Supply Chain & Logistics Technology: ERP’s great intersection

With ERP vendors gaining traction in the supply chain execution market, top analysts suggest that best-of-breed providers are going to need to step up their game. We dissect the intersection of ERP and supply chain management software and discuss how the cloud could drive further progress.

Latest Logistics News

Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations More Global TradeThe intersection of enterprise resource planning (ERP) and supply chain execution software is blurring, according to Gartner Inc.’s 2014 Supply Chain Users Wants and Needs Study.

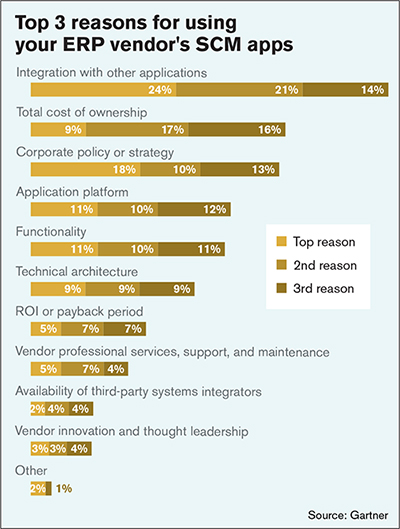

The study, which highlights user expectations for supply chain performance and investment strategies for the upcoming year, unveiled a “very strong” tendency for shippers to use ERP-based supply chain software—as long as those solutions met the shippers’ basic needs. According to Dwight Klappich, research vice president for Gartner, 43 percent of respondents said they were “strongly committed” to the ERP platform and 27 percent said they were “pretty committed.”

“Right there,” says Klappich, “you have 70 percent of roughly 550 managers surveyed revealing a commitment to an ERP platform and also looking at those platforms from a supply chain management standpoint.”

Credit the fact that ERP vendors have really “upped their game” on the supply chain front, says Klappich, with helping to drive those results. He points to SAP, Oracle, and Infor as the three fastest-growing warehouse management systems (WMS) providers in the space. “These three vendors have added as many clients in the past 12 months as the rest of the WMS market—roughly 25 vendors total—combined,” says Klappich.

Another key driver of this trend is the fact that many shippers think that if their ERPs offer a “good enough” version of a WMS, then it’s just easier to fold the supply chain management component under the larger enterprise umbrella. “Shippers know that they could have something better if they wanted to, but if their ERP vendor serves their needs then they’ll go with the latter,” says Klappich.

The same philosophy doesn’t always hold true on the transportation management systems (TMS) side of the equation, says Klappich, where Oracle leads the ERP pack and vendors like SAP have yet to catch up in terms of offerings and functionality.

Where ERP vendors are beginning to make new traction is within the global trade management (GTM) space. “Even though the best-of-breed software providers remain strong with GTM, there are shippers out there that just need basic capabilities around global trade compliance,” Klappich points out. “Those shippers are using their ERPs’ offerings as opposed to introducing a new vendor to the mix.”

Over the next few pages we’ll continue to explore the intersection of ERP and supply chain management software, look at what other drivers are coming into play, discuss how the cloud is having an impact, and talk to analysts about the future trends for the key vendors in this space.

Planning for success

Singling out Oracle and SAP as the two ERP providers that are currently making the most headway in the supply chain execution space, Steve Banker, director of supply chain solutions for ARC Advisory Group, says SAP, in particular, is gaining TMS market share.

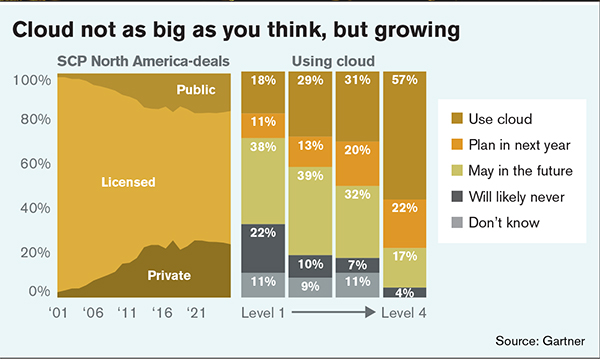

Banker says that the supply chain planning (SCP) space is also growing, despite the fact that in the past most ERPs couldn’t work in this “constrained” space. “They had to use giant, in-memory applications database solutions that were separate from ERP in order to provide supply chain planning,” says Banker.

That scenario is changing. Vendors like SAP, for example, are taking advantage of the rapidly-advancing technology and talking about stopping the support of its SCM advanced planning and optimization (APO), says Banker.

“At some point, the planning will just be part of SAP’s core ERP solution,” Banker predicts, noting that this is by far the most interesting development currently underway in the ERP-SCP space. “There used to be a sort of artificial wall between supply chain planning and ERP, but it’s breaking down now, thanks to advancements in technology.”

Banker has also picked up on a growing interest in cloud-based solutions—a trend that’s largely being driven by Wall Street’s interest in cloud revenues. “One of the largest providers of ERP supply chain solutions is going to make a big push with potential buyers, telling them to go down the cloud route versus taking the licensed software approach,” Banker says. “That’s going to help make the cloud decision more attractive than it’s been in the past.”

Despite the fact that huge software providers are infiltrating their space, the best-of-breed supply chain software providers continue to gain market share, says Banker, who points to Manhattan as one vendor that has had a “very good year” so far in 2014.

“I don’t see best-of-breed going away,” says Banker. “And while some of the ERP supply chain applications are very robust and comparable to the best-of-breed platforms, in general it’s the operational types that tend to favor such options while the financial and IT types have a bias toward ERP solutions.”

Comparing ERP versus best-of-breed supply chain offerings, Banker says it’s becoming increasingly important to be able to offer a supply chain “platform” versus just a single type of software. “Whether you’re a best-of-breed vendor or an ERP, you’d better be able to offer WMS, TMS, and various other types of supply chain solutions,” says Banker.

With that in mind, adds Banker, at this point it’s not so much about best-of-breed versus ERP, it’s more about larger best-of-breeds and bigger ERPs that offer platforms with the goal of distancing themselves from smaller players in the market.

Heading into the cloud?

Chris McDivitt, vice president and supply chain technologies leader for Capgemini North America, says he continues to see more shippers adding supply chain management capabilities software to their lists when shopping for ERPs.

“There is greater consideration of looking at ERP and SCM capabilities together these days,” says McDivitt.

Also garnering more interest are cloud-based SaaS solutions that—at least for now—are more evolved with best-of-breed vendors versus large ERP providers. “From the shipper perspective, cloud SaaS is popping up more and more as a requirement,” McDivitt says, “leveraging collaboration and visibility capabilities across the supply chain network on the planning and TMS side versus the WMS side.”

McDivitt sees the growth of omni-channel distribution as another driver of the ERP-SCM connection. “Omni-channel is causing the ERP providers to look at expanding their capabilities,” he points out. “As they evolve their ERP solutions framework, it’s just natural to also grow and integrate the capabilities that are surrounding it—planning, WMS, and TMS included.”

Klappich says that for the most part, both new and existing ERP users continue to take the traditional, licensed software acquisition route. He says that there are several reasons for this traditional approach. For starters, most are able to easily “bolt on” WMS, TMS, or other applications to their existing ERPs—a capability that keeps many of them tied to on-premise options.

“They already have the infrastructure in place for their ERPs, so adding a TMS in the cloud would just add complexity versus putting the TMS into the same instance where they’re running everything else,” says Klappich. “This scenario has slowed down some shippers’ adoption of cloud.”

Right now, Klappich says Oracle is the vendor that’s made the most progress in the cloud with its TMS. “But not with its other offerings,” he points out. Oracle either hosts the TMS for a client or works with several partners that handle the hosting for users. “So Oracle is in the cloud,” remarks Klappich, “but it’s still just a small percentage of customers that are using this option.”

Carving a future path

Looking ahead, Klappich sees WMS playing a more prominent role in the intersection of ERP and SCM. “That’s the next application where we’ll see the ERPs taking a dominant position,” he says, noting, like Banker, that the best-of-breed vendors will continue to play a key role in the WMS space.

“The best-of-breed providers will have to be creative,” says Klappich. “They’ll have to stay ahead and keep introducing new innovations.”

Comparing the ERP versus best-of-breed decision to the car-buying process, Klappich says that for some people, the least expensive yet reliable vehicle is enough. At the other end of the spectrum, some drivers want to be able to go from zero-to-60 in a split second and have all of the bells and whistles that come with higher-end, luxury models.

“The Honda Accord—comparable to the Oracle or SAP supply chain offering—covers a much larger market in terms of customers who just need a solid, reliable option,” says Klappich. “The best-of-breed, on the other hand, can command a significant premium with a more specialized, customizable software package.”

Somewhere in the middle of those two extremes are the Manhattans and JDAs of the software world, which Klappich compares to the BMW or Mercedes-Benz. This is the market that will need to innovate the most, he says.

“It becomes incumbent upon them to be the first out with new functionality and to stay out in the forefront,” says Klappich. “These vendors can’t be hyper-conservative. SAP and Oracle can wait for a market to mature and lose a handful of customers in the process, but these smaller, mid-range players can’t afford to.”

Article Topics

Global Trade News & Resources

Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations Descartes announces acquisition of OCR Services Inc. Industry experts examine the impact of Baltimore bridge collapse on supply chains More Global TradeLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources