Global Logistics: Optimizing 3PL partnerships

In today’s dynamic, global marketplace, shippers need to execute a checklist of essential action items in order to get the most out of their third-party logistics partnership.

When examining best practices in managing third party logistics provider (3PL) relationships, leading consultants, analysts, and educators recognize that most logistics managers begin their search with one goal in mind: to reduce cost by leveraging outsourced expertise and technology.

Naturally, one assumes that top 3PL players will provide the basic services that are now in widespread demand to achieve these goals. For example, the best 3PLs use the latest tools such as Lean and Six Sigma concept and offer the latest in warehouse management systems (WMS) and transportation management systems (TMS). And, the big players have real-time tracking and event management systems with “shipper alerts” for delays.

Shippers also expect their 3PLs to have network optimization capability to enable them to select the optimal warehouse locations. And, of course, 3PLs are relied upon for global expertise, including regulatory compliance and documentation.

However, according to our expert sources, there’s more than meets the eye when it comes to managing and optimizing a 3PL relationship. According to J. Paul Dittmann, Ph.D., executive director of the Global Supply Chain Institute at the University of Tennessee, shippers also need their 3PL to take direction, respond rapidly, and generate ideas for improvement.

“Shippers further expect their 3PLs to become a strategic partner in efficiently growing their business,” says Dittmann. “Today, aggressive, continuous improvement is a given.”

According to Dittman, industry surveys indicate that the most important factor in establishing a successful 3PL relationship is trust—fostered by good communications between the two parties. Third party logistics providers report that their greatest challenge is finding qualified people who are dedicated to learning the client’s business, and taking it to the next level.

However, in order to complete that journey, several steps must be initiated and executed. If a checklist has not yet been established, the time for creating one is now. Our experts have helped us create a list of three steps that they feel will go along way in helping shippers fully optimize their 3PL partnerships.

1. Establish “gain sharing”

For Dittman, it’s all about “gain sharing,” or a mutually beneficial arrangement that is nurtured over time.

“Gain sharing is often a second phase, implemented after the relationship matures to some extent,” says Dittman. “About one-third of all 3PL contacts have gain sharing arrangements. Most gain sharing relationships are based on a 50/50 sharing of cost savings, while some have an incentive payout if key performance indicators are met.”

But agreeing on a method to measure cost savings against a base line is challenging, admits Dittman, and is the main reason gain sharing arrangements are not used. “Those managers that are experienced with it believe strongly that an arrangement should be initiated only after the 3PL has demonstrated that it can meet all of the performance requirements expected.”

Dittman adds that once performance expectations have been met, and a good cost baseline (cost/unit shipped) has been documented, it should be possible to move forward with a plan to share 50/50 in the cost savings proposed and implemented by the 3PL. Service level credits can also be considered.

“A major variable in establishing a gain sharing formula is whether or how to factor in normal inflation,” says Dittman. “For example, if a logistics cost index goes up 3 percent and actual cost/unit stays flat, does that mean a 3 percent savings was achieved?” Dittman adds that the downside of waiting a year or more to initiate a gain sharing arrangement is that the 3PL may withhold its cost savings proposals until a gain sharing deal is begun.

2. Find a cultural fit

The vetting process is a two-way street according to John Langley, Ph.D., professor of supply chain and information systems at Penn State University. He says 3PLs carry a checklist of their own when interviewing prospective customers.

“A good 3PL will let a shipper know if they can build a long-term relationship,” says Langley. “Basically, the same evaluation principles apply. Third party providers want shippers to share their operational strategies and financials with them, and they want the big picture before committing to a deal.”

This includes learning about the shipper’s core competencies and its labor relations, says Langley. Once that’s achieved, the 3PL can align its offerings with shipper demands. “The shipper can then ask the 3PL to outline its range of operational capabilities and services,” he adds. “They should define their geographic areas of strength, information technology, and their capacity for growing the shipper’s business.”

Langley defines this as “onboarding,” or the gradual integration of cultures based on management of performance and feedback processes. He adds that a “pre-planned exit strategy” should also be put in place.

“There is delicate balance to be maintained during the initial collaboration, and if either party fails to understand the shared objective, they should part ways before the situation worsens,” says Langley.

Robert Lieb, professor of supply chain management at Northeastern University, agrees, notes that most 3PL contract failures can be traced to the implementation stage.

“Remember, the deal isn’t done when the contract is signed,” he says. “At that time it’s essential that both parties are clear about expectations, responsibilities, and the metrics to be used in judging performance.”

Lieb advises shippers and 3PLs to “cross-train” as part of the implementation process, thereby learning the same tactics and strategies necessary for collaboration. “Don’t look at the relationship between the two companies as a zero-sum game,” he adds. “And don’t panic during tough times. My research has indicated that at least one-third of 3PL relationships actually improve during periods of time when the parties look at their problems and work toward resolving those problems together.”

Lieb says he can’t stress enough the power and benefit of strong communication between the parties: “Develop an early warning system that identifies potential problems when they first emerge and don’t personalize the problems. Collectively work toward problem resolution.”

3. Implement risk mitigation

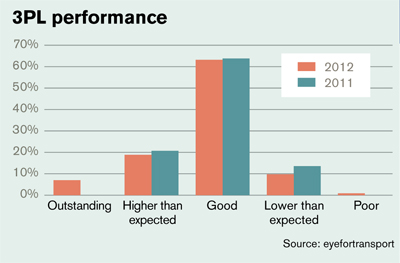

Researchers at Eyefortransport (EFT), a London-based logistics and transportation think tank, report that 3PLs are seeing their best opportunities for growth in China and North America. According to their recent report Global 3PL & Logistics Outsourcing Strategy, the two regions also saw the biggest change in opinion since last year, with North America having seen the largest increase and China having seen the largest decrease.

According to Linda Conrad, director of strategic business risk management for Zurich Services, shippers doing business in China should be especially vigilant. “Productivity there can be disrupted despite an absence of physical damage,” says Conrad. “Companies need to think beyond their traditional contingent insurance coverage toward supply-chain disruption, which can come from any cause.”

Physical damage has not been the only cause of business disruption in recent years, according to Zurich’s database of unanticipated events. Business disruptions can come from many sources, such as information technology outages, port closures, labor actions, or regulatory changes.

“Knock-on effects mean it’s more important than ever to map out the value chain from end-to-end, including inter-dependencies. Companies need to ask and be aware of the triggers or drivers that would cause a risk to come to fruition,” Conrad says. “Then, they need to determine what they would do to mitigate the risk or severity.”

Most companies look at what they can do to respond to a crisis, which is reactive, she says. It’s more important to be proactive, by coming up with preventive measures and continuity plans.”

“When shippers and 3PLs are planning proactively for business resilience, it becomes a competitive advantage,” she says. “Because you’re back in the market more quickly than your competitors, they can benefit from a lower cost of recovery and even gain market share.”

Shippers can’t assume that a 3PL’s force majeure or typical insurance policies will cover supply disruption from things such as strikes, says Conrad. If the fault is with the supplier, it’s the supplier’s insurance that should compensate.

“However, the supplier might be under-insured or not insured at all, and you might end up paying for claims that should have been covered by your vendor unless your own insurance covers all risks of non-delivery,” adds Conrad.

The ultimate 3PL checklist contains a failsafe clause, analysts agree. When it comes to finding a 3PL shippers need to do due diligence on the insurance they require of their suppliers so there are no gaps that leave them exposed.

Article Topics

Global Logistics News & Resources

2024 Global Logistics Outlook: Crisis mode lingers The reconfiguration of global supply chains Hidden risks in global supply chains Global Logistics 2023: Supply chains under pressure Roadrunner rolls out new direct lanes and transit time improvements U.S. rail carload and intermodal volumes are mixed, for week ending March 12, reports AAR State of Global Logistics: Time for a reality check More Global LogisticsLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources