Top 30 U.S. Ports 2017: Digitization is driving change

Advancements in operational technology and robotics are becoming key differentiators for our nation’s leading ocean cargo gateways. At the same time, increasing numbers of port terminals are using higher levels of automation to improve productivity and efficiency.

When the American Association of Port Authorities (AAPA) staged their annual “Smart Ports” seminar in Oakland two months ago, the host gateway was able to showcase its digital shipping platform capable of speeding up global trade flows by the third quarter of 2018.

It was just one of several new announcements made by top U.S. ports signaling a huge tidal shift in the way containerized ocean cargo will move in the future.

“We’re building an online portal for transactions that range from tracking to transporting containerized cargo,” says Oakland’s senior project administrator Eric Napralla. “The move aligns with an industry migration toward digitalization of international supply chains that every port authority recognizes.”

This “common platform” promises to provide a single window for shippers to get personalized cargo status updates and check ocean vessel schedules. At the same time, it can help shippers pay freight-handling fees and make appointments to pick up their inbound goods.

Oakland is working with New Jersey-based logistics software provider Advent Intermodal Solutions to create the portal. Every marine terminal operator at San Francisco Bay cargo gateway is already using Advent’s eModal port community system, making it easier to roll out a common platform, says Napralla.

“Terminals are the ‘pivot point’ of containerized trade, as ocean vessels, trucks and trains converge to transport cargo,” adds Napralla. “Advent will aggregate information from Oakland’s four terminals to create a harbor-wide community portal.”

Speculation that more “Uber-like” drayage models might take advantage of this development has yet to be addressed, but portside truckers will at least soon know exactly when and where to dispatch drivers for container pick-up. With this development, marine terminals would benefit from more efficient movement of cargo in and out of the port.

“They’ll only log in to the portal once,” Napralla explains. “Then they can navigate the entire port with a few simple clicks.”

Top 30 U.S. Ports | |||||||||

Import TEUs | 2017 | 2016 | |||||||

Rank | Port | TEUs | % of Total | % of Change | 5 year CAGR | TEUs | % Total | % Change | Rank |

1 | 4,782,737 | 17.8% | 2.6% | 1.4% | 4,663,515 | 18.3% | 6.5% | 1 | |

2 | 4,088,296 | 15.2% | 8.4% | 3.7% | 3,770,968 | 14.8% | -2.5% | 2 | |

3 | 3,718,607 | 13.9% | 3.5% | 4.7% | 3,591,532 | 14.1% | 2.9% | 3 | |

4 | 2,006,610 | 7.5% | 10.2% | 8.1% | 1,820,283 | 7.1% | 6.5% | 5 | |

5 | 1,709,831 | 6.4% | 11.7% | 5.9% | 1,530,634 | 6.0% | 3.8% | 6 | |

6 | 1,345,389 | 5.0% | -26.6% | 3.4% | 1,834,113 | 7.2% | 7.8% | 4 | |

7 | 1,293,212 | 4.8% | 10.8% | 6.8% | 1,167,433 | 4.6% | 9.2% | 7 | |

8 | 1,229,870 | 4.6% | 30.6% | -7.1% | 941,973 | 3.7% | -20.4% | 10 | |

9 | 1,179,170 | 4.4% | 10.7% | 6.5% | 1,065,188 | 4.2% | 0.6% | 8 | |

10 | 978,597 | 3.6% | 1.9% | -0.1% | 960,366 | 3.8% | 5.8% | 9 | |

11 | 714,199 | 2.7% | 1.3% | 5.2% | 705,085 | 2.8% | 5.8% | 11 | |

12 | 621,481 | 2.3% | 7.2% | 1.7% | 579,639 | 2.3% | 1.5% | 12 | |

13 | 470,479 | 1.8% | 9.4% | 5.0% | 429,885 | 1.7% | 9.2% | 13 | |

14 | 469,109 | 1.7% | 44.4% | 21.8% | 324,930 | 1.3% | 24.1% | 14 | |

15 | 294,704 | 1.1% | -1.0% | 4.7% | 297,627 | 1.2% | -10.2% | 15 | |

16 | 276,319 | 1.0% | 14.9% | 7.1% | 240,506 | 0.9% | 7.9% | 16 | |

17 | 190,508 | 0.7% | -0.3% | 3.8% | 191,009 | 0.7% | 6.0% | 17 | |

18 | 157,497 | 0.6% | 10.1% | 4.1% | 143,077 | 0.6% | 16.3% | 19 | |

19 | 147,652 | 0.6% | 4.9% | 3.8% | 140,729 | 0.6% | -0.9% | 20 | |

20 | 147,441 | 0.5% | -11.1% | 8.4% | 165,894 | 0.7% | -9.9% | 18 | |

21 | 107,660 | 0.4% | 26.9% | 0.3% | 84,834 | 0.3% | 18.5% | 22 | |

22 | 101,288 | 0.4% | 26.0% | 12.8% | 80,391 | 0.3% | 21.4% | 23 | |

23 | 92,409 | 0.3% | -17.7% | -4.7% | 112,308 | 0.4% | -12.9% | 21 | |

24 | 68,810 | 0.3% | 28.6% | 6.9% | 53,492 | 0.2% | 6.3% | 25 | |

25 | 63,094 | 0.2% | -10.8% | 4.8% | 70,738 | 0.3% | 22.5% | 24 | |

26 | 48,500 | 0.2% | 4.7% | 5.6% | 46,338 | 0.2% | -3.8% | 26 | |

27 | 37,686 | 0.1% | 20.8% | 12.5% | 31,206 | 0.1% | 2.8% | 28 | |

28 | 34,607 | 0.1% | 4.7% | 2.6% | 33,058 | 0.1% | -17.7% | 27 | |

29 | 32,631 | 0.1% | 50.6% | 177.3% | 21,670 | 0.1% | 29 | ||

30 | 30,474 | 0.1% | 88.4% | 28.4% | 16,173 | 0.1% | -23.7% | 30 | |

National | 26,839,589 | 100.0% | 5.2% | 3.3% | 25,509,131 | 100.0% | 2.6% | ||

Source: Panjiva | |||||||||

Collaborative effort

Meanwhile, the “mega ports” of Los Angeles and Long Beach are collaborating with GE Transportation to increase visibility, enhance real-time decision-making and optimize cargo movement through terminals in San Pedro Bay.

Building on the success of its pilot with the Port of Los Angeles, where the solution is helping to increase transparency of incoming cargo from two days to two weeks, GE Transportation, a division of the General Electric Company, has implemented the Port Optimizer solution at marine terminals. This includes Total Terminals International and Long Beach Container Terminal for pilot testing period ending this month.

“We experienced record volumes last year, with an 11% increase to 7.54 million twenty-foot equivalent units [TEU], making 2017 our busiest year ever,” says Mario Cordero, executive director of Port of Long Beach. “This partnership with GE is providing an important trial for us as cargo and competition grow.”

The journey toward digitization has not been an easy one, recalls Jon Slangerup, CEO of Atlanta-based American Global Logistics. But as a seasoned logistics veteran, he recognizes that U.S. ports are finally keeping pace with technology-driven trends in other transport industries.

“When I was recruited to be the CEO at the Port of Long Beach in 2014, the biggest concern was to get the dockside labor and management issues put aside,” Slangerup recalls. “But when we finally addressed that, we discovered a whole culture of inefficiencies related to the resistance to new technologies.”

Slangerup resigned from the Port of Long Beach in 2016, but not before overseeing a significant transformation in strategic operations by introducing a Cloud-based platform enabling supply chain transparency. “Having custodial control of both goods and information is key,” he says. “Shippers who came to rely on expedited air and courier freight during our labor crisis were now demanding the same level of sophistication from the ports. “

Port terminal survey reveals more on automation trends

More evidence that ports are initiating digital advances surfaced recently in a global port terminal survey conducted by Oakland-based Navis, a part of Cargotec Corporation.

According to Navis researchers, increasing numbers of terminals are using higher levels of automation to improve productivity and efficiency and ultimately raise their competitive advantage in the market.

According to Navis researchers, increasing numbers of terminals are using higher levels of automation to improve productivity and efficiency and ultimately raise their competitive advantage in the market.

Respondents to their global customer survey show that a majority of terminal operators (74%) clearly believe that automation in some form (full, equipment or process automation) will be critical to stay competitive in the next three years to five years.

The results from the survey gathered from 75 Navis customer respondents at various stages of automation delve into current views on the importance of automation, future plans for automation projects, perceived benefits and challenges, as well as projected improvements to productivity and operational costs achieved through automation.

Of those responding Navis port terminal customers, 20% of respondents are already fully automated and 13% are investigating this option; 37% already have process automation and 40% are investigating this option; and 21% already have automated equipment and 24% are investigating this option

“Within the next 20 years, I believe it’s not only possible, but likely, that we’ll see a fully autonomous transport chain,” says Raj Gupta, CTO of Navis. “This could extend from loading and stowage of the container, autonomous sailing to its destination, unloading by automated cranes, and then finally being loaded on to autonomous trucks and trains for the final destination.”

That forecast is not without its skeptics, however. John Driscoll, maritime director for the Port of Oakland, says that while he never discounts the potential of technology, “this seems aggressive given the issues of safety and cost.”

Navis maintains that automated terminals can deliver consistent performance and reduce the chances of interruption due to job actions.

Indeed, Navis customers exploring these upgrades in some capacity believe automation can help them realize important benefits including increased operational safety (65%), better operational control and consistency (62%), lower overall terminal operational costs (58%) and increased operational productivity (53%).

While the expected benefits are clear, many are taking a more cautious approach and have expressed reservations about the challenges of successfully implementing automation and ultimately proving it’s worth the investment. The top challenges cited by respondents are the costs are too high (68%), lack of skills or resources to implement and manage automation (52%), challenges with labor unions (44%), and the time it takes to implement (30%).

“While the potential is there, there are still several barriers that need to be overcome in order to make automation a realistic option for some of the smallest terminal operators in the U.S.,” says Gupta. “But as we saw in our survey, exploration and implementation will continue to evolve to meet the needs of their shippers

Rather than enduring “fragmented handoffs” between vessel operators, warehouses, and drayage companies, they insisted on having a “backbone” providing a single link to do away with this segmentation. “And once we got the Federal Maritime Commission [FMC] to buy into this, we took a major step forward,” says Slangerup.

Mandated efficiencies

Three years ago, the FMC issued its landmark report titled “U.S. Container Port Congestion & Related International Supply Chain Issues: Causes, Consequences & Challenges” that developed stakeholder discussion around six main themes at major gateway ports.

Seaport experts and analysts say this represented a “gotcha” moment in the dawn of digitalization. Federal maritime commissioners were on the verge of mandating ports to pay closer attention to investment and planning, thereby enabling chassis and related drayage issues. Port authorities nationwide began working overtime to ensure smoother vessel and terminal operations, truck turn-times and extended gate hours. Even “congestion pricing” has been explored.

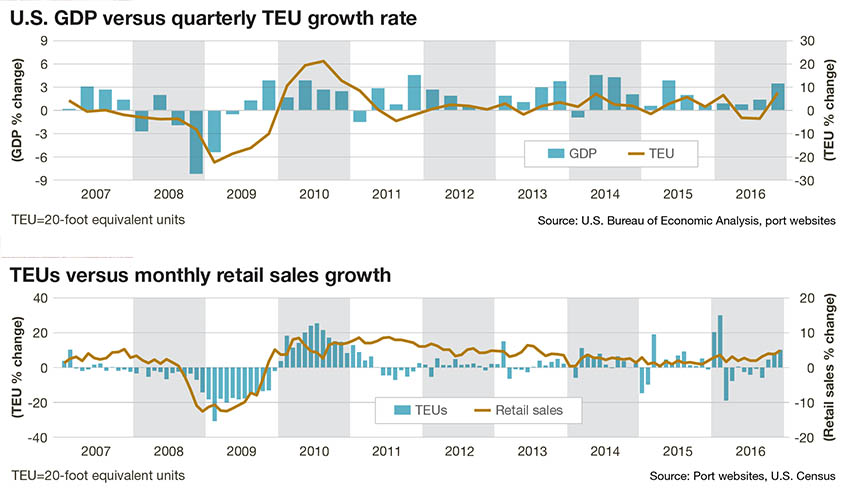

Panjiva research director Chris Rogers agrees that such an imperative was long overdue, noting that now competition from technological innovators in the Gulf and Southeast may be seizing away market share elsewhere on the U.S. West Coast. “The ports of Savannah and Houston overtook Tacoma in our Top 30 standings this year,” he says. “We’re also seeing the port of Norfolk and Charleston gaining traffic due to more high-tech investments.”

Operational efficiencies enhanced by information technology are also having an impact. Thanks to recent advances made in intermodal and rail switching, for example, The Georgia Ports Authority achieved 14% growth in March container volumes, says GPA chairman Jimmy Allgood. For the fiscal year to date (July-March), TEU container trade grew by 9%, or 255,786 additional units for a total of 3.08 million, a new record for Savannah.

“As the numbers show, our rail cargo is growing at a faster pace than our overall trade,” says Allgood. “This is important because rail is playing a key role in our responsible growth strategy. We anticipate our rail infrastructure investments to take 250,000 trucks off the road each year by 2020.”

Keeping it simple

Descartes Datamyne, a global trade data technology provider that ranks the Top 25 U.S. ports based on monthly imports, has also seen some of the leading

contenders move up the food chain due to technological innovation. However, analysts argue that “old school” fundamentals can still help the smaller players compete.

“Certain refinements in existing automation can achieve a great deal for some ports,” says Brendan McCahill, Descartes’ senior vice president of Trade Data Content. “The Port of Baltimore, for example, is concentrating on attracting carriers with fewer just-in-time demands.”

He observes that Baltimore’s combined public and private auto terminals had a record year in 2017 by handling 807,194 cars and light trucks. “It was the first time surpassing the 800,000 car and light truck mark and the seventh consecutive year that Maryland had handled more cars and light trucks than any other U.S. port,” says McCahill. “And they did it all with existing technology.”

According to McCahill, the small Port of Portland in the Puget Sound is another efficient alternative gateway for specialized cargo that can

be handled with legacy on-dock appointment systems and fundamental tracking and tracing technology for intermodal moves.

“At the same time, however, there’s no turning back for the larger ports,” McCahill says. “They must continue to work with terminal operators to enhance operations which are constantly measured and monitored by ocean carriers and their shippers.”

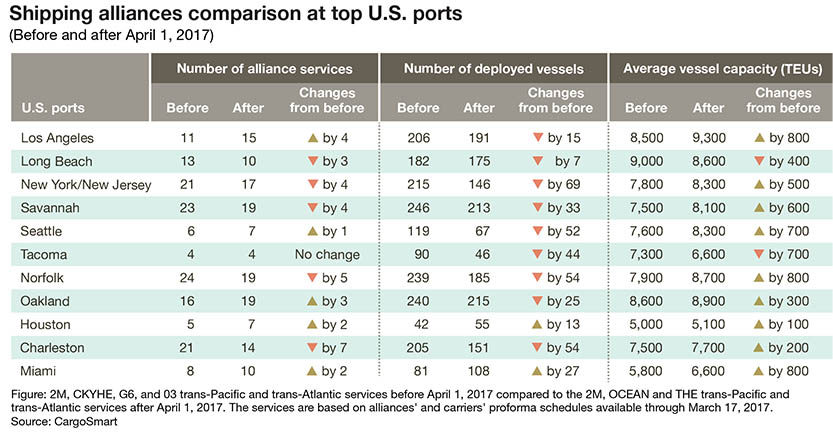

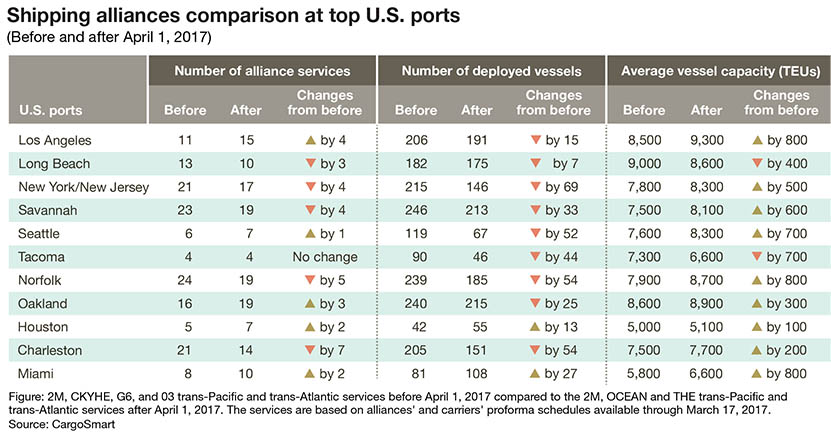

Lionel Louie, chief commercial officer at CargoSmart Limited, a global shipment management software provider that regularly measures U.S. port vessel service changes, agrees. The company’s “vessel berth times” metrics are now tracked closely by global logistics managers.

“While we have had online and EDI capabilities to provide schedule information for many years, we now have the capabilities to leverage the Internet of Things and artificial intelligence to make better predictions about performance based on vessel operators, carriers, ports, and routes,” says Louie. “This increased visibility will allow carriers to optimize their services, and it allows shippers to tap into the ecosystem of data. And ultimately, those insights can digitally transform their shipment management processes.”

Article Topics

Ports News & Resources

U.S.-bound import growth track remains promising, notes Port Tracker report Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore New Breakthrough ‘State of Transportation’ report cites various challenges for shippers and carriers in 2024 Industry experts examine the impact of Baltimore bridge collapse on supply chains Port of Baltimore closed indefinitely to ships after 1.6-mile Key Bridge collapses following maritime accident February and year-to-date U.S. import growth is solid, reports S&P Global Market Intelligence More PortsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources