Supply Chain Technology: There’s power in the cloud

Our contributing technology editor documents how far SaaS has infiltrated the SCM software space and then introduces us to a shipper that’s partnered with its 3PL to leverage a hosted solution that’s managing its domestic and international moves.

Latest Logistics News

Industrial real estate market conditions remain tight, with space in short supply, reports CBRE Freitrater® Freight Rating and Routing Software for Shippers CT Logistic’s SaaS-based TMS platform leverages API’s and technology CT Logistics Employs Qlik® Business Intelligence Software Inspur Information Named IDC Supply Chain Technology Leader More Press ReleasesSoftware-as-a-Service (SaaS), now more commonly referred to as “cloud computing,” has a lot going for it. The need for less capital expenditure out of the gate, minimal implementation time, and the fact that such systems don’t require robust IT infrastructures (human, equipment, or otherwise) to run, are the top selling points for these hosted solutions.

There are also challenges to contend with, as we’ll touch on a little later; but it’s safe to say that, at this point in the evolution of supply chain management (SCM) software, SaaS has already made a significant imprint.

Shippers have taken to the SaaS delivery method, which finds software being deployed over the Internet instead of being installed from a box and onto the user’s servers or computers. Using a subscription model, SaaS providers “license” the use of their software to customers who pay low or no upfront implementation costs. That’s because all of the technology resides in the “cloud,” and is accessed via the Internet as a service.

SaaS is being used across many business applications including accounting, customer relationship management (CRM), enterprise resource planning (ERP), content management, and human resource management (HRM). It’s also taken hold in the supply chain space, where transportation management systems (TMS) and global trade management (GTM) systems—both of which rely heavily on collaboration to run smoothly—claim the highest use of on-demand systems.

Over the next few pages we’ll explore just how far SaaS has come in the supply chain software space during the last few years, and then introduce you to a shipper that’s partnered with its thirdparty logistics provider (3PL) to successfully manage its internal and external logistics operations.

Jumping into the cloud

Greg Aimi, director of supply chain research at Gartner, estimates that 25 percent of TMSs will be delivered on demand by 2013, and that the penetration of both the TMS and GTM markets currently stands at about 20 percent. Some of those on-demand solutions are standalone, while others are served up as part of larger solutions developed by companies like Oracle, Manhattan Associates, and Red Prairie, says Aimi.

Aimi says that TMS and GTM work particularly well in the cloud environment because each revolves around “multi-party management” programs that can be fragmented and difficult to manage without a centralized system that all entities can access.

“Transportation involves a lot of working parts, and when you get into the international scene you also have to factor in freight forwarders, consolidators, and multi-modal carriers,” says Aimi.

“SaaS’ single repository system is valuable, and different than traditional software systems that require software installation, servers, hardware, data centers, and the development of [individual] connections with all of the parties who are acting on your behalf.”

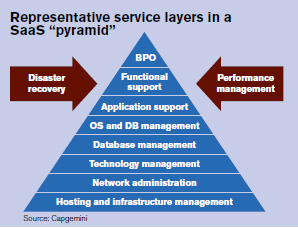

Ben Pivar, vice president and North American supply chain lead for consulting firm Capgemini, says that much of the business case for SaaS can be traced back to the packaged software revolution, when shippers realized that software development wasn’t their core competency.

“A similar movement is happening with SaaS, with shippers looking hard at whether they really want to set up and manage hardware and software in-house,” Pivar says. “Through the on-demand model, companies can work with vendors that leverage their expertise across multiple clients, and for a better price.”

SaaS systems also require less upfront investment, says Aimi, although some shippers do question the value of paying subscription fees over the long term, versus writing one check for a professional license. “The initial cost of SaaS is definitely attractive,” says Aimi, “because anytime you have lower capital expenditure upfront, the investment tends to be less risky.”

That selling point has attracted companies of all sizes to SCM SaaS options, which are no longer relegated to budget-conscious shippers who lacked robust IT infrastructures and support systems. Even large corporations like Proctor and Gamble (P&G) are tapping the option, says Aimi, who points out that the consumer packaged goods firm is using a SaaS-based program for its global transportation rollout. “That’s a really big deal,” says Aimi. “You don’t get any bigger than P&G.”

Not always fluffy

SaaS isn’t all easy. What happens, for example, if the software vendor’s system goes down, leaving the shipper and all of its constituents in a lurch? It can happen, says Adrian Gonzalez, SCM technology analyst and director of Logistics Viewpoints, and it’s something to consider before making the move to a hosted SCM solution.

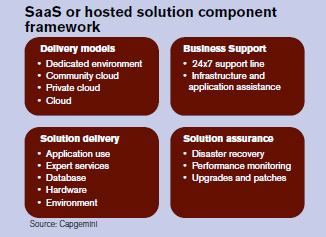

Gonzalez advises shippers to ask vendors the tough questions like, what happens if your system goes down? What type of backup and recovery methods are in place to ensure that this doesn’t occur? What other risks do I need to be concerned about? “The key is to understand what types of systems and processes your vendor has in place,” says Gonzalez, “and to take these risk-related issues into consideration when you’re shopping around for a solution.”

Geography is another challenge, particularly on the TMS side, where many of the SaaS solutions available on the market are U.S.- or North American-centric, says Gonzalez. The shipper who is seeking a single, enterprise-wide, TMS platform that can span multiple geographies, and company divisions should think twice before investing the time and energy in an on-demand TMS, says Gonzalez.

Data integrity issues should also be considered, says Pivar. “Security is one of the biggest things that’s holding SaaS adoption back right now,” he says. Of lesser concern, but still an issue, he adds, are performance issues.

“If you’re relying on a hosting environment and accessing it through the web, that system had better be running in an optimal manner,” says Pivar, who advises shippers to ask for service level guarantees that govern the vendor’s use of proper hardware sizing, as well as the reliability and continuity of the application.

“Shippers want assurances about continuity and security,” says Pivar, who expects SaaS’ popularity to grow, despite those challenges. “Hosted solutions are definitely becoming more mainstream and we expect them to continue to expand,” he says. “I also think that we’re going to see other SCM applications playing in this space, such as warehouse management systems (WMS). There’s no reason why a SaaS model wouldn’t work in that arena.”

Looking past the cloud

Like Pivar, Aimi also sees potential for SaaS in the WMS space, where the concept of running multiple DCs on a single system is fairly new. Because a warehouse exists within “four walls,” says Aimi, the notion that a single, hosted system can handle the activities going on inside is still foreign for most shippers. However, he says the idea that multiple DCs can be connected at an enterprise level through a common system that doesn’t require, say, four different reports from four different facilities, should be a major selling point for the hosted WMS.

And while SaaS still makes the most sense for systems that are inherently network-centric, says Gonzalez, the low upfront investment and faster implementation times afforded by such systems will help drive the hosted software movement across new categories, including WMS.

“If you had asked me a few years ago if SaaS made sense in WMS and ERP, I would have said not as much as it does in TMS and GTM,” says Gonzalez. “However, we’re now seeing some traction in other software areas due to the fact that shippers are looking for quick time-to-value, and/or wanting to replace their existing spreadsheets and fax machines. SaaS could be a good starting place for them.”

Evergreen Packaging: Head in the cloud

When Evergreen Packaging Inc., and Blue Ridge Paper Products Inc., joined to form Evergreen Packaging Group in 2007, it didn’t take long for the new company to get on the growth path.

Soon, the new company realized that it needed to centralize its supply chain and leverage more aspects of its existing transportation network, which was geographically dispersed and fragmented.

David Friedson, director of logistics and distribution for the Memphis-based firm, which makes paperboard packaging solutions that can be found in consumer products like microwavable trays, envelopes, and even lollipop sticks, says the search for a TMS was rooted in the company’s need to centralize its transportation component.

“As the company grew, we realized that our logistics were highly decentralized and taken care of at the facility level,” says Friedson. “We were doing an excellent job handling everything that way, but we really weren’t taking advantage of the complete network that we had in place.”

Evergreen manufactured 15 billion milk and juice cartons in 2009 and served them up to a globally dispersed customer base. Working from nine domestic manufacturing plants and eight more that are located around the globe, the company has a complex supply chain that includes “many different parts and pieces that are moving around the globe at any given time,” says Friedson.

Those moving parts aside, the merger between the two companies and the formation of Evergreen went smoothly. Working in the new company’s favor were the reputations already created by its two predecessors, because both companies had already established themselves as world-class manufacturers, says Friedson. To maximize this unique position—and to make that reputation carry over to the new entity—the firm set its sights on a new logistics strategy that covered both the supply chain execution and the strategies behind it.

The first step involved looking at 10 different supply chain solution providers, according to Friedson, and then narrowing that list down based on a few key criteria. Topping that criteria list were the solution’s value proposition, the client-vendor relationship, the vendor’s knowledge of Evergreen Packaging’s business, as well as the vendor’s project management skills.

Perhaps most importantly, Friedson says that the manufacturer wanted to be able to manage its supply chain on a 24/7, ongoing basis within a dynamic environment that “wasn’t just a static, optimized picture of what had happened in the past, but rather, a look at what was going on during the journey itself.”

After a rigorous selection process that included both on-demand and purchase-and-install options, Evergreen Packaging selected a managed TMS from Transportation Management Center (TMC), a division of C.H. Robinson Worldwide, Inc. Friedson says SaaS was selected after a thorough market search revealed that it would “get us there faster, in terms of really creating value over time and allowing us to focus on strategy, while leaving the execution issues up to the vendor.”

The TMS implementation started in May 2010. Over the eight months that followed, the new system would be rolled out to a total of nine domestic locations, with the last two added in January 2011. “We moved at lightning speed,” says Friedson. “The fast pace alone illustrates just how successful the implementation has been.”

The manufacturer is using the TMC TMS for its North American logistics operations, the bulk of which is handled by truckload and less-than-truckload carriers. The system’s order management component handles all freight-related activities, from tender right on through to payment. “We also use it for business intelligence, to help us improve both our cost and service,” says Friedson. The TMS also captures Evergreen Packaging’s rail transportation activities, although Friedson points out that it’s not being used for the tendering of rail freight.

Because the shipper was previously using a highly fragmented approach to transportation management, there were naturally some cultural issues to work through with the new system. “The challenges were mainly around change management,” says Friedson, who points out the manufacturer’s choice of a hosted solution helped ward off some of those issues right out of the gate.

“Using the hosted model helped us mitigate the change management issue because it allowed us to focus on the change that is going on in our operations, and not worry about how to install and configure a TMS,” says Friedson. “We were able to concentrate on interfacing with the system, and centralizing our transportation management process.”

So far, Evergreen Packaging has seen positive results from its TMS investment with its 3PL. Friedson says carrier performance has improved, although no solid savings or cost cuts have been detected yet. “We’re still in the process of looking at the financial benefits,” says Friedson, who sees hosted solutions as a good bet for shippers of all sizes who are looking to save money and get up and running quickly.

“Compared to the SaaS solutions of 10 years ago, today’s hosted options are fully vetted and very powerful,” says Friedson. “They’re viable options that should be evaluated along with all of the other solutions that are available on today’s market.”

Article Topics

Press Releases News & Resources

Industrial real estate market conditions remain tight, with space in short supply, reports CBRE Freitrater® Freight Rating and Routing Software for Shippers CT Logistic’s SaaS-based TMS platform leverages API’s and technology CT Logistics Employs Qlik® Business Intelligence Software Inspur Information Named IDC Supply Chain Technology Leader Norfolk Southern rolls out details of strategic company plan Supply Chain Technology: Cloud computing breakthrough More Press ReleasesLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources