Top 50 Trucking Companies: Anticipating needs; exceeding expectations

Common denominators of our 2014 Top 50 include strong leadership, a growing list of diversified service offerings, and the desire to partner with their shipper customers—all essential characteristics for continued success in the new era of tightened capacity.

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsSome are full truckload (TL) carriers operating from Point A to Point B as quickly and efficiently as possible. Others are less-than-truckload (LTL) operators handling partial shipments to literally hundreds of thousands of customers each day. And still others are providing a plethora of services as they seek to become the final, vital portion of a shipper’s complex supply chain.

But Logistics Management’s 2014 roster of the nation’s Top 50 trucking companies have some common denominators: All have excellent top management teams with a vision for the future, keeping a sound eye on what shippers will be asking for next; most have modern fleets of trucks; and the best are becoming a vital partner, able to streamline all transportation needs.

“I would say that some are morphing into supply chain optimizers for their customers,” says John Larkin, the veteran trucking analyst for investment firm Stifel Inc. “They’re offering or plan to offer all the services a customer may need to run an efficient supply chain operation.”

No matter what the specific service is—TL, LTL, truck brokerage, intermodal, dedicated, or international to Mexico and Canada—these leaders all focus on the day-to-day “blocking and tackling” in the execution of their services.

According to Larkin, it’s the combination of vision and execution on the ground that separates the best from the rest. “Others are inclined to be the best operators they can be by focusing on service and cost,” says Larkin. “Sometimes they offer complimentary services to help some customers, but they shy away from endeavoring to be all things to all people.”

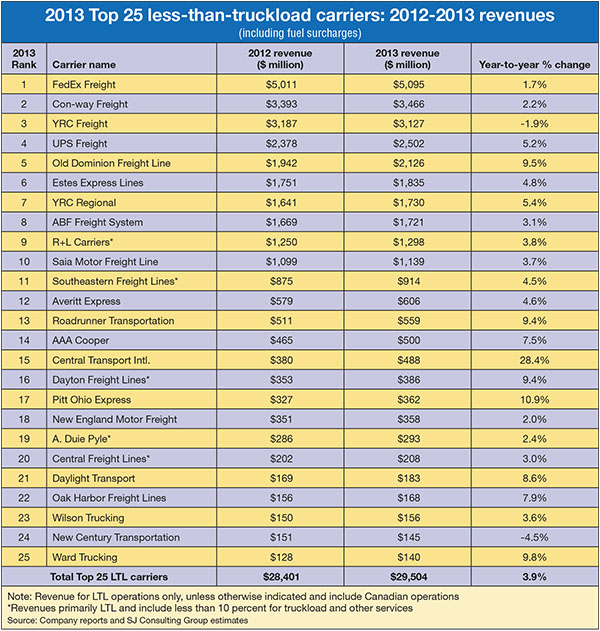

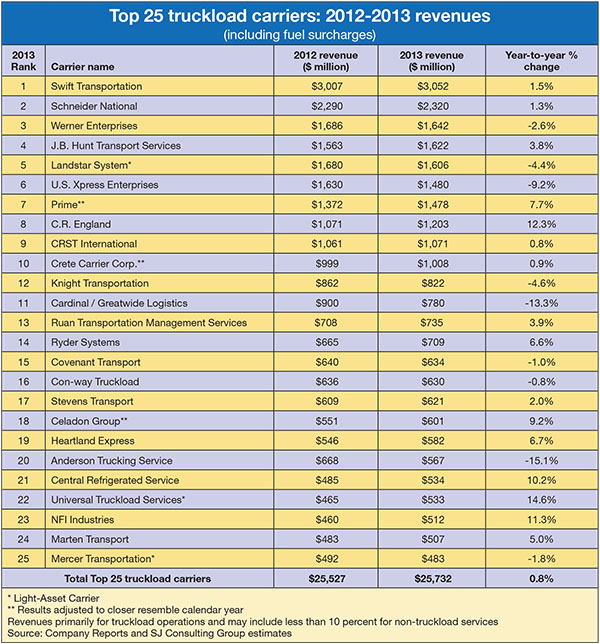

Pitt Ohio (No. 17 LTL), A. Duie Pyle (No. 19 LTL), Stevens Transport (No. 17 TL), Heartland Express (No. 19 TL), as well as smaller carriers Raven Transport and Cowan, have all tweaked their operations in recent years to expand services from their original offerings.

James Welch, CEO of YRC Worldwide (parent of long-haul YRC Freight, No 3 LTL, and YRC Regional, No. 7 LTL) says the best carriers are not just cost competitive, but efficient and consistent in their overall offerings. “We seek to provide competitive and consistent service,” says Welch. “Shippers tell us they need their carriers consistent.”

The best are also conscious of their position in the industry and are willing to take a leadership role. “We push ourselves to be much more than just a good service carrier,” says Chuck Hammel, president of Pitt Ohio. “We feel every aspect of doing business is as important as service. We make our customers, employees, and our community feel that they have a trusted partner in us.”

Now let’s delve deeper into the inner-workings of the 2014 Logistics Management Top 50 Trucking list and see what moves the top players are making to maintain the delicate balance of providing leading service while delivering strong results on the bottom line.

How they stay on top

Trucking is a capital- and labor-intensive business. Between labor and rolling stock, carrier executives say that nearly 70 percent of all revenue gets eaten up immediately.

Throw in fuel, insurance—both liability and healthcare for employees—and debt service, and that percentage rises to nearly 85 percent. So even the best and most profitable carriers are running rather thin profit margins compared to railroads and other industries.

Larkin says that the most important things carriers can do to stay on top in this brutal operating environment is to price their services properly, maximize equipment utilization and productivity, proactively manage safety, recruit and retain high-quality drivers, manage driver turnover, maximize fuel efficiency, trade in rolling stock regularly, and avoid an over-leveraged balance sheet. That, of course, is easier said than done.

“The most important thing is pricing properly,” says Larkin. “Without that, all cost and efficiency measures are for naught.”

Myron “Mike” Shevell, chairman of the Shevell Group (parent of Northeast Regional giant NEMF, No. 18 LTL) who’s been in trucking for more than 60 years, heartily agrees with Larkin’s assessment. “There’s so much discounting going on, it’s crazy,” he says. “Everything we buy has been going up—equipment, fuel, insurance, driver pay, terminals—but some guys insist on cutting rates. If this keeps up, we’re going to end up like the airlines, with one or two carriers dominating every region. You have to recapitalize and invest to stay in business.”

The profit leader in the LTL sector is Old Dominion Freight Line (No. 5 LTL). While not immune to rising health care costs and difficult winter operating conditions, ODFL still posted an impressive 87 operating ratio (OR) with 10.9 percent year-over-year tonnage growth in the fourth quarter of 2013.

Even so, ODFL is not standing still. It is making significant IT investments, including a 3-year to 5-year project of expanding and enhancing its technology platform and getting a new mainframe to position the company for another doubling of capacity over the next 10 years.

TL carrier U.S. Xpress (No. 6 TL) takes great pride that its fleet of 6,000 tractors and 16,500 trailers is among the youngest in the industry, with power units averaging less than four years old. “We routinely recapitalize our fleet assets in order to provide our customers one of the safest and most efficient TL fleets on the road today,” says Todd Davis, USX senior director of pricing and marketing.

And it’s not just in rolling stock. “Just as we are investing in our physical assets, we are also investing in our human assets,” Davis adds. “We are undertaking a company-wide Lean Six Sigma training program to further improve quality and efficiency.”

In that category, USX joins Con-way (No. 2 LTL and No. 16 TL) in embracing Lean Six Sigma. Con-way formally began its continuous improvement process about six years ago. According to Doug Stotlar, president and CEO of parent Con-way Inc., it is a process, not an event. In fact, its third party logistics unit, Menlo Worldwide Logistics, has been a leader in Lean for nearly a decade, Stotlar adds.

“The past two years have seen these continuous improvement practices roll into our trucking operations, which we believe will drive efficiencies and more fully engage employees in the business,” says Stotlar. “Our focus is now on becoming a world-class safety organization.”

Stotlar says that Con-way has invested in advanced onboard safety technologies, while changing its approach to safety. “We are focused on going beyond the traditional rules-based safety program to developing a true, high-performing safety culture.”

According to Hammel, “Pitt Ohio continually invests in technology to become more efficient and to understand our customers better. We know which customers work well for us in certain lanes and which customers don’t. We’re also investing in back office functions to keep our costs low and our service high.”

Pitt Ohio enjoyed 10.9 percent jump in revenue last year, the largest organic revenue increase of any LTL carrier, according SJ Consulting, Logistics Management’s partner in producing the annual Top 50 Trucking list.

Hammel says that jump is partially due to Pitt Ohio’s solid relationship with third-party logistics providers (3PLs), which increasingly control an ever-larger share of freight. “From a go-to-market standpoint, we have embraced 3PLs as a valued sales channel,” Hammel explains. “Many carriers see them as competition, but we see them as an efficient way of onboarding new business at a fair price.”

Another innovation is the formation of new creative services on the ground. Pitt Ohio and Averitt Express (No. 12 LTL) have teamed with a handful of other traditionally regional LTL carriers to form the “Reliance Network,” which allows for longer-haul, national coverage.

Averitt also introduced “PortSide” services in response to the near-shoring trend in manufacturing. This provides shippers with one-stop shopping for transloading, drayage, inland transportation management for road and rail, distribution and consolidation, as well as warehousing and other services.

Information services is another differentiator for the Top 50 carriers. Besides moving boxes and pallet loads of freight consistently, YRC’s Welch says that there is a new demand to provide timely and reliable information about where those boxes and pallets are.

Race for drivers

Besides offering new services, chasing freight, and trying to keep their customers happy, all truckers face the prospect of coping with $4-per-gallon diesel, increasingly costly government regulations, greater capital expenditures for rolling stock, information technology investments, and higher driver pay.

Of all those cost, perhaps the driver situation is the most vital. Very few fleets are expanding significantly, mostly because they don’t have the additional supply of drivers. “The truckload driver shortage is as severe as ever,” Larkin says. “Finding drug free, CSA compliant drivers remains a challenge, despite commendable efforts on the part of many carriers.”

Some carriers are turning to military veterans returning from Iraq and Afghanistan as a partial solution. Con-way, for instance, actively recruits from the military and already has 2,500 ex-military working at its various units. Con-way Truckload has a goal of hiring 500 drivers this year who are veterans.

Driver retention has always been challenging, says Phil Pierce, executive vice president of sales and marketing for Averitt Express. He says Averitt hires only 2 percent to 3 percent of all driver applicants, utilizing one of the most selective hiring practices in the industry.

Once drivers are behind the wheel, they must try to use best driving practices to conserve fuel and lower a fleet’s operating costs.

Some carriers are using the carrot—rather than the stick—approach. Pierce says Averitt drivers have been rewarded with thousands of dollars in gift cards, a new Mercedes Smartcar, and a Ford F-150 pickup truck.

The rate effect

Trucking rates in 2014 will largely be determined by which type of trucking service is desired, capacity restraints in that area at any given time, the cost of fuel, geographic lane, the carrier’s lane balance and freight density, and the ascent of the U.S. economic recovery.

Perhaps most importantly, contract rate increases will depend on a shipper’s particular relationships with their carriers. Factors such as freight volumes, lanes, ease of delivery/drop-offs, and percentage of “driver friendly” freight tendered play a huge part, carrier executives say, when it comes to contract renewal time.

However, in talking with analysts and industry executives, and taking all the operational challenges into consideration, the following ballpark estimates of rate increases can be expected in 2014: dry van TL freight may see 1 percent to 3 percent rate hikes (net of fuel surcharges); temperature-controlled TL carriers perhaps 3 percent to 5 percent; and LTL rate hikes in the 3 percent range, but perhaps higher in some lanes with tighter capacity.

“Capacity is currently at a premium, and it looks as though it will stay that way for a long time,” Pitt Ohio’s Hammel says. “Rates certainly will go up, as they have been, for the foreseeable future.”

Of course, geographic lanes and shippers’ individual freight characteristics will largely determine precise increases. An increasing number of carriers, including Pitt Ohio and Con-way, are eschewing large announced general rate increases (GRIs) in favor of working individually with customers.

“Rates and capacity are always linked and are often driven by fluctuations in the market,” Averitt’s Pierce says. “Our philosophy is to position ourselves for as many contingencies as possible.”

Con-way’s Stotlar adds that savvy shippers are aligning themselves with carriers as “strategic partners,” working collaboratively to make both sides better. “It’s not a pure rate play,” he says. “It’s understanding the value of service and having capacity where and when you need it. Those shippers who demonstrate true partnerships and can work toward continuous improvement for both sides are the ones who will fare best in a tightening market.”

On the truckload side, USX’s Davis says that his company has been “up front” with shippers on the double whammies of the tightening driver supply and increasing cost of compliance with government regulations. “We primarily seek to improve network velocity, density, and eliminate deadhead,” Davis says. “Then we review the rate to ensure all aspects are being adequately addressed.”

The bottom line for shippers: They can help mitigate inevitable rate hikes by working collaboratively with the best in the industry.

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources