Top 30 U.S. Ports: Economies of scale in play

While ranking ports on size and container throughput is both valid and traditional, analysts contend that domestic ocean cargo gateways might also be compared by volume and value of trade as well as value-added services.

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsThe simple meaning of “economies of scale” is doing things more efficiently with increasing size of operation. Industry analysts agree that size of a port, in terms of traffic flow, says nothing about productivity, efficiency, or responsiveness to beneficial cargo owners. An overview of some of the U.S. ports participating at this month’s International Association of Ports and Harbors in Los Angeles illustrates this point.

The Virginia Port Authority (VPA), which owns ports in Norfolk, Portsmouth, and Newport News, represents a regional hub for East Coast shippers seeking a wide range of container vessel choices. With more than 30 international lines serving the gateway today, it’s well positioned to take advantage of the Panama Canal expansion in 2015.

“We’ve seen growth in January, February, and March, and our year-to-date twenty-foot equivalent unit (TEU) volume is up 6.2 percent, a difference of nearly 30,000 TEUs,” says Rodney Oliver, the port’s interim executive director. “Given what we’ve seen thus far in 2013, we’re optimistic about the coming months and focusing all of our energy on leveraging this port’s assets to build volumes.”

One notable physical asset is the VPA’s 50-foot channels—the deepest on the East Coast, and capable of accommodating the largest “mega vessels” now being launched in the trade. Shippers wishing to reach inland markets in the Midwest, Ohio Valley, and the Southeast are also being attracted to the port, says Oliver. “Both Norfolk Southern and CSX offer on-dock, double-stack intermodal service,” Oliver observes.

Kurt Nagle, president and chief executive officer of the American Association of Port Authorities (AAPA), notes that “keeping a balanced portfolio” helps ports of any scale stay in the game. “By providing a wide variety of shippers with customized services like those offered at VPA, our members can compete in an honest and transparent manner,” he says. “Diversity wins in this marketplace.”

Perishables equal profit

As the second busiest export facility in the U.S., the Port of Savannah contributes significantly to promoting U.S. businesses in the global marketplace. Last year alone, the Georgia Ports Authority (GPA) saw a 3.9 percent increase in refrigerated cargo exports, totaling nearly 108,000 TEUs.

In a recent move designed to expand the cold chain advantage, Nordic Cold Storage opened the first phase of its modern storage and blast facility, located just minutes from the port’s docks. “Nordic’s announcement extends our power to support Georgia’s vital agricultural industry, in particular, our poultry producers,” says Curtis Foltz, GPA’s executive director. “The Port of Savannah handles nearly 40 percent of the nation’s containerized poultry exports, supplied largely by Georgia’s farms.”

Meanwhile, Georgia has allocated $231.1 million toward the state’s portion of the Savannah Harbor Expansion Project (SHEP). A U.S. Army Corps of Engineers study has shown that SHEP will reduce shipping costs for private companies by at least $213 million a year. “Additional studies by the Army Corps of Engineers show a 5.5-to-1 benefit to cost ratio, meaning that for every dollar spent on the deepening, the nation will reap $5.50 in benefits,” says Foltz.

The channel deepening project and re-introduction of on-dock rail at the Port of Miami is also bringing in new shippers, particularly those who are targeting Latin America. “Ongoing investment in our infrastructure will ensure that we remain competitive in a highly competitive global marketplace,” says the port’s director Bill Johnson.

The port’s recently-released “2035 Master Plan” has earned a National Recognition Award from the American Council of Engineering Companies as part of the organization’s Engineering Excellence Awards competition honoring projects that demonstrate exceptional achievement in engineering.

Geography also seems to favor Miami. The “Cargo Gateway to the Americas” is the closest East Coast port to producers of winter fruits and vegetables in Central and South America. “Miami truly is a natural entry point for perishables, and it is our goal to become shippers’ preferred entry point,” says Johnson.

Nice niche

Florida’s Port Canaveral is becoming recognized as a modest “niche” gateway for importers of perishables as well. Citrus concentrate from Brazil and deciduous concentrates from Argentina and Chile are major commodities here.

Cargo tonnage has new record high of 4.55 million, and Canaveral has recently begun regularly scheduled cargo service to the Caribbean. “Recent funding for new cargo facilities will accelerate our current growth and potential,” says John Walsh, Port Canaveral’s interim CEO.

Growing pains are part of the happy problems being dealt with at a similar small port on the West Coast. Instead of trying to compete with huge container operations on the scale of neighboring Port of Oakland, Stockton is expanding its niche role as a bulk cargo specialist serving the agriculture and construction industries of California’s Central Valley and beyond.

Efforts have had a considerable boost by the introduction of Swire Shipping’s new IndoTrans Asia liner service, which provides a multipurpose breakbulk and containerized service linking Southeast Asia and Papua New Guinea to the Pacific Islands as well as key ports on the West Coast of Canada and the U.S.

The service operates a fleet of three sister vessels—Pacific Adventurer, Pacific Explorer, and Pacific Voyage—on a 30-day frequency. The vessels are designed to carry dry containers, reefers, conventional breakbulk, heavy-lift and project cargo. “That regular monthly scheduled service will open a lot of doors for the Port of Stockton,” says port director Richard Aschieris. “It will also enable freight forwarders in the region to become more fully acquainted with markets in East Asia and the South Pacific.

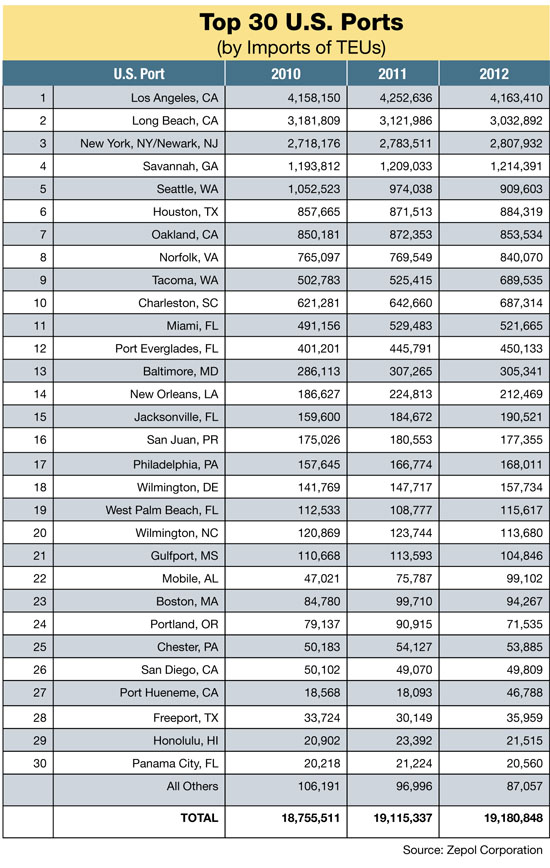

Paul Rasmussen, CEO of Zepol Corporation, a leading trade intelligence resource, says Stockton and Canaveral have the economies of scale to compete with even the biggest gateways. “Both ports bring in a good mix of commodities as well as specialty goods that larger ports might not be able to handle as well,” he says. “Chemicals and oils are just a few examples.”

Regional collaboration grows

Regional rivals can also be friends—especially when competing against a foreign nation for freight and market share. The Ports of Seattle and

Tacoma have made peace as they engage in a joint marketing campaign to compete against Canada’s Port Prince Rupert and Vancouver.

Tay Yoshitani, the Port of Seattle’s CEO, recently joined port commissioners in a series of discussions with Central and Eastern Washington agricultural producers. Their mission: to update shippers on the shifting patterns of global trade. “The port is also seeking to learn where it can assist in removing logistical and policy barriers that inhibit commerce,” he says.

The series of export roundtables provided the port with an opportunity to share its “Century Agenda” vision for growth, and discuss the need for statewide transportation investments for freight mobility that will facilitate the flow of exports. “Our Century Agenda strategy charts significant growth for the port over the next 25 years and we need to know what more we can do to support global trade,” says Port of Seattle Commission President Tom Albro.

Seattle was the outbound port for more than 75,000 containers TEUs of hay last year. Meanwhile, the state’s agricultural businesses exported $8.6 billion in farm products in that year. The other major export category (timber, lumber, paper, and other forest products) accounted for another 135,000 containers exported through the port.

Educating shippers and enlisting their support for federal legislation reform is also high on the agenda for Washington’s ports. Joining Seattle in its resistance to the Harbor Maintenance Tax on imports, is the Port of Tacoma, which is also seeking to “level the playing field” with Canadian ports which do not have to pay for dredging.

“While the Panama Canal expansion should have us concerned about East Coast ports in the future, we have to keep on eye on the competitive forces here in the Pacific Northwest,” says John Wolfe, CEO of the Port of Tacoma.

Double-digit growth in both imports and exports propelled a 16 percent gain in the Port of Tacoma’s 2012 container volumes. Breakbulk cargo volumes ended 68 percent higher for the year, while the port handled 1.7 million TEUs, marking its best year since 2008.

“Our intermodal lifts grew 30 percent, reflecting the port’s growing container volumes,” says Wolfe, who also notes that the tonnage improved almost 4 percent to nearly 18 million tons last year.”

In the meantime, full-containerized imports improved more than 27 percent for the year to 611,085 TEUs, bolstered by strong demand for auto parts, furniture, toys and sporting goods. Agricultural products and bulk commodities like scrap paper helped push full export container volumes up almost 22 percent for the year to 457,078 TEUs.

Tacoma’s 2012 container volumes reflect the addition of the Grand Alliance deployment with its associated carriers, as well as significantly stronger volumes from established customers. The carrier consortium—comprising Hapag-Lloyd AG, Nippon Yusen Kaisha, and Orient Overseas Container Lines—helped increase container vessel calls by 10 percent.

The trends signaled in this feature—while U.S.-centric—are surfacing in data gathered by both the AAPA and IAPH, say analysts. “It’s interesting to note that the volume and value quotient for ports worldwide is becoming a competitive factor,” says Rasmussen of Zepol. “Our ongoing search for data reveals that ports worldwide are looking for any and all special services to gain an edge. The performance of the top U.S. ports clearly reflects this.”

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources