Pearson on Excellence: Findings of the World Economic Forum study on Supply Chain Risk

Latest Logistics News

A new day at the post office Despite small decline, Services economy remained strong in April, reports ISM U.S. Senate signs off on confirmation of two new STB Board members Moore On Pricing: The business case for transportation management How to Solve the Digital Transportation Puzzle More ColumnsThis month we reflect on the views of the businesspeople, government policy makers, and academics that participated in the World Economic Forum (WEF) study of supply chain risk. See Part I here.

In the April edition of Logistics Management, I profiled a variety of research efforts targeting supply chain risk. If there is a common theme that straddles those various findings, it is this: The scope, intensity, and economic consequences of supply chain risk are greater today than in any other period in recent history—and new solutions for mitigating and managing risk are clearly needed.

This month, I’m taking a look at the nature and focus of a select few solutions. Whereas last month’s column profiled research by numerous entities, this month’s column specifically reflects the views of the businesspeople, government policy makers, and academics that participated in the recently conducted World Economic Forum (WEF) study of supply chain risk.

First and foremost, no recommendation put forth by members of the WEF initiative should be deemed more important than a call for increased collaboration. Three interlocking views explain why:

1. Risks outside the control of individual organizations—from terrorism and weather to currency shifts and political upheavals—have been escalating furiously; so much so that few, if any, of those concerns can be fully addressed by one entity. As a result, risk must be managed across companies’ global supply chains, in lock-step with manufacturers, suppliers, customers, and third parties.

2. Risk assessment, planning, and response can no longer be the sole province of operational risk managers. Effective risk management must now encompass multiple levels within an organization: from C-suites and boards to logistics, finance, and human resources.

3. Governments must be encouraged to help companies understand and manage risk. The political, economic, and security implications of regulating in a complex environment demand greater public/private cooperation.

The above insights are not simple calls to join hands. The point is that supply chain risk has become too big an issue to handle insularly. In most cases, risk has gone global; and broad-based, inter-organizational responses are key.

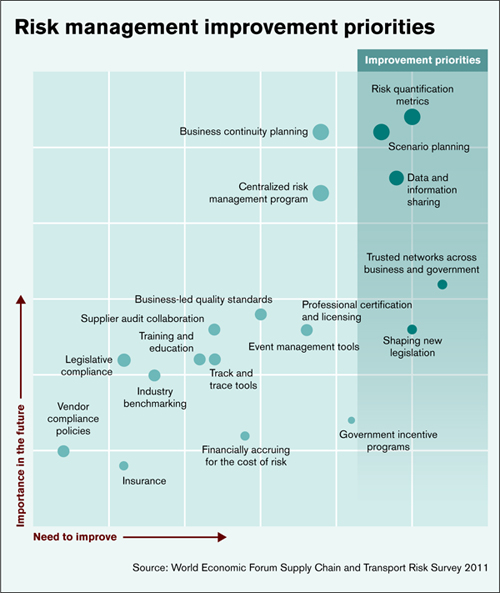

The WEF task force also identified five high-level risk-management priorities. These are not mutually exclusive but rather should be thought of as an integral suite of capabilities:

1. Risk-quantification metrics.

Insufficient or improperly focused metrics leave many companies struggling to quantify the risk exposure of their own organizations, or to compare risk mitigation service providers.

Thus, a top priority is developing a broadly accepted set of supply chain risk-quantification metrics that can be used to obtain accurate, consistent insights, prioritize risk management activities more effectively, and align incentives, exposure, and risk appetite.

2. Scenario planning.

Conducting scenario planning on a regular basis ensures that external risks and network vulnerabilities are always top of mind and that associated mitigation controls are effectively updated.

Scaling scenario planning to the multi-stakeholder level is also vital because it enhances a company’s understanding of external environments—while contributing to better anticipation of actions by network partners and improved joint preparation

of continuity plans.

3. Data and information sharing.

Access to accurate, reliable information can help create a clearer global picture of supply-chain-wide vulnerabilities and support the harmonizing of backup plans in the event of a disruption.

Identifying recurring risks at the industry level can also help businesses and governments focus efforts on increasing network resilience. Two specific actions topped the WEF list: establish reliable dashboards for macro-level information flows, and increase data circulation across end-to-end networks to maximize network-wide transparency.

4. “Trusted networks” across business and government.

Bringing together public and private sector entities will allow greater sharing of data and information, thus enabling organizations to better understand and quantify supply chain risks.

This in turn will point public and private sector investment more tightly toward areas of vulnerability and facilitate the development of proactive and effective legislation.

5. New legislation and regulation.

Simplified and internationally harmonized risk legislation emerged as a key WEF priority. One reason was that poorly targeted regulation could exacerbate supply chain problems.

Consider that when Iceland’s Eyjafjallajökull volcano erupted in 2010, the sluggish response of European transport ministries and civil aviation authorities resulted in uncertainty and delays restarting air traffic. This was primarily the result of failing to recognize in advance the potential threat of volcanic ash clouds from Iceland, the inflexible nature of existing aviation protocols, and the absence of any pre-existing agreement on safe ash levels.

While the above steps are high-level, they still represent a valuable framework that companies can use to approach risk management.

And given risk’s growing presence and sweeping implications, many organizations should conclude that new approaches are vital.

Article Topics

Columns News & Resources

A new day at the post office Despite small decline, Services economy remained strong in April, reports ISM U.S. Senate signs off on confirmation of two new STB Board members Moore On Pricing: The business case for transportation management How to Solve the Digital Transportation Puzzle Process and technology in balance Cold Chain and the USPS Crisis More ColumnsLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources