29th Annual Quest for Quality Awards: Freight Forwarders keeping pace

Global manufacturing and retail shippers now have their eyes firmly fixed on the tentative economic condition of Europe, attempting to calculate the eventual impact the situation will have on supply chain operations in the region and the rest of the world.

Latest Logistics News

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week More News

In a recent report from Panjiva, an online data source covering global supplier and manufacturer operations, U.S.-bound waterborne shipments, which fell 2 percent from April to May, posted a 2 percent gain from May to June. According to analysts at the firm, shipments for the first six months of the year are up 5 percent. “Relatively speaking, the numbers are holding up reasonably well,” Panjiva CEO. Josh Green recently told LM. “And considering the economic headwinds we’re facing, we’ll take it.”

And while Europe’s various economic challenges are not having a direct impact on the U.S. just yet, Green cautions that if the uncertainly continues it will most likely begin to impact trade flows across multiple geographies—adding yet another layer of complexity to global logistics management.

For global shippers, these ongoing economic issues, along with new trade agreements and increasingly complicated export policies, have forced them to become increasingly reliant on freight forwarding market leaders for most of their expanding global distribution needs—and that reliance on proven providers is not likely to end any time soon.

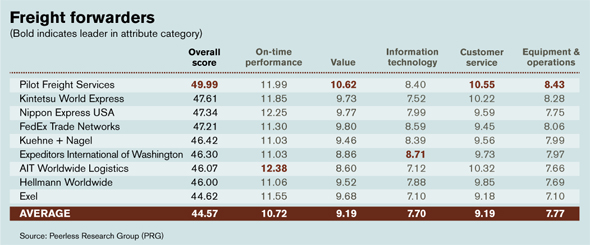

One thing is for sure, the nine freight forwarders listed below have certainly proven themselves in the eyes of LM readers in terms of service reliability over the past 12 tumultuous months. In fact, the overall weighted average score of 44.57 is up more then 2 points over 2011 results, signaling that global shipper satisfaction has improved.

Posting the highest score in the category this year is Pilot Freight Services with an impressive 49.99. Pilot put up top marks in Value (10.62), Customer Service (10.55), and Equipment & Operations (8.43). AIT Worldwide Logistics posted the top score in On-time Performance (12.38), while Expeditors International of Washington was called out as tops in Information Technology (8.17).

2012 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL |  home page |

2012 Quest for Quality Freight Forwarders Sponsor

Article Topics

Latest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources