9th Annual Software Users Survey: Mixed Results

While shippers say they’re taking a more calculated approach to vendor and product selection, our survey finds that there will be an increase in overall supply chain software spending over the next 18 months.

Logistics Management magazine recently conducted its 9th Annual Software Users Survey to better understand the current supply chain software market, identify pertinent trends, and gauge just how far logistics and supply chain managers have come in terms of implementation.

With the economic recession gradually loosening its chokehold on the nation’s businesses, Logistics Management was keen to learn which new and upgraded software options were at the top of shippers’ wish lists, and which of those options were already in the planning and purchasing stages.

As in years past, specific areas of evaluation from survey respondents included types of software currently used and planned for purchase; annual software expenditures; respondents’ stage in the software buying process; reasons for consideration of supply chain solution software; number of software packages and vendors used by company; and expected timeframe for payback on purchases of supply chain software, to name just a few of the areas examined.

As in years past, specific areas of evaluation from survey respondents included types of software currently used and planned for purchase; annual software expenditures; respondents’ stage in the software buying process; reasons for consideration of supply chain solution software; number of software packages and vendors used by company; and expected timeframe for payback on purchases of supply chain software, to name just a few of the areas examined.

This benchmark study to assess the supply chain software market was conducted among readers of Logistics Management magazine and e-newsletters, and the study participants are involved in specifying and evaluating logistics and supply chain software solutions for their company. The study gauges the state of the market and identifies any trends that may have become apparent from year to year.

A total of 132 qualified responses were received from Logistics Management subscribers who indicated that they were personally involved in buying supply chain management (SCM) software for their companies’ operations. Over the next few pages we go deeper into the results and find out what some of the top SCM analysts have to say about this year’s findings.

Who’s planning to buy what?

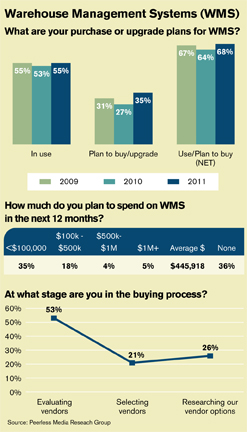

The top software choice for logistics professionals in buying mode was warehouse management systems (WMS), with a total of 68 percent of shippers either already using or looking to buy a new WMS in 2011, compared to 64 percent in 2010.

When they’re ready to procure those systems, 35 percent plan to spend less than $100,000, while 18 percent expect to pay $100,000 to $500,000. Four percent plan to shell out $500,000 to $1 million for their new WMS. Key expectations from such systems include upgrades of existing packages, real-time controls, inventory deployment, and label printing.

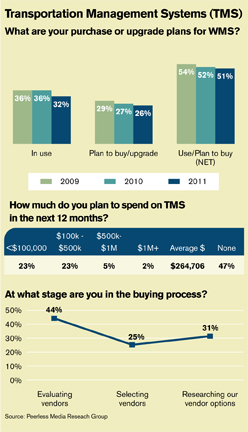

Transportation management systems (TMS) are also top of mind for shippers this year, with 26 percent planning to purchase such systems within the next 12 months. A total of 51 percent are either already using or looking to buy a new TMS this year, compared to 52 percent in 2010. Twenty-three percent expect to pay less than $100,000 for a TMS, while another 23 percent want to procure their TMS for $100,000 to $500,000. Five percent expect to pay $500,000 to $1 million for the software.

Transportation management systems (TMS) are also top of mind for shippers this year, with 26 percent planning to purchase such systems within the next 12 months. A total of 51 percent are either already using or looking to buy a new TMS this year, compared to 52 percent in 2010. Twenty-three percent expect to pay less than $100,000 for a TMS, while another 23 percent want to procure their TMS for $100,000 to $500,000. Five percent expect to pay $500,000 to $1 million for the software.

When it comes to getting the most out of a TMS, shippers are hoping to gain better routing and scheduling capabilities, improved carrier selection and load tendering, shipment consolidation, and routing and rating.

Seventeen percent of companies are shopping around for new enterprise resource planning (ERP) packages this year, with 24 percent planning to spend less than $100,000 for their new systems. Fifteen percent expect to procure their ERPs for $100,000 to $500,000, and three percent will pay $500,000 to $1 million. When buying their ERPs, 48 percent of companies will be looking for an integrated WMS and 25 percent expect a TMS to be included in the package.

To help improve inventory visibility, demand planning, order management, and vendor/supplier collaboration, 13 percent of shippers will invest in supply chain planning (SCP) software this year, compared to 27 percent in 2010. In total, 43 percent of shippers say they’re either using or planning to use SCP in 2011, compared to 25 percent in 2010. Fourteen percent of those firms say they’ll pay less than $100,000 for this investment, while 5 percent expect to spend $100,000 to $500,000, and another 5 percent will shell out $500,000 to $1 million.

When asked whether 2011 would be the year to integrate a global trade management (GTM) system into the mix, just 6 percent of shippers nodded. Of that group, 4 percent want to spend less than $100,000 for their GTM, while 4 percent will pay $100,000 to $500,000 and 2 percent will spend $500,000 to $1 million. Yard management systems (YMS) are on the radar screen for 3 percent of shippers this year.

Taking to the cloud?

Twenty-four percent of shippers report that they’re currently using an on-demand supply chain package, and the same percentage of respondents say they’re looking to move into an on-demand option over the course of the next 12 month. Meanwhile, 76 percent say they weren’t using on-demand solutions and are currently not shopping for one.

In examining this low interest in on-demand supply chain solutions in the survey, Belinda Griffin-Cryan, global supply chain executive program manager at Capgemini Consulting, says that the numbers could be trending downward because while the initial buzz around such solutions has subsided, they also haven’t “quite hit critical mass yet.”

“Shippers are still interested in on-demand solutions,” says Griffin-Cryan, “but they are approaching it more cautiously than we would expect, and that cautiousness is reflected in the adoption rates of some of these solutions.”

When asked how much logistics professionals are expecting to spend overall on supply chain software in 2011, 48 percent of shippers plan on $100,000 or less. Twenty-five percent expect to pay out $100,000 to $499,999; 9 percent are planning on $500,000 to $999,999; and 10 percent fell into the $1 million to $2.49 million range. The average amount that shippers expect to pay is $703,448, up from $538,800 in 2010.

The criteria that shippers use when evaluating software packages has changed as a result of challenging economic conditions. Forty-six percent of respondents say they are scrutinizing their software investments more closely (compared to 33 percent in 2010) and moving more cautiously, while 21 percent have frozen all investments for this sector (compared to 18 percent in 2010).

Thirty-eight percent of respondents say their company’s use of supply chain software has increased over the last two years. When asked the same question in 2010, 47 percent responded affirmatively. This year, 56 percent of companies say their supply chain software investment has remained steady over the last 24 months, and 6 percent say it has decreased.

Important factors that shippers will use when choosing the right supply chain software include operations service/support; compatibility with existing software; and configurability. Twenty-four percent of shippers are currently using an on-demand supply chain package. Most respondents (43 percent) expect ROI on their purchases within 12 to 18 months, while 29 percent want to see those results within six to 12 months.

What do the analysts think?

Dwight Klappich, research vice president for Gartner, Inc., isn’t surprised by the overall results of the software survey, which indicates a cautiously optimistic approach to new purchases for 2011, an overall increase in total supply chain software spending, and a more calculated approach to vendor and product selection.

Klappich did have some comments on specific data points. For example, he says that a higher number of shippers are probably considering on-demand solutions than the survey indicated. “Our own analysis shows that about 50 percent of supply chain operations are looking at on-demand options,” says Klappich.

Griffin-Cryan says she was surprised at the fact that inventory visibility and demand planning “dropped off a bit” as drivers of supply chain software purchases. While 58 percent of respondents cited inventory visibility as a key concern in 2010, only 42 percent pointed to it as a driver in 2011. For demand planning, the percentages were 52 percent and 25 percent, respectively.

She credits an improving economy with taking some of the emphasis off of those two drivers. “During the recession, that’s where companies were spending money because there was so much focus on improving inventory position and doing better demand planning,” Griffin-Cryan says. “That’s probably why we’re seeing a drop-off now, because those were the two areas where companies were able to justify spending for the last couple of years.”

When it comes to overall spending on supply chain software, Griffin-Cryan states that the Logistics Management survey results are in line with Capgemini’s own findings. “It does look like firms are starting to spend money and invest again,” she notes. “We’re seeing that trend in our own discussions with clients, and it’s reflected in the survey data.”

Adrian Gonzalez, director at Newton, Mass.-based Logistics Viewpoints concurs, and says his firm’s numbers also show an uptick in IT spending in the supply chain space for 2011, compared to the previous two years. “The year 2009 was a bad one for the market, and a lot of companies pulled back,” says Gonzalez. “In 2010 we started to see some recovery, and the momentum is definitely continuing in 2011.”

Article Topics

Press Releases News & Resources

Industrial real estate market conditions remain tight, with space in short supply, reports CBRE Freitrater® Freight Rating and Routing Software for Shippers CT Logistic’s SaaS-based TMS platform leverages API’s and technology CT Logistics Employs Qlik® Business Intelligence Software Inspur Information Named IDC Supply Chain Technology Leader Norfolk Southern rolls out details of strategic company plan Supply Chain Technology: Cloud computing breakthrough More Press ReleasesLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources