30th Annual Salary Survey: Reeling in the talent

Our 2014 survey finds that large companies are boosting their initial salary offerings for new hires by as much as 10 percent. Will this trend help close the logistics talent gap?

According to the findings of Logistics Management’s (LM) 30th Annual Salary Survey, young logistics managers are being wooed by competitive offers from large companies that come close to matching those of high-tech, finance, and engineering industries.

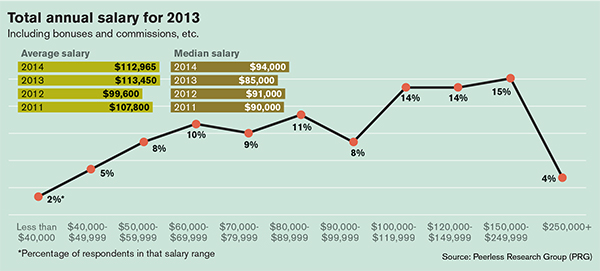

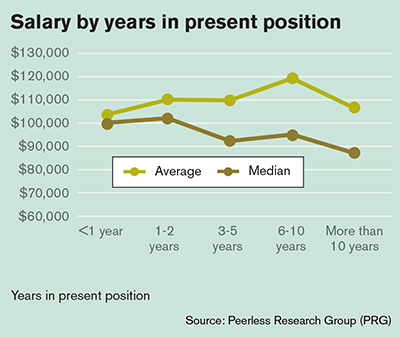

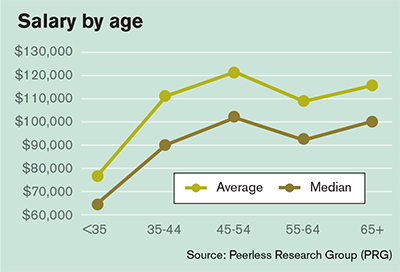

At the same time, however, median earnings remain in line with those posted last year, indicating that veteran logistics managers should not expect the same pay incentives. Our survey reveals that while some senior executive positions showed substantial increases over last year, older managers may have seen their salaries peak by age 54.

This year’s report, conducted by Peerless Research Group (PRG), reconfirms findings from last year that young professionals can make the most of their fast track offers by continuing to enhance their career planning before hitting the wall in their 50s. Management peers will be raising the bar, however, expecting aspiring workers to demonstrate thought leadership when in comes to the introduction of new technologies and strategic human resource initiatives.

This year’s median salary range for managers in the 45-year-old to 54-year-old range topped off at $101,500, but older managers in the 55-year-old to 64-year-old category still comprise 33 percent of the leadership workforce, earning a median salary of $92,000.

Job satisfaction continues to hold sway with veteran managers, who may be seeking to find balance in their lives as they reach the end of their earning cycle. But that doesn’t mean that the job is becoming any easier.

Seventy-seven percent of our respondents say that the number of functional roles they’re fulfilling on the job has increased again—an alarming fact that reveals more and more pressure being placed on an already exhausted workforce that says it’s been doing more with less for the last six years.

Company size matters

This year’s results—based on nearly 1,000 qualified LM readers—indicate that 60 percent again saw a year-to-date salary increase over the past year. Of that number, the median raise was 3 percent with the average raise coming in as high as 6 percent.

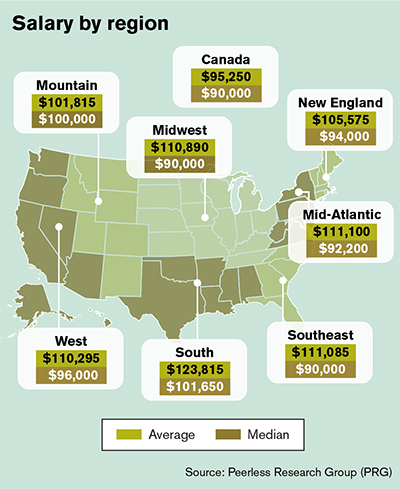

So, where are logistics professionals being shown the money? “If you’re young and seeking a job in this business, it’s best to aim for a big company first,” says PRG’s research director Judd Aschenbrand. “That’s where the money is.”

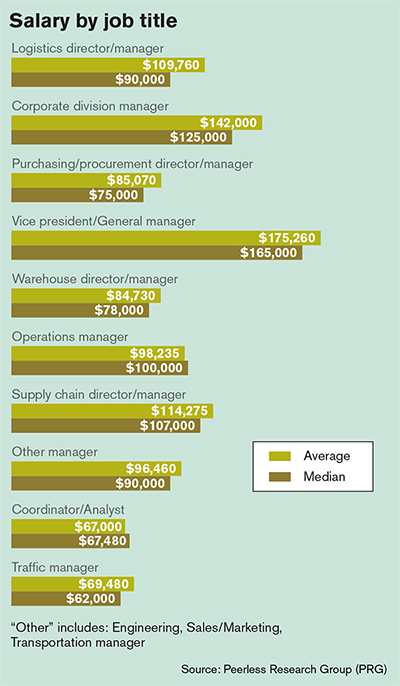

A cursory glance at the survey’s “salary by company revenues” illustrates this observation. Companies generating $2.5 billion or more pay a median salary of $115,000.

Those younger professionals should also be armed with a solid, “holistic” logistics and supply chain education, say executive recruiters. Now that a trend has been established to do more with less, employers are not likely to hire more logistics specialists than they need as today’s talent is able to thrive in many roles.

“Hire the best and leave the rest,” says Lynn Failing, vice president of supply chain recruiting firm Kimmel & Associates. “The big Fortune 500 companies are looking for a supply chain major who has taken classes in finance and technology as well. There’s so much cross-over in those disciplines, and we don’t see that going away.”

Alan Beaulieu, president of ITR, an economic forecasting firm, agrees, noting that by hiring multi-skilled professionals now, companies can secure a competitive advantage as the global economy stages a fresh rebound in 2015.

“Healthcare issues should be addressed and reformed by then, and we’ll have survived mid-year elections,” says Beaulieu. “In the meantime, China’s economy should improve, thereby driving demand for U.S. exports of heavy equipment and finished goods, putting more emphasis on the need for skilled, global supply chain professionals.”

For the time being, he advises companies to remain active in the global marketplace, as a concentration on purely domestic business may pose a long-term risk.

Closing the gender and generation gap?

While the generation gap may be closing, our survey indicates that a similar trend is not taking place with the gender gap this year. The median salary earned by men weighs in at $98,000 while women earn a median salary of $72,250. However, many survey respondents took issue with this finding, explaining in interviews that women continue to make steady headway in the business.

Amber Hilt, a logistics and warehouse manager at Abaxis AVRL in Kansas City, notes that her veterinary reference laboratory has put her on a terrific career track. “I graduated with a degree in biochemistry, but discovered logistics when I left school,” she says. “Now I’m nearly done with my business degree in operations management and human resources.”

Hilt, who has been in logistics management a little more than 10 years, continues to pursue higher education. She adds that managing people is going to be critical in the coming years as more corporations realize how important the logistics function is to the bottom line.

“I speak with other women about the potential of this career path,” says Hilt. “This has been a steady progression and points to the opportunity for women in this business. Furthermore, a logistics manager can live very well in Kansas City on the salary most companies offer.”

Julie Wanstedt, marketing manager for third-party logistics provider Keller Logistics Group in Toledo, Ohio, likens the challenge of finding logistics managers to the search for qualified truck drivers. “Unless the pay is very good for an entry-level position, young people seem to go elsewhere,” she says. “We will consider a candidate with just a couple of years of college if that person has some supply chain experience and seems willing to make a career of it.”

Reaching young people through social networking seems sound, but it’s also time consuming for recruiters. Wanstedt uses LinkedIn when she’s looking for logistics talent, but also goes to job fairs at Bowling Green State University to help fill the pipeline. The school currently offers a Bachelor of Science in Business Administration in supply chain management.

“Once a young person really understands that they can earn a good, middle-class income in this business, they might find it more attractive,” adds Keller.

Brenda Gautier, director of operations and carrier engagement at MW Logistics in Dallas, says social networking is popular among young candidates, but her company’s reputation is the real attraction. “Our clients are principally Fortune 500 companies, household names,” she says. “We are privately held, and very well known in the Dallas Ft. Worth area.”

Now in her eleventh year at MW, Gautier says that many professionals who came to the logistics industry “midstream” in their careers had a work ethic that may be hard to find in today’s youth. “A college degree is important, but we’re really looking for people with a passion for logistics,” she says.

“I need problem solvers, not just someone who can execute. There’s no middle ground in this business,” says Gautier. “You either love it or leave it.” Gautier is active with the Transportation Club of Dallas, CSCMP roundtable, and the Association for Transportation Professionals.

Becky Moss, a 13-year veteran transportation manager at Orbit Irrigation Products in Salt Lake City, says logistics managers are too busy working at desks to get out much, so social networking can be useful—up to a point.

“It’s still important to attend industry trade shows and participate in local association networks,” says Moss. “Our local CSCMP roundtable is very valuable for discovering opportunities and common challenges faced by logistics managers.”

Irrespective of gender, adds Moss, she wants workers who are detail oriented and dedicated to logistics.

“They must also be good communicators. Unfortunately, our industry is still under the radar for many women. Companies still have the get the word out,” she says.

Retaining talent

Terry McDorman, CEO of MGRM Associates, an executive recruiting firm in Chicago, agrees that for young men and women, a career path in the logistics and supply chain industry is showing new signs of life. “Salary levels, particularly in the logistics and supply chain engineering sector, have increased dramatically, and it’s about time,” he says.

According to McDorman, the general impetus behind the increase is that shippers and their companies are finding substantial opportunities for cost savings when fresh human talent is brought aboard to manage inventory, procurement, and optimized transportation service.

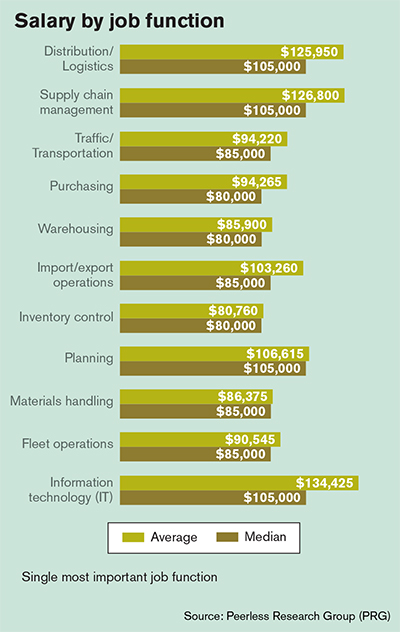

“This is not just about the transportation sector anymore, but has ramifications in the areas of assembly, warehousing, and distribution as well,” says McDorman. “It’s no longer a matter of which carrier gets it there on time and at the lowest cost. Today, a logistics manager has far more responsibilities.”

Meanwhile, selling the most gifted and driven young professionals on this industry remains a goal shared by both Fortune 500 companies and our leading institutions of higher education.

Joel Sutherland, managing director of the Supply Chain Management Institute at the University of San Diego says that there is clear frustration related to staying in the same position or job function for too long—if not for an entire career.

“This can lead to employee turnover when they search outside to gain a richer supply chain experience,” Sutherland says. “Companies, large and small, need to provide and communicate a clear advancement plan for their employees if they want to retain this talent. As evidence, it appears that 69 percent of the LM salary survey respondents are either passively or actively looking for new opportunities.”

Mike Burnette, associated director of The Global Supply Chain Institute at the University of Tennessee, Knoxville, says that sincerity and recognition of what it takes to keep logistics managers happy is also changing.

According to Burnette, many logistics leaders scratch their heads trying to figure out the new supply chain recruits, those we define as Generation Y, born between 1977 and 1994. “They’re a diverse, technology-wise, and sophisticated generation. To keep them engaged, given their shorter attention spans, Generation Y must be challenged.”

And because the survey clearly conveys respondents’ strong desire to raise their salaries, employers should encourage them to pursue ongoing education, says Dr. Bruce Arntzen, executive director of the supply chain management program at the MIT Center for Transportation & Logistics.

“Staying ahead of the learning curve will keep young logistics managers on a positive salary trajectory,” says Arntzen. “This year’s survey clearly points to that trend.”

Article Topics

Latest in Logistics

Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources