Global 3PLs: Managing complex global networks

An immense amount of operational and technological expertise exists among global 3PL partners. Determining how those attributes may be used to amp-up logistics and supply chain performance is a demanding task, but one well worth doing. Our resident consultant suggests that it’s time for a more rigorous, holistic approach to the process.

Latest Logistics News

2024 Global Logistics Outlook: Crisis mode lingers The reconfiguration of global supply chains Hidden risks in global supply chains Global Logistics 2023: Supply chains under pressure Roadrunner rolls out new direct lanes and transit time improvements More Global LogisticsThe scale of global commerce is getting progressively larger, more complex, and sophisticated. At the same time, the recent rise of monolithic multinational companies has ushered in extraordinary transportation and logistics requirements now necessary for managing these complex global networks.

The perceived rush of the large-scale merger and acquisition movement has had at least two very distinctive and very different sets of outcomes from the start. The first is the view created by corporate image-makers, who stage and position these strategic moves in the best possible light; and second is the operational reality and corporate-wide integration challenges that are faced after vows are exchanged.

The logistics and supply chain professionals and the C-suite (CEO, chief financial officer, chief procurement officer, and chief information officer) will quickly recognize that there are always-tempting “synergies” to chase that will take cost and inefficiency out and improve supply chain performance.

However, after more than 21 years of transportation and logistics consulting and another 23 years prior to that working on the carrier and third-party logistics (3PL) provider side, I have found that this is where the rubber meets the road—or, in many cases, where the wheels come off.

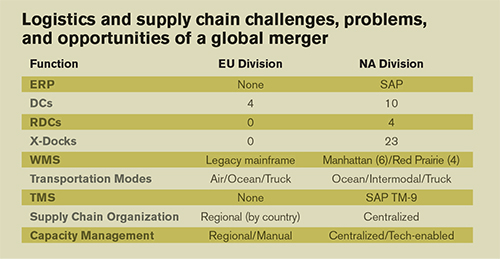

There exists a litany of reasons why expanding, newly-merged companies managing complex, global supply chains just don’t seem to get the job done in terms of harmonizing operating practices and processes, integrating IT systems, and, perhaps most challenging of all, dealing with human capital in streamlining the organization.

And, when they do, it’s more often an evolutionary, rather than revolutionary, process and often leaves millions of dollars, euros, or yen in its wake. Sometimes this simply stems from focus being on put other parts of the business. In other cases, there isn’t clear direction from the C-suite—the “strategic imperative”—to take action, or there’s a lack of corporate will to take on the always-difficult task of integrating diverse cultures, people, and technologies.

As always, regardless of where in the organization the issues arise or how they manifest themselves, it’s a profound challenge for leadership. On top of this set of scenarios, the whole drama is frequently repeated as additional acquisitions and mergers are piled on top of those not yet fully integrated.

So, what does that mean for a logistics and supply chain executive?

My experience says that the logistics professionals usually have a good vision of what’s needed to operate in the new environment. However, with all the competing priorities, it’s often difficult to get the requisite attention from executive management.

This extends to things like funding for new facilities, or improvements to existing ones, or investments in integrating IT systems—which is rarely simple and always more expensive than anyone anticipates. So, when you find yourself facing these sorts of issues as the result of some multi-national mega-merger or a major corporate restructuring, here are a few things to consider.

Streamline, standardize, simplify

When it comes to integrating supply chains and logistics management, many organizations take a hard look in the mirror and realize that trying to take on such a large-scale, potentially heavily-politicized task is a risky proposition.

Many organizations turn to 3PLs and sometimes 4PLs to assist in operating their global networks. Sometimes it’s the expansion of existing roles these parties already play, other times it’s the introduction of new talent, capabilities, and technology. Often, it’s a strategy of getting to a solution faster or of risk mitigation in situations where the existing organization needs help in coping with the large number of tasks and activities that must be undertaken, coordinated, and executed.

There are also instances where large global companies have matured to the point where they want to streamline, standardize, and simplify their operational portfolio.

Let me share a case in point. In the last century, I was part of a team that did some work for a U.S.-based multinational company. At the time they had 65 3PLs in their portfolio in various capacities. This was not by design, but rather as the result of no centralized supply chain management. This was, of course, complicated by on-going growth and acquisitions over time.

With no institutional strategy for any other course, the number had proliferated. A review of supply chain practices brought the situation to light, and we were engaged to help develop a new strategy. The stated objective was to see if the 65 3PLs could be reduced to a single global provider—the elusive “one throat to choke.”

While none of us believed that such a complex network would ever be consolidated with a single provider, clearly action was needed since no one was making the case that there was a need for all 65. After several months of work, the consensus was that the irreducible minimum was probably a limited portfolio of three 3PLs, all with global reach and capabilities.

The reason for three rather than one was simple: Although each of the three had global operations, none was the number-one player in every market. Playing to each one’s strengths led to the conclusion that the three selected were the right partners to provide the best capabilities respectively in Asia, Europe, and the Americas.

That, of course, did not solve the strategic goal of the “one throat to choke,” which led to the decision of implementing a 4PL model, whereby a fourth-party was layered on top to manage the portfolio in accordance with the client’s strategic goals.

This was a bold strategy at the time and more difficult to execute because of the limitations of technology. The enormous leaps forward with the advent and rapid growth of e-commerce makes this a strategy much more readily implemented today.

Engaging a third party

The seminal change that’s distinguishing this century from the last is the seismic shift to more powerful, enabling technologies—providing supply chain visibility—and a sustained trend toward outsourcing and managed services.

New technologies—such as provided by GT Nexus—can help companies achieve true supply chain visibility (the “glass pipeline”) to track product end-to-end at the SKU-level. This is the foundational element in the identification of bottlenecks and problems in the supply chain and the path to continuous improvement.

Working with 3PLs is frequently a practical way to make rapid progress as opposed to trying to effectuate sweeping change internally. While not for everyone or necessarily meant as something that will last forever, properly engaging 3PL and 4PLs is a sound strategy for helping navigate the increasing speed of change in an era of permanent volatility with its attendant risks.

The trick—and the art—of executing a successful partnership with a 3PL or 4PL for a multi-national network stems from architecting the solution design. All too often, in a rush to outsource, the buyer essentially throws the services contract over the fence, declares victory, and awaits benefits—and this is frequently preceded by an RFP process where the “work” is put out to bid to a selected list of providers. This is often done without proper due diligence and with predictable results.

While the majority of 3PLs can demonstrate competence in the ability to execute, they’re not all created equal. The solution architects need to carefully determine what it is they’re looking to accomplish.

They must do the “as-is” process mapping, uncover the warts, and produce a viable and detailed “to-be” design that can be the basis for 3PLs to provide the requisite responses to an RFP. There are no shortcuts.

The next major step is to identify the 3PL or 4PL companies that are best suited to the design criteria and the geographical boundaries they are meant to cover. If your focus is on Latin America, then don’t put someone on the list who has their key strengths in Asia Pacific. To reiterate, nobody is No. 1 in all markets, so you have to do the due diligence to map the skills, capabilities, technology, and strength to your specific requirements.

Some global 3PLs are strong in automotive, others excel in electronics or pharmaceuticals, while still others have honed their skills in apparel. It’s vitally important to have an unparalleled depth of knowledge about your potential partners.

People don’t usually get married after one date, and, in a similar frame of thinking, service providers should not be selected on the basis of a single RFP response alone. Traditional RFPs are generally based on incomplete or inaccurate information, they’re poorly written, often overly complicated, contain demands for useless or redundant information, and almost always focus too much emphasis on transactional pricing rather than value delivered.

The obligation of the buyer to properly prepare will not be mitigated by creating an “everything-but-the-kitchen-sink” type RFP—the response to which can rarely be accurately assessed and evaluated.

Too often, buyers rely on the respondents to do the lion’s share of the work that leads to a solution. While the respondent often offers valuable input, if the request from the buyer is incomplete or overly complicated with requests for information, then the responses will lead to pain and suffering when it comes to implementation and the operational realities become evident.

How to avoid pain

Tony Robbins, the inspirational speaker and author, once said: “People are only motivated by two things: pain and pleasure. And, they will do more to avoid pain than they will to seek pleasure.” In the spirit of avoiding needless pain, consider these suggestions:

-

Look at core competencies of your supply chain and decide what part of the operation is truly best done in-house and what makes sense to outsource to a 3PL. And keep in mind that the relationship doesn’t have to be forever. “Design-build-run-return” is a viable approach for engaging with 3PLs.

You need to plan well. Expend the time, effort, resources and money to conduct thorough due diligence on what you’re trying to do—and you need to do this before you complete the detailed process mapping.

Design the new workflows and processes. In this step, you need to be clear about objectives and develop detailed specifications that enable a provider to clearly understand what they’re being asked to price and execute against.

Find out how many solution architects you have. If the answer is none, then get some or retain consultants with those skills.

If you don’t already have in-depth knowledge of who the key players are that are likely to meet your criteria, then you need to develop an RFI to pre-screen potential partners.

Meet with and visit all potential 3PL partners and do in-depth interviews and capability assessments.

Talk to existing 3PL clients. Learn what hasn’t worked as well as what has—and why.

Develop an RFP that can be turned into an actionable blueprint that can be operationalized. If you provide an incomplete, inaccurate spec, then the response will reflect the gaps, and implementation will be complex and fraught with problems, not to mention more expensive.

- Conduct rigorous evaluations of the RFP responses and hold face-to-face meetings in a workshop format to jointly discuss how your potential partner would work with you to solve the operational problems you’ll be facing with implementation and beyond.

The bottom line is that an immense amount of operational and technological expertise exists among the 3PL partners. When done correctly, determining how those attributes may be used to amp-up supply chain performance is a demanding task, but one well worth doing—whether it be to solve short-term problems or long-term challenges.

Article Topics

3PL News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Going Deep with 3PLs Orchestration: The Future of Supply Chain LM Podcast Series: 3PL market update with Evan Armstrong GXO’s acquisition of Wincanton remains on track for completion by late April New TIA Q4 Market Report sees declines amid some positive trends Uber Freight heralds strong growth in its European Managed Transportation business More 3PLLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources