U.S. Ports Update Part 1: Expanded Panama Canal Changes the Balance

Following the close of its 2017 fiscal year, Panama Canal authorities announced that the entrepot welcomed a record 403.8 million tons—the largest amount of annual volume ever transited in its 103-year history. Industry analysts say the impact on U.S. ocean cargo gateways will soon become evident.

At this time last year, industry analysts were waiting to see if the Trump Administration would deliver on its promises to enhance port infrastructure. While the jury is still out on that one, the focus has now been placed on finding the customized solution for U.S. ports reliant on the Suez and newly-expanded Panama canals.

According to its latest throughput figures, the Panama Canal transited a total of 13,548 vessels during its fiscal year 2017, representing a 3.3% increase compared to totals the year before. Thanks to the larger Neopanamax vessels now able to transit the expanded Canal, the growth in traffic translated into a 22.2% increase in total annual tonnage from 2016, and helped the Panama Canal surpass the already ambitious cargo projection of reaching 399 million tons.

“These record figures reflect not only the industry’s confidence in the expanded Canal, but also illustrate our continued ability to transform the global economy and revitalize the maritime industry,” says Jorge Quijano, Panama Canal administrator.

The past year’s results also include many significant milestones. Less than eight months after inauguration of the expanded Canal, it welcomed the YM Unity containership, its 500th Neopanamax vessel transit. In March 2017, Mediterranean Shipping Company’s MSC Anzu became the 1,000th Neopanamax vessel to transit the Canal, while the September 2017 transit of the COSCO Yantian containership marked 2,000 Neopanamax transits.

After setting similar records in December 2016 and May 2017, the Neopanamax containership CMA CGM Theodore Roosevelt became the largest ship to transit the Canal to date in August 2017, carrying nearly 15,000 twenty-foot equivalent units (TEUs). From there, the vessel called the Port of New York and New Jersey for the inauguration of the raised Bayonne Bridge.

Fitch Ratings: U.S. ports “stable” from investment perspective

Fitch Rating’s latest “U.S. Transportation Trends” report indicates that all major U.S. ports are “stable” from an investment perspective, and forecasts this “neutral” status will continue in 2018. And while government funding of port infrastructure remains uncertain, there’s some evidence that the private sector is wiling take a chance.

According to Emma Griffith, a director of Fitch’s Global Infrastructure Group, new terminal operations at the Ports of Virginia and New York/New Jersey are two outstanding examples of this model. “If the risk exposure is not too significant, we may see more of this investment,” she says. “Still it’s a tough nut to crack.”

Griffith also believes that some ports on the East Coast will continue to ready themselves for mega-vessels transiting the Suez. Simply assuming that enough tonnage will come through the Panama Canal would be “unwise,” she says.

Ryan Cunningham, a director at Fitch, concurs, noting that the tariff structure of the Panama Canal remains uncertain, and gate charges could suddenly ramp up. “The Panama Canal Authority is not tied to the sovereign state,” he says, “and it’s much more stable. However, the political environment in the region is volatile.”

Both analysts say that U.S. ports handled last year’s storms and hurricanes well, recovering quickly without much disruption to freight operations. “These kind of weather events are a reality in the region,” says Griffith. “We don’t expect logistics managers to stop calling these ports in the Gulf and Southeast.”

Nor does she expect the Port of Los Angeles/Long Beach to lose much share because of new environmental legislation regarding truck emissions. “The concentration of population and intermodal connections is always going to be the big advantage of Southern California,” she says.

Here are other observations made by Fitch:

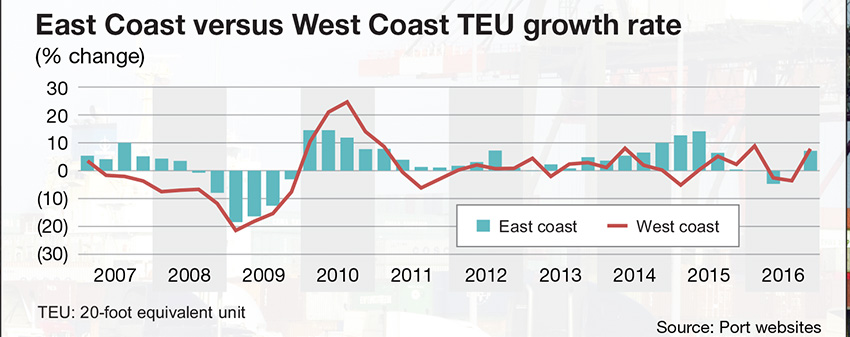

- Throughput measured in TEUs for the first half of 2017 shows a strong year-over-year increase of 7.1%, well above real U.S. GDP growth of 0.3% and 0.1% seen in the first and second quarters of 2017, respectively. Retail sales trends highlight increasing consumer confidence, driving imports, while exports rose due to improving global demand.

- Both coasts saw above average growth for the first half of 2017. Fitch-tracked West Coast port volumes were up 6.4% over a year prior, while Fitch-tracked East Coast ports saw an 8.1% increase for the same period, led by South Carolina and Houston. Imports trended toward a more even balance between East and West Coast ports over the past decade.

- Port capital improvements continue to focus on big ship readiness, with capacity enhancements facilitating the handling of increased cargo volumes from larger ships traversing both the Suez Canal and the newly expanded Panama Canal, as well as improving inland infrastructure.

- As vessel overcapacity continues to challenge the shipping industry and pressure rates, the results of recent shipping company mergers and shifting alliance structures are beginning to affect volumes and routing decisions. Fitch continues to monitor potential volume and revenue impacts for affected ports.

- While the second half of 2017 may see short-term reductions in volumes due to recent hurricanes in Florida and Texas, Fitch expects overall cargo growth to continue to mirror GDP growth in 2017 and beyond.

- Ongoing strategic shifts due to shipping mergers, bankruptcies and alliances may weaken protections provided by previous contractual protections. Fitch continues to assess existing contracts and protections they provide port cash flow profiles.

Changing scenario

Several other ports along the U.S. East Coast have since announced significant increases in container throughput in 2017. Some even set year-on-year growth records in the total amount of tonnage received—all of which can be directly attributed to the widening of the Panama Canal.

“Other ports recently completed or are continuing to advance a number of infrastructure projects that will allow them to receive Neopanamax ships as well,” observes Quijano.

The Panama Canal currently serves 29 major liner services, including 15 Neopanamax liner services, primarily on the U.S. East Coast to Asia trade route. Chris Rogers, an analyst with the global trade consultancy Panjiva, notes that the diversion of Asian-inbound traffic from U.S. West Coast ports to those on the East Coast “took a step forward” last September.

“Our data shows shipments to Southeast ports increased by 26.9 % on a year earlier, while those to California increased by a more modest 7.7 %,” says Rogers. As a consequence, in the third quarter, Southeast ports handled 15.8 % of incoming traffic—the highest since February—while California’s handled 54.6%, down from a peak of 55.5% in May.

“The battle for market share between the two Canals continues,” says Rogers. “Most recently, Panama has announced additional Neopanamax slots and slot sharing across ocean carrier alliances.”

West Coast ports, meanwhile, are hoping that the new generation of “mega vessels” will restore their throughput this year. In a recent report developed by McKinsey & Company, “Container Shipping: The Next 50 Years,” analysts say that might not be such a bad bet.

“On balance, we don’t view 20,000 TEUs as the natural end point for container ships,” says McKinsey partner John Murnane. “In fact, 50,000-TEU ships aren’t unthinkable in the next half-century.”

However, Murnane adds that progress will probably be much slower than it was in the past decade, as overcapacity means that new ordering will be slower over the next five to ten years. Lower slot costs materialize only when demand fills up larger ships, which hasn’t happened recently.

“But if demand catches up with supply, as it may well do in the early 2020s, the logic of scale will once again drive orders for bigger and bigger ships,” says Murnane. “Nonetheless, since 40% of all shipyard capacity is unutilized, and it’s not conceivable that governments will allow shipyard bankruptcies on a large scale, they could find a way to prompt some level of new ordering.”

Infrastructure question marks

While some ports seek investment funds for a surge in Neopanamax traffic, and others look to upgrade their mega-vessel facilities, the question of where this money will come from remains unanswered.

In reviewing the details announced in President Trump’s fiscal 2018 budget request, the American Association of Port Authorities (AAPA) sees declines for most federally funded, port-related programs.

“The port industry has identified a need of $66 billion in federal investments to port-related infrastructure over that next decade,” says the association’s president and CEO Kurt Nagle. He adds that U.S. ports and their private sector partners plan to invest $155 billion over the next five years alone in port facility infrastructure, and it’s vital that supporting federal investments be made, primarily to improve the waterside and landside connections.

“While encouraged by the prospect of a sizable infrastructure investment program being considered, we’re concerned about the significant reductions proposed for fiscal 2018 in many of the programs critically important to ports, such as TIGER [Transportation Investment Generating Economic Recovery] discretionary grants, HMTF [Harbor Maintenance Trust Fund] outlays, port security grants, and assistance in reducing diesel emissions,” says Nagle.

The AAPA maintains that activities at U.S. seaports account for more than a quarter of the nation’s economy, support over 23 million American jobs and generate more than $321 billion a year in federal, state and local tax revenue.

Among the budget proposals for 2018 is eliminating the U.S. Department of Transportation’s TIGER grants program, which last year awarded U.S. ports $61.8 million in multimodal infrastructure grants such as dock, rail and road improvements. Additionally, the Department of Homeland Security’s Port Security Grant Program, which Congress last funded at $100 million and provided 35 port security-related grants in fiscal 2017, would see funding reduced to $47.8 million—a 52% cut.

All of this gives the AAPA cause for concern.

“As the fiscal 2018 budget process and the anticipated infrastructure initiative moves forward, it’s vital that significant federal investments be made in port-related infrastructure,” says Nagle. “Such investments will pay huge dividends in terms of our international competitiveness, economic growth, American jobs and federal tax revenues.”

Article Topics

Ports News & Resources

U.S.-bound import growth track remains promising, notes Port Tracker report Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore New Breakthrough ‘State of Transportation’ report cites various challenges for shippers and carriers in 2024 Industry experts examine the impact of Baltimore bridge collapse on supply chains Port of Baltimore closed indefinitely to ships after 1.6-mile Key Bridge collapses following maritime accident February and year-to-date U.S. import growth is solid, reports S&P Global Market Intelligence More PortsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources