State of Logistics 2013: Truckload

The $280 billion truckload (TL) sector is expecting the remainder of 2013 to be much like the past three years: moderate demand with no increases in fleet capacity and rate increases in the 2-percent to 4-percent range.

“It’s been spotty,” says Saul Gonzalez, president of Con-way Truckload, a $559 million unit of Con-way, who adds that most large TL carriers are reporting so-so domestic dry freight demand but increases in cross-border and intermodal traffic. “Our Canada and Mexico business continues to grow, and we’re seeing dedicated business providing lots of opportunity and growth potential.”

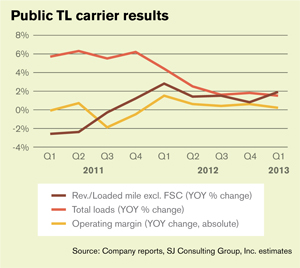

The numbers bear out that sentiment. Loads have been up slightly (between 1 percent and 2 percent) in five of the last six quarters. But TL margin growth has been minimal, less than 1 percent. The average operating margin for the public TL carriers was 5.7 percent in the first quarter, compared with a scant 1.8 percent for publicly held LTL carriers.

John Larkin, trucking analyst for Stifel Nicolaus, says a confluence of factors could cause the TL sector “to be right on the cusp” of a capacity shortfall. Larkin says that any of a number of factors could push up demand including pent up demand from the delayed arrival of spring, acceleration of the rate of new home construction, as well as the Hurricane Sandy rebuilding effort.

At the same time a number of factors could simultaneously push down supply, including lower productivity from new federally mandated safety rules, the driver recruiting and retention battle, and failure or downsizing of smaller, less financially stable carriers.

Even if GDP grows in the 1.5 percent to 2 percent range, these other factors have the potential to cause sharply higher rate increases in the TL sector. “In this case, we think that rate increases will then, once again, outstrip the rate of cost increases, especially for large, purchasing-advantaged TL carriers,” adds Larkin.

Richard Mikes, managing general partner of Transport Capital Partners, which closely tracks the TL sector, says that long-term, once the economy kicks in, he’s very optimistic for the TL industry. “It all depends on GDP growth, but it’s very difficult to forecast the year ahead,” Mikes said. “We’re absolutely very tight on capacity, and we’ve hardly added to the Class 8 fleet in five years. It’s not going to take much of a bump in GDP for rates to bump up.”

Among the factors is the government’s Compliance, Safety, Accountability (CSA) initiative that’s forecast to winnow as many as 150,000 of the nation’s three million long-haul drivers. In addition, pending changes to driver hours of service will reduce capacity and productivity between 1.5 percent to 4 percent decline, according to American Trucking Associations forecasts.

John White, executive vice president of sales and marketing for U.S. Xpress, the nation’s fifth-largest TL carrier, says “time will tell” exactly how much those regulatory changes will cost shippers. “We’re going to have to see,” White says. “There are some things we can do to offset the impact, but there’s going to be impact and some of it will be customer specific.”

Those shippers who give carriers operational flexibility and don’t demand specific time pickups and deliveries will see mitigated rate hikes. More challenging to TL carriers, adds White, will be those customers that demand pickup and devivery at specific hours.

Article Topics

Latest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources