U.S. Port Update 2015: Moment of truth arriving

The Panama Canal expansion is moving forward on schedule, bringing with it the potential for more direct shipment between Asia and the East Coast. Ports in the Gulf are anticipating growth from trade with Latin America, while West Coast ports are just trying to retain market share.

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsIn the topsy-turvy world of port development, U.S. shippers are keeping a wary eye on a number of issues shaping future supply chain strategies.

The first—and most obvious—is taking measure of the impact a newly-widened Panama Canal will have on ocean carrier deployments early next year. As the deadline approaches, a new wrinkle was thrown into the mix by authorities that are proposing a toll structure increase commencing in April of 2016.

“The proposal, in its current form, safeguards the competitiveness of the waterway, charges a fair price for the value of the route, and facilitates our goal of providing service to the global shipping and maritime community,” says Jorge Luis Quijano, the administrator and CEO of The Panama Canal Authority (ACP).

According to ACP, the proposed restructuring calls for each shipping industry segment to be priced based upon different units of measurement, while aligning with carrier’s needs and requests, and modifying pricing for all Canal segments.

For example, containers will be measured and priced on twenty-foot equivalent units (TEU); dry bulkers will be based on deadweight tonnage capacity and metric tons of cargo; liquid natural gas (LNG) will be based on cubic meters; and tankers will be measured and priced on Panama Canal tons and metric tons.

The new structure will apply to the existing Canal as well as the new lane of traffic when the expansion project begins operations. The new locks will allow shipping lines to transit the Canal with larger ships, providing greater economies of scale. Moreover, the expansion will open new global shipping routes and allow the transit of non-traditional commodities through the waterway, such as LNG.

While container vessel tolls have remained unchanged since 2011, analysts say this price hike represents yet another challenge for carriers trying to develop long-term deployment schedules serving U.S. ports.

Building loyalty

In an unprecedented move, the ACP is proposing a “customer-loyalty program” for the container segment. Frequent vessel operators will receive premium prices once a particular TEU volume is reached.

“The proposed tolls include significant reductions in the capacity-based charge, and price differentiation based on vessel size ranges,” says Quijano. “With this framework, the ACP shares the risks associated with fluctuating economic conditions and lower-utilization return voyages.”

Such loyalty will be severely tested, however, if the proposed Grand Canal of Nicaragua ever gets beyond its dream stage. “As the Panama Canal expansion project struggles with delays and cost overruns, the planned Nicaragua Interoceanic Grand Canal is stepping into the spotlight,” notes Nelson Cabrera, manager of business development at Lilly & Associates International, a global freight forwarder based in Miami.

The proposed Canal, which is backed by Chinese investors, is due to be completed in 2020. If completed, the Nicaragua Canal will be 72 feet wide and 65 feet deep, and will stretch 174 miles across Nicaragua.

“Overall, the Nicaraguan government has chosen to prioritize the improvement of their economy over the concerns of individual citizens and the environment, and will reap the financial rewards,” says Cabrera, noting that worldwide shipping will also benefit from the option of a new trade route. “But how the construction of the Nicaragua Canal will affect the power relationships in the rest of the world remains to be seen,” he adds.

Meanwhile, the Suez Canal has been booming, and U.S. East Coast ports are doing just fine. The Suez Canal Authority reports that 2014 was a record year for revenue, even though the number of vessels passing through its gates is on a downward trend.

Explaining that paradox is easy, maintain analysts from Drewry Maritime Research: the super-mega ships are swarming to that route. “And even when Panama has deepened its channels, it will not be able to accommodate ultra large container vessels (ULCV) ranging from 14,000 TEU to 19,000 TEU,” says Philip Damas, Drewry’s director.

East Coast ready

But U.S. East Coast ports will welcome the additional cargo irrespective of which canal is used. To date, the ports in New York, Baltimore, and Norfolk have channels with sufficient post-Panamax depth.

The Port Authority of New York and New Jersey, however, must complete their $1 billion project to raise the Bayonne Bridge by 65 feet before the megaships can pass underneath. To date, that project is more than 25 percent complete, and executives there expect to remove the navigational clearance restriction in the summer of 2016.

“It’s important to also note that cargo shipped on the port’s ExpressRail system also continues to grow,” says Richard Larrabee, the port authority’s commerce director. “More than 14 percent of the total port traffic is now transported by rail.”

Rail traffic at the Port of Virginia rose significantly as well, with a 4 percent jump over last year. But at the same time, truck container traffic rose 9.1 percent to about 868,000 TEU, “In 2014, we moved 169,000 more TEU than we did in 2013, which until now was our most productive year on record,” says John Reinhart, CEO and executive director of the Virginia Port Authority. “The growth is significant, but it has created significant challenges as well, especially in service levels for our motor carriers.”

The Port of Baltimore reported that the number of containers handled at the public marine terminals last year was up 10.3 percent over the same time period in 2013—which was a record year for containers at the port’s public marine terminals.

James White, the executive director of the Maryland Port Administration, observes that the ocean cargo gateway also features deep-water advantages. “Our new 50-foot deep container berth and four supersized cranes have placed us in a very competitive position to attract some of the largest ships in the world,” he says. Overall Baltimore is ranked No. 9 for the total dollar value of cargo and No. 14 for cargo tonnage for all U.S. ports.

S.C. on a roll

No longer regarded as pesky outliers, the players comprising the South Carolina Ports Authority (SCPA) are on a roll, with volumes up 13 percent year over year. SCPA owns and operates public seaport facilities in Charleston and Georgetown, as well as the South Carolina Inland Port in Greer.

“As measured year over year, our monthly pier container volume has seen nine consecutive months of double-digit growth,” declares Jim Newsome, president and CEO of SCPA. “This broad-based growth reflects strength of both imports and exports, although we will likely see volumes settle over the next few months.”

Charleston, too, has captured federal funding to deepen its harbor to accommodate larger vessels. Concurrent with that development is the ongoing effort by the Port of Savannah to dredge its channels to post-Panamax depth.

Having survived what port authorities call “regulatory purgatory,” Savannah has embarked on a project costing approximately $706 million, including construction and environmental mitigation costs. Timing for such a move could not be better, as Savannah is currently handling double-digit increases in imports—much faster growth than the national U.S. average.

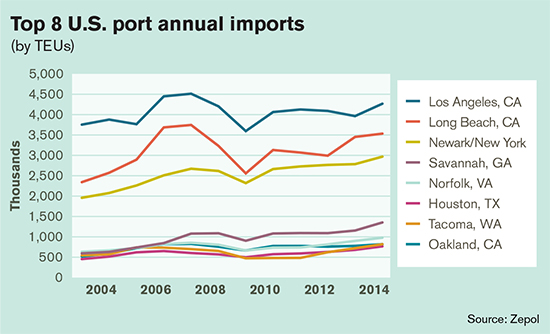

According to Zepol, a global trade and intelligence provider, Savannah will remain one of the top eight import gateways for some time to come. Aspiring to the same status, is Jacksonville in north Florida, a port that’s made similar strides toward improving its infrastructure.

According to port officials, the project to deepen the shipping channel in Jacksonville to 47 feet is a critical economic development project, and a recent initiative aims to maintain the project’s progress while ensuring mitigation for potential environmental impacts.

Latin connection

The rest of Florida and the Gulf share a heightened awareness of expanded trade potential in Latin America. The Port of Miami is well along with its 50-foot dredging project, and its strategic alliance with the Florida East Coast Railway positions it well for north-south commerce, says port director, Juan Kuryla.

“In today’s global marketplace, logistics managers often need cross-border solutions that involve multiple modes to move goods from the point of origin to the final destination,” adds Kuryla. “The Panama Canal expansion will only make us more attractive.”

Ports in Texas continue to add capacity in anticipation of the Canal’s expansion as well, with Houston and Corpus Christi leading the way. “The new shipping lane at Panama, fracking, the population explosion and the economy of Mexico are all driving more and more value for investment in port infrastructure,” says Jeff Moseley, a commissioner of the Texas Transportation Commission.

While Texas lacks a statewide port authority like those in Alabama and Mississippi, the state’s ports interact through the Port Authority Advisory Committee to develop road and rail connections to support port growth “outside the gates,” says Moseley.

In 2014, the committee approved more than $13 million for projects at the ports of Beaumont and Port Arthur, which are key shipping centers for chemicals and other products from the state’s refineries. The commission also awarded $4.3 million to install a new set of railroad tracks inside the Port Arthur.

West Coast concerns

While U.S. West Coast ports are at more risk of losing market share, they have demonstrated great resiliency. “Talk of our demise is greatly exaggerated,” quips Phillip Sanfield, spokesman for the Port of Los Angeles.

Indeed, even amid labor management strife, container volumes at the Port of Los Angeles increased 6 percent in 2014 over the previous year, with total volumes reaching 8,340,065 TEU. It was the third busiest year in the port’s history, just behind 8.4 million TEU in 2007 and 8.5 million TEU in 2006. “The 2014 numbers are an encouraging indication that the national economy continues to improve,” says Gene Seroka, executive director of the Port of Los Angeles In fact, analysts at Zepol still rank Los Angeles as the top U.S. ocean cargo gateway.

At the neighboring Port of Long Beach, cargo container trade climbed 1.3 percent in 2014, indicating continued economic growth for the U.S. and bringing the port its third-busiest year ever behind the peak years of 2006 and 2007.

Last year’s overall volume at Long Beach rose to 6,820,806 TEU. Imports increased 1.8 percent to 3,517,514 TEU, exports declined 5.9 percent to 1,604,394 TEU, while empties rose 8.2 percent to 1,698,898 TEU. Empty containers are sent overseas to be loaded with cargo.

Port officials at Long Beach attribute the growth in 2014 to “strong relationships with the shipping industry,” something that may still be sorely tested by ongoing labor issues over the next few months. Nonetheless, authorities here remain bullish.

“This is the third straight year that imports have climbed,” says Jon Slangerup, the Port of Long Beach’s executive director. “We could not have achieved our third-busiest year in our history without the support from our longtime business partners.”

Historical precedent was also made at California’s third largest port. In fact, Oakland officials report that cargo volume reached an all-time high last year. According to John Driscoll, port maritime director, the port handled the equivalent of 2.394 million TEU, thereby breaking the record of 2.391 million boxes moved in 2006. A 20 percent surge last December of loaded import containers contributed to the record performance.

“An unprecedented series of events has brought us to this point,” says Driscoll. “It’s our job now to efficiently manage the growth.” Port of Oakland officials report that overall container volume—imports and exports—increased 2 percent in 2014. Import volume for the year increased 5.29 percent—a figure that’s important due to the fact that the port has made import growth a strategic business objective over the past few years.

Alliance in PNW

The two largest ocean cargo gateways in Washington are hardly standing still, analysts observe. In a move to strengthen the Puget Sound region, Seattle and Tacoma plan to unify marine cargo terminal management.

Dubbed “The Seaport Alliance” by the two port commissions, the arrangement will align cargo terminal investments and operations along with planning and marketing. “We must make it clear that this is not a merger,” says Tara Mattina, the Port of Tacoma’s communication director. “The Alliance was created to compete for more cargo on a regional basis.”

Taken together, marine cargo operations at both ports support more than 48,000 jobs across the region and provide a critical gateway for the export of Washington state products to Asia.

One aspect of the alliance that remains to be addressed, however, is the impact it will have on dockside labor. No mention of this issue was made in either statement by the ports. For the time being, both ports have framed the arrangement as a positive move.

“Where we were once rivals, we now intend to be partners,” says Stephanie Bowman, co-president of the Port of Seattle Commission. “Instead of competing against one another, we’re combining our strengths to create the strongest maritime gateway in North America.”

According to the ports, the Seaport Alliance is the outgrowth of talks held under the sanction and guidance of the Federal Maritime Commission (FMC), the independent federal agency responsible for regulating the U.S. international ocean transportation system.

While subject to further FMC review and approval, the two port commissions will enter into an Interlocal Agreement that’s intended to provide the ports with a framework for a period of due diligence to examine business objectives, strategic marine terminal investments, financial returns, performance metrics, organizational structure, communications and public engagement. Following the due diligence period, the port commissions intend to submit a more detailed agreement for the alliance to the FMC by the end of March.

Amid all this positive discussion, however, is the fact that shippers still had to deal with huge congestion problems on the West Coast this past year. The FMC says it has made this issue a priority in 2015.

“Among the FMC’s statutory goals is the assurance of an efficient ocean transportation system,” says Mario Cordero, FMC chairman. “I look forward to a thorough review of stakeholder concerns, and we will continue to protect the shipping public by addressing unreasonable or unjust practices by carriers or marine terminal operators.”

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources