Logistics Technology: TMS gets more warehouse aware

TMS and YMS expand on integration and supply chain visibility capabilities, gaining a better handle on warehouse constraints in the process.

Latest Logistics News

First scheduling API through the Scheduling Standards Consortium is released by Uber Freight TD Cowen/AFS Freight Index points to a muted peak season and mixed activity across TL, LTL, and parcel markets Enterprise Resource Planning (ERP) continues to push further into Supply Chain Management (SCM) Gain Greater Visibility With ERP & TMS Integration Top Transportation Management System (TMS) Trends for 2023 More TMSThe biggest trend within the transportation management system (TMS) and yard management system (YMS) markets is not so much incremental features within each market, but capabilities that blend TMS and YMS with other supply chain solutions and enhance visibility in the process.

Whether you call it process orchestration or supply chain execution (SCE) visibility or integration, leading software executives and analysts agree that TMS and YMS are expanding beyond traditional feature sets to help users coordinate overall processes.

“Warehousing, yard, and transportation processes are pretty much connected at the hip, but today, the systems for these domains are often still run as independent processes,” says Dwight Klappich, a research vice president at Gartner. “You can’t achieve all the benefits if you manage the processes independently instead of seamlessly. That’s why vendors are looking at the intersection points between warehousing, yard, and transportation.”

Suppliers are focused on making solutions such as TMS more aware of constraints in warehouses and yards, rather than basing transportation plans solely on traditional factors such as freight cost. YMS, meanwhile, is helping shippers respond to pressures from carriers, and also expanding to address the issue of visibility of shipments in transit.

Warehouse aware TMS

The classic problem, says Klappich, is that SCE applications are used in a sequential process without the integration needed to communicate constraints from one domain to another. A common scenario, he says, is for orders to come down to a TMS, where loads, and shipments are optimized based on factors like lowest cost freight or quickest delivery.

Whether the warehouse or yard can handle those plans in terms of factors such as available dock doors, labor to pick, and labor to load, historically has been considered a downstream execution challenge, says Klappich. However, suppliers are working toward integrated platforms that can address key constraints from each area. “We have opportunities to integrate those areas better,” says Klappich.

Data-centric integration between software like TMS and warehouse management systems (WMS) is only a “stop gap” on the road to a holistic platform for execution, according to Mike Mulqueen, a senior director with Manhattan Associates. The real trick, he says, is to make TMS aware of constraints at the warehouse level, so that if, for instance, a palletizer is down, the TMS planning engine or “solver” knows that. “I want to make sure that I can balance my transportation plan so my warehouse doesn’t get overloaded,” Mulqueen says.

Integration in itself won’t deliver this warehouse aware planning, Mulqueen adds. An underlying platform architecture synchronizes TMS, YMS, and WMS activities for Manhattan’s users. “The integration platform is the foundation you will need, but the end goal is the complete synchronization of supply chain execution,” he says.

Fab Brasca, vice president of global logistics for JDA Software, agrees that more than data integration is needed between TMS and WMS. JDA is working on a “suite strategy” that allows users of JDA’s TMS to address distribution center constraints.

Essentially, says Brasca, the TMS can model factors such as how many docks there are at a DC, what type of docks are available, and average loading/unloading times. “We have the ability, in the TMS, to model the throughput constraints of the warehouse,” says Brasca.

Another trend with TMS, adds Brasca, is toward “dynamic and iterative” planning where the optimization adjusts to order changes. With this type of planning engine, he adds, loads aren’t finalized until they have to be executed. “This is particularly important in the omni-channel retail environment, where the variability on orders is skyrocketing,” he says.

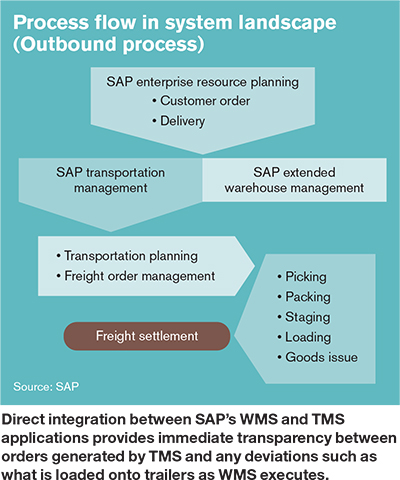

At SAP, there also is a tighter merging of TMS and WMS, says Markus Rosemann, SAP’s vice president of global solution management for logistics and order fulfillment. Where this integration at one time had to be relayed through SAP’s enterprise resources planning (ERP) system, SAP now offers direct integration between TMS and WMS processes. For example, when a shipment is created in TMS, everything the warehouse needs to know to prepare surfaces in SAP’s WMS software. “It’s all about creating real transparency about plans, and then coordinating the operations accordingly,” says Rosemann.

So rather than having to deal with different numbering schemes for loads, orders or shipments, with direct integration between TMS and WMS, everything related to shipments has common numbering, and it is visible within SAP’s WMS solution. The WMS now also has a “shipping cockpit” user interface to coordinate with TMS processes and also display metrics. “The cockpit brings all the relevant information into one environment,” Rosemann says.

While making TMS solutions more “warehouse aware” is a valid goal, with the trend toward omni-channel, fulfillment not only originates from DCs, but also from stores or suppliers doing drop shipments, according to Stephan Craig, a managing partner with enVista. So TMS needs to be more “inventory aware” regardless of where the inventory sits, Craig says. There are technology developments from suppliers that should help improve inventory awareness, but some of the fix will involve “good old fashioned cleaning up” of bad data and processes, he adds.

“Omni-channel distribution is driving the overall systems and data model to be more inventory aware in ways that most companies’ systems have not been in the past,” says Craig.

Other TMS trends in TMS, says Gary Gross, a vice president with HighJump Software, are the need for a TMS that can be used on a global basis, as well as one that allows planners to utilize back haul capacity. TMS solutions today also need to be adept at parcel shipment planning and execution.

Gross also sees the need for better integration of TMS with multiple SCE solutions. “Many times when we integrate systems for users, it’s a two- or three-way integration, not just one system to another,” says Gross.

Better yard control

Within the YMS market, dock scheduling functionality has been drawing more interest, says Klappich. The driver for this has been pressure from U.S. carriers under hours of service (HOS) rules to have solid appointment windows at yards, rather than having to wait to load or unload.

Carriers who have to wait extra time may charge detention fees to the shipper, which is driving the need for more YMS and dock scheduling capability. “There is real money to be saved here,” says Klappich. “Companies are seeing detention penalties.”

Greg Braun, senior vice president of sales and marketing with C3 Solutions, agrees that there is strong interest in YMS and dock scheduling due to pressure from carriers. It’s even driving relatively smaller yards with fewer yard drivers or “hustlers” to inquire about YMS.

A YMS, says Braun, gives a company tight, real-time control over yard activities and assets, such as the number, location, and type of trailers in the yard. For example, a YMS enables smoother “drop and hook” activities in which a carrier’s truck leaves a load and picks up another trailer. “You need more intelligence to manage yard management processes today,” he says.

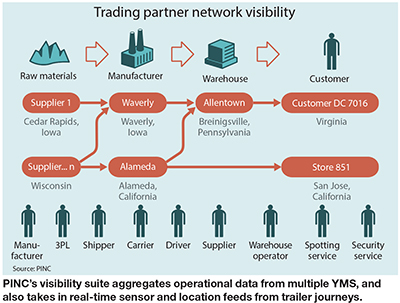

At PINC Solutions, the company is applying its experience in real-time locating systems (RTLS) and yard management to the challenges of enterprise-wide logistics visibility. In May, PINC announced Enterprise Visibility Suite Version 4, a cloud-based platform that collects real-time data from sensor and data feeds, and uses the data for the tracking of trailer journeys and other execution processes.

According to Matt Yearling, PINC’s CEO, shippers can gain a real-time grasp over logistics based on such sensor feeds, which are an example of Internet of Things (IoT) technology. “We’re focused on supply chain execution powered by the Internet of Things,” he says. “Invariably what people are looking for is real-time information on trailer shipments, not just in their yards and facilities, but over the road as well.”

In a sense, supply chains can be viewed as one big yard, says Yearling, though with truck routes of several hours or more, you don’t need the pinpoint locating like that within a YMS. A range of IoT-style feeds might be used for tracking goods in transit, from advanced telematics and onboard communications on newer trucks, to simpler feeds based on tracking of a driver’s cell phone signal. Yearling says PINC has also placed RFID tags on trailers to enable trailer tracking between points in a supply chain.

The problem with previous generations of supply chain visibility solutions, Yearling contends, is that they tended to rely on human inputs like keyboard updates to a portal, or phone calls to communicate exceptions. “Many companies are still very dependent on paper, or fingers on keyboards, to track progress. If that’s what you are relying on, you can’t have a truly accurate understanding of what is going on now, and what has transacted in the past,” says Yearling.

Yearling says PINC’s enterprise visibility solution augments TMS, YMS, and WMS by providing a real-time view of progress and exceptions, and giving managers accurate measures on factors like gate velocity, which is a measure of how quickly trucks are clearing gates.

Starting upstream

Suppliers of SCE software, especially those with broader footprints in supply and demand planning, are also looking to tie SCE solutions into upstream planning. After all, says JDA’s Brasca, distribution orders flow from customer demand, so ideally, companies should be looking to link forecasting, replenishment planning, and sales and operations planning with SCE capacity.

For example, says Brasca, replenishment plans can be “bounced” against available resources at the TMS and WMS levels to see what is feasible and optimal. “This adds a whole other level to the efficiency of replenishment planning that most companies can only try to deal with as a downstream execution issue,” he says.

SAP’s Rosemann also sees a need to treat SCE resources in much the same way that manufacturing operations have when learning to optimize production capacity—as a network-wide balancing act, rather than one plant at a time. “What we’ve learned on the manufacturing side 20 years ago is now reaching a point of use in logistics,” he says. “As logistics gets increasingly complex with smaller shipment sizes and higher customer expectations around multi-channel, it requires a more sophisticated way of planning, scheduling, and assigning resources.”

Article Topics

TMS News & Resources

First scheduling API through the Scheduling Standards Consortium is released by Uber Freight TD Cowen/AFS Freight Index points to a muted peak season and mixed activity across TL, LTL, and parcel markets Enterprise Resource Planning (ERP) continues to push further into Supply Chain Management (SCM) Gain Greater Visibility With ERP & TMS Integration Top Transportation Management System (TMS) Trends for 2023 Trimble acquires Transporean in major deal, for nearly $2 billion What you need to know for a better ROI More TMSLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources