State of Logistics 2013: Less than Truckload

The $32 billion “Rich get richer, others looking for options” less-than-truckload (LTL) sector of the trucking industry can best be characterized as schizophrenic. It offers some of the best-performing companies in the entire trucking industry as well as a few underachievers that are saddled with challenging union contracts and desperately trying to compete with the best of the best.

First, the positives: Old Dominion Freight Line (ODFL), the nation’s fifth-largest LTL carrier, will exceed $2 billion in revenue for the first time in its history this year. Not only that, ODFL is extremely profitable. During the first quarter this year, traditionally the softest period for truckers, ODFL posted a 22 percent rise in operating income while performing at an industry-best 87.6 operating ratio.

David Congdon, ODFL’s president and CEO, chalks up his company’s profitability to a diversification strategy enacted 15 years ago. Recognizing that his once-sleepy Southeast regional LTL carrier had to offer more services to shippers, ODFL has transformed itself to a “multi-platform” carrier, now offering interregional, truckload, logistics services, and even ocean operations.

Another current success story is Saia Motor Freight Line, a carrier that exceeded $1 billion in revenue for the first time in company history last year. But it’s not just the top line that is growing with Saia. It posted the largest yield increase of any publicly held LTL carrier, and last year the carrier nearly tripled its net income to $32 million with a 94.7 operating ratio.

FedEx Freight, the LTL revenue leader with more than $5 billion last year, has revamped its network and posted the largest operating margin growth of any public carrier last year. Privately held gems such as New England Motor Freight (NEMF) succeed partially because of its high service levels as one of the few remaining family-owned carriers in the sector under the leadership of founder Myron “Mike” Shevell, chairman of the Shevell Group.

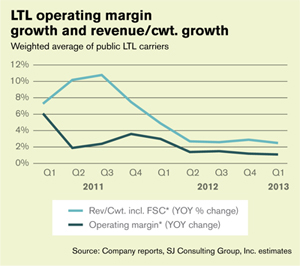

LTL yield growth (revenue per hundredweight, excluding fuel surcharges) and operating margin growth for the public LTL carriers has slowed. Yield growth rose just 2.5 percent in this year’s first quarter, causing year-over-year operating margin growth to grow by a scant 1.1 percent.

As an industry, the LTL sector is relatively flat. The $32 billion total revenue is roughly what the industry posted seven years ago, but that’s because some LTL freight is being siphoned off by truckload carriers at the heavy end and by parcel carriers being increasingly aggressively in the 70-pound to 500-pound range.

“The LTL industry as a whole hasn’t made progress,” said Satish Jindel, principal of SJ Consulting, which closely tracks the sector. “Despite of the recovery that they’ve had, they haven’t retained large amounts of LTL shipments handled by TL and parcel guys and fringe players.”

YRC Freight finally posted a tiny operating profit following six years of losses that exceeded $2.6 billion. ABF Freight System lost $13.4 million in the first quarter of this year.

Oddly enough, even though part of YRC Freight’s financial problems stemmed from two billion-dollar acquisitions of Roadway Express and USF Corp. back in the 1990s, the company recently disclosed that it has made overtures to ABF parent Arkansas Best Corp. on a merger possibility.

James P. “Jim” Hoffa, whose Teamsters union represents both carriers, is annoyed at the prospect of another difficult trucking merger. “We thought they had finally learned the lessons of past management catastrophes,” says Hoffa. “Unfortunately it appears they have not.”

Toronto-based Vitran Corp., which operates a sizeable network of regional LTL carriers in the U.S., is another troubled carrier. It recently replaced longtime CEO Richard Gaetz with interim CEO William Deluce, who recently admitted he was “very disappointed” in Vitran’s 102.7 operating ratio in the first quarter.

Vitran is not alone. David Ross, LTL analyst for Stifel Nicolaus, says overall operating conditions are just fair. Sluggish economic growth has translated into still-tepid LTL freight volumes, he says, and because volumes are only rising “modestly” few carriers are adding capacity. With that, says Ross, LTL pricing remains “fairly rational.”

According to Ross and carrier executives interviewed, overall top line growth will be flat in the LTL sector for some time, and rate increases will be in the 2-percent to 4-percent range. “Anything above 4 percent gets significant pushback from large national accounts who have options,” adds Ross.

Article Topics

Latest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources