Top U.S. logistics companies lead in brand recognition and value, new report says

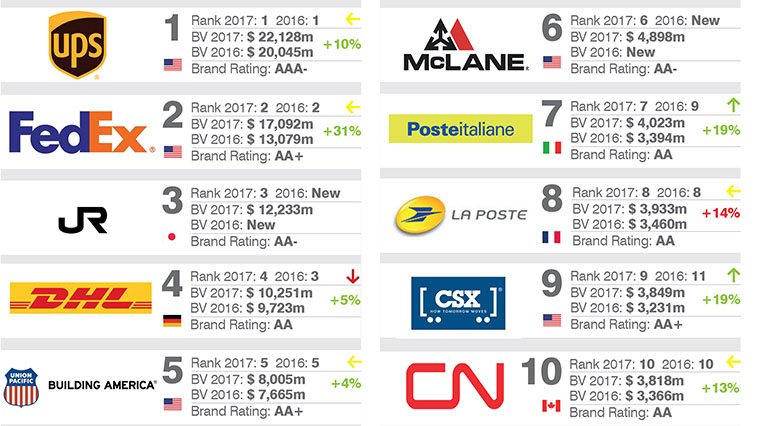

UPS and FedEx again placed 1-2 in a prestigious new international survey of the most trusted and important brands in worldwide logistics. In the fourth year of London-based Brand Finance’s valuation of logistics brands, American-based companies filled out four of the top six slots and seven in the Top 25

UPS and FedEx again placed 1-2 in a prestigious new international survey of the most trusted and important brands in worldwide logistics.

In the fourth year of London-based Brand Finance’s valuation of logistics brands, American-based companies filled out four of the top six slots and seven in the Top 25. Brand Finance publishes over 3,500 brand valuations from more than 30 industries every year, drawing on a data base to 1996.

“Brands are of utmost importance in logistics because the customer trusts the brand to deliver their items unscathed and on time,” David Haigh, CEO of Brand Finance, told LM in releasing this year’s rankings. He added that companies often incur many mistakes in trying to build their brands because of miscommunication and misguided efforts at the middle and top management levels.

“Trust and brand equity result in high margins for these companies and that often goes overlooked when you compare to some of the more visible examples of brands around,” Haigh notes.

He said that’s why video-viral scandals regarding delivery drivers throwing parcels over gates or fences causes uproar. “That is a breach of the trust a customer is placing in the brand, which, if removed, will cause serious damage to the business,” he said.

Looking at the top brands in this year’s Brand Finance Logistics 25 league table, such as UPS and FedEx, Haigh said, “All immediately conjure up images of structured, well-oiled machines with the ability to capitalize their investments in technology and to deliver the goods in the time they state. In a sector like logistics, with an important [focus] on B2B, the certainty that your consignment is going to reach you where and when you need it, is the cornerstone of brand success.”

Besides UPS and FedEx, Union Pacific Corp., the major east-west U.S. railroad, came in fifth for the second straight year.

McLane Co., a supply chain services company based in Temple, Texas, and a unit of Berkshire Hathaway, ranked sixth for the second straight time.

Further down the list, CSX moved from ninth to 10th, Burlington Northern Santa Fe moved from 11th to 12th, and third-party logistics provider C.H. Robinson held down the 22nd spot after an 18th ranking last year.

But most of the attention in the rankings fell to UPS and FedEx, major beneficiaries of the ecommerce boom and major innovators in their fields. UPS earned more than $8.7 billion operating profit and $4.9 billion net income on $65.8 billion in revenue as the world’s largest and most profitable transport company. And that doesn’t count an expected $1 billion savings due to the new Trump-induced tax bill.

And it’s not just bragging rights at stake here. Brand Finance says there is a “compelling link” between highly rated brands in logistics and their stock prices. Founded in 1996, London-based Brand Finance calls itself the world’s leading independent branded business valuation and strategy consultancy. It has offices in more than 20 countries.

Investing in the most highly branded companies would lead to a return almost double that of the average for the S&P 500 as a whole, Brand Finance reported.

As far as a technical definition, Brand Finance helped develop the internationally recognized standard on Brand Valuation, ISO 10668. It then calculated values of brands using something called “the Royalty Relief approach” which is compliant with these standards.

“We are absolutely confident in the reports,” a Brand Finance spokesperson said in releasing the latest evaluations to LM exclusively.

Despite huge investments in design, launch, and promotion of brands, he said many logistics organizations fail to go much beyond that initial phase. That results in companies missing huge opportunities to effectively make greater use of their most important assets.

Many companies do an inadequate job of monitoring brand performance, Haigh said. What monitoring is done is often sporadic, and lacks financial rigor.

As a result, marketing teams can struggle to communicate the value of their work to upper management. And at the CFO level, some skepticism remains over the importance of branding, experts say.

Whatever marketing spending there is can be poorly selected and can result in a slow slog toward brand awareness.

“No logistics company can afford to disregard the importance of branding,” Haigh said. “The big online retailers like Amazon have purchasing power that cannot be ignored, so the existing brands will need to use every asset at their disposal to meet the new threat of ‘Shipping with Amazon’ (SWA).

“If they stick their head in the sand and ignore one of the most valuable assets they control – their brand, they will crumble under the force of Amazon, Tencent, and Alibaba,” Haigh predicted.

Almost three decades since the fall of communism, emerging Europe brands still do not shine as bright as their western counterparts. After UPS and Fed Ex, Japan Rail, DHL, UP, McLane, Italian Post, Canadian National, Deutsche Post and CSX round out the top 10.

Of those, only Italian Post and Deutsche Post are European-based companies. Both are heavily subsidized by the Italian and German governments. Other national brands from emerging Europe are much weaker and less valuable than their western neighbors, the report concluded.

Article Topics

3PL News & Resources

DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains More 3PLLatest in Logistics

DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources