Global Logistics: Asia Pacific’s challenges and opportunities in market integration

While the EU appears to be increasingly fragmented, today’s global shippers are viewing parts of Asia as a “single market.” Indeed, the latest report from specialist research company Transport Intelligence (Ti) suggests that opportunities for U.S. companies will only get better in this dynamic commercial arena.

“Economic growth throughout Asia moderated in 2011 due to weaker demand in developed markets and especially the impacts of the Eurozone crisis,” says Ti CEO John Manners-Bell.

“However, investment overall increased slightly and consumption remained buoyant.”

China remained the strongest economy in the region, growing at roughly twice the pace of large countries such as Indonesia, Malaysia, the Philippines, and Thailand. Korea and Taiwan both grew at slower rates, as weak investment compounded the effects of slower exports. Vietnam’s economy grew in the mid-single digits due to strong growth in industrial output and consumption.

Real GDP in China grew only 7.6 percent year-on-year in the second quarter of 2012, its slowest pace in three years, observes IHS Global Insight Economist Sara Johnson. While the current slowdown in China is not nearly as severe as it was in 2008 and 2009, she says that in many ways China is more “vulnerable” now.

“Credit markets are overstretched, house prices are still unsustainably high, commercial banks are weak, and local government debt is high,” says Johnson. “All this suggests that growth this year and next will only be in the 7.5 percent to 8 percent range. On the other hand, given the recent aggressive policy response by the central bank and government, the odds of a hard landing are no more than 25 percent.”

Japan’s economy, meanwhile, bounced back after its crippling earthquake and tsunami, and a period of contraction. Rebuilt supply chains and investment added to the growth. However a strong yen continued to have a negative impact on exports and led to an increasing migration of manufacturing to its neighbors.

Ti analysts say that Indonesia is expected to be one of the strongest economies in the region, with retail sales growing at 25 percent a year. Malaysia and Thailand are expected to recover from supply chain disruptions, although will be hit hard by weak export markets in Europe. “With Western markets stagnating,” observes Manners-Bell, many economies in the region are looking to intra-regional trade for stronger growth prospects.”

Look before you leap

Given the recent history of supply chain disruption in the region, U.S. shippers seeking to enter the Asia Pacific markets are advised to proceed with caution. Just when automobile factories had begun to recover from the Japanese tsunami in 2011, the high-tech sector took a huge hit when Thailand was dealing with catastrophic flooding.

This year it was India—Asia’s third largest economy—that gained the spotlight and added scrutiny of risk mitigation analysts. That nation’s massive power outage this past summer should serve as “wake up call” for many multinationals, says analysts.

“The power grid failure can have a ‘domino effect’ on businesses, communications and IT systems,” says Linda Conrad, director of strategic business risk management for Zurich Services. “Furthermore, this will weaken supply chain infrastructures including all forms of transportation, which could have a major affect on multiple industries.”

With emergency workers and energy professionals still searching for clues to India’s electricity grid collapse, logistics managers should consider risk mitigation strategies now, says Conrad. “As we learned from natural disasters in Japan and Thailand, the ripple effect can be devastating on second- and third-tier suppliers,” she says. “Companies that are over-exposed in India now might consider some supply chain alternatives for 2013.”

Conrad notes that many countries including the U.S. outsource call centers and IT services to countries like India. She says an outage like this can cause serious damage to businesses that rely on those services such as hotel chains and technical support. “It should also give us pause to consider what might happen if a similar shutdown occurred if there was a terrorist attack on India’s power grid. The situation might be even worse.”

Rethinking outsourcing

Terrorist attacks or angry acts of nature notwithstanding, it may appear that the tide has begun to turn on the flow of manufacturing jobs from the U.S. to the Asia Pacific.

According to a new study from The Hackett Group, Inc., some companies are already reshoring a portion of their manufacturing capacity, and this trend is expected to reach a crucial tipping point over the next two to three years.

“The total landed cost gap between the two regions continues to shrink, driven in part by rising wage inflation in China and continued productivity improvements in the U.S.,” says David P. Sievers, principal and strategy and operations leader for The Hackett Group.

At the moment, China remains a manufacturing powerhouse, with nearly 75 percent of the companies surveyed having some manufacturing capability in China for at least three years, either directly or through contract manufacturers. The Hackett Group estimates that Chinese manufactured exports to the U.S. currently support between 15 million and 20 million jobs in China.

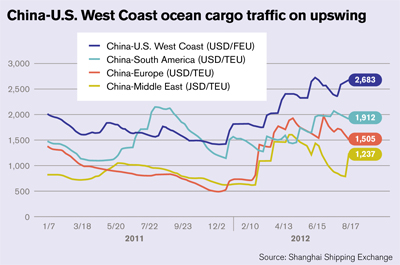

But reshoring is expected to become more viable with each passing year, as the total landed cost gap of manufacturing offshore shrinks, say some analysts. The Hackett Group’s research found that the cost gap between the U.S. and China has shrunk by nearly 50 percent over the past eight years, and is expected to stand at just 16 percent by 2013. This trend is not only driven by escalating labor costs, but also by rising fuel prices globally, which affects shipping costs.

“This is good news for the American worker as growth in the U.S. manufacturing sector keeps more high-paying jobs at home,” says Sievers.

For Rosemary Coates, president of Blue Silk Consulting, some U.S. companies may simply be getting tired of exercising the diligence needed to start a business in China. “That doesn’t mean shipping and transportation providers will not be needed in the Asia Pacfic, however,” says Coates. “On the contrary, with greater inter-regional trade, U.S. shippers may be hedging their bets by doing business with several neighboring countries at once.”

Mixed forecast

Asia Pacific’s rapid-growth markets (RGMs) started to slow sharply since the beginning of this year, but this will only be a “temporary blip,” according to Ernst & Young’s quarterly Rapid-Growth Markets Forecast (RGMF). The analysts are particularly bullish on the recovery of Vietnam and Thailand.

“RGMs—particularly in Asia—have the necessary tools available to ease both fiscal and monetary policy allowing growth to resume towards the end of the year,” says Carl Astorri, senior economic adviser to Ernst & Young’s RGMF.

He says that RGMs are well placed to weather the major risks facing the global economy at the present time, given that they have the space to relax fiscal and monetary policy. “This has already happened in some RGMs—especially in India and China—and it’s likely that there will be further easing of monetary policy in the months ahead, particularly if the global economy deteriorates further.”

Analysts at Ti also forecast that the Asia Pacific contract logistics market will grow at a compound annual growth rate of 13.9 percent between now and 2015. Growth will be strongest in China and the market is expected to double in size by 2015.

“China will become the largest market in the region overtaking Japan, which will see the lowest level of growth,” says Ti analyst Cathy Roberson. “However, the region remains susceptible to any deterioration in the global economy as exports and subsequently domestic demand would have a significant impact on the contract logistics industry.”

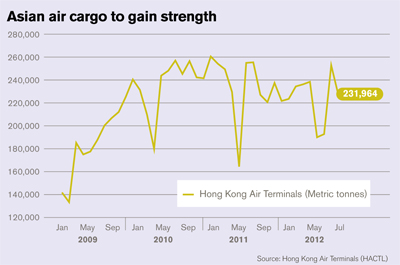

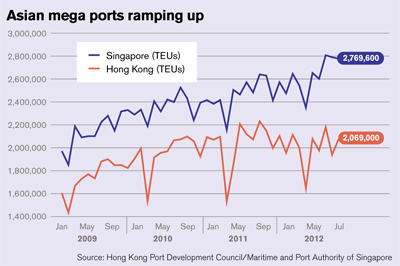

The Association of Asia Pacific Airlines noted a slight decline of 0.8 percent compared to July 2011, while Asian ports continued to report mixed results with Hong Kong’s twenty-foot equivalent units (TEUs) declining almost 7 percent, but Singapore reporting a 9 percent increase. The mixed port data may indicate increasing demand among the Southeastern Asian countries as foreign investment continues to be infused into this region.

While domestic demand in the region generally remained strong, external demand declined. Exports to Europe fell considerably, resulting in a decline in manufacturing activity and acted as a drag on growth within the region.

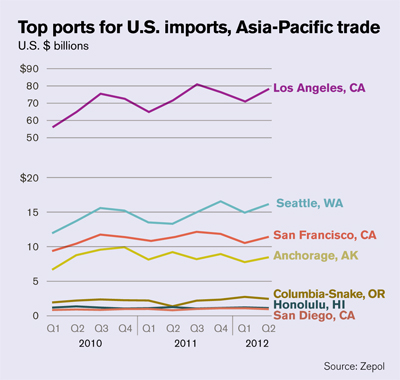

Zepol Corporation, a leading trade intelligence company, reports that U.S. exports to Asia have been ramping up, thereby benefitting a number of major seaports. But U.S. manufacturers are continuing to lose market share. At the same time, industry analysts note that Asian countries have negotiated more than 160 trade agreements among themselves, while the U.S. has signed only three with regional countries—Singapore, Australia, and most recently South Korea.

Article Topics

Global Logistics News & Resources

2024 Global Logistics Outlook: Crisis mode lingers The reconfiguration of global supply chains Hidden risks in global supply chains Global Logistics 2023: Supply chains under pressure Roadrunner rolls out new direct lanes and transit time improvements U.S. rail carload and intermodal volumes are mixed, for week ending March 12, reports AAR State of Global Logistics: Time for a reality check More Global LogisticsLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources