22nd Annual State of Logistics Report: A bumpy ride

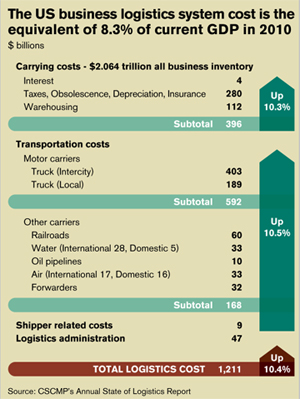

The cost of the U.S. business logistics system jumped up 10.4 percent in 2010, making up more than half of the preceding year’s decline. But don’t expect gains like this to continue as the economy begins to slow and all four transportation modes scramble to make adjustments during this period of unprecedented volatility.

When the transportation and logistics market’s chief prognosticator, analyst Rosalyn Wilson of Declan Consulting, gave Logistics Management some early insight into her findings for the 22nd Annual State of Logistics Report (SoL), she was still wrestling with a title.

“We had given some thought to calling this report ‘Coming in on a wing and a prayer,’ but felt that would be too negative,” says Wilson. “After more thought we decided to call it “Navigating through the recovery.” But after the official release in mid-June in an event sponsored by the Council of Supply Chain Management Professionals (CSCMP) and Penske, it was clear that no matter how you slice and dice the data she’s collected, shippers are going to be in for bumpy ride in terms of rates, capacity, and service over the next six to eight months.

“An unstable rate and capacity environment hurt both sides, including the freight intermediaries, and it’s not going to get much better for a while,” says Wilson.

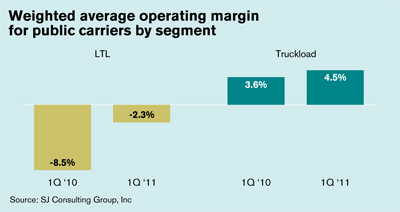

In her SoL report, which is designed to neatly summarize the previous calendar year in logistics and transportation spending, Wilson says that 2010 was certainly a better year for carriers and third party logistics providers (3PLs) than 2009—but it didn’t turn out to be all that we had hoped. The recovery from the Great Recession has proven to be more elusive and prolonged than any other in our history, and the slow growth presented another year of challenges for the logistics industry, she notes.

In her SoL report, which is designed to neatly summarize the previous calendar year in logistics and transportation spending, Wilson says that 2010 was certainly a better year for carriers and third party logistics providers (3PLs) than 2009—but it didn’t turn out to be all that we had hoped. The recovery from the Great Recession has proven to be more elusive and prolonged than any other in our history, and the slow growth presented another year of challenges for the logistics industry, she notes.

“Volumes firmed up early in 2010, but dropped off in the second half,” says Wilson. “Demand for capacity began to equalize with available space in many sectors, but rates continued to be constrained. Inventories began to climb , and retailers pulled back on their ordering because spending did not expand as expected.”

|

|

|

|

Visit the 2011 Quest for Quatlity Winners NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL | |

According to Wilson, the economy began to falter in the second half of 2010 as the contribution from the various stimulus packages, put in place to jump start the first year of the recovery, began to fade. “We may have hit a wall,” says Wilson.

All four major transportation modes are scrambling to make adjustments during this period of volatility, and shippers may be forced to do more with less as a consequence.

Economy: Thwarted charge in 2010

Macroeconomic trends have a profound impact on the growth of logistics and transportation markets. And, consumers are not leading the charge as they have in other economic recoveries due to the fragile state of their personal wealth, says Wilson.

“Unemployment is still pervasive, new jobs are being created at a rate that does not even cover population growth, the housing market hasn’t rebounded in most areas, foreclosures continue, home prices are still deflated, and fuel and food prices have been steadily rising,” says Wilson. “Personal net worth plummeted for most people, causing them to adjust their view of the economy and their spending patterns,” she adds.

In the three years prior to the recession, the personal savings rate in the U.S. averaged 1.9 percent, which is in line with a steady decline over the last 20 years, according to the SoL report. Since the beginning of 2008 and through 2010, the personal savings rate has averaged 5.3 percent, which is still significantly lower than the 9 percent to 10 percent average before 1990. Consumer spending and retail sales grew modestly in 2010, not igniting as expected. Most of the increase in retail sales came in the form of sales of fuel, automobiles, and food.

Manufacturing and business spending were the bright spots during much of 2010. Industrial production was up 5.3 percent in 2010, after declining 11.2 percent the year before. Industrial production and manufacturing for businesses was up, while consumer goods production was almost flat. Capacity utilization increased from 69.2 percent in 2009 to 74.5 percent in 2010, while consumer spending and retail sales grew modestly.

“These were all signs that the economy was strengthening, but by mid-year there was a slowdown and it never fully reached that level of momentum again,” says Wilson. And there were other encouraging stories as we entered 2011, says Wilson. For instance, the auto industry was rebounding, and recently Chrysler paid off its TARP loans seven years ahead of the due date.

“Given the weather conditions in most of the country at the start of 2011, most measures would call the first quarter a strong one for the logistics industry,” says Wilson. “In the last few months of 2011, however, volumes have been eroding, along with other key economic indicators, and there are signs that the economy is stalling and predictions for a strong 2011 may fall short.”

Read the individual mode reports below:

2011 State of Logistics: Air Freight

2011 State of Logistics: Ocean

2011 State of Logistics: Truckload

2011 State of Logistics: Less-than-truckload

Hard numbers

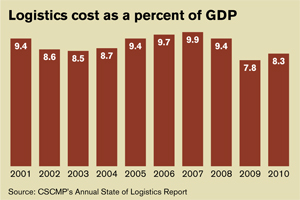

Total logistics costs rose 10.4 percent in 2010 after tumbling in both 2008 and 2009. Transportation costs are up over 10 percent in 2010 due to higher freight volumes, fuel surcharges, and for some modes, rate hikes. Interest rates continued to drop, while inventory levels inched back up. Lower warehouse costs were more than offset by increases in other inventory related costs (insurance, depreciation, taxes, and obsolescence) resulting in a 10.3 percent gain in inventory carrying costs.

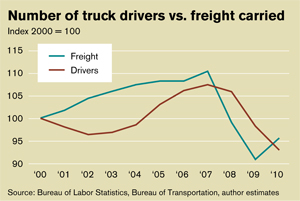

“Logistics as a percent of our nominal GDP moved back up to 8.3 percent, still lower than any year but 2009,” says Wilson. Wilson also notes that volumes have only recovered about half the recession losses, yet industry capacity, particularly in truck and air, is close to being fully engaged. The recession had a “devastating effect” on total industry capacity, which is much lower than it was in 2007, the report says.

“The recovery is not being felt evenly in the economy, and 2010 did little to shore up precarious carriers who have been hanging on hoping to be rescued by a resurgence,” says Wilson.

Business inventories increased in all quarters except the second, which experienced a slight dip. By the third quarter, inventory levels were heading back to levels experienced at the start of the recession, ending the year at the highest point since third quarter 2008. The average investment in all business inventories (agriculture, mining, construction, services, manufacturing, wholesale, and retail trade) increased to almost $2.1 trillion in 2010, a jump of $199 billion as stock was replenished in the first quarter of 2011.

Holiday shopping volumes were reportedly higher than in 2009, but final sales figures showed that people weren’t buying as much as anticipated. And, says Wilson, many waited until late in the season to buy to take advantage of discounted merchandise.

“Ugly” details

Wilson concludes her report on a decidedly candid and downbeat note, telling us that “the ugly details” show how vulnerable the recovery actually is, which will translate into one of the more volatile periods shippers and carriers have ever seen.

The first quarter 2011 GDP growth rate was revised downward in the latest release, with preliminary estimates coming in at just 1.8 percent, well short of the 3.1 percent projection. Consumer spending was revised downward, hitting a six-month low while inventories climbed higher.

“The current economic picture is not indicative of a strong recovery,” she says, “in fact it appears that the recovery is losing momentum. Originally robust estimates for second quarter GDP have been cut dramatically to between 2.5 and 3 percent.”

She points to the fact that the public sector continues to shed jobs as budgets are chopped. A recent survey by ADP, the payroll processing company, showed a sharp decline in the rate of job creation at private businesses. Firms added only 38,000 jobs in May, compared with 179,000 jobs added in April. Also, the number of people filing new claims for unemployment insurance benefits is on the rise again. Pervasive unemployment undercuts GDP growth by reducing consumer demand, which in turn makes it harder to create jobs.

“It used to take six months for the employment situation to get back to normal after a recession,” says Wilson. “This time around the Federal Reserve Board Chairman has said that he expects it could take as long as five years to get back to a pre-recession level.”

Although many industry observers are predicting strengthening of logistics services as we head to the second half of 2011, Wilson says that the pieces are not falling into place to support anything more than weak growth.

For example, retail sales rose in May, but were well below what had been forecast for May and lower than April’s numbers. The Consumer Confidence Index dropped sharply in May from 66.0 to 60.8, reflecting consumer uncertainty and rising pessimism about inflation, their income prospects, and the housing market.

This uncertainty is translating into a slowdown in purchasing. Business spending and manufacturing are declining as well. New orders and production declined in May, 10.7 and 9.8 percent respectively. The Purchasing Managers Index recorded its steepest drop since 1984, plunging 6.9 percent in May. Imports and exports are also forecast to be flat or even a little down in May.

Wilson says starkly: “By the end of 2011 we will see a different looking freight picture. Shippers may be dodging about in a search for capacity during sudden surges in demand, and carriers will continue to look for a sustainable revenue model.

“Which scenario will play out?” she asks. “It could go either way at this point, but my money is on the innovators in the logistics industry who are navigating through the recovery.”

Read the individual mode reports below:

2011 State of Logistics: Air Freight

2011 State of Logistics: Ocean

2011 State of Logistics: Truckload

2011 State of Logistics: Less-than-truckload

Article Topics

Latest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources