Top 25 Freight Forwarders - Is democratized data the secret to a successful freight forwarder?

With the advent of Cloud-based instant quotation and booking systems, some shippers may begin to question the utility of traditional freight forwarders. Indeed, there is potential to see an industry-wide decoupling between these “data-unified” freight forwarders and the less profitable “data-fragmented” players.

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsIndustry analysts note that mergers and acquisitions continue to reshape the freight forwarding landscape, with the top players enlarging their global footprints and adding specific trade lane capabilities.

At the same time, however, it should be noted that advanced technologies are being developed which have the potential to transform forwarding and trade processes. This trend, add analysts, could also allow small- and medium-size forwarders to compete more effectively against the big corporates as “solutions” becomes increasingly affordable and democratized.

“More than ever, forwarders need to be agile and adaptive to their customer’s needs,” says John Manners-Bell, chief executive of the London-based consultancy Transport Intelligence (Ti). “The next few years could see ‘root and branch’ changes in the composition of the industry as new market entrants eye up opportunities and efficiency savings.”

“More than ever, forwarders need to be agile and adaptive to their customer’s needs,” says John Manners-Bell, chief executive of the London-based consultancy Transport Intelligence (Ti). “The next few years could see ‘root and branch’ changes in the composition of the industry as new market entrants eye up opportunities and efficiency savings.”

Strategic trends

Indeed, Ti researchers come to a great many other supportive conclusions regarding this ever-evolving market in their recent report titled “Global Freight Forwarding 2016.” The last few years have seen considerable mergers and acquisition activity, as all the major logistics companies have sought to increase their presence and capabilities in the global market to keep pace.

Some highlights of this trend include:

- The purchase of Exel by Deutsche Post. Exel itself was the product of a merger between contract logistics company Exel and forwarder Ocean Group (including MSAS)

- Deutsche Bahn’s acquisition of German forwarder Schenker and U.S. forwarder Bax Global

- CEVA’s acquisition of EGL

- Geodis’ acquisition of OHL

- Kuehne + Nagel’s acquisition of ReTrans

- XPO’s acquisition of Norbert Dentressangle and Con-way

- DSV’s acquisition of US forwarder UTi Worldwide

- Kintetsu World Express’ acquisition of APL Logistics

“The reasons behind these purchases vary by company, but have a unifying logic in reflecting the trends in the market for freight forwarding,” observes Manners-Bell. “For example, Deutsche Post DHL was created out of its acquisition of both Exel and Danzas—a logistics division that combines the ability to move large volumes of freight both by sea and air with the road transport and warehousing capabilities of its contract logistics business.”

Manners-Bell adds that this is also the case with Kuehne + Nagel, which has aggressively built up its contract logistics and road freight network in order to complement its freight forwarding business.

New players gaining foothold

There is another aspect to the strategic trends in the freight forwarders market, say Ti analysts. As in the case of UPS, a number of express parcel companies are trying to claim part of the business that has traditionally been undertaken by freight forwarders.

This is particularly the case in airfreight services for the electronics business, but is also seen in other sectors. Shipping lines too have sought to capture the upstream and downstream spend of their clients by establishing forwarding units: Damco (Maersk) and Yusen (NYK) are cases in point.

“The freight forwarding industry is evolving at a relentless pace,” says Ken Lyon, a 30-year logistics veteran and a board member at Ti. “The large forwarders are increasing their scale not only to leverage their buying power with carriers and broaden their geographic scope, but also to develop their range of services, especially those that add value and increase margin.”

As an illustration of this trend, Lyon points out that over the past few months, many of these logistics giants have struggled with operational issues, including challenges related to legacy IT systems. Which begs the question: In a dynamic environment that requires market players to be agile and fast moving in order to maximize new opportunities, how well suited are these new mega-forwarders?

“At the same time, small- and medium-sized freight forwarders are being forced to evolve,” says Lyon. “Not only do they all have to become smarter and more efficient in an environment where manual data entry is still widespread, but they have to enhance their commoditized offerings.”

For some forwarders, this means that they will need to develop their levels of expertise in specialized sectors with higher barriers to market entry in order to differentiate their services—which can be costly and time consuming. Ti analysts add that others will evolve from pure forwarders to fully developed logistics providers, increasingly offering shippers integrated logistics services.

“The technology systems that they can offer will be critical to their customer proposition,” concludes Lilith Nagorski, the head of Ti’s research department.

With the advent of Cloud-based instant quotation and booking systems, some shippers may begin to question the utility of traditional freight forwarders. Indeed, there is potential to see an industry-wide decoupling between these “data-unified” freight forwarders and the less profitable “data-fragmented” players.

Technology learning curve

However, even the biggest players can make serious missteps when trying to implement new technology. This was made abundantly clear when DHL Global Forwarding, the logistics arm of Deutsche Post DHL, finally gave up on its new information technology system heralded as a key milestone in DHL’s modernization plan.

Dubbed the “New Forwarding Environment,” the new system was designed to bring order to DHL’s globe-spanning operations, attract more business and add transparency to the process. The $1 billion investment never paid off, leaving the mega-forwarder looking for other options.

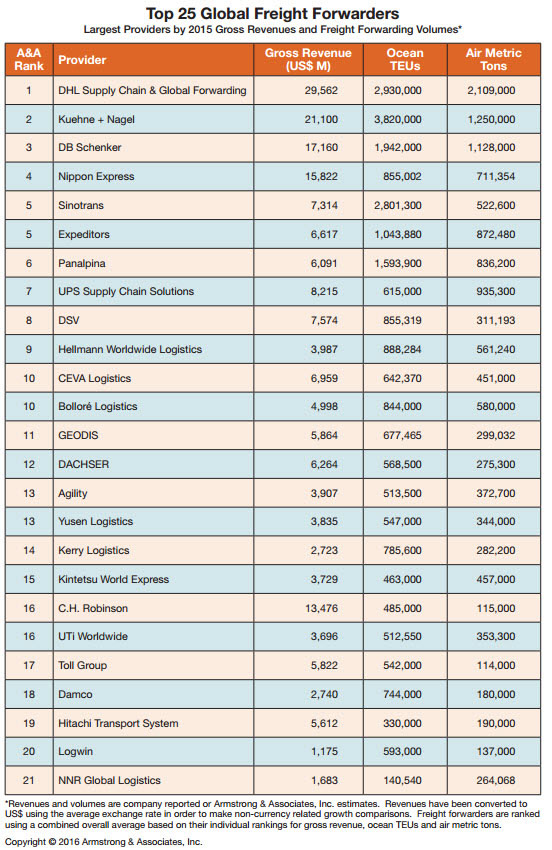

Despite this setback, however, DHL prevailed in this year’s “Top 25 Global Freight Forwarders,” as compiled by, Armstrong & Associates. “It is worth noting that European forwarders, once again, took the top three positions,” says Evan Armstrong, president of the consultancy. “DHL, Kuehne+Nagel and DB Schenker all did well again over the past year.”

While moves to advance their technology capabilities certainly helped these leaders, shifts in new leadership is also playing a role. For example, in order to best exploit business opportunities in the European markets, Kuehne + Nagel plans to establish two organizational units headquartered in Amsterdam, Netherlands, as of October 1.

According to Dr. Detlef Trefzger, CEO of Kuehne + Nagel International AG, the forwarder’s Central Europe and Western Europe offices will also have new leadership as well. “Dr. Hansjoerg Rodi will join us when we open the new office new office,” he says. “As a former executive with DB Schenker, this should strengthen our position in the region.”

DB Schenker, meanwhile, was wooing away an executive from rival DHL and continues to gain on its competitors. In air traffic alone, its volumes jumped by 1.4% this year. DHL veteran Tim Scharwath has already stepped into the position to lead its forwarding division.

Regional and modal strengths

As widely expected, Expeditors recorded strong growth of 6% over the past year while UPS Supply Chain Solutions finished strong in 7th place, with volumes growing by 2.5% in North America. The best placed Asia-based forwarder was Nippon Express which climbed a place on last year thanks to an 8.8% improvement in demand, particularly in the automobile and electronics sectors.

Breaking out performances by modes is also revealing, says Armstrong, who observes that the three companies that recorded the fastest airfreight growth rates were Hitachi Transport Systems (HTS) at 11.8%, Yusen Logistics at 11%, and Hellman Worldwide at 10.6%.

For U.S. exporters, the forwarding prospects look somewhat promising, say analysts at HSBC Bank. In its annual “Trade Confidence Score” report, the United States declined modestly in the bank’s index to 126 in the second half of 2015 compared to 127 in the in the index compiled six months earlier, reflecting a broadly stable view of near-term prospects.

“The majority of companies surveyed (77%) continue to expect trade volumes to increase in the coming months,” says Janet Wong, an analyst at HSBC global banking and markets in New York. “Notably, the proportion of respondents expecting changes to government trade regulation to have a ‘very favorable’ impact on trade volumes jumped to 18% in the latest survey from 13% in first half of 2015, which likely reflects the recent positive news regarding a preliminary agreement on the Trans-Pacific Partnership.”

Confidence factor

The Trade Confidence Score in the United States remained stable compared to six months earlier, with the majority of respondents (77%) expecting trade volumes to increase over the next six months.

Brandon Fried Executive Director, The Airforwarders Association, agrees that shippers and intermediaries are bullish for a variety of reasons. “All indications point to a rebound,” he says. “And we feel that leveraging Big Data and transparency will contribute to a positive outlook.”

The nation’s economy remains well positioned to benefit from a faster expansion of global activity over the medium term, with two-way trade between the U.S. and Asia expected to grow in importance relative to slower-growing but more established trade ties with industrialized economies.

U.S. manufacturing production, particularly in investment goods, appears poised to take advantage of the expected recovery in foreign demand over the next five years. Additionally, petroleum products and chemicals will be key growth sectors, as they benefit from the development of shale oil.

While domestic momentum in the U.S. economy appears robust, helping to drive continued growth in imports, exports remain constrained by sluggish global demand and the strong dollar. Much of the recent weakness in foreign demand stems from a cyclical slowdown in emerging markets, however, so HSBC remains confident that the medium-term outlook for U.S. exports is brighter.

Rick Mettetel, vice president of global forwarding for C.H. Robinson adds that free trade agreements have a history of “spurring” forwarding activity. “Should they fail,” he cautions, “shippers should choose forwarders who are better positioned to be technologicaly advanced and flexible when economic or geographic changes occur.”

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources