2017 State of Logistics: Truckload (TL)

Turbulent market roils with consolidations and “muted” freight demand

Nobody can accuse the $310 billion TL market of being boring—especially at the top.

In the first six months of this year, Schneider National, the storied Green Bay-based carrier, took the plunge with an initial public offering that netted in excess of $500 million. That was quickly followed by the stunning news of a $6 billion combination of Phoenix-based TL giants Knight-Swift Transportation, producing a new behemoth atop the highly fragmented TL marketplace. Even after the merger, Knight-Swift commands barely 2% market share in the low-cost, point-to-point TL sector.

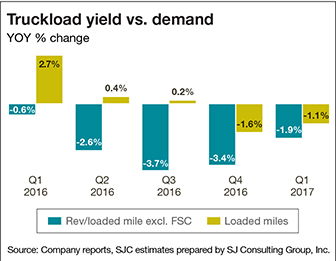

These moves come at a curious time in truckload carriage. Demand has been sluggish for about a year, as too many trucks continue to chase too little freight. However, this is good news for shippers, who have been leveraging that excess capacity into lower contract rates.

John White, chief marketing officer at U.S. Xpress, the nation’s 7th-largest TL company, says that demand for truckload services is “somewhat muted” so far this year. But he and other TL executives remain optimistic that the second half of 2017 will bring the usual upticks in demand.

“We’d like to see it a little more robust, but we haven’t seen a drop off in volumes from the second half of last year,” says White. “Those customers demanding extra capacity are still there, but in general, it’s quiet.”

Some publicly held TL carriers are reporting sharp drops in earnings in the first quarter. Universal Logistics Holdings, for example, saw its net profit plunge 42% in the first quarter to $4.3 million, compared to $7.5 million in the first quarter of 2016—that was despite a 9.2% jump in revenue. It’s even a worse picture at USA Truck, the nation’s No. 53 TL carrier, which suffered a $4.9 million loss in the first quarter, widening the loss of $1.8 million in the year-ago quarter.

Analysts say that part of the reason for these TL losses is the increase in online, “Uber-like” applications that link shippers and brokers to carriers seeking capacity. One of these newcomers is Next Trucking, which describes itself as an “online trucker-centric marketplace” designed to connect shippers and truckers. The company says it has $5 million in funding already secured since launching. Its goal, the company says, is to “disrupt” the truckload long-haul market.

In the meantime, veteran trucking analyst John Larkin of Stifel Inc. says that the TL sector remains “sluggish,” with a few exceptions. “Dry van freight has yet to show much more than a modest seasonal uptick.”

On the positive side, Larkin says that the year-long inventory glut has largely corrected; the seasonal build of late spring/early summer merchandise is underway; a strong produce harvest in California is drawing temperature controlled equipment from the generic dry van segment; and industrial activity, led by the energy sector, has started its rebound.

“Also large fleets have shed some excess rolling stock,” says Larkin, noting that some of the large fleet downsizing may have been offset by fleet growth across many of the smaller fleets. “Normally, all of these positive factors would have resulted in a much tighter supply/demand dynamic than is reflected in the reality of today’s dry van market.”

On the demand side, many were hopeful that the tightening of the spot market and strength in the carload and flatbed sectors would translate into tightening in the dry van truckload contract market.

However, Larkin adds that “persistent mediocre” freight demand seems to be a function of uninspiring consumer demand, a wet spring, softening in the automotive sector, and recent weakness in the housing market—all of which have depressed TL demand. Most the TL market has been a series of modest ups and downs, unevenness that hampers freight demand capacity planning for carriers.

Keep in mind that this is all good news for bottom-line oriented shippers seeking TL capacity at bargain rates.

For the full 2017 State of Logistics article click here.

Article Topics

Motor Freight News & Resources

XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates Preliminary March North America Class 8 net orders see declines National diesel average heads down for first time in three weeks, reports EIA Trucking industry balks at new Biden administration rule on electric trucks: ‘Entirely unachievable’ New Breakthrough ‘State of Transportation’ report cites various challenges for shippers and carriers in 2024 More Motor FreightLatest in Logistics

Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources