Top 20 U.S. Ports: Where’s the money?

Creative funding for expansion and infrastructure improvement is critical for the top U.S. ports, especially as shippers are slowly reconfiguring their supply chains to become less dependent on the West Coast.

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsIf there is one lesson learned by the catastrophic global events recently, it’s that “just-in-case” scenarios trump “just-in-time” imperatives. Japan’s earthquake, continued political unrest in the Middle East, and wild world currency fluctuations have shippers hedging their bets these days—and that includes domestic seaport selection.

Even on the West Coast, mega-ports in San Pedro, the San Francisco Bay, and the Puget Sound face daunting competition from a foreign gateway to the north. According to Peter Gatti, executive vice president of the National Industrial Transportation League (NITL), British Columbia’s Prince Rupert is becoming the favored gateway for many of the League’s members sourcing goods from the Far East.

“It is a day’s shorter transit time,” Gatti notes, “and they don’t have the labor problems U.S. ports have.” But the real advantage, he adds, is the rail link provided by CN that not only feeds across the continent, but also down into Kansas City. “Canada has clearly been investing in the port’s infrastructure.”

Infrastructure, or rather the lack thereof, is also a key growth indicator for Richard Thompson, executive vice president of the global supply chain practice for Jones Lang LaSalle. He maintains that “connectivity” will be the watchword for U.S. ports in the future.

“Given the current energy picture, shippers are becoming ever more reliant on rail and intermodal,” says Thompson. “That means that the ports will be concentrating on on-dock or near-dock rail service and the DCs to support intermodal transfer. This kind of connectivity softens risk as well.”

Thompson’s recent research suggests that shippers are slowly reconfiguring their supply chains to become less dependent on West Coast ports. With California’s economy in tatters, raising capital to improve infrastructure in that state alone has been daunting.

Thompson’s recent research suggests that shippers are slowly reconfiguring their supply chains to become less dependent on West Coast ports. With California’s economy in tatters, raising capital to improve infrastructure in that state alone has been daunting.

Three of the nation’s top 10 ports—Los Angeles, Long Beach, and Oakland—are constantly seeking new ways to maintain existing “connectivity” and build for the future. But as we’re finding, all of our nation’s ports are struggling with similar funding challenges.

What does this mean for shippers? Thompson explains: “All the multinationals are trying to get locked into long-term contracts with specific ocean carriers. And if the carriers are calling ports that can’t meet all the inland distributions needs, the shipper is out of luck.”

Consequently, ports are more intent than ever to keep both carriers and shippers happy—but to do that they need to find the proper investment capital.

In search of funding

Witness last month’s biennial Port Administration and Legal Issues Seminar in San Francisco sponsored by the American Association of Port Authorities. The event featured an in-depth discussion on port funding and public finance management. While many paths can be taken toward achieving a financing goal, most speakers advise a “go slow” approach for port administrators.

“It’s crucial that one set priorities with all the port stakeholders before moving forward,” says Karl Pan, chief financial officer for the Port of Los Angeles. “Before getting started, make sure you understand the risks and whether you’re staffed with the administrative skill sets to the get the job done.”

There are debt service reserve fees, financial covenants, and unique reporting requirements.

“So when you’re trying to sell your plan to a Board,” he says, “it’s important to avoid financial jargon.” Pan also insists that complete transparency be provided in any presentation, as “there is no place to hide.” Given the economies of scale that most ports are now under, financial advisors are “a must” says Pan.

Jessica Soltz Rudd, senior director with Frasca & Associates, LLC, concurs, noting that advisors can help ports navigate the intricacies of the financial marketplace.

“Back in the ‘go-go ’90s’ ports were bringing in so much cargo that money for expansion was a given,” she says. “The growth multiples were three times or more each year; and given the capital intensive nature of port operations, money was not that hard to raise.”

But in the wake of a severe recession, and with consumer confidence now just beginning to gain traction, ports are under pressure to justify investment before trying to raise cash. “Even with a bond rating like the one Los Angeles has it’s not an easy thing to do,” says Sotlz Rudd. “And once you get the funding, it’s important to stay on your guard, and remain proactive. You are only as good as your credit.”

Industry analysts say that there’s been a direct correlation between capital investment in port infrastructure, and the volume growth at those load centers.

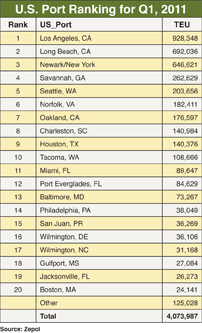

Zepol Corporation—a leading trade data and market intelligence company specializing in ocean cargo data—notes that there’s been a shift in share over the past year. “Long Beach and Los Angeles lost a combined 4 percent and 14 percent, respectively,” says Zepol’s president, Paul Rasmussen. “East Coast ports are picking up this traffic. New York/New Jersey and Houston were the biggest winners on the container front in the past two years.”

Meanwhile, Houston increased its throughput by 31 percent over 2010, and other lower volume ports increased their market share, as well. Earlier this year, Houston opened the Cargo Bay Road truck entrance with considerable fanfare. Presently, trucks transport about 75 percent of the port’s inbound and outbound cargo.

Houston City Council member James Rodriguez, whose District I includes several Port Authority operational facilities, notes that the new truck entrance will help improve traffic flow with three inbound and two outbound lanes. “It will be open around the clock and staffed by contract security personnel,” says Rodriguez.

Investment paying off

Houston is not the only “mid-tier” port investing in its future, says Zepol’s president. “Port Everglades, Miami, New Orleans, and Baltimore, all ports that invested recently, all saw significant percentage increases in TEU volumes versus 2010,” he says.

Ongoing capital improvements, including widening and deepening of its entrance channel and waterways, ensure that Port Everglades will have the ability to handle future growth in container traffic, say officials there.

“We have been saying for years that cargo ships are getting larger and more efficient,” says Port Everglades’ executive director Phil Allen. “Our 20-year master plan recognizes that Port Everglades will need to widen and deepen its channels to handle fully loaded ships of the current generation and even larger ships once the Panama Canal expansion is completed in 2014.” ??

Meanwhile, Florida’s Governor Rick Scott asked the Department of Transportation to allocate $77 million to the Port of Miami to deepen the channel to minus 50 feet so larger ships can gain access to the port.

“This is a solid first step toward enhancing Florida’s infrastructure and getting our state ready for a new generation of international trade with South America and beyond,” says Scott. “There are a number of worthy infrastructure projects that deserve our attention, and as Floridians, we know best where our resources should be focused.”

As LM has reported in the recent past, the Port of New Orleans is also continuing with its expansion—particularly in regard to greater hemispheric trade with Latin America.

In the past 10 years, the port has invested more than $400 million in new facilities. Improved breakbulk and container terminals feature modern, multipurpose cranes, expanded marshalling yards, and a new roadway to handle truck traffic.

The Port Authority of New York and New Jersey has started the engineering and design work for a project to “Raise the Roadway” of the Bayonne Bridge. This unique alternative to dredging is designed to accommodate larger ships after the Panama Canal upgrades are completed.

The authority, which is continuing the development of the Global Container Terminal in Jersey City to accommodate future growth, is also upgrading and expanding the capacity of the cross-harbor rail float barge operation between Brooklyn and Jersey City. Plans are on the books to also develop the Greenville Yards in Jersey City.

However, the limited increase in revenue to the NY/NJ Port Authority generated by the increase in cargo volumes does not cover the costs of the port’s annual state of good repair—nor does it cover all of the capital improvements needed to maintain the port’s competitive position.

“In this economic environment, the competition for port business is fierce,” says Chris Ward the NY/NJ port authority’s executive director. “That is why we continue to take steps with our industry partners to improve our position.”

Despite the extremely competitive environment among ports on the East Coast, NY/NJ remains the largest ocean cargo gateway there, and the third largest in the United States behind Los Angeles and Long Beach. The port handles approximately 31 percent of all East Coast cargo.

But while much of that cargo is headed to the immediate region, more than 20 percent of the cargo is destined for locations that can be served by other ports. “This discretionary cargo is part of a highly competitive market that every port in the U.S. and Canada seeks,” says Ward. “To meet the challenges of future growth, the we will invest $283 million in 2011 to upgrade the port road network, enhance the existing ExpressRail system, and continue its program to deepen the port’s channels to 50 feet.”

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources