 per FEU from 2013-2014 levels for U.S. West Coast cargo and $400 per FEU for all other cargo. A key consideration, obviously, is the revenue baseline set as contract negotiations move forward.

“Simply rolling over last year’s contract rates—let alone reducing the rates, as some shippers have requested—is just not workable,” Conrad says, reiterating that no major transpacific carrier operated profitably in the trade in 2012 or 2013. “The goal is a meaningful net increase, with full cost recovery for fuel, chassis, free time and other costs, irrespective of supply/demand or other considerations.”

Moment of truth

Shippers, meanwhile, are waiting to see how the trend toward greater carrier consolidation will play out.

The TSA’s “talking agreement” among 15 liners is a relatively small shift in balance compared to the recent success of The Grand Alliance, which was organized by NYK Line, Hapag-Lloyd, and Orient Overseas Container Line. Through their vessel sharing agreement, all three operate scheduled deployments on a variety of trade lanes where each may have ownership of participating vessels in the string—giving all carriers the ability to book freight on any of the partner’s ships.

“There are quite a few vessel sharing agreements operating this way in trade lanes around the world,” says Rich Roche, vice president of international transportation for the freight forwarder Mohawk Global. “Some are larger than others, and some are specific to a single trade lane, while others cross multiple lanes.”

Roche notes that a few carriers have opted out of vessel sharing arrangements, choosing instead to provide all the vessels on a given string, be fully responsible to fill out slots, and profit solely from their efforts. “This is not the norm on most container trades, where volume concentration is key to success,” he adds.

Further complicating the picture are the alliances forged by G6 and P3 carriers. Originally deployed together in the Europe-Asia trade, G6 recently expanded their service to include Transpacific and Transatlantic trade routes as well. They currently employ 240 vessels serving 66 ports in three major trade lanes.

The G6 Alliance members are: APL, Hapag-Lloyd, Hyundai Merchant Marine, Mitsui O.S.K. Lines, NYK, and Orient Overseas Container Line. Member carriers maintain that this cooperative agreement is characterized by competitive transit times, broad port coverage, and newer containerships.

“Ocean freight has been commoditized over the years,” says Roche. “Drastic measures like super-consortiums are the next answer to survival for the ocean carriers we have all come to depend on.”

Pending approval by the Federal Maritime Commission, the effective start date for P3 is March 24. This agreement comprises the world’s largest vessel owners—Maersk, CMA-CGM, and MSC. Their plan is to operate an even larger group than G6, with 255 vessels and 28 vessel strings serving the same three trade lanes.

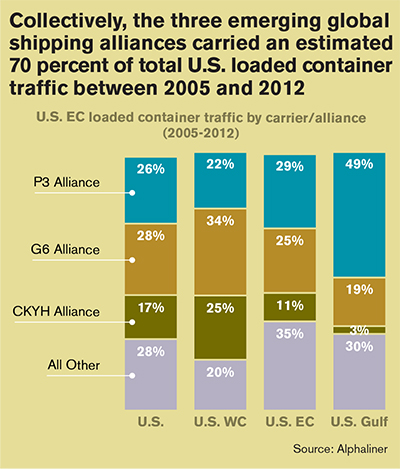

“Collectively, the three emerging global shipping alliances carried an estimated 70 percent of total U.S. loaded container traffic between 2005 and 2012, notes James Brennan, partner with the supply chain consultancy Norbridge, Inc. He adds that the three largest alliances account for 52 percent of the projected world fleet and 69 percent (operational and on order) of its projected capacity.

“Furthermore,” says Brennan, “evolving alliance structures could provide a path to significant consolidation. This in turn, could alter global trade patterns for vessels transiting both the Panama and Suez Canals.”

Economies of scale

Bruce Carlton, president of the National Industrial Transportation League, says that shippers have voiced their concern about having limited options, but that “free market forces” will always prevail when it comes to vessel deployments and availability.

“And hopefully these alliances will result in a lower rate level in the long term if the carriers let shippers benefit from the carriers’ significant unit costs,” says Carlton. “Everyone in this industry is trying to be more efficient.”

But analysts at the Paris-based think tank Alphaliner say that although the P3 carriers are expected to rationalize some of their services, capacity reductions are not expected. They add that the large “newbuildings” will replace smaller ships on the east-west routes.

“P3 will probably deploy almost all of their 130 ships of above 10,000 twenty-foot equivalent units (TEUs ) on Asia-Europe and the Pacific routes,” notes Stephen Fletcher, Alphaliner’s commercial director. “The P3 alliance will be particularly dominant on the Asia-

Europe trade lane, while P3 on the routes between the Far East and North America will have less coverage in relation to the services that the two other alliances offer.”

Room for improvement

Analysts agree that the industry’s major players are continuing to adapt to a new era characterized by too much vessel capacity and cargo volumes on many trade lanes that refuse to live up to previous forecasts. Yet liner shipping may be becoming less reliable as operators ignore service standards in the rush to cut costs.

According to Drewry’s newly published Carrier Performance Insight report, containership reliability worsened in every quarter of 2013, with the fourth-quarter decline taking the on-time average below 64 percent—the lowest it has been for two years. Compared to the same quarter in 2012, when the all-trade averages reached a peak of 75.2 percent, the fourth quarter result was down by a hugely disappointing 11.4 points.

The weaker performance coincided with a raft of skipped voyages, and the short-term outlook for reliability is not great, say analysts.

“The focus on reliability seems to have been lost in the current cost-cutting environment,” says Simon Heaney, senior manager of supply chain research at Drewry. “Shippers are now paying more for poorer services, but they know lines are saving money. So, they may be unwilling to accept further increases from all the carriers; in turn, this could provide an opportunity for more reliable carriers to secure better rates.”

Maersk Line maintained its position as the most reliable major carrier in the industry in a generally poor fourth quarter when most of its competitors suffered a free fall in on-time ship arrivals. Maersk achieved 80 percent on-time reliability in the fourth quarter, improving its all-trade reliability by 0.8 points. It was one of only eight carriers to improve on their third-quarter performance.

A three point improvement was enough to see Evergreen rise from No. 11 to No. 2 with a 74 percent on-time result. Despite a four point decline, Yang Ming ranked third with an on-time average of 73 percent. At the wrong end of the table, the worst performing carriers were MSC (48 percent) and CSAV (51 percent).

But all this may change as a consequence of the alliances, says Alan Murphy, chief operations officer and partner at SeaIntel Maritime Analysis in Copenhagen. “As carriers continue to cooperate through alliances and agreements, they will increasingly be aboard the same vessels and will subsequently lose their ability to show differences in performance,” he says.

SeaIntel predicts that carriers’ reliability will remain about the same in 2014 as it’s been over the past two years. However, the company advises shippers to prepare for approval of the P3 and expansion of the G6, which could cause disruptions to reliability during network restructuring.

Constant pressure

Peter Sand, chief shipping analyst for The Baltic and International Maritime Council in Copenhagen (BIMCO), observes that the increased demand from “advanced economies” should increase the utilization of containerships.

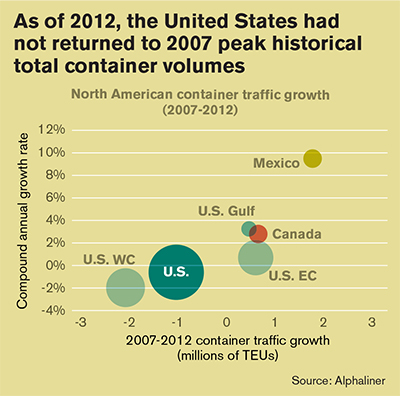

“The U.S. economy is the key driver for global growth in container shipping, and we see a slow but positive development there,” says Sand. “On a global scale, containerized export research shows that activity improved in May following a weak start to 2013. Since then, the pace has picked up, and November and December saw 5 percent to 7 percent growth rates from same months of last year.”

In terms of fleet growth, BIMCO expects 2014 and 2015 to be similar to last year—around 6 percent. The council adds that the industry’s ability to land the supply growth at a “new normal” level—one that matches demand growth better—seems strong.

In the meantime, the World Shipping Council (WSC) says that it’s no secret that international liner shipping is a tough business, with shipping rates under constant pressure. “It is a bit of a paradox that, notwithstanding financial returns that are generally poor, investment continues at the rate it does,” says Chris Koch, WSC president and CEO. “It’s not an industry of quitters, it’s an industry of fighters.”

Koch adds that the strategies being used to win the fight are evolving. “Some carriers that have tried to differentiate themselves by providing higher cost and premium service have had a tough time making those higher operating costs pay off,” he says. “Higher cost services struggle to attract enough cargo at rates needed to cover those higher price points. As a result, carriers have had little choice but to focus on cost-savings and increased efficiency as their strategy.”

For example, fewer ocean carriers try to provide integrated or sophisticated logistics services as part of their ocean transportation service offerings. Because the market dynamics predominantly favor shippers, carriers have been generally unsuccessful at recovering the costs of higher “value added” services, so they are offering them less often as part of their ocean transportation offerings.

“To the extent ocean carriers provide such logistics services, they increasingly tend to do that through stand-alone affiliate companies that are responsible for their own profit and loss, not as an integrated service offering to give away to a customer at less than cost in the ultra-competitive liner shipping market,” says Koch.

The competitive market forces have led to a variety of ocean carrier cost saving measures, such as “slow steaming” to save fuel. They’ve also led to ocean carriers getting out of the practice of providing container chassis in North America. Carriers now focus on larger, more fuel-efficient ships that have lower costs per container slot—even if that means fewer service strings and challenges at port terminals that have to handle the larger cargo volumes.

“These changes are unlikely to go away,” says Koch. “Carriers can’t control the market, so they must focus on areas where they can hope to have some control.”

Industry watchers say that there are plenty of reasons to doubt a reversal of fortune is in the offing. Koch sums it up this way: “Some shippers may not like slow steaming because it takes longer for their cargo to be delivered, but there are simply not enough shippers willing to pay the higher fuel costs of faster service.”

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources