2012 Supply Chain Software Users Survey

Latest Logistics News

UPS reports first quarter earnings decline Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth More Global Trade

The results of Logistics Management’s Annual Software Users Survey over the past few years revealed that economic woes and corporate cutbacks suppressed reader spending in 2009-2010. However, the results of our 2012 study are in, and it seems as if supply chain software spending is back to “normal” after several years of backpedaling.

“Pre-2011 there was a lot of uncertainty in the market and companies were really holding back on investments,” says Belinda Griffin-Cryan, global supply chain executive program manager at Capgemini Consulting. “The environment started to improve last year because a lot of companies just couldn’t wait any longer to purchase or upgrade their supply chain software.”

According Griffin-Cryan, as well as the results of our latest study conducted by Peerless Research Group (PRG), the initial rush of investment that was seen in early 2011 has since calmed; however, spending has certainly stabilized as we roll into 2012.

PRG conducts our annual software users survey to gain a better understanding of the current supply chain software market and to identify pertinent technology trends that may affect the logistics and transportation community. The results of this year’s study are based on the feedback provided by 280 qualified readers of Logistics Management.

Specific areas of evaluation among survey respondents include types of software currently used and planned for purchase; annual software expenditures; stage in the software buying process; reasons for consideration of supply chain solution software; number of software packages and vendors used by company; and expected timeframe for payback on purchases of supply chain software.

Over the next few pages we’ll look at the results of the survey and hear what top analysts are saying about the findings.

Top line overview

Stabilization is the name of the game in 2012 as companies steadily add more supply chain technology to their stables and/or upgrade their existing systems. This is a good sign compared to the spending decreases that the survey picked up on in 2009 and 2010.

When asked how the current economic climate has changed their companies’ approach to supply chain management software spending, 31 percent of respondents say that they’re scrutinizing their software purchases, down from 33 percent in 2011.

Twenty-one percent say they are still freezing investments, up from 18 percent last year, while 21 percent say that they’ll be making investments in new software in the next 12 months.

Another 21 percent say they plan to upgrade existing systems, compared to 22 percent the year prior—another indication that upgrade intentions have finally stabilized.

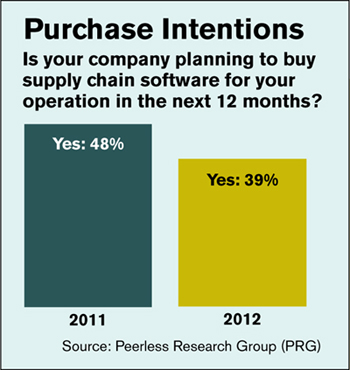

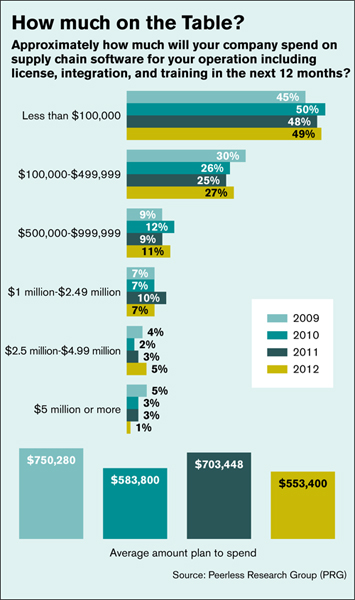

Monetary commitments to supply chain software have decreased when compared to 2011’s survey results. When asked if their firms were going to buy supply chain software in the next 12 months, 39 percent responded favorably compared to 48 percent in 2011. Budgets are up slightly, with 49 percent planning to spend less than $100,000 (compared to 48 percent in 2011) and 27 percent spending $100,000 to $499,000 (versus 25 percent the year prior).

Adrian Gonzalez, director of Logistics Viewpoints, says that this year’s respondents’ acquisition intentions indicate that companies are continuing to either buy new or upgrade existing systems. And while the numbers have flattened somewhat compared to 2011, Gonzalez says the “tighten up our belts” sentiment of 2009-2010 has clearly passed.

“A lot of shippers have come to grips with the fact that this is the business environment that they have to operate in now,” says Gonzalez. “It’s going to be dynamic and there are going to be ups and downs.”

Squeezing benefits from, TMS

Half of the logistics professionals surveyed say that their use of supply chain software has increased—only 38 percent answered positively to that question in 2011—and 46 percent say that usage stayed the same compared to 56 percent last year. When ranking the importance of individual software features, shippers have once again pinpointed the right features for their operations, configurability, compatibility with existing software, and service/support availability as their top “must haves.”

Digging down to the various software packages that comprise supply chain software as a whole, we learned that 56 percent of shippers are using warehouse management systems (WMS), a number that comes in about the same as 2011. Twenty-four percent are planning to buy or upgrade their WMS, while a net 67 percent are either using or planning to buy a WMS. From their WMS, these companies want real-time control, inventory deployment abilities, existing package upgrades, and labor management capabilities.

Thirty-seven percent of respondents are currently using transportation management systems (TMS), up from 32 percent in 2011. Twenty-five percent are planning to buy or upgrade—steady from last year’s numbers—and a net 50 percent are either using or planning to buy a TMS (versus 51 percent last year). Shippers most want routing and scheduling, routing and rating, shipment consolidation, carrier selection, and load tendering capabilities from their TMS.

Dwight Klappich, research vice president for research giant Gartner, says shippers’ keen interest in routing and scheduling falls in line with what his firm is seeing in the marketplace. “Three years ago the routing and scheduling market was dead, there just wasn’t a lot of energy there,” says Klappich. “That’s changed over the last three years as more shippers are finally turning to technology to streamline these vital activities.”

One area of the survey that surprised Klappich involved ERP systems, which are currently being used by 47 percent of companies. Fifty-four percent say they’re planning to buy ERP this year, while 54 percent of those buyers say their ERP will include a WMS module compared to 48 percent last year.

The fact that shippers see their ERP providers as capable of providing solid WMS caught Klappich’s eye. “This is a testament to the fact that ERP vendors have invested significantly in their WMS applications to the point where more than half of the companies feel that they could get their WMS from their ERP vendors,” he says, noting that 10 years ago most shippers would not have made that assumption, namely because at the time best-of-breed WMS vendors were thought to be the de facto source of such software.

Any action in the cloud?

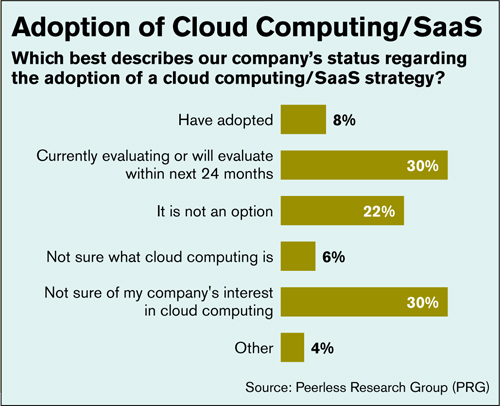

The “cloud” and Software as a Service (SaaS) may be hot topics right now across many different software sectors, but they remains a blip on the horizon for many logistics professionals. Just 8 percent of respondents say that they’re using SaaS while 30 percent are evaluating such delivery methods. Twenty-two percent say SaaS is not an option for their firms, with issues like security and privacy concerns, system reliability and system performance, and data integrity and a lack of control cited as the biggest deterrents.

Of those firms that will be investing in supply chain software in 2012, 21 percent say SaaS is indeed an option. Gonzalez take a “glass half-full” approach to the SaaS-related survey findings, noting that 8 percent (adoption rate) plus 30 percent (currently evaluating) equals 38 percent—much higher than the 22 percent of shippers who say SaaS is not an option.

“Clearly SaaS is an area that more companies are considering as a deployment model,” says Gonzalez, who remembers just six or seven years ago when SaaS was on very few radar screens. “That’s a positive sign,” he adds.

As we get further into 2012, and as the national economy continues down the slow path to recovery, exactly how the supply chain software sector fares this year remains to be seen.

However, this year’s software users survey indicates a leveling off of interest in most of the sector’s modules, but also indicates a higher overall investment by those firms that are buying new or upgrading. Regardless of the fine points within the results, the overall market appears to be progressing on a slow-and-steady growth path that isn’t expected to let up anytime soon.

Article Topics

Global Trade News & Resources

UPS reports first quarter earnings decline Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations Descartes announces acquisition of OCR Services Inc. More Global TradeLatest in Logistics

March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources