2011 State of Warehousing/DC Equipment and Technology Survey

The number of supply chain organizations planning to spend on materials handling equipment and technology is increasing; but after being in “survival mode” for so long, budgets are small and decision makers are still wary.

Last December, Washington lawmakers wrote a small provision into the new 2011 tax law allowing businesses to fully write off productive capital investments in one year, instead of amortizing them, giving companies lower taxable incomes and essentially freeing up more money to spend on labor or expansion.

If the government gets its wish, this year businesses will stop putting off the purchase of automated sortation systems and lift trucks and spend, spend, spend. Well, it seems that this wish could in fact come true.

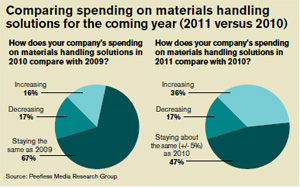

According to the 2011 State of Warehouse/DC Equipment and Technology Survey conducted for Logistics Management and sister publication Modern Materials Handling in January by Peerless Media Research Group, significantly more respondents—36 percent versus 16 percent last year—are planning to increase their spending on materials handling solutions in the coming year versus the previous year.

And while this finding most certainly sets an optimistic tone for the report, there is some data that may slightly temper the industry’s enthusiasm. While more companies may be spending, the median amount each firm plans to spend over the next 18 months for both materials handling equipment and information systems solutions is just $77,000, or 8 percent lower than our 2010 findings when that number rang in at $84,000.

“That’s the equivalent of two nice new lift trucks or one specialized truck like a turret truck,” says Don Derewecki, senior business consultant for TranSystems, a supply chain consulting firm. “With that level of investment you’re just making marginal improvements. Only 12 percent of the respondents are planning to spend a million dollars or more; so, to me that says that only 12 percent say they’re doing something significant.”

“The costs of the distribution and warehousing side of many supply chains have been so depressed over the past couple of years that there’s really not a lot of movement you can make,” says Scott Pribula, president of TranSystems’ management and supply chain consulting group. “If buying two lift trucks is your budget, then that’s just attrition to me. You’re not really moving into the next level of efficiencies.”

In fact, a sense of caution remains with 78 percent of our 2011 respondents saying that they’re proceeding slowly until the economy becomes more stable. Most are keeping spending dollars to a minimum and only for those purchases critical to sustain ongoing business.

However, these findings are just the tip of the iceberg. Over the next few pages we’ll go deeper into the data gleaned from the 2011 survey results while tracking changes in the materials handling market over the past year. We’ll examine current utilization rates of manufacturing and warehousing facilities, zoom in on specific areas that warehouse and distribution managers are planning to invest, track which best practices are gaining importance, identify green initiatives currently in use, and explore how they’re currently making materials handling purchase decisions.

Questionnaires were e-mailed to readers yielding 463 total respondents, mostly from manufacturing companies with revenues ranging from large (35 percent have sales of $100 million or more) to small (16 percent are under $5 million). Only those responses from management and personnel directly involved in the purchase decision process of material handling solutions were considered.

With such a broad representation of respondents, this is a great opportunity to gauge how plans for your warehouse/DC equipment and technology investment match up with those of your peers across the country. Here’s what we found.

Low capacity = low motivation to improve

There’s one explanation for the low amount of spending dollars attributed for 2011: There’s just too much available capacity. Even though growth and spending started turning the corner last year, there’s still plenty of available capacity in our respondents’ facilities with utilizations averaging only 64 percent, a continuing decline from last year’s 65 percent.

“Corporate management is guaranteed to question the need for additional investments when operating at such low capacity utilizations,” says Derewecki. “People really don’t even think of investing until capacity constraints start biting them.”

This continued downhill trend in capacity utilization for manufacturing is also baffling our experts. “Most manufacturers, in order to stay in business, had to really consolidate their manufacturing effort,” notes Pribula. “With the optimism in the economy and the building of inventory, I would think it would rather be on the uptick, instead of going down.” He cites a company with three plants that currently have very high utilization rates—but two years ago, it had five plants.

There is also continued low capacity in stand-alone warehouses (60 percent on average) and warehouses supporting manufacturing (56 percent on average). “This doesn’t surprise me,” says Pribula. He believes companies, in general, have gotten much better at demand planning and controlling their inventories.

Shopping list for 2011

While the budget for this year’s materials handling spending may not be as big as many had hoped, let’s examine the areas where supply chain organizations say they’re going to spend their money over the next 18 months.

The top three items remain the same as the 2010 findings: (1) New equipment/new equipment upgrades (68 percent); (2) Information technology hardware/software (47 percent); and (3) Staffing/labor(37 percent).

For specific material handling equipment, results show continued high interest in RFID solutions/products and automated storage solutions (including carousels and vertical lift modules) for two years in a row. However, the percentage of respondents actually using RFID and automated storage has remained relatively unchanged from last year—at about 20 percent. “It doesn’t surprise me that they are evaluating it,” notes Pribula. “But when are they going to truly invest? Are they really going to implement it?”

Over in the information management systems aisle, with over 40 percent of respondents already using ERP and WMS, plans are to evaluate and invest mostly in warehouse control systems (WCS), transportation management systems (TMS), and voice systems. Derewecki predicts voice technology will gain even more traction in the coming years. “It’s a means for significantly improving the execution and control of your operation without a huge hardware investment,” he says. “While it’s been used in picking for a long time, it could be used very flexibly in virtually every department such as receiving and replenishment.”

Best practices inside the four walls

For two years in a row, both manufacturing and distribution sectors have considered (1) continuous improvement, (2) labor productivity, measurement, and management, and (3) “lean” operations as very important best practices inside their organizations. For manufacturing, results show a significant percentage increase in the importance of building to stock. Derewecki points out that when you build to stock, product rolls off the assembly line directly into a trailer for shipping to a customer. “In this case,” says Derewecki, “you don’t need warehousing.”

For distribution, same-day order shipping is gaining importance. “It’s consistent with what we’re seeing out there,” reports Derewecki. “We just did a project for a healthcare company and their policy is if you order it by 5:00 p.m. it gets shipped that day.”

Value-added services (VAS) are also gaining prominence. While a few companies may be doing it as a means of differentiating themselves, it’s mostly because customers are demanding it, says Derewicki. “They’re pushing more services back up the supply chain so you have more shelf-ready merchandise for retailers.”

Pribula expects increasing focus in trading partner collaboration by 2014. “More companies are working together in such areas as distribution and transportation, sharing loads with their trading partners, or utilizing other people’s networks to reduce their costs,” he says. “I’ve heard other people sharing logistical costs based on capacity within certain players—even competitors—not only in rail but also trucking.”

Green initiatives continue to blossom

Recycling remains the top green initiative in use at 78 percent, followed closely by lighting fixtures and/or controls (74 percent), and fans to circulate cool or warm air (51 percent). Pribula speculates that the reason these initiatives are so widely in use is because these are fairly inexpensive and quickly gets “green money back to me.” He points out that the bottom three: upgraded insulation, LEED certification for new buildings, and solar panels require higher capital costs in order to execute them.

There is also a significant increase in respondents taking advantage of the benefits of being green by obtaining rebates from authorities and applying for tax incentives—from 50 percent in 2010 to 64 percent in 2011.

“There’s more of a communication drive and more awareness into these incentives,” notes Pribula. “With two of my biggest clients, there are actually people that have been hired to strictly have this responsibility. Yes, they have VPs of sustainability.”

Who’s doing the buying?

High capital investment projects—such as automation and software that extends beyond the four walls—have heavy involvement from corporate management, while the responsibility for purchasing lower cost solutions—such as lift trucks, racks, and packaging equipment—lies mostly with materials handling and warehousing/DC management.

Our experts were not surprised by the high level of loyalty given to existing suppliers, particularly with IT solutions market. “Many managers of warehouse/DC operations really do see themselves as captive to the information system supplier that they already have, just because it would be such a huge change for them to do something different,” adds Derewecki.

However, this sense of loyalty doesn’t seem to apply to third-party logistics providers (3PL). Over 40 percent are planning a switch to a new 3PL supplier, instead of sticking with their existing one. “If your existing 3PL becomes non-competitive, there are many others,” he adds.

Taking it all in

The economy might be on a road to recovery, but not necessarily at the speed we all would like. The number of companies planning to spend on materials handling solutions is increasing, but after being in “survival mode” for so long, budgets are still small and companies are moving slowly and being cautious.

Despite these cautionary tales, however, the future is certainly looking brighter than it was just 12 months ago. “But I wouldn’t call it exuberant…not just yet,” adds Derewecki.

Article Topics

Warehouse and DC News & Resources

Automatic Data Capture (ADC) at the edge Lift Trucks join the connected enterprise 2018 Warehouse / Distribution Center Survey: Labor crunch driving automation Warehouse Management Systems (WMS) / Inventory Management Technology: 6 Trends for the Modern Age ERP Suppliers’ Changing Role 2016 Warehouse/DC Operations Survey: Ready to Confront Complexity Warehouse and DC Management: 4 ADC Trends More Warehouse and DCLatest in Logistics

Amid ongoing unexpected events, supply chains continue to readjust and adapt Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources