CBRE research points to expected gains in cold-storage warehouse space

As more consumers continue to buy groceries online, it has the potential to drive up the demand for roughly 35 million square-feet of United States-based cold storage space moving from retail stores to warehouses and distribution centers over the course of the next seven years. That is the main takeaway of research released this week by industrial real estate firm CBRE in a report entitled “Cold Storage: About to heat up?”

As more consumers continue to buy groceries online, it has the potential to drive up the demand for roughly 35 million square-feet of United States-based cold storage space moving from retail stores to warehouses and distribution centers over the course of the next seven years.

That is the main takeaway of research released this week by industrial real estate firm CBRE in a report entitled “Cold Storage: About to heat up?”

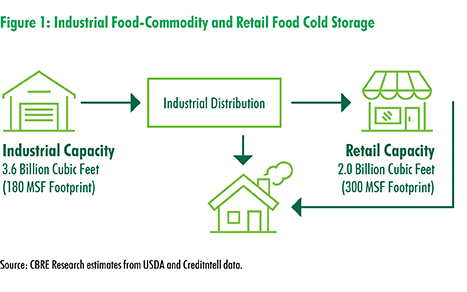

According to CBRE estimates, the U.S. market for food-commodity cold storage space covers 3.6 billion cubic feet of food-commodity cold storage capacity, covering around 180 million square-feet of industrial space, mostly in the form of refrigerated warehouses, as well as 2 billion cubic feet of similar capacity or roughly 300 million square-feet of space in grocery stores and other retail venues.

While these numbers are impressive on their own, CBRE data indicates there is much more room to run for the United States cold storage space market.

Online grocery sales, it said, accounted for $19 billion, or 3%, of total 2017 grocery sales, but are expected to hit $100 billion, or 13%, by 2024, based on data from FMI/Nielsen.

CBRE Senior Vice President for its Food Facilities Group Art Rasmussen told LM that the primary drivers for cold storage facilities include population growth, particularly in metro areas, and the change of consumer consumption habits.

“For example, millennials tend to dine out more and cook less, while two-income households typically don’t have time to prepare meals,” he said. “Cold storage use is also on the rise due to the convenience factor, given the greater variety and quantity of frozen and fresh food offerings. Plus, many supermarkets and convenience stores today offer ready-to-eat alternatives, ranging from hot entrees, soups, salads, desserts to juice bars. Places like Target feature quick-serve restaurants, and we are seeing a continued growth in fresh-food outlets with increasing variety of food offerings. Just look at all the refrigerated food alternatives at stores such as Trader Joe’s, Whole Foods, Gelson’s and Bristol Farms.”

What’s more, Rasmussen pointed out that new retailers from Europe such as Aldi and Lidl and established retailers such as Target are increasing their frozen and refrigerated food offerings frequently. And he noted that demand for frozen food has proven to be pretty inelastic, pointing out that during the 2008 recession, restaurant visits dropped dramatically while demand for frozen food products increased. He also observed that demand from the evolving “food halls” concept is driving demand for cold storage facilities as well.

“Sustaining all this demand is our steadily improving economy since the recession, which has allowed consumers to increase their spending on “non-discretionary” food items,” he said.

When asked what the biggest changes are in the intersection of the e-commerce and the online food and grocery sector over the last five years as it relates to the cold storage warehouse and distribution center space, Rasmussen explained that the largest example is the entry of entry of large e-commerce players into the grocery and food-distribution markets.

“Those players learned that building an ideal cold-storage infrastructure is challenging and time-consuming,” he said. “Some of this, as we’ve seen, can be addressed by e-commerce players purchasing existing grocery chains, which have established cold-storage supply chains. That type of M&A activity spurs the grocery industry to modify its business models, including refining and enhancing its cold-storage infrastructure. Additionally, consistent growth in the organic sector has also driven further need for refrigerated (and some frozen) food offerings.”

With the anticipated growth in online sales expected to rise 10% between 2017 and 2024, as indicated by the aforementioned FMI/Nielsen data, Rasmussen said there are various things that stakeholders such as e-commerce players, online grocery companies, and food shippers, can do to prepare for the surge.

“[They] need to allocate ample storage and warehouse space to support increasing demand through a variety of food industry verticals,” he said. “Increased volume through e-tailing and home delivery, for example, requires both the e-tailer and retailer to have adequate inventory to fill orders in a timely manner. The barrier to entry is very high for industrial cold storage infrastructure from a cost and availability standpoint. There is no speculative market creating new supply like there is in the dry warehouse market. With public refrigerated warehouses (PRWs) operating at almost capacity, growth companies will need to rely even more on these PRW operators to fulfill the link in the chain between food industry producers, e-tailers, retailers, distributors and the end consumer. Use of a public refrigerated warehouse, which often does not require a long term contract unlike a standard warehouse lease, can bridge the growth gap between capital commitment to build out the distribution infrastructure, which takes time, resources, new staff and predicting space needs in the right locations. With a few exceptions, it will be challenging for most retailers, while fighting for customers, to be as nimble or capable to respond. Therefore, they will have to rely on third-party warehousers to store, sort, handle and potentially deliver product for them.”

In the report, CBRE said it found that larger concentrations of food-grade, cold-storage facilities occur in states with substantial agricultural production, large populations or both. And CBRE said it estimates California to have the most industrial cold-storage space (nearly 400 million cubic feet), followed by Washington state (271 million), Florida (260 million), Texas (231 million) and Wisconsin (228 million).

Article Topics

3PL News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates More 3PLLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources