2014 State of Logistics: Less-than-truckload’s welcomed rebound

Latest Logistics News

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources Transportation Best Practices/Trends: Private fleet growth soars Cold Chain: Despite challenges, continues to evolve Freight Audit and Payment Update: Take what you need 2018 Ocean Cargo Roundtable: Unsettled seas More Transportation TrendsThe $35 billion less-than-truckload (LTL) market, benefitting from a rebound in the U.S. industrial sector, is enjoying a renaissance after five lean years. And leading LTL executives say it’s about time.

Chuck Hammel, president of regional LTL Pitt Ohio, labels the current overall market as “good, not great,” adding that “good” is surely a welcome change from what it has been since 2009. “We’re seeing solid tonnage growth from existing customers, and we’re asking for and getting fair increases on the rates,” he said. “Capacity is running between balanced and tight.”

LTL carriers enjoy a distinct market concentration advantage over the highly fragmented truckload sector. The top five LTL carriers by revenue (FedEx Freight, YRC regional and long-haul, Con-way, UPS Freight, and Old Dominion Freight Line) have a 55 percent market share. By contrast, the top five carriers in the non-union TL market have less than 5 percent market share of that $300 billion market.

This differentiation is due to the fact that LTL carriers face significant barriers to entry. In order to operate a typical LTL hub-and-spoke network operation, it takes hundreds of millions of capital costs to buy real estate, build terminals, and staff those facilities around the clock. By contrast, TL carriers operate largely point-to-point without much in terms of brick-and-mortar costs.

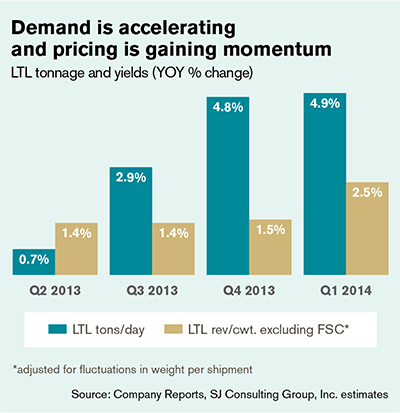

Statistics provided by SJ Consulting, a research firm that closely tracks the sector, show LTL’s renaissance. As the accompanying chart shows, LTL demand is accelerating and pricing has been gaining momentum over the past four quarters.

In the first quarter of this year, LTL tonnage rose by a robust 4.9 percent year over year. That followed 0.7 percent, 2.9 percent, and 4.8 percent year-over-year increases in tonnage for the second, third, and fourth quarters of 2013.

Not surprisingly, this tonnage surge has resulted in solid LTL revenue gains. In the first quarter of this year, LTL revenue per hundredweight (excluding fuel surcharges) rose 2.5 percent. This followed similar gains of 1.4 percent, 1.4 percent, and 1.5 percent in the second, third, and fourth quarters of last year.

“LTL pricing is fair,” said Satish Jindel, principal of SJ Consulting. “It will vary by which part of country and which lanes, with carriers in the Midwest and Mid-Atlantic seeing good improvements.”

Several factors may be responsible for those geographic gains. The auto industry’s rebound is helping carriers in the upper Midwest keep their trucks filled. The Mid-Atlantic is gaining strength due to pent-up demand after a brutal winter caused first quarter freight levels to drop. And keep in mind that U.S. operations of Toronto-based Vitran Express are basically being closed out and absorbed by Central Transport, causing better results for other U.S. LTL carriers in those regions once served by Vitran’s units.

Most LTL carriers are routinely seeking and getting 3 percent to 4 percent increases on some lanes of contract traffic. Most carriers announced a general rate increase in the 5.5 percent range the first of the year, and there is some talk about a second GRI later this year.

But increasingly, carriers are making rate adjustments on a customer-by-customer basis. Those shippers with the best freight characteristics—little waiting at the docks, ease of entry/exit, accurate weight shipments—are getting the best consideration when it comes to mitigating higher costs.

Most LTL fleets are reporting difficulty in adding quality drivers, especially in line-haul operations. In that area, the LTL industry is competing with the larger, mostly non-union, long-haul TL carriers that have been coping with a driver shortage for years.

The bottom line for shippers is to expect pass-through rate increases in the LTL industry to help cover for the higher costs in recruiting and obtaining qualified long-haul drivers.

Article Topics

Transportation Trends News & Resources

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources Transportation Best Practices/Trends: Private fleet growth soars Cold Chain: Despite challenges, continues to evolve Freight Audit and Payment Update: Take what you need 2018 Ocean Cargo Roundtable: Unsettled seas Trucking Regulations: Washington U-Turns; States put hammer down Transportation Trends and Best Practices: The Battle for the Last Mile More Transportation TrendsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources