Quarterly Transportation Market Update: Air Cargo Demand Cycle Starts Steady Ascent

While air cargo load factors for most of 2016 remained historically low thereby keeping yields under pressure, industry analysts forecast a “soft turnaround” in the final quarter. However, regulatory obstacles and trade barriers must be addressed before logistics managers see any significant long-term rate improvement.

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsFew suprises are contained in the most recent data released by The International Air Transport Association (IATA) in the year’s final quarter, showing that global airfreight markets gained momentum as 2016 comes to an end.

Demand, measured in freight tons, rose 3.9% year-on-year, while freight capacity increased by 4.1% over the same period. According to IATA researchers, industry conditions have improved since the particularly soft patch in the first quarter. Indeed, carriers in all regions except Latin America reported an increase in year-on-year demand in September.

However, regional results varied considerably. For the third time in four months, airlines based in Europe posted the highest collective annual growth of all regions, while airlines in the Middle East experienced their slowest growth in more than seven years.

“September numbers showed improvements in cargo demand,” observes Alexandre de Juniac, IATA’s director general and CEO. “While this is good news, the underlying market conditions make it difficult to have long-term optimism.”

Juniac notes that world trade volumes fell by 1.1% in July with no improvement on the horizon. Furthermore, he says that the current global political rhetoric in much of the world is more focused on protectionism than trade promotion. “Economies need to grow out of the current economic doldrums,” he says. “Governments should be focused on promoting trade, not raising protectionist barriers.”

Regional variation

Asia-Pacific airlines reported a 2.8% increase in demand for air cargo in September compared to last year, while capacity in the region expanded 1.2%. International traffic within the region has been the strongest of the “big-four” markets (Asia Pacific, Europe, North America and Middle East) so far this year, with traffic up by 6.5% year-on-year in July 2016.

North American carriers, meanwhile, saw freight volumes expand 5.5% in September 2016 year-on-year and capacity increase by 3.7%. International freight volumes grew by 4.6% in September—the fastest pace since the U.S. seaports disruption boosted demand earlier in 2015. However, seasonally adjusted activity has barely altered from 2008 levels, and in the meantime, the strength of the U.S. dollar continues to keep the U.S. export market under pressure.

European airlines posted the largest increase in freight demand of all regions in September 2016, with a 6.6% jump year-on-year while capacity increased 4.7%. The positive European performance corresponds with an increase in reported new export orders in Germany over the last few months. Indeed, European freight demand has now broken out of the corridor that it occupied between mid-2010 and the start of this year.

Middle Eastern carriers saw airfreight demand slump to 1.8% year-on-year in September 2016—the slowest pace since July 2009, while capacity increased by 6.9%. The strong upward trend seen in Middle Eastern traffic over the past year or so has halted. In seasonally-adjusted terms, volumes in July 2016 were slightly below those seen in January 2016.

“The weakening performance is partly attributable to slower growth between the Middle East and Asia,” explains de Juniac. “This suggests that Middle Eastern carriers are facing stiff competition from European airlines on the Europe-Asia route.”

There was marked contraction in Latin American markets where airlines lost money in annual terms for the sixth consecutive month. Freight tons in September 2016 fell by 3.3% compared to the same period last year and capacity decreased by 0.2%. The region continues to be blighted by weak economic and political conditions, particularly in the region’s largest economy, Brazil.

Meanwhile, African carriers saw demand rebound sharply in September to 3.7%—the fastest growth rate in 12 months. Despite this, freight capacity continues to outstrip demand, due to rapid long-haul expansion. Capacity surged in September year-on-year by 29.2%. The combination of rising capacity and modest growth has significantly affected the load factor of African airlines. In September 2016, it was almost 6 percentage points lower than a year ago and is around half the industry average.

From ocean to air

The old expression “it’s an ill wind that blows nobody good” may be invoked here when it comes to examining the collapse of the ocean container shipping giant Hanjin at the end of August. According to IATA analyst David Oxley, air cargo carriers have a few reasons for some optimism in the near term.

“There is the potential for shippers to turn to air cargo during the peak season of product launches and deliveries of new product lines,” notes Oxley. “This may provide a ‘one-off’ boost to the air mode similar to that seen during the disruption at seaports on the U.S. West Coast in early 2015.”

The uptick in the new export orders component of the global purchasing managers’ index back into expansionary territory in recent months also offers some encouragement for airfreight over the months ahead, adds Oxley. “But crucially, any boost in the near term is likely to prove transitory,” he adds. “The bigger picture is that the ongoing sluggishness of global trade conditions continues to present a stiff headwind for airfreight.”

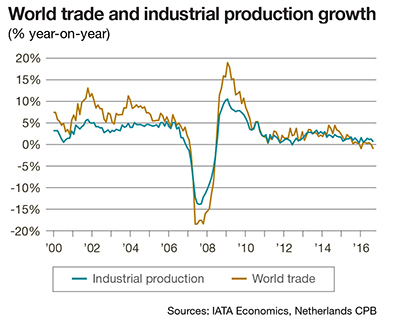

This note of caution is also echoed in recent data compiled by the CPB Netherlands Bureau for Economic Policy Analysis—part of the Ministry of Economic Affairs. Analysts there say that world trade volumes fell by 1.1% month-on-month in July, and contracted in year-on-year terms for only the second time since the end of 2009.

“Global trade growth has lagged behind that seen in industrial production so far this year—a far cry from the trend before the global financial crisis when global trade tended to grow around twice as fast as output,” say CPB economists.

IATA’s analyst Oxley adds that while there is no mechanistic link between airfreight and world trade, the industry is prone to periods of under and over performance relative to global trade volumes, mainly reflecting the narrow product mix transported by air. “However, in the current political environment, any new impetus to reinvigorate the stagnation in world trade volumes looks unlikely,” he says. “Furthermore, taking political rhetoric at face value, the future of even existing free-trade arrangements appears under threat.”

The upshot is that the tailwinds that used to propel global trade and air cargo volumes are likely to be much weaker in the future than they were in the past, IATA concludes. Such a backdrop points to continuation of just modest and fitful growth in airfreight volumes in the years ahead, rather than a sustained return to the 5% to 6% growth rates of old.

Airport infrastructure

Another sobering note was sounded when Airports Council International (ACI) released its report “World Airport Traffic Forecasts (WATF) 2016–2040” in Montreal last month, confirming that the weakened global economy and a sluggish global trade environment were definite deterrents to growth in air cargo volumes.

However, Angela Gittens, director general of ACI, says irrespective of short-term fluctuations in the business cycle, future growth in air transport potential will originate to a large extent from emerging markets.

“Large population bases and increases in per-capita incomes in these markets are major forces driving this demand,” says Gittens. “At the same time, microeconomic factors, which include heightened competition across the aviation sector and the increased presence of the ‘no-frills low cost’ business model among air carriers, will continue to stimulate demand with lower cargo rates.”

Gittens also maintains that there continues to be a structural substitution effect in the delivery of goods across modes of transport—even in the face of strong economic fundamentals.

“While the shipment of raw materials and perishables have been affected the most by a move away from air cargo services to ocean freight, the modal shift can also be seen in shipments of high-tech and machinery parts,” says Gittens. “The largest trade flow from Asia has experienced the weightiest shift away from air cargo. So in the short to medium terms, global air cargo volumes are expected to increase modestly, in the realm of 2.4% on annualized basis up to 2025.”

Admittedly, adds Gittens, there are several impediments that could curtail this forecast. Specifically, these are related to geopolitical unrest, terrorism and threats to security in certain parts of the world.

“Physical capacity considerations and potential bottlenecks in air transport infrastructure also pose challenges in accommodating future airport plans,” says Gittens. “Finally, protectionist policies that retreat from further economic integration and transport liberalization could contract air cargo services.”

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources