26th Annual State of Logistics: Freight moves the economy

In the best year for the freight transportation industry since the Great Recession, logistics managers chalk up efficiencies that drive further U.S. economic growth. However, capacity issues persist, causing shippers to worry about rate hikes as carriers continue to be meticulous in their partnerships.

Latest Logistics News

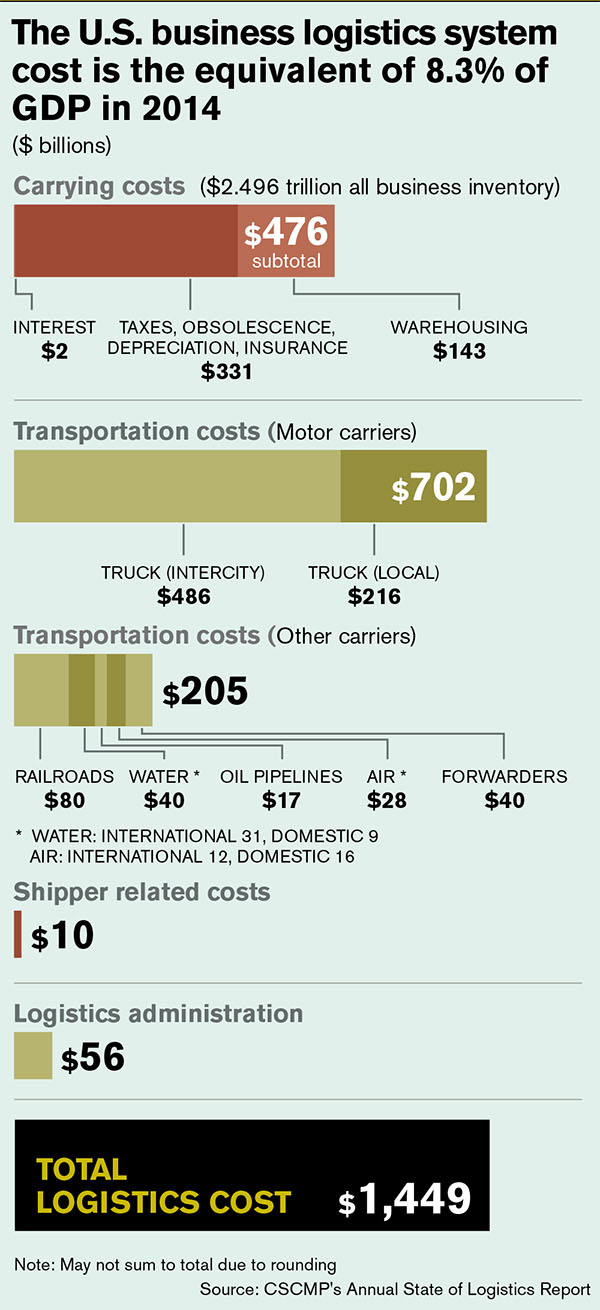

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch More 3PLAccording to the 26th Annual State of Logistics Report (SoL), the logistics and transportation industry chalked up its best year since the Great Recession, with U.S. business logistics costs rising 3.1 percent to $1.45 trillion last year. In the meantime, logisticians’ savvy management of their transportation networks held logistics costs to an historically low percentage of gross domestic product (GDP).

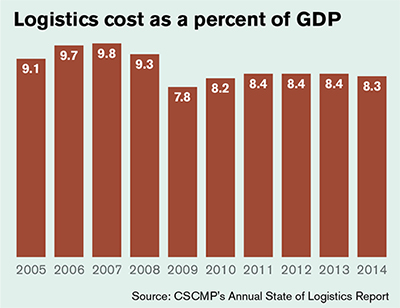

Presented by the Council of Supply Chain Management Professionals and Penske Logistics, the SoL reports that logistics costs were a scant 8.3 percent of GDP in 2014, a tenth of a percent lower than in each of the previous three years and less than half of what logistics costs were as a percentage of GDP in 1979, the last year of fully regulated surface freight transportation.

Freight transportation costs rose 3.6 percent last year due to stronger shipment volumes and inventory carrying charges that were up 2.1 percent, according to the report. But overall, it was a very solid year for logistics management professionals, who were able to manage fluctuating volumes amid tight capacity due to infrastructure constraints and labor issues such as the West Coast dock slowdowns.

“In 2014, consumers began to drive the economy once again as consumer confidence measures soared,” says Rosalyn Wilson, author the of the annual SoL report. “And it was freight transportation helping to drive that consumer spending in the most efficient manner possible.”

2014 in review

While transportation and tonnage volume still hasn’t rebounded to pre-recession levels, freight shipment volumes followed a predictable trend in 2014—starting the year at or below previous year levels, rising through the spring, flattening or even dropping during the summer, peaking during August and September, then falling close to the levels that the year started.

“Shipment volume rose in April, reaching the highest level since June 2011,” says Wilson. “Freight continued to gain momentum, although the performance of the economy overall during the period was very weak.”

In 2014, the trucking industry edged closer to 100 percent utilization. Predictably, the capacity constraints affected truck rates. In May 2014, freight payments were 11.2 percent higher than in May 2013 and 77.7 percent higher than at the end of the recession in 2009.

“Rates held steady despite the tightening capacity,” says Wilson. “Both the number of shipments and freight spend reached a crescendo in June, with shipment volume surpassing the November 2007 pre-recession levels.”

By mid-year, following a seasonal trend of previous years, the freight transportation market perked up with the August Supply Management PMI report rising 3.3 percent, its highest reading since March 2011. New orders of durable goods were up 5.2 percent, and order backlog rose 5.1 percent.

This good news affected capacity in nearly all modes. The Association of American Railroads (AAR) reported U.S. weekly rail volumes, in terms of carloads and intermodal containers and trailers, was higher in August 2014 than in any month since October 2007.

The freight logistics sector was flat in September, but turmoil returned in October in the form of a rising freight shipments, particularly imports. But the real story last fall was that freight was having a difficult time moving due to congestion in ports, especially in the ports of Los Angeles and Long Beach (LA/LB) where a long-standing labor dispute continued to simmer.

Those ports handle more than 40 percent of all ocean imports, and an even higher percentage of consumer goods. By the end of October, there was more than a three-week delay in unloading ocean vessels at LA/LB.

“The October slide can be attributed to port congestion and to a drop in new orders for manufactured goods in September,” says Wilson. However, the “underlying problem” at the ports has to do with another mode—the supply of trucks, especially dray. “Perhaps the biggest problem was a serious lack of chassis on which to move the containers,” she adds.

December showed the expected seasonal drop of 6.3 percent in shipment volumes, matching a 6.7 percent decline in freight payments. But those December figure matched the highest end-of-year values since the beginning of the recession in 2007.

“Traditionally the peak holiday shipping season falls between July and September as retailers build up their inventory,” says Wilson. “But in 2014, the peak shifted even earlier as shippers imported goods earlier due to concerns about the July 1 expiration of the ILWU contracts with the ports of Long Beach and Los Angeles.”

State of the modes

Trucking, the largest component of freight transportation costs, rose 3 percent last year as total trucking costs (intercity and local) surpassed $700 billion for the first time to $702 total. Intercity trucking rose 2.7 percent to $488 billion, and local delivery was up 3.7 percent to $216 billion.

The number of truck shipments actually declined, but total truck tonnage was up 3.5 percent. That supports anecdotal evidence that loads are heavier and more trucks are moving at or near full capacity. “Interestingly, total freight payments rose less than the number of shipments,” says Wilson. “That indicates rates were flat and very competitive overall.”

However, truck driver turnover remains stubbornly high. American Trucking Associations Chief Economist Bob Costello reports that driver turnover in the fourth quarter for truckload carriers was 95 percent for small carriers and 96 percent for large carriers (over $5 million revenue). By comparison, LTL carriers had just 11 percent turnover.

Rail transportation costs rose 6.5 percent to $80 billion. Class 1 freight revenue per ton-mile increased 0.1 percent from 3.961 cents to 4.054 cents, the report states. Overall rail traffic was up 4.5 percent—3.9 percent for carloads and 5.2 percent for intermodal.

Rails responded with more capacity. More than 1,300 new and rebuilt locomotives were added to the fleet at an average cost of $2.2 million dollars each. About 3,800 new freight cars were purchased and 700 new leased freight carts were put into service.

The AAR reported that September 2014 employment was the highest for any year since November 2000 and was 4 percent higher than the start of the year in January—one of the highest employment growth rates among all industries. In 2015, railroads plan to invest another $29 billion on capital spending and maintenance and to hire 15,000 new employees.

“The rail industry is now very close to pre-recession traffic volumes,” says Wilson.

Costs for water transportation rose 8.9 percent, the second highest growth sector last year. The domestic costs for movement of freight in and out of the U.S. through its deep water ports was $31 billion—not including actual ocean shipping costs—and $9 billion for domestic lake and coastwise moves.

East Coast ports saw the biggest percentage gains due to the traffic picked up by congestion and turmoil caused by the work stoppages at the West Coast ports.

The one mode shrinking was airfreight, where revenue slipped 1.2 percent to $28 billion ($12 billion international and $16 billion domestic). According to the SoL, this slip is due to “downshifting” by shippers to more expedited ground shipments and a 6 percent drop in international air shipments.

Looking to 2015

So, what’s ahead for 2015? Capacity problems will continue to worsen for at least the next two years before any improvement is seen, according to the SoL.

“Shippers should be aware that a trucking shortage allows carriers to be selective about with whom they do business,” says Wilson. “Providing ‘driver friendly freight’ will continue to drive discounts in trucking.”

The SoL adds that shippers who hold drivers for long periods of time waiting to load or unload, or who do not treat their drivers well, will fall to the bottom of the list. “Maximum equipment utilization, quicker turns, and fewer empties go right to the bottom line,” says Wilson. “Shippers willing to work with carriers to accomplish this will fare better than carriers who neglect these issues.”

While it’s unlikely the nation will sustain GDP growth above 3.5 percent this year, the SoL report expects consumer spending to level off. In the meantime, the relative strength of the U.S. dollar is making exports more expensive, cutting into that U.S. economic strength. Still, shippers should be prepared to pay more.

“Rates should level out toward the end of 2015, and increases will be modest to moderate in 2016 depending on the level of economic activity,” Wilson concludes. “Carriers will still have the ability to pass on their higher costs to shippers.”

2015 State of Logistics

LTL: Managing capacity key to profitability

Truckload: Demand growth flat, but tightening capacity means higher rates

Rail/Intermodal: Still on track, but not immune to challenges

Air: Air cargo sector strengthens

Ocean: Ocean cargo still faces stiff headwinds

Article Topics

3PL News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates More 3PLLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources