29th Annual Quest for Quality Awards: 3PL winners in the logistics decathlon

The Great Recession didn’t slow it down, and now economic woes throughout Europe don’t seem to be impeding its progress. The global third-party logistics (3PL) industry just keeps rolling along, as merger and acquisition (M&A) activity heats up and the world’s providers report decent revenue growth.

Latest Logistics News

Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains More 3PL

If you need any evidence of recent, game changing M&A then look not further than this past March. UPS not only made a celebrated purchase of TNT Express, but also went on to buy Italian pharmaceutical logistics company Pieffe. Geodis, which fell short of our Quest for Quality weighted average this year, then acquired French pharmaceutical logistics and distribution company Pharmalog—but that’s just scratching the surface of the 3PL deal market.

In the meantime, data from third party logistics consultancy Armstrong & Associates reveals that all of this global M&A activity has certainly made sound, business sense. In fact, Armstrong reports that total global 3PL gross revenue in 2011 at $133.8 billion was up 5.2 percent over 2010. Furthermore, net revenues, at an estimated $61 billion, posted a 5.9 percent annual gain during that time.

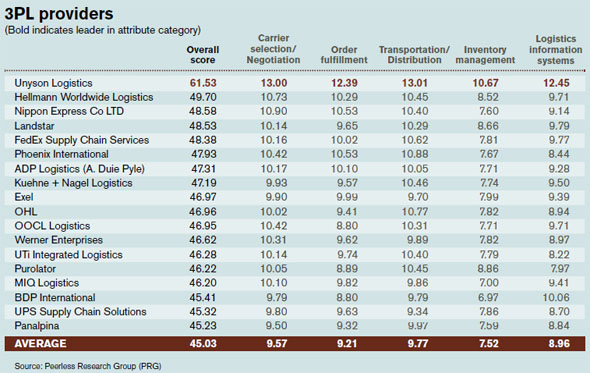

And it appears that current business strategies, especially on the service performance front, are paying off in a big way for the 18 3PLs listed above. In fact, the 45.03 weighted average is an impressive 8.49 jump from last year’s number, signaling that in this category shippers have witnessed marked improvement in overall service over the last year.

The most notable news this year is Unyson Logistics’ overall score of 61.53, the biggest number posted by any of the carriers or service providers in the 2012 Quest for Quality survey. Unyson’s 2012 number is a whopping 21.67 points better than its 2011 score, while the provider led all of this year’s 3PL attribute categories, scoring 2 points to 3 points above the remaining list of winners in every area.

And while Unyson’s score certainly stands out, the remaining 17 winners all posted impressive overall scores this year, with the second highest score, Hellmann Worldwide Logistics’ 49.70, coming in 4.51 points better than its 2011 overall high mark.

Some other significant scores were posted across the attribute categories this year. Nippon Express Co. put up an impressive 10.90 in Carrier Selection/Negotiation and tied with Phoenix International with a 10.53 in Order Fulfillment. Phoenix, a brand new Quest for Quality, also posted the second-best score in Transportation/Distribution with a 10.88.

2012 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL |  home page |

Article Topics

3PL News & Resources

Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline More 3PLLatest in Logistics

Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources