2012 Warehouse/DC Operations Survey: Mixed signals

A record response reveals that readership is divided in terms of investment: one side remains cautious, while the other is on the verge of making significant changes to their warehouse/DC operations. How have your operations emerged from the Great Recession?

Latest Logistics News

Automatic Data Capture (ADC) at the edge Lift Trucks join the connected enterprise 2018 Warehouse / Distribution Center Survey: Labor crunch driving automation Warehouse Management Systems (WMS) / Inventory Management Technology: 6 Trends for the Modern Age ERP Suppliers’ Changing Role More Warehouse and DCAfter years of slow economic progress, the results of Logistics Management’s (LM) 2012 Warehouse and Distribution Center (DC) Operations Survey show that there appears to be two schools of thought emerging from the ashes: There are those companies that remain cautious, staying conventional with minimal plans for expansion; and there are those on the verge of making significant investments and changes to their distribution operations.

Designed to gauge activities and trends in warehousing and DCs, our annual survey offers a first-hand look into the state of today’s DC and warehouse operations. In September, a survey questionnaire was sent via email invitation to LM readers. The survey gleaned 805 qualified responses (a new record for this survey) from upper-level managers to CEOs—all personally involved in decisions regarding their company’s warehouse and DC operations.

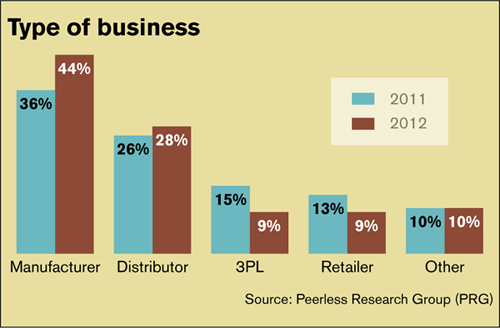

Most participating companies came from manufacturing (44 percent), followed by distributors (28 percent), third party providers (9 percent) and retailers (8 percent). An assortment of products handled in the DC was once again well-represented with food and grocery leading the pack at 11 percent, followed by industrial/chemical at 10 percent, and electronics and building materials, tied for third, at 8 percent each.

This year’s findings revealed mixed signals coming from opposite ends of the spectrum. About 52 percent of respondents are adopting a more cautious approach, spending less than $250,000 for warehousing equipment and technology in 2012.

“That’s a predominant statistic,” says Norm Saenz, senior vice president and principal of TranSystems, a supply chain consulting firm and our partner for this survey. “It supports how tough economic times have controlled spending to less than $250,000 for a majority of respondents. That’s only good for minor improvements to operations, such as racking or the purchase of a lift truck, versus opening a new facility or implementing new technologies.”

However, Don Derewecki, senior management consultant also from TranSystems, prefers to focus on the other end of the spectrum: those 17 percent of respondents who are spending $1 million or more this year, and another 16 percent planning to spend that same amount next year.

“That’s for significant projects—an indicator that companies are doing more than just replacing worn out equipment,” says Derewecki. “These stronger companies have diligent managers who have probably been continuously shaving points off their operating costs over the past few years. By now all the low hanging fruit is gone, so they’re starting to get more aggressive and finally looking to squeeze the trigger on investments in mechanization and automation.”

Over the next few pages, we’ll dig into the high-level findings of the 2012 Warehouse and Distribution Center (DC) Operations Survey to share more detail on how the warehousing and distribution landscape has changed over the past year. This year we’ve updated portions of the survey to capture emerging trends while continuing to track the critical measures of warehousing activities we’ve charted over the past six years. Let’s see how your operations compare to what your peers are doing inside the four walls.

What’s trending?

Despite the mixed signals, there’s one clear conclusion that both Derewecki and Saenz derived from this year’s survey: Corporate is making its presence felt inside the warehouse and DC.

“There’s an increasing recognition of the importance of the supply chain and how much money is being spent on it,” says Derewecki. “Corporate managers have become increasingly focused on the details that make the difference, even at the DC level.”

According to Saenz, this fact is never more evident than in the number of respondents who say they’re using their enterprise resource planning (ERP) system’s warehouse management system (WMS) functionally in the DC (27%)—twice the number of respondents using best-of-breed WMS (13 percent). “Corporate does not want to play around with expensive WMS packages,” speculates Saenz.

“They made a commitment to use an ERP system, so they want to use everything these systems can offer—even though it may not be the best thing for the warehouse.”

Derewecki agrees, adding that the WMS being offered today by the big ERP players “isn’t as bad for the warehouse as it used to be.” He says that 10 years ago some of his clients were forced to use ERP at the DC level because corporate wanted everyone to integrate with the company’s ERP system. “All of the functionalities that managers used to have with their stand-alone WMS just weren’t there,” says Derewecki. “In some cases, they had to switch back to more manual operations.” But these days, he adds, developers have significantly improved the functionality of ERP’s WMS packages.

“As more companies run their businesses with an ERP system, it’s easier and less costly to simply use that ERP’s WMS,” adds Saenz. “I think this is a trend that’s going to continue.”

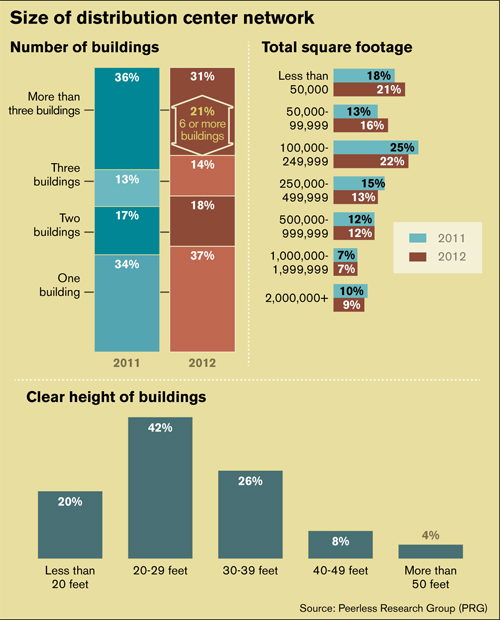

There’s also a trend towards a more consolidated network. Since 2010, the percentage of respondents with three or fewer buildings has been steadily increasing, while the percentage with four or more buildings has been steadily decreasing. Saenz believes that it’s all part of a continuing push by companies to do more with less.

“However, with fewer facilities, you may achieve savings in operating costs, but you may be potentially increasing your freight,” Saenz cautions. “This is not a particularly good move with today’s inflating gasoline prices.”

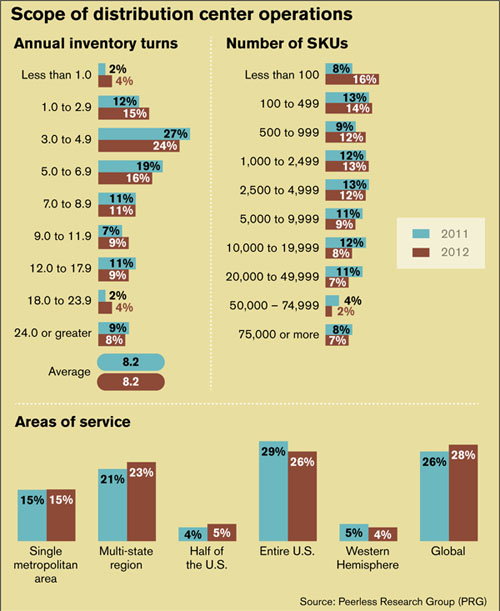

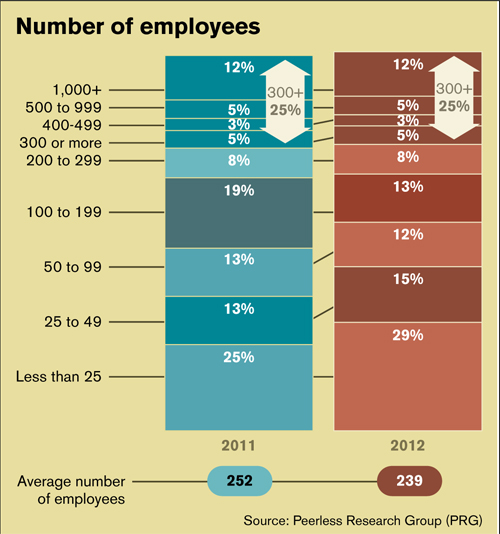

Even more mixed signals surface from this year’s findings. While some networks may be contracting to fewer facilities, about 60 percent of respondents are planning to do some sort of expansion this year. Twenty-six percent are increasing their number of SKUs, and 25 percent are increasing the number of employees.

Despite these plans for expansion, average inventory turns have not improved and remain steady at 8.2. Derewecki offers a possible explanation: “At many companies, in spite of the emphasis on inventory control and the improvement in information systems tools, the proliferation of SKUs has prevented the overall turn ratios from improving.”

The multi-channel effect

For the first time, we decided to track how companies use market channels—or how they make product available to their customers.

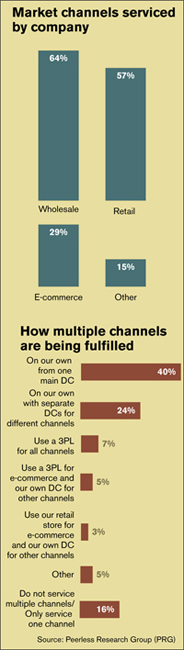

Most of the respondents (84 percent) report servicing more than one channel: 67 percent report shipping to wholesalers; 57 percent to retailers; and 29 percent are e-commerce based, shipping products directly to customers.

“I would be most interested in tracking e-commerce penetration over the coming years,” says Derewecki. “It seems that despite what industry our clients are in, if they are not using the Internet now, they have a plan to get into it.” He notes that more consumers are now using brick-and-mortar stores merely as “showrooms” to see a particular model, confirm its looks and functions, but then head back home to compare costs among web retailers before ordering that model online.

How are multi-channel respondents fulfilling their orders? Forty percent are filling their orders themselves from one main DC, designating separate areas for retail or e-commerce or scheduling specific pick waves for certain channels.

“Almost 25 percent of respondents have already decided to put it in a separate DC,” notes Saenz. “It would be interesting to see how these results change as each channel grows. I predict more separate DCs and the use of more third-party logistics providers.”

2012 DC network profile

The profile of this year’s distribution network remains mostly the same as the past few years.

Sixty percent of respondents operate less than 250,000 square feet of space in their distribution network, with most common clear heights of 20 to 29 feet. Derewecki predicts that, over time, the mix is going to shift towards taller, higher buildings. “Lift truck technology is making higher buildings very practical,” he says. “Newer, double-deep reach trucks, for example, can lift to a height of over 36 feet.”

Seventy percent of respondents report undertaking some kind of distribution network optimization and location studies, mostly on an “as-needed” basis. As a result of these studies, half of respondents (50 percent) report “moving inventory among warehouses” as it is the easiest and quickest option among all the other network improvement actions. For those adding DCs as a result of these studies, most cite “improved customer service” (70 percent) and “the penetration of new markets” (36 percent) as their top two drivers.

Tracking previous trends

Recycling continues to dominate sustainability efforts at 76 percent. This year however, slightly more respondents are “reusing shipping containers” and “using metal and/or plastic pallets.”

Recycling continues to dominate sustainability efforts at 76 percent. This year however, slightly more respondents are “reusing shipping containers” and “using metal and/or plastic pallets.”

Derewecki notes that he’s seeing more plastic pallets in use at pharmaceutical manufacturing because of FDA requirements. “Wherever you have a requirement of a sterile or cleanroom environment, then that’s one good way you can use reusable plastic pallets.”

Fortunately, fewer respondents (only 15 percent versus last year’s 28 percent) experienced catastrophic events this year compared to last year. Open-ended responses show many operations being hit by hurricanes and tornadoes; but to protect against these particular threats, survey takers have installed back-up generator and data retrieval systems, set plans in place to re-route demand to another DC, and have established multiple sources for parts and raw materials.

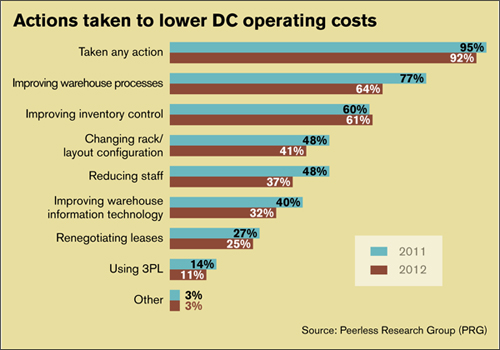

To reduce operating costs, “improving warehouse processes” (64 percent) and “improving inventory control” (61 percent) remains the top two actions preferred most by respondents. “It makes sense because both do not necessarily involve a high level of investment,” says Derewecki. “However, the better operators have already done all the process improvements that they can do without making capital investments. They are at the next stage. To improve, they may need to invest in mechanization and automation.”

Article Topics

Warehouse and DC News & Resources

Automatic Data Capture (ADC) at the edge Lift Trucks join the connected enterprise 2018 Warehouse / Distribution Center Survey: Labor crunch driving automation Warehouse Management Systems (WMS) / Inventory Management Technology: 6 Trends for the Modern Age ERP Suppliers’ Changing Role 2016 Warehouse/DC Operations Survey: Ready to Confront Complexity Warehouse and DC Management: 4 ADC Trends More Warehouse and DCLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

About the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources