Top 50 Trucking Companies of 2016: Reinventing the fundamentals

A new breed of leadership is creating a long-term vision to earn strategic relationships with shippers. Solid day-to-day execution and aggressive investment in technology set the direction for trucking’s new guard.

Over the years we’ve found that the biggest trucking companies have maintained their size and scope due to the leadership of solid management teams that have the ability to transform a long-term vision into a profitable day-to-day business plan—and continue to do so in a cyclical industry where earnings for even the best companies are razor thin.

This formula for success is not difficult to create, but it’s elusive to achieve. “You have to find a niche and serve it better than anyone else,” says Stifel’s veteran trucking analyst John Larkin. “Stay true to that core service offering, watch your costs like a hawk and treat your people like the heroes they are.”

But while the logos on Logistics Management’s (LM) annual listing of the Top 50 trucking companies rarely changes, we’re seeing a new breed of younger, but seasoned management teams take the helm of several of these market leaders—changes that are sure to continue.

For example, FedEx Corp.’s 72-year-old founder Fred Smith stepped down as president of the nation’s second-largest transportation concern as of Jan. 1, although he will remain CEO and board chairman. David Bronczek is taking over Smith’s role as president, and analysts say that the $50.4 billion freight conglomerate won’t miss a beat.

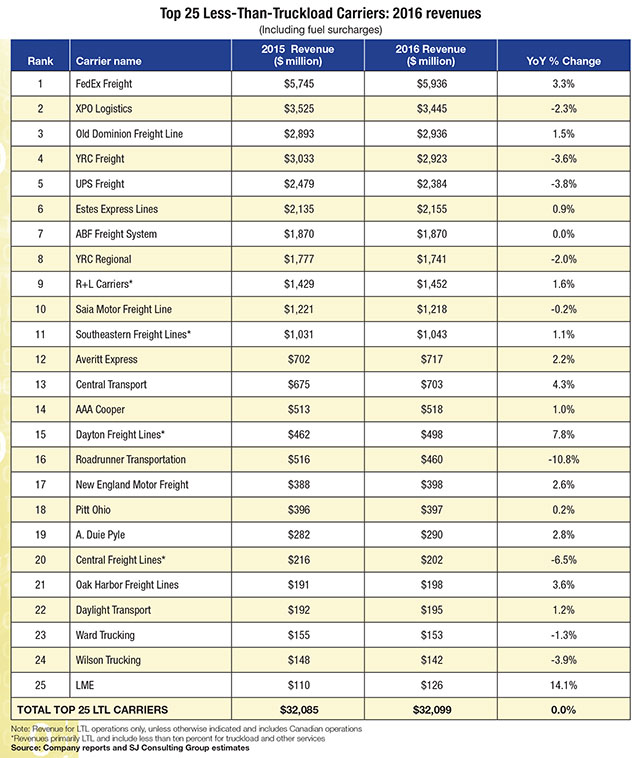

Top 25 Less-Than-Truckload Carriers: 2016 Revenues

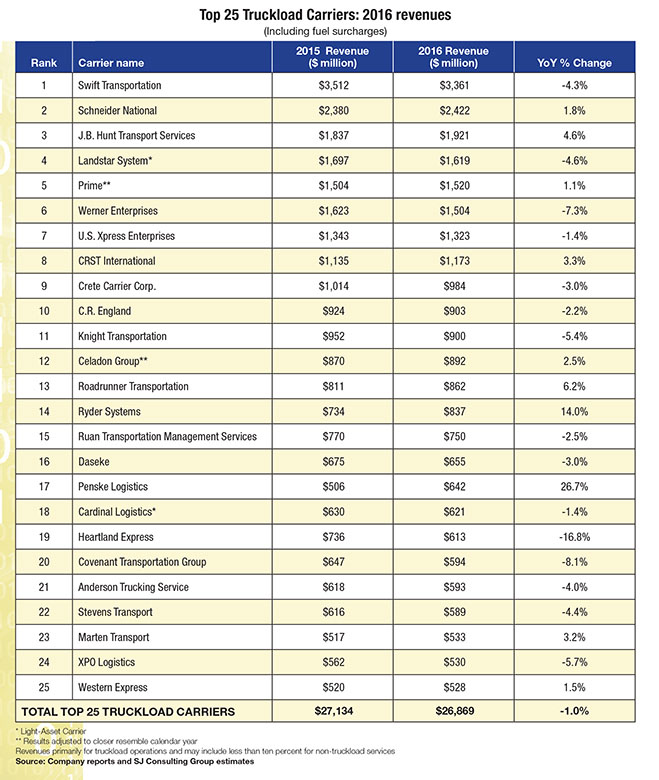

Top 25 Truckload Carriers: 2016 Revenues

At Swift Transportation, No. 1 on the LM listing of truckload (TL) carriers, its founder and longtime chairman and CEO Jerry Moyes stepped down recently and was replaced by Richard Stocking. Not to worry, as Swift’s senior management team still has more than 150 years of trucking experience.

Following the death of its namesake chairman and truckload visionary Don Schneider in 2012, the No. 2 TL carrier is making a significant move of its own this year. Privately held Schneider is planning to go public with what would be the largest initial public offering (IPO) since Swift went public in 2010. The move is being engineered by Schneider’s CEO Chris Lofgren who formerly was chief information officer at the company and generally regarded as one of the best innovators in the industry.

When Robert Young III joined ABF Freight (No. 7 on the LM LTL list), President Harry Truman fired Gen. MacArthur, Joe DiMaggio played his final game for the Yankees, and Winston Churchill returned to power in the U.K. It was 1951, and Young was 10. He recently ended a 52-year career at the conglomerate now known as ArcBest Corp., and organization now run by Judy McReynolds—the only female CEO among LM’s Top 50 listings.

“There comes time when a leader is ready for retirement, and, if the retiring CEO has done a good job, there will be at least several candidates ready to move up into the CEO slot,” says Larkin. “Often the change is tricky, as an entrepreneurial founder is often replaced by a younger ‘professional manager.’”

Other times, a change at the top is the best thing that could have happened. For example, James Welch performed a near-miracle as new CEO in saving YRC Worldwide (YRCW) from bankruptcy. A Yellow veteran who left the company during the reign of Bill Zollars, Welch returned in 2011 and has led a successful turnaround. This occurred after YRC, which is parent to the No.4- and No.8-largest LTL companies in its long-haul and regional carriers, flirted with bankruptcy amid $2 billion in debt.

Getting YRC on the road to profitability—and saving 10,000 jobs in the process—is an ongoing task. “Progress at YRCW has not, or will not always be linear as we work to move the company profitably forward,” said Welch. “We can expect some bumps along the way.”

What “bumps” lie ahead for some of the biggest and the best in the trucking industry? LM looked at what makes the biggest companies tick and what changes they’re making to stay on top.

Technology, technology, technology

Increasingly, spending millions on technology is no longer seen as optional for the biggest trucking companies. Today, it’s simply the ante required to stay in the game. As analyst Larkin says: “Technology is everything.”

“I rarely turn down a request internally for IT capital expenditures,” says Brad Jacobs, chairman and CEO of XPO Logistics, parent of the No. 2 LTL carrier, who adds that technology is a “big part of our strategy to make it easy and profitable to do business with us.”

Since XPO bought the former Con-way LTL companies for $3 billion in 2015, Jacobs told LM that the company has completed “dozens” of significant IT developments. These include the rollout of 15,000 handheld devices for better crossdock management at its terminals, an LTL dashboard for shippers and a new “virtual pricing” workbench for its sales staff along with other mobilized IT processes.

“We’ve integrated our LTL options into every other XPO unit to spot untapped efficiencies and create cost savings,” says Jacobs “First, it makes both carriers and their customers more efficient. Second, it brings down costs.” And third, but certainly not least, this level of integration creates what Larkin calls “sticky” relationships between carriers and shippers—less transactionally-based, and more strategic in nature.

According to Larkin, what the best carriers are trying to give their customers is state-of-the-art visibility while providing shippers with continually optimized, “fail-safe” supply chain management services.

“Almost all of us are trying to get more strategic with customers from a sales and services perspective,” says John White, chief marketing officer for U.S. Xpress, the No. 7 TL carrier. “We’re all trying to get deeper relationships, providing multiple service relationships, getting more imbedded into customers supply chains and bringing value beyond trucks and rates.”

To do that, says White, “requires trucking carriers to start rolling up our sleeves and driving efficiencies and costs out with our mutual customers. Their customers are ultimately our customers as well.”

Changing to stay in the mix

No trucking company was in worse financial condition than YRC was back in 2007-2010. Coming off ill-timed purchases of Roadway Express and USF Corp. and grappling with the worst economic downturn since the 1930s, YRC teetered on the brink of bankruptcy.

Bill Zollars, who had engineered the Roadway and USF purchases in an attempt to grow in revenue to compete with the likes of multinational giants UPS and FedEx, left under pressure in 2011. That opened the door for James Welch, who held senior management positions at Yellow before leaving the company five years earlier, to return.

The blueprint was simply survival. Equipment and terminals were sold for cash. Labor negotiations were renewed with concessionary agreements. Non-performing operations were closed or sold. And management was trimmed, a move that continued this year when about 100 middle managers at both YRC’s long-haul and regional carriers were let go.

YRC called it “normal rightsizing adjustments” as a result of advances it has made in processes and technology. Welch calls the entire recovery process “a balancing act” to create profitability.

According to Welch, it starts with weight per shipment and lengths of haul in an effort to create the right “freight mix” among its customers. “A little tweak here and a little tweak there in its customers’ freight can create all the difference when it comes to producing the freight density needed on key lanes to create long-term profitability,” he says.

The results have been impressive. YRC ended 2016 with the lowest levels of debt YRC has had since 2005, reducing debt by more than $70 million. Last year’s operating income of $124.3 million was YRC’s best result in 10 years. But when asked if he was satisfied, Welch said that the answer is “a resounding ‘no.’ However, I believe the company is well positioned to participate profitably as the economy strengthens.”

What can shippers expect from changes?

So, what are the immediate effects of these long- and short-term changes being made by these top carriers as they work to become more diversified, more strategic and more connected with their customers?

In short, it means rate increases, probably in the 3% range for TL carriers and perhaps as high as 5% for some LTL customers. However, these are not your father’s rate increases. Unlike the one-size-fits-all rate hikes of the past, more carriers now say that they’re tailoring their rate increases to cover their costs first on their most costly customers.

If a shipper is providing “driver-friendly” freight on efficient lanes with steady demands, that shipper can substantially reduce or mitigate these price hikes, carrier executives say.

“In terms of demand and pricing, the LTL market is looking good,” says Wayne Spain, president and COO of Averitt Express, No. 12 on our LTL listing. “We’re optimistic that LTL shipments will grow relative to the positive outlook of the economy.”

Spain adds that there’s “a good possibility” that the trucking industry and freight numbers “could outperform many of the predictions that analysts made” at the end of last year. Of course, there are may uncertainties including the mercurial new administration in Washington, geopolitical macro issues and general skittishness on the part of businesses to invest in their operations.

Implementation of electronic logging devices (ELDs) has already occurred in most LTL carriers as well as in most of the largest TL carriers. “I suspect if it has any impact, it will be on the truckload side,” says YRC’s Welch.

Of course, any TL capacity issue is never a bad thing for LTL, because some of those multi-stop truckload shipments filter back down into LTL networks. “From a capacity standpoint, I can tell you that we have capacity at all four of our operating companies,” says Welch. “Some companies have a varying degree of difference between capacity that’s available, but we certainly think that we can handle the surge if there is one. We’ll just have to see how it plays out.”

With that said, Welch adds that he’s planning “an aggressive stance” on pricing over the next couple of quarters, calling the LTL market “very stable” at the moment.

However, the situation in TL is harder to predict, analysts say, because of the unknown impact on ELDs on capacity. “It helps us,” says USX’s White. “In the short run it may increase some costs, but in the long run it ends up with benefits.”

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources