Top 50 3PLs: Will mergers and acquisitions alter the third party logistics landscape?

A flurry of major service provider deals captured mainstream headlines in recent months, but the consequence of this activity has yet to be measured by domestic and international shippers. Meanwhile, the EU flounders, Asia remains strong, and emerging nations may represent the next great opportunity for the major 3PL players.

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsEuropean sovereign debt issues, a tepid U.S. recovery, and a hard landing in emerging markets—among a slew of factors—could provide macroeconomic shocks to the third party logistics (3PL) industry, say leading market analysts. Still, many catalysts are expected to drive merger and acquisition activity over the rest of 2012.

According to PricewaterhouseCoopers (PwC), the transportation and logistics industry continues to be “highly cyclical.” “A continuing theme in the first half of this year has been infrastructure deals, particularly in emerging markets, that reached a historic high in the logistics sector,” says Ken Evans, U.S. transportation and logistics leader at PwC.

In fact, in the first quarter of 2012, the proportion of deal volume involving infrastructure targets leapt to a 12-year high. This “secular trend” toward more infrastructure privatizations and transactions, adds Evans, also drove the relative increase in 3PL “deal value” and volume as a percent of the overall merger and acquisition market during the first quarter.

“Overall, logistics deal activity seems more likely to rise than fall given continued global economic expansion and the secular trend of rising infrastructure concessions,” says Evans.

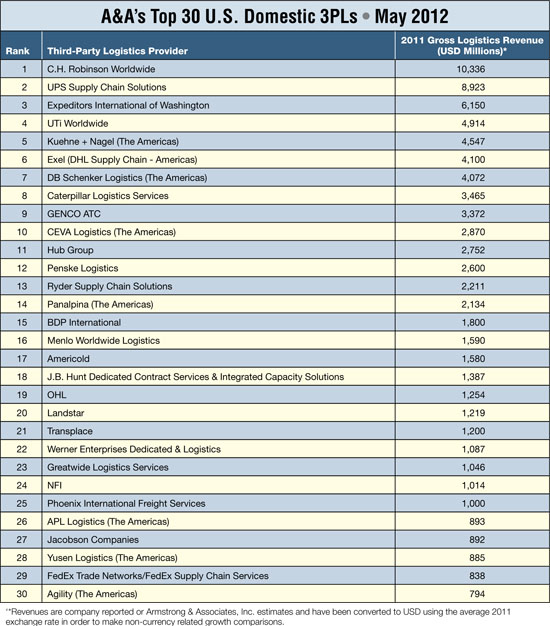

For 3PLs, adds Evans, consolidation will be an ongoing given, as more pure-play domestic companies seek to expand globally. “I can assure you that even the 3PLs found only on ‘domestic’ listings will at some point be hauling or arranging to haul freight globally,” he says. “For those bigger companies seeking to expand worldwide, mergers and acquisitions can be an attractive way to proceed.”

If one needed any more evidence of this phenomenon, consider the merger and acquisition activity of just a few months ago. UPS not only made a celebrated purchase of TNT Express, but went on to buy Italian pharmaceutical logistics company Pieffe. Geodis, meanwhile, acquired French pharmaceutical logistics and distribution company Pharmalog.

Then in a move to broaden its own pharmaceuticals footprint, DHL Global Forwarding acquired Lufthansa’s 50 percent ownership in its joint venture company LifeConEx, a cold chain management provider in the life sciences industry.

In the Asia Pacific region, merger and acquisition activity was just as intense. Kerry Logistics acquired Trustspeed Medicine Logistics in Taiwan, and it also established a joint venture with Mosskito Logistics in Australia to expand its cold chain distribution segment.

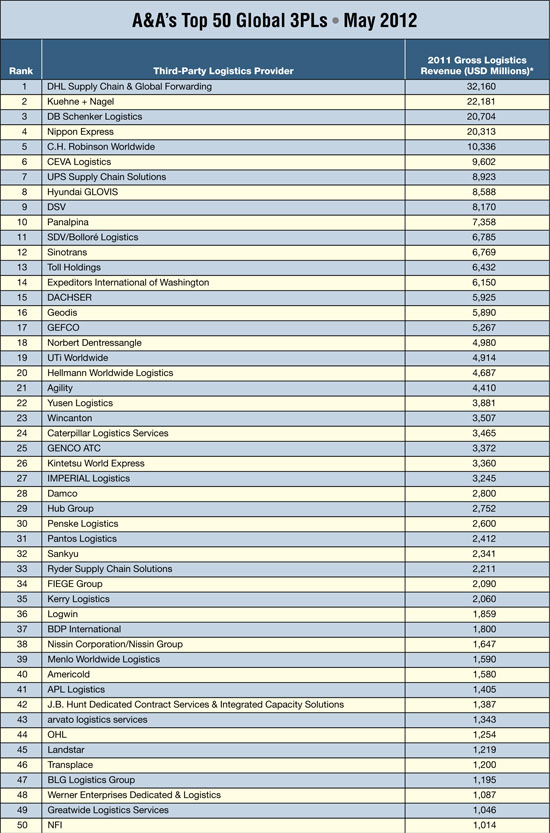

Meanwhile, data from Armstrong & Associates—the third party logistics consultancy that compiles our annual top rankings of global and domestic 3PLs—shows that all of this global merger and acquisition activity certainly makes sound, business sense. In fact, Armstrong reports that total global 3PL gross revenue in 2011 at $133.8 billion was up 5.2 percent over 2010. Furthermore, net revenues, at an estimated $61 billion, posted a 5.9 percent annual gain.

EU blues

Given that most of the mega 3PLs are based in the European Union, economists are suggesting that Darwinian tendencies will prevail and the smaller companies will be acquired before the year is out.

“Hopefully, easing inflation, improving global growth, a relatively competitive Euro, and containment of Eurozone sovereign debt tensions will help the economic activity stabilize in the second half of 2012,” says Howard Archer, IHS Global Insight’s chief European economist. “But much will depend on events in Greece and their repercussions.”

IHS currently forecasts Eurozone GDP to contract by around 0.5 percent overall in 2012, and economists fear that renewed contraction is very much in the cards for the second quarter. In its most recent survey of purchasing managers, the evidence has been largely disappointing.

“The Eurozone is still facing major headwinds, including increased fiscal tightening in many countries and markedly rising unemployment,” says Archer. “Elevated oil prices have kept inflation sticky, maintaining a significant squeeze on consumer’s purchasing power while also hurting companies’ margins. On top of this, relatively muted global growth is limiting export orders.”

It is worth noting, however, that despite global economic concerns, mergers and acquisitions within the transport and logistics industry remained strong, as the number of deals increased almost 5 percent through the third quarter of 2011 compared to same period in 2010.

According to Transport Intelligence (Ti), a London-based think tank, the current global total deal value in 3PL and contract logistics compared to 2010 is down by almost 40 percent.

“This suggests that smaller, more specialized logistics providers appear to have been targets of acquisitions throughout 2011,” says Ti analyst Cathy Roberson. “The majority of the acquisitions made were in Asia and other emerging markets; however, the European and the U.S. merger and acquisition market remained fairly strong.”

Leading academic experts say much the same thing about global 3PL resiliency. For John Langley, clinical professor of supply chain management at Penn State University, the fact that so many major players remain in the mix at all is testament to the strength of the sector.

“It’s clear that contract logistics is a global business that can’t be brought down by regional economic decline,” says Langely. The process of outsourcing product flow management, storage, and related information transfer services—usually under long-term contract—remains the objective of increasing efficiency and control no matter where it’s being done.”

Modest growth forecast

Principals at Armstrong & Associates maintain that growth in the sector will be sustained, but sluggish. “After surveying our 3PL tracking group and seeing the final 2011 results, our initial estimate of 12.9 percent growth in the international transportation management [ITM] segment has been revised down,” says consultancy president Evan Armstrong. “With the European economy in decline and Asia cooling, ocean freight revenues expanded slightly, but could barely counteract the decline in airfreight revenues.”

Armstrong notes that this is more of a continuation of 2010, with domestic transportation management doing well and the value-added warehousing and distribution segment remaining steady. “Beyond that, dedicated contract carriage, which is the most mature of the 3PL market segments, should be able to grow 4 percent as providers keep a lid on capacity and manage fleet asset additions.”

At the same time, Armstrong expects ITM net revenues to grow 3 percent in 2012. Domestic transportation management should continue to lead the way, with approximately 10 percent net revenue growth this year.

“It’s a good time to be an integrated 3PL with business in multiple 3PL segments,” says Armstrong. “Most large 3PLs have internal lead logistics providers [LLP] groups that tend to focus on process re-engineering, continuous improvement, and information technology deployment for improved ‘control tower’ supply chain management.”

Part of Armstrong’s forecast also suggests that most global 3PLs will conduct modal shifts away from airfreight and express modes to lower cost transportation alternatives to save money through the tepid economic recovery. “Tighter inbound transportation control and overall network optimization means that providers that can meet the required service standards will continue to be the 3PL leaders,” he adds.

This may explain why there was no change among the seven leading global 3PLs in this year’s ranking. Like 2011, DHL Supply Chain & Global Forwarding leveraged its extensive integrated global footprint. Armstrong says that Kuehne + Nagle is still the largest “pure” ocean freight forwarder with over 2.9 million twenty-foot containers (TEUs) managed in 2011.

“C.H. Robinson Worldwide continues to expand globally and has added operations in Mumbai and Shanghai,” says Armstrong. “While still growing, one must remember that only 8 percent of Robinson’s revenues are derived outside of the United States.”

Advancing companies include Norbert Dentressangle, which is continuing to expand beyond Europe, and Toll Holdings, which has expanded its Southeast Asia operations and overall global network. Armstrong says that Agility has had the most dramatic decline, dropping from number 16 to number 21 mainly due to past legal complications with U.S. government clients.

Emerging markets

Dick Armstrong, who shares the consultancy’s role as president, says that some of the companies resting at or near the bottom of this year’s Top 50 Global 3PLs and Top 30 Domestic 3PLs are harder to quantify.

“All of the 3PLs listed have particular strengths in their specific markets,” says the elder Armstrong. “Obviously, the euro-centric players are going to have a rougher time of it, given the sad state of their economy. On the other hand we see opportunity for 3PLs in Latin America, where Brazil is rapidly investing in its infrastructure.”

But for those third party players that are not involved in China now, he says that it may be too late to gain a foothold. “In fact, we feel that more and more domestic Chinese forwarders will surface to become leading 3PLs in the future.”

Angela Yang, managing director of the Asia-Pacific Region for Penske Logistics, also sees China as being key to any 3PL’s global strategy. “With China experiencing rapid growth in the last 20 years, I would call this market ‘dynamic,’ but not yet mature,” she says. “As a result, China is a very competitive place and pricing is key in many industries.”

According to Yang, China-based manufacturers are constantly seeking low price providers. Because the logistics business environment is just so fragmented in China, and with lower prices constantly being offered, it’s vital that 3PLs develop strong personal relationships with the customer.

Yang observes that the cost of labor is a relatively small percentage of overall logistics costs in China. The lion’s share of expense is related to warehouse leasing, which can run anywhere from 50 percent to 70 percent. Equipment expenses are also considerable.

“In many cases, companies would rather hire additional people versus investing in equipment,” says Yang. “Sourcing is vital to a 3PL’s success in the Chinese market—leveraging resources, executing a lower total cost solution, and providing great customer service is critical.”

Encompass Global Logistics LLC, a fast-growing, privately-held 3PL serving shippers in North America and China, may well demonstrate how a “smaller player” can penetrate this burgeoning arena.

“Many 3PL’s complement their ocean freight program with robust airfreight services and domestic distribution services in China,” says Encompass CEO Asa Cheng. “The collective service menu puts many ‘smaller players’ on par with those giant multinationals.”

Secondly, says Cheng, the smaller player can be more flexible in offering premium service from the inception of the purchase order to the shipper’s door. He notes that the 3PL has the ability to negotiate volume across multiple carriers and utilize those carriers whose services best complement the needs of specific shippers.

“We can work the spot market for our accounts, as we are on the forefront of market-driven rate differentials by lane and by service,” he adds.

Finally, says Cheng, many of the larger multinationals were kept busy during the recession, “strafing” clients with selling, general, and administrative expenses, which is a major non-production cost presented in an income statement.

“Instead of concentrating on short-term tactics, we should all be focusing on how to bundle customer-specific packages that address certain key elements of their supply chains,” Cheng says.

Growing importance of IT

If any consensus can be arrived at with this year’s special report on 3PLs, it’s that all lead logistics providers—especially in emerging markets—should provide web-based systems that give importers and exporters complete and instant visibility to their shipments throughout the supply chain.

Penn State’s John Langley may have summed it best by observing that emerging markets represent a “blank slate” when it comes to IT infrastructure: “Building information technology systems can be achieved more easily in a country like China because it’s being done from scratch. Rather than adding on to legacy systems, or tearing one down to build another, 3PLs can now concentrate on putting the most modern solutions in place from the start.”

In the end, the same can be said for airports, seaports, surface transportation networks, and everything else related to the expanding world of global logistics management.

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources