2017 State of Logistics: Third-Party Logistics (3PL)

No rest for the weary. Logistics management looks at the trends in the Third Party Logistics market.

The global forecast for the third-party logistics provider (3PL) market this year, as composed by the consultancy Armstrong & Associates, is “lukewarm,” says the organization’s chairman Richard Armstrong.

With the release of its new report, “Third-Party Logistics Market Results and Trends for 2017” that includes estimates for 190 countries, Armstrong says that “nothing spectacular” was recorded over the past 12 months. “Not that we expected much,” adds Armstrong. “The global economy has been softening, and that is reflected in supply chains worldwide in generally every commodity shipped.”

Furthermore, 2016 was a “mediocre year” for third-party logistics in the U.S., says Armstrong, with net revenues growing a modest 2.1% over 2015 to $73.5 billion, while overall gross revenues increased 3.5%, expanding the total U.S. 3PL market to $166.8 billion.

In the meantime, big merger and acquisition deals changed third-party logistics from mid-2014 through 2015, according to Armstrong, but in 2016 the pace slackened significantly. The biggest deal last year was FedEx’s acquisition of TNT Express in the second quarter. Other big deals were DSV’s acquisition of UTi Worldwide in January and HNA Group’s purchase of Ingram Micro for $6 billion.

In 2016, the third-party domestic transportation management (DTM) segment increased 5.3% in gross revenue and 7% in net revenue, as DTMs tightened up operations in an effort to compensate for ample truck capacity. International transportation management (ITM) providers, which had strong growth 10 years ago, grew 2.6% in gross revenue, but net revenue fell 1.9%.

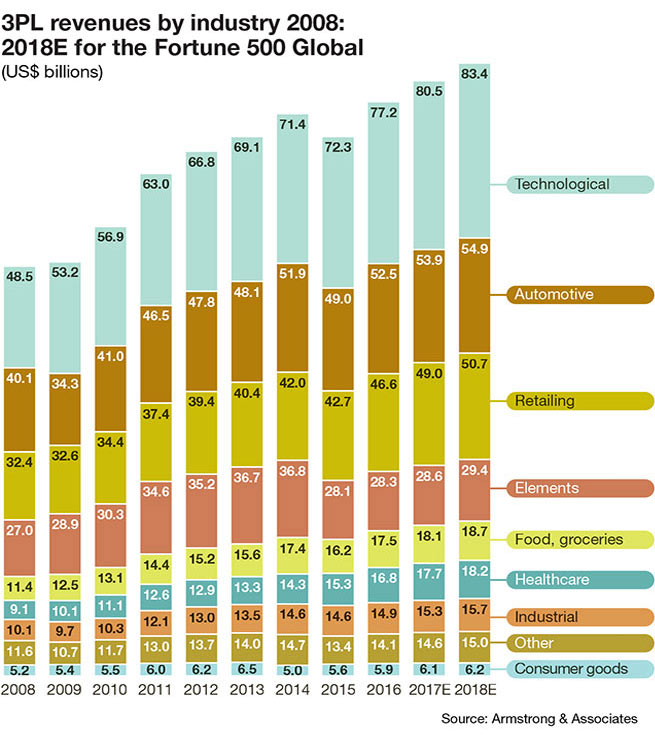

According to Armstrong, both domestic and international providers were negatively impacted by too much air and ocean capacity in the market. In the meantime, providers with a strong dedicated contract carriage business grew 3.5%, with segment leader Ryder up 14%. Global 3PL revenues reached $802 billion in 2016 and are on track to exceed $962 billion in 2020.

Even as these numbers are projected to be on a healthy upswing over the next few years, Evan Armstrong, the consultancy’s president, says that there’s still a general need for more collaboration between 3PLs and logistics managers.

Armstrong further notes that there’s an interesting competitive paradigm developing in the current marketplace where large 3PLs are perceived as “not innovating.” At the same time, innovative start-ups are perceived as being unable to develop a network scale.

“The consensus is that large 3PLs will be acquiring, or leveraging the technology developed by the most interesting innovators—such as the deal DB Schenker has done with uShip in Europe,” he says.

Along with other industry analysts, Armstrong observes that customer requirements remain very diverse. The challenge is how to respond to this segmentation and anticipate shipper needs. “Major 3PLs are stressing targeted customer acquisitions,” he adds. “The focus is on targeting vertical industries and playing to a 3PL’s strengths to deliver value for customers.”

Robert Lieb, Ph.D. a professor of supply chain management at Northeastern University, agrees, noting that the big 3PLs just keep getting bigger as they merge and acquire smaller players while offering more integrated services.

“This is especially true of niche markets like pharmaceutical and automotive,” says Lieb. “And this trend will continue as we see new services being developed for cross-border trade and emerging markets.”

Read the full State of Logistics 2017 article here.

Article Topics

3PL News & Resources

DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains More 3PLLatest in Logistics

DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources