State of Industrial Real Estate: It’s crunch time

DCs are hot, especially for e-commerce fulfillment. But with so much demand, space availability is not necessarily ready to be had. Companies examining their supply chains need to be savvy about what they’re up against in terms of site selection—and realize that an ideal location will come at a higher cost.

Warehouses and distribution centers (DCs) has evolved immensely over recent years. The traditional warehouse was once an afterthought—a large building with the sole purpose of storing goods and tucked away in some remote location. However, today’s robust, e-commerce-driven economy has created a significant shift in how logistics real estate is viewed.

“Same-day delivery is evolving into same-hour delivery in some places, and consumers are insisting on a broader selection and availability of goods,” observes Dan Letter, a managing director of capital deployment for Prologis, a multinational logistics real estate investment trust. “As a result, selecting a market and a property are now business-critical decisions that favor high-quality space in prime locations near urban centers.”

Prologis, and other companies analyzing the industrial real estate market, find that e-commerce comprises about 20% of new leasing for DCs—that’s up from less than 5% just five years ago. “One reason for this growth,” reports Letter, “is that online retailers need approximately 1.2 million square feet (msf) per billion dollars of online sales on average, which is three times the distribution center space required for traditional brick-and-mortar retailers.”

In essence, retailers want supply chain strategies that keep store shelves stocked in a cost-effective manner and also meet the increased service demands of e-commerce.

“It’s become clear that neither one size—nor one supply chain strategy—fits all,” contends Jason Tolliver, head of logistics and industrial research for the Americas at Cushman & Wakefield. “It’s also clear that, in the paradigm of an online world, the interaction a retailer has with the customer often occurs on the retailer’s website and on the customer’s doorstep. So with that in mind, developing robust, flexible, and highly responsive final-mile networks capable of consistently meeting delivery commitments in an ever-tightening time window will remain an essential component of doing business.”

Bill Waxman, executive vice president of industrial and logistics at leasing and advisory firm CBRE concurs. “The phenomenon of next-day and same-day delivery has spurred companies to build out their last-mile networks,” he says. “This often takes the shape of a hub-and-spoke distribution network, such as a regional hub in, say, New Jersey that filters packages to a satellite DC in New York City, Long Island, Connecticut or elsewhere. Additional demand for distribution space comes from support companies, such as delivery services, 3PLs and packaging companies.”

But with so much demand, space availability is not necessarily ready to be had. Companies examining their supply chains need to be savvy about what they’re up against in terms of site selection. Indeed, location may be paramount, but it may come at a cost.

Hot, yet cautious market

While it may seem that with so much demand, e-commerce should be at the height of its growth cycle. However, Prologis observes that the sector is still in the early stages of expansion and is only trending upward. Similarly, CBRE found that in the 50 largest industrial leases finalized in 2017, roughly 43% came from e-commerce companies. While that number is high, it indicates, they say, there’s room to grow.

There are plenty of examples of e-commerce’s growth. A couple include Duke Reality’s long-term lease announced in November with home goods e-commerce company Wayfair for an 874,566-square foot, built-to-suit DC in Lancaster, Texas.

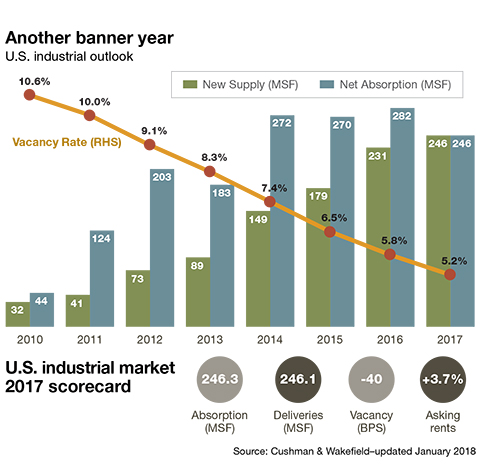

Given all the hype surrounding the e-commerce boom, analysts particularly exclaim that last year was another banner year for U.S. industrial real estate leasing activity. Cushman & Wakefield reports that markets absorbed a total of 246.3 million square feet (msf). “The market has now recorded over 240 msf of absorption for four consecutive years—the strongest run on record,” says Tolliver. The greatest leasing demand occurred in Dallas/Ft. Worth, Atlanta, Southern California (Inland Empire), Chicago, and the Pennsylvania I-81/I-78 Distribution Corridor. “Together they accounted for 38% of overall net absorption,” he says.

Given all the hype surrounding the e-commerce boom, analysts particularly exclaim that last year was another banner year for U.S. industrial real estate leasing activity. Cushman & Wakefield reports that markets absorbed a total of 246.3 million square feet (msf). “The market has now recorded over 240 msf of absorption for four consecutive years—the strongest run on record,” says Tolliver. The greatest leasing demand occurred in Dallas/Ft. Worth, Atlanta, Southern California (Inland Empire), Chicago, and the Pennsylvania I-81/I-78 Distribution Corridor. “Together they accounted for 38% of overall net absorption,” he says.

In the meantime, analysts report that the national industrial vacancy rate for 2017 was around 5% for all product types. “This is the lowest rate on record with market conditions tightening in the Midwest and South,” adds Tolliver.

Aaron Ahlburn, managing director of industrial and logistics research at global commercial real estate firm JLL, points out that nearly 80 msf of industrial space was absorbed in the fourth quarter of 2017 alone. “That’s more than the similarly strong fourth quarters from 2014, 2015 and 2016,” he says. “With low vacancy rates, coastal barriers and the continued growth of e-commerce, we’re seeing demand spread beyond major cities and into secondary and tertiary markets.”

According to Ahlburn, this includes such markets as Cleveland and Columbus, Ohio; Indianapolis, Ind.; Louisville, Ky.; and Memphis, Tenn. JLL reports that over 3.2 msf of speculative product is under construction in Columbus where vacancy rates are a low 4.4%.

“Depending on the operation and business, being within two-day ground shipping to all U.S. population may suffice,” says Michelle Comerford, project director for industrial and supply chain practice leader at site selection advisory firm Biggins Lacy Shapiro & Co. “But, if you’re Amazon, or attempting to compete with Amazon, then you have your sights set on being able to deliver to most U.S. population much faster—eventually, within hours.”

While such demand is creating the perfect environment for speculative DC space, Comerford stresses that many developers are still cautious. “It was a long recovery for many following the recession a decade ago,” she adds. “Many found themselves with excess space.”

David Egan, global head of industrial and logistics research at CBRE, concurs. “Early in the cycle, back in 2010 to 2013, most of the unbalance was due to the market working its way through the glut of space that was left over from the recession,” he says. “However, even after that space was absorbed, the level of demand was so high that developers were unable to keep up.” He attributes this to a variety of reasons, most notably more stringent financing, more rigorous entitlement processes, a more institutional and risk adverse development community, and a lack of suitable land sites.

While most of those issues continue to persist, with land being the biggest, analysts report that the development pipeline has improved. Some developers are utilizing brownfield sites, including “dead” shopping malls, to construct DCs.

In fact, that’s the case with Seefried Industrial Properties of Atlanta, which was hired to construct a DC for Amazon—its second in northern Ohio. Seefried located a 69-acre former shopping mall in North Randall, Ohio and is constructing a $177 million, 855,000 square-foot DC that’s projected to open in the second half of this year. According to Seefried, the location offers two critical ingredients: proximity to population and available labor.

Land restrictions are causing others to be creative, such as Prologis, which is developing Georgetown Crossroads, a three-story, 590,000 square-foot fulfillment center scheduled for completion in third quarter of 2018. The first of its kind in the U.S., the building will feature truck ramps leading to loading docks on the second level, and a third floor served by forklift accessible freight elevators for lighter-scale warehouse operations.

“Although the multi-story warehouse is commonplace in Asia, and Prologis has developed numerous facilities there, it’s a brand new concept in the U.S.,” says Letter. “As cities grow in density and land becomes more constrained, developers are challenged to operate from locations much closer to the end consumer.”

Timelines and markets

Some markets, however, are especially challenging despite their huge advantages of infrastructure (highway, rail, port access) and proximity to population centers.

“In markets such as Chicago, Northern New Jersey, Southern California, Atlanta and Dallas, developers control most of the land sites, so land prices are extremely high. “And although some speculative construction is occurring, it’s not at a rapid pace to keep up with demand in those regions,” says Comerford.

“On average, we have seen most inland markets report higher vacancy rates, between 5% and 10%, as compared to the tight coastal markets which is under 3%),” reports Ahlburn. “These markets are land-constrained, densely populated and have entry

barriers for warehouse and distribution tenants requiring larger

building footprints.”

CBRE’s Egan finds that the markets with the most severe supply problem are on the West Coast, including Oakland, Walnut Creek, Los Angeles, and Orange County. “All are less than 2% vacant,” he says. “These markets are in high demand because they contain the perfect combination of large population, a strong consumer base, access a major port infrastructure, and scant land for new development.”

Meanwhile, CBRE sees similar dynamics in other coastal markets such as North New Jersey, Central New Jersey, South Florida, Seattle, and Savannah. Major inland-port markets like Chicago, Eastern Pennsylvania, and Dallas/Fort Worth are also in high demand, but have more land. Hence, their vacancy rates are not as low as on the coasts, although very low compared to history.

In addition, the farther a DC is from the city center, the less expensive the land is and the larger the DCs can be. “For example, roughly 30 miles out from New York City, the DCs run in the range of 200,000 to 400,000 sq. ft.,” says Mindy Lissner, executive vice president of industrial and logistics at CBRE. “They’re even larger, reaching over 1 million square feet alongPennsylvania’s I-78/I-81 corridor,which is a major regional distribution hub for the Northeast.”

By comparison, last-mile—or as some call them, final-touch centers—typically range from 40,000 to 60,000 square feet. “That’s especially true if they’re in urban-infill locations, where land is at a premium,” she adds.

Network tips

Despite all the challenges, those in the field advise logistics management executives to stay focused on a number of critical variables when evaluating distribution networks. Rich Thompson, who leads JLL’s supply chain and logistics group, suggests keying in on these three elements: Freight, labor, customer service requirements.

“Freight costs typically represent the largest operating cost of a DC, and are increasing to the tune of 10% in 2018,” says Thompson. “This is a big increase and it is driven by tightening capacity and increased costs on the part of the operators. Increasing freight costs will have a tendency for companies to have more facilities—closer to their customers.”

Cushman & Wakefield’s Tolliver suggests that logistics operators plan ahead and engage strategic real estate partners who can help assess the current and future state of a rapidly changing market.

“The advancement of omni-channel shopping, technology, brick-and-mortar experiential retail, and the need to coordinate supply chain functions will continue to have widespread effects on the demand for logistics real estate,” adds Tolliver. “Although supply chain strategies will remain as varied as the retailers who pursue them, it’s clear that logistics is becoming a revenue driver, with high-velocity distribution centers increasingly considered strategic assets of a retailer’s business.”

Article Topics

Warehouse News & Resources

The Ultimate WMS Checklist: Find the Perfect Fit 40th Annual Salary Survey: Salary and satisfaction up Data Capture: Bar coding’s new companions Salary Survey: Pay, satisfaction, youth on the rise Examining the impact of the Taiwan earthquake on global supply chain operations Reverse Logistics: Best Practices for Efficient Distribution Center Returns Exploring Customized Forklift Solutions More WarehouseLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources