Air Cargo Report: Managing global air freight costs

Our team of market leading consultants offers global shippers a strategic approach for optimizing air freight expenditures in a way that simultaneously improves service and capacity.

Latest Logistics News

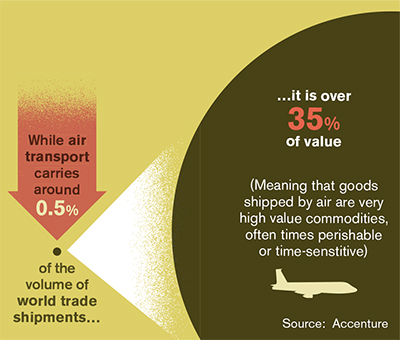

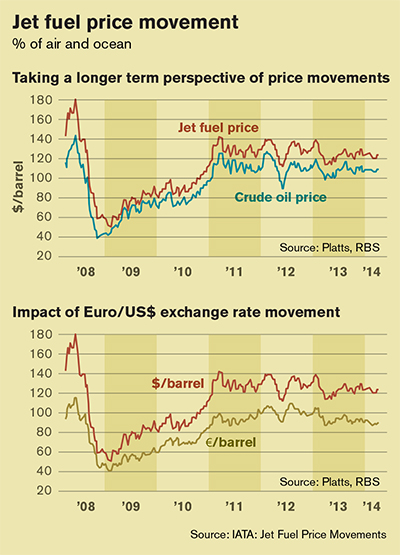

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsManaging air freight across complex global networks has never been more challenging: The rapid rise in fuel adversely affects air cargo carriers much more dramatically than other more fuel efficient modes, creating a widening economic gap.

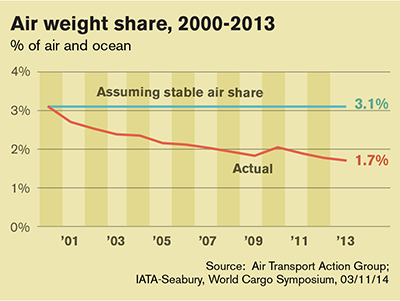

The net result of this trend has been a relatively steep decline in air cargo volume worldwide over the past decade or more. Recent research by the International Air Transport Association (IATA) has revealed that containerized air cargo declined from 3.1 percent in 2000 to 1.7 percent in 2013.

The same study attributed a significant portion of this erosion to modal shifts from air to ocean or surface transport. This trend is likely to continue, despite the importance of air cargo, particularly for those companies with high-value products.

While capacity has not been a problem of late, the larger challenge stems from effective management of air freight spend in a market where the cost of providing the service is seen to be rising.

Our goal over the next few pages is to describe a strategic approach for optimizing the expenditures in a way that simultaneously improves service and capacity. The strategic objective is aimed at converting the international lanes of air and ocean cargo to a network-based strategy of global capacity management.

For many, this requires a different way of thinking, different skills, capabilities, and tools. In this piece, we will discuss how to attack this problem and suggest solutions that can be “operationalized” to improve supply chain performance.

Maximizing utilization

The fundamental precept is based on a single, simple fact: Air cargo capacity stems from large, expensive assets. The best way to take cost out of the supply chain is to maximize the utilization of those assets, which is done by employing a network-based approach to sourcing capacity through what we refer to as “expressive competition.”

To successfully set up an event for sourcing global airfreight capacity, participation, alignment, commitment, and willingness to act and make decisions for the betterment of the company from every single stakeholder involved are a must.

A global airfreight sourcing event will have cross-regional synergies that will benefit both the providers and your organization. It will serve as an opportunity to proffer visibility to the client’s entire network, integrate networks, and formulate global versus regional partnerships.

The steps that need to be taken to coordinate a global event of this kind should take place in a pre-defined manner. However, before you can truly consider going out to the market with a strategy that will reduce costs, maintain or increase service levels, and secure capacity, you first need to know what your current global airfreight spend is—a number that is often more challenging to identify than one might think.

Companies frequently house data in multiple sources around the globe or rely on the service provider for volume and cost information; costs are captured on an “all-in” basis, versus being broken out by the contributing components; and, most deflating, is that data is not captured in a standardized fashion. Therefore, deciphering what you have and what is actually useful can be rather daunting, frustrating and time consuming.

Whether captured by the shipper or the provider, the quality and quantity of data is significant. The more fragmented and decentralized a company is, the greater the risk of not having a complete and useful data set that reflects your current total spend.

Prior to the start of working with a global client, Accenture provided them with a data request that included all shipments within the past year. We were pleasantly surprised when the client immediately replied that this request would easily be fulfilled.

However, upon receiving the data, we were disappointed to find that their rate tables had not been updated in 16 months, and the entire data set was for less than 30 percent of their total global spend.

Air freight cost factors include movement rates, surcharges and fees, and fuel and security charges. Most shipments have multiple charges with only some being controllable. The volatility of fuel, and the fact that shippers are also faced with varying supply and demand, makes it difficult to know if contracting or spot purchasing is more advantageous. Complex networks with diverse types of products from diverse industries (e.g., automotive, high tech, or healthcare) force shippers to react to consumer demands, which often require shorter lead times and lower predictability.

Understand your costs

Other cost contributors are related to the different business requirements associated with areas such as the product, origin/destination, equipment, lanes, and transit times, to list a few. Capturing each detailed requirement is absolutely necessary as these requirements most always incur costs, and you need to be able to capture those as part of your spend.

Usually the business or operations groups have an understanding of the requirements, and if Standard Operating Procedures (SOPs) are documented and available, they’re usually the most reliable and accurate sources. In instances where there are no documented requirements or procedures, you may need to obtain the information from the carrier.

Once all perceived requirements have been compiled, it is worthwhile to gather the stakeholders and review that list. This is primarily due to the fact that we often find that what may have once been deemed as a requirement may no longer be necessary, thus eliminating any cost related to that requirement. Uncertainties exist every day, and with every shipment, but the better your understanding of your air freight requirements and spend, the easier it will be to effectively understand and control your costs.

When the correct data and detailed requirements have been captured at a global level, you can begin to analyze all the information you have at a profile level. You can then evaluate key lanes by looking at the amount of volume leaving an origin, then delivering to a destination, broken out by region, country, and exact points or capturing the volume being hauled by a specific provider, once again by region, country, or other specific point.

Breaking down this type of information to the lowest possible level of detail will provide visibility to all your costs—and will enable you to identify areas of opportunity to improve rates and charges. Detailed cost breakouts will also help you better understand your competitiveness in today’s marketplace.

There are multiple ways to compare your costs to others in the marketplace. Two approaches that we find most clients asking for are benchmarking and going out to the market with a competitive bid. Benchmarking can be a good source of information if you have a well-rounded sampling of comparable data.

The similarities should include: origins; destinations; special requirements (e.g., temp control, ‘DanCom,’ etc.); transit times; product; volumes; and routing which are often difficult to obtain, but necessary for a true “apples-to-apples” comparison.

Another crucial element in airfreight is the fuel surcharge. Volatility in jet fuel prices combined with volatility in exchange rates are adding additional pressures to the bottom line. Given the high volatility in fuel prices, fuel management is complex and properly the subject of a separate discussion.

How do carriers value your freight?

An often more effective approach to understanding where your costs stand up in the market, is to take all the data and requirements you’ve obtained and go ask the market how they value the freight you have to offer.

This is done annually through strategically sourcing global capacity that maps to existing and predictive freight flows. The process continues by qualifying a legitimate set of carriers and executing a sourcing event that will clearly let you see how your costs measure up to others, based on actual rates and pricing received from carriers that understand your freight flows, characteristics, and requirements.

In many of the sourcing events that we’ve conducted, there is a high promise for drastic cost reductions, but only if the rates are implemented correctly. While sourcing global airfreight bid is not an easy task, implementing one is even more difficult. One needs to setup a diligent process to ensure:

Carriers implement rates in a timely fashion. Shippers need to check if the invoices post the implementation date and reflect changed rates.

Various shipping stations are informed about the new rates and carriers to be used.

- SOPs are created, understood, and agreed upon on lanes where carriers’ changes have taken place. As supply chain professionals, we want to ensure that the business continues to run smoothly, and an incomplete or incorrect SOP would affect our ability to change carriers in the future.

Another critical part of the implementation program involves confirming realization of promised savings to help gain stakeholder confidence that the rates put in place are realistic and meet the service level criteria set at the start of the contract. This not only ensures the carriers are charging as per the contract, but it also helps in creating a fact-based budget for the next year.

The good news is that despite the challenges associated with minimizing airfreight costs, there are processes companies can put in place that can help companies reduce waste and maximize the return for their spend. And, in today’s digital world, data analysis can play a very important role in understanding your air freight costs and needs, as achieving these objectives begins and ends with data management to understand where you’re starting from and the progress that you’ve made.

The endgame is producing a rigorous, well-disciplined and proven strategy that drives cost out of the supply chain. This is a win for providers because it makes for a more efficient operating environment, which in turn becomes a win for the shipper who gets better service at a more competitive price.

Brooks Bentz is a managing director in Accenture Strategy, Operations, which works with its clients to architect, build, and operate high performance supply chains. Jeanne Dailey, senior principal, and Mohit Kumar, a manager, also deliver operations services in Accenture Strategy.

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources