Top 20 U.S. Ports: Competition heats up for discretionary cargo

At this time last year, West Coast port congestion was a speculative concern. Now that shippers have seen the worst case scenario unfold, many analysts feel that Gulf and East Coast ports are ready to pull in more vessel calls at peak season this year. Is a “battle royale” waiting for the bell?

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special Reports“I could’a been a contender.” The iconic statement made by longshoreman Terry Malloy in classic film On the Waterfront might resonate more with the port community than that of labor these days.

Disruptions by dockworkers on the U.S. West Coast at the end of last year added to the congestion woes of Los Angeles and Long Beach, thereby raising the profile of competing ocean cargo gateways like Miami and New York/New Jersey. Even the little upstart of New Orleans got into the action. Today, they’re all contenders, say industry experts, especially as the Panama Canal expansion finally nears.

According to John Morris, Americas services leader for the industrial real estate firm Cushman and Wakefield, containerized imports through Los Angeles and Long Beach were down 26 percent in January, but up sharply at Savannah and other East Coast ports.

“These migrations have be ongoing,” says Morris. “Many Fortune 500 shippers and carriers have been diverting cargo away from the West Coast to gateways in Canada and Mexico as well—but this does not come without greater costs in time and money.”

During the labor unrest, East Coast ports charged $1,000 “West Coast congestion” surcharges, on top of their already-higher price per container rates. “Of course not every shipper will be able to diversify,” says Morris. “For example, geography dictates which ports the agriculture industry uses to export its products. Small businesses, too, will be crimped by costs of diversification and many will simply choose not to make the investments.”

However, despite all the anger and frustration caused by the slowdown, the Ports of Los Angeles and Long Beach still represent the quickest and most cost-effective destinations for shippers to get goods from Asia to the U.S. Furthermore, as vessels continue to get larger—up to 20,000 twenty-foot equivalent unit (TEU) capacity—these two Southern California ports will be able to offer the deep-water and capacity not available anywhere else in North America.

But timing is everything, adds Morris. The sequencing of the Panama Canal expansion, which was already thought to be having some marginal impact on port choices for importers, coupled with the most recent Pacific Rim congestion factors, will likely have a cumulative effect on the future of container traffic.

“The net outcome of the dynamics over the last few years could not have worked out better for economic development in Panama and in the Gulf and Southeast regions of the U.S.,” says Morris. “And it could not have come at a better time for many of these vested groups.” Long-term damage on West Coast?

Analysts further note that while labor relations in the East are less than ideal, the last contract renewal was successfully completed without the extreme difficulties seen on the West Coast.

“Many feel that long-term damage to the reputation of West Coast ports has been done,” says Larry Gross, an analyst at freight transportation consultancy FTR. “The Northeast ports, which had seen severe congestion issues last winter, have taken a number of steps to improve operations and they are running more smoothly now. The Southeast ports have been running very efficiently, as have Gulf ports.”

Gross adds that cargo services that had been diverted from the U.S. West Coast to the East Coast may not be coming back. From a land transport perspective, the shift favors truck vs. intermodal, as the hauls off the East Coast are far shorter and less “intermodal friendly” than the long hauls from the West Coast to the Midwest.

“Most important for cargo interests to understand is that the congestion problems will not disappear now that the contract is settled,” says Gross. “There are deep-seated problems in the ports revolving around the peaking problems associated with the new mega-ships, chassis supply, and the turmoil associated with the new shipping alliances,” he adds.

Greg White, senior vice president of Ports America, agrees with Gross, noting that while carriers are working together to take advantage of economies of scale, they’re also competing for business. The quality of data being shared in the new carrier alliances may also need to be refined, says White, who notes that the “truthfulness” of key performance indicators designed to monitor, measure, and benchmark alliance performance is still regarded with suspicion.

“Vessel polarization prevents flexibility, and limits the levels of engagement,” White adds. “This creates problems for terminal operators who have already had to deal with the impact of labor disruptions.”

East Coast leaders

Dain Fedora, lead researcher for JLL Industrial and author of the firms Ports, Airports, and Global Infrastructure report, notes that the Port Authority of New York and New Jersey is expected to rank high again in its findings this year.

“Our analysis of seaport-centric industrial space takes into a account a variety of factors,” Fedora says. “We explore industrial property fundamentals in a 15-mile radius from seaports, given a minimum building size of 50,000 square feet. New York and New Jersey scores high here.”

Things look good here on the labor front as well. Port authorities note that 509 new dockworkers were certified and added to the labor registry since this time last year. Of that number, 472 are working and 238 of those workers are veterans.

“Although their training on heavy equipment and vessel gangs continues, they became immediately available as car drivers and baggage handlers,” says Richard Larrabee, port commerce director for the Port Authority of New York and New Jersey. “In addition, 49 new checkers also have been certified. Hiring and training to meet current demand as well as the demand for implementation of the Relief-Gang system will continue in 2015.”

Meanwhile, construction on the Bayonne Bridge “Raise the Roadway” project is more than 25 percent complete, and the Port Authority expects to remove the navigational clearance restriction in the summer of 2016. This will allow larger, cleaner, and more environmentally friendly post-Panamax ships to dock at its terminals.

The Maryland Port Administration also recently announced that 2014 was a record year for key targeted commodities at The Port of Baltimore’s public marine terminals. Memories of waterfront wildcat strikes staged two years ago by the International Longshoremen’s Association (ILA) have faded for most shippers, especially those who have benefitted most since those troubled days—exporters of roll/on-roll-off cargo.

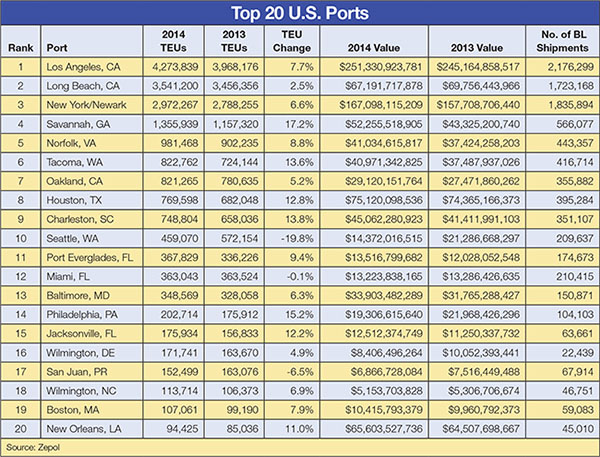

The American Association of Port Authorities (AAPA) ranks Baltimore first for handling autos, light trucks, farm and construction machinery, imported forest products, imported sugar, and imported aluminum. And overall, Baltimore is ranked ninth for the total dollar value of cargo and thirteenth for cargo tonnage for all U.S. ports.

Everything looked pretty rosy for the Virginia Port Authority (VPA) at the beginning of this year as well until a series of crippling storms hit Norfolk and Richmond. “The volume was lower than forecast because of vessel delays where 7,000 moves from February did not occur until the first days of March,” says John Reinhart, CEO and executive director of the VPA. “Furthermore, we had to halt eastbound export rail for work to clear up rail cargo at the terminals. Those delays resulted in volume and revenue reductions earlier in the year—much or which will be recaptured.”

Container growth at the South Carolina Ports Authority (SPCA) over the same span of time grew by 18 percent. Since the fiscal year began in July, the port’s TEU volume is 14.3 percent higher than the same period last fiscal year.

“Our import gains are reflective of a strengthening U.S. economy and population growth across the Southeast, while manufacturing in South Carolina and our region bolsters our export business,” says Jim Newsome, SCPA president and CEO. Fiscal year to date, SCPA has handled 700,630 boxes and plans to surpass the 1 million container mark by the end of the period.

Southeast gains momentum

The regional export leader, however, continues to be the Port of Savannah, which JLL analysts rank high in its forecast. “With consistent volume growth over the past decade, Savannah continues to lead the second tier of ports,” says Fedora. “Much of the cargo is bound for Atlanta, which from an industrial perspective, has had strong absorption gains during the first half of the year.”

The Port of Jacksonville, which previously occupied the second tier, now tops the third grouping, says JLL, noting that its annual TEU volume was flat and available blocks of industrial space have decreased.

In the meantime, all of Florida’s ports are making a concerted effort to take market share from the West Coast. In an unprecedented display of unity, the Florida Ports Council is aggressively promoting the advantages of all 15 of the state’s ocean cargo gateways, with Miami representing the “Jewel in the Crown.”

In a recent report, the council noted that $850 million of state investment over the past five years has gone into ports, and several ports are working on infrastructure improvements such as expanding terminals and deepening harbors.

For example, the Port of Miami is counting down to July for the completion of the “Deep Dredge” project that is deepening the main harbor channel from -42 feet to a depth of -50/-52 feet. Once finished, it will be the only major global logistics hub south of Virginia capable of handling bigger post-Panamax vessels.

James Hertwig, president and CEO of Florida East Coast Railway, says that its on-dock intermodal rail facility at port is the next step in the company’s ongoing efforts to promote multi-modal shipping and support global trade into and out of South Florida.

“To be competitive in this marketplace, we need three things,” Hertwig says. “First, is to serve a densely-populated region; second, is to have on-dock rail; and finally, it’s deep water. Next month, Miami will have all that it needs to compete with both the West Coast and the Southeast.”

Gulf options opening

Last year was a good one for the Port of New Orleans, and officials there are forecasting an even more robust cargo scenario in 2015. Earlier this year, shippers were provided with new direct weekly options to Europe from the port via CMA CGM, the world’s third largest contain line, and Maersk has reintroduced premium service to the Gulf gateway.

Gary LaGrange, the president and CEO of the Port of New Orleans, says that these types of additional services help to create momentum for terminal operators and customers. “The challenge now is to build upon these successes and continue to grow,” he says.

Total port-wide cargo, which includes midstream operations, export grain, and private tonnage within the port’s three-parish (county) jurisdiction also rose 28 percent to 31.05 million tons. New shippers, such as Chiquita, which returned to the port after a 40-year hiatus, and project cargo generated by the growing chemical industry, will bolster cargo figures in the future, says LaGrange.

Shippers are bullish on prospects here. “Chiquita plans to ship 30,000 to 39,000 TEUs of bananas and other fresh fruit into the Port of New Orleans, as well as 30,000 to 39,000 TEUs of various outbound cargos,” says Mario Pacheco, Chiquita’s senior vice president.

Container terminals at The Port of Houston were 40 percent busier last year, and for a great variety of reasons. “Our sharp increases in container volume are not just from East Asian services and diversion from the West Coast,” says Roger Guenther, the port’s executive director. “Those have been large, but all of our trade lanes, including the East Coast of South America, Europe, and he Mediterranean have seen substantial increases in export volumes.”

And the momentum continues to grow, says Guenther, adding that revenue for the first quarter of 2015 is up 24 percent over last year.

West Coast recovery

Exports have always been the good story for the Port of Oakland, the Pacific Rim’s leading outbound ocean cargo gateway. But like its neighbors in the Pacific Northwest and Southern California, the congestion crisis of 2014 badly damaged its reputation.

Signs that this might be improving surfaced in April when cargo volume increased 6.4 percent from a year ago—that’s a turnaround from a 31 percent decrease in the first part of the year. “We’re moving in the right direction again,” says John Driscoll, port maritime director. “But we still have plenty of work to do to make up for a slow start to the year.”

Exports were also constrained by vessels bypassing Oakland to recover time lost at congested Southern California ports. Those ships are now returning to Oakland, says Driscoll, providing additional capacity for overseas cargo.

Despite all of their troubles, Los Angeles and Long Beach remain strongly positioned for recovery, especially because they are working together at an unprecedented level.

In their first meeting under the formal discussion agreement recently approved by the Federal Maritime Commission, ranking staff of the two San Pedro Bay ports—the busiest seaport complex in the U.S.—agreed that the primary goal of the collaboration is to get cargo moving more efficiently.

“Our shared goal is to optimize the performance of the trans-Pacific supply chain,” says Jon Slangerup, Port of Long Beach CEO. “The San Pedro Bay has always been the fastest route between Asia and the U.S., and I’m confident that we’ll find ways to significantly increase the velocity of goods movement and overall efficiency of our end-to-end system, thereby reinforcing our gateway as the No. 1 choice for shipments to and from Asia.”

As part of the formal discussion agreement, the ports will discuss innovative approaches to improving the efficiency of marine terminal, trucking, rail and vessel operations. The ports also plan to discuss legislative advocacy, security enhancements, infrastructure, technology, and environmental improvements related to supply chain optimization.

Shippers will no doubt be keeping an eye on how the Ports of Tacoma and Seattle will work together this year as well. As partners, they form the third-largest container gateway in North America, representing a critical connection to Asia and Alaska.

Robust import volumes so far this spring have both ports forecasting a strong comeback from the woes of 2014, but even as they cooperate, a competitive force looms in Canada where Prince Rupert and Vancouver aggressively woo carrier calls.

It’s a fair fight, though, say industry analysts, who note that shippers may be getting more options than they planned for in the Pacific Northwest.

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources

Click for larger view

Click for larger view