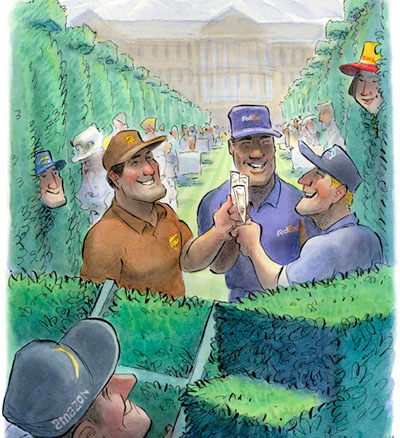

2018 Parcel Express Roundtable: Business Boom

Our experts offer their insight into what’s driving market trends and share practical advice for how logistics operations need to re-adjust to ever-shifting conditions—especially as business booms and new entrants loom.

When it comes to assessing the current state of the parcel express market, a working thesis could be: Change is always the air.

That’s apparent when looking along the lines of pricing variables from the parcel duopoly of FedEx and UPS as well as the ongoing influence e-commerce is having on overall logistics and supply chain management decisions regarding final-mile strategies—moves that are literally reshaping the logistics playbook for both new and long-established industry players.

In our annual effort to get shippers get up to speed on this dynamic and ever-changing market, we’re joined by Jerry Hempstead, president of Hempstead Consulting, a parcel advisory firm; David Ross, transportation and logistics director at investment firm Stifel; and Rob Martinez, president and CEO at Shipware, an audit and parcel consulting services company.

Over the next few pages, our experts offer their insight into what’s driving parcel market trends and share practical advice for how logistics operations now need to

re-adjust to market conditions and weigh all of their options.

Logistics Management (LM): How would you describe the current state of today’s parcel marketplace?

Rob Martinez: UPS and FedEx continue to dominate the parcel market despite high general rate increases, costlier dimension-based pricing and “peak” surcharges that left many residential shippers scrambling for alternatives during their busiest time of the year. Expect more of the same in 2018 as both national carriers continue to look for ways to alleviate peak season pressure and maximize margins.

This year will bring huge increases aimed at shippers who ship large/heavy packages, as well as non-conveyable packages that require additional handling. It remains to be seen to what degree Amazon will truly shift the marketplace, but shippers are certainly paying attention. And don’t forget, the USPS showed again in 2017 that they’re capable of handling huge peak season volumes, but it’s unclear what that means in terms of winning significant market share.

Jerry Hempstead: I’ll simply add that the parcel market is booming. Apart from the global players of FedEx, UPS, USPS and DHL, we see the rise of regional carriers like OnTrac, Lasership, and Dicom, and we can’t deny that Amazon is a logistics company that delivers packages—and, by the way, all of these firms are clicking right now.

Save for some hiccups during the Christmas season, service in 2017 was outstanding; and based on recent earnings reports, it’s good to be a parcel carrier. When you back out the pre-funding for retiree healthcare from the USPS numbers, even they have a good balance sheet. The bad news for shippers is that TNT is now gone from the landscape, and although they were not really present here in the U.S., they were a major global presence. And don’t forget, with TNT being acquired by FedEx, shippers have one less alternative in the marketplace.

David Ross: Indeed, at this moment, the market is extremely fast-paced, as online sales continue to be the growth leader in retail, and that forces shippers to think about the best last-mile solutions. Traditionally, those were either UPS or FedEx, but the USPS is playing a bigger role than ever, and other companies are looking at how they can get into the business.

LM: How would you describe the current rate and pricing environment for parcel shippers?

Hempstead: Because much of the small parcel spend is here in the U.S., and because we only have two real choices of firms with ubiquitous service and a complete service menu, most shippers are faced with increasing costs and more resistance to price discounting by UPS and FedEx.

This year will again see a sharp focus on yield improvement by the publicly traded firms, and almost every pricing variable is going to show increases in the next 12 months. With that in mind, shippers need to have a strong understanding of their parcel spend and those factors that drive costs, as just using the announced “average” increase by the carriers may not result in an accurate forecast for one’s budget.

Martinez: I’ll add that shippers need to be aware of rate increases, service guide changes, and how to navigate the ever-changing pricing environment. Again for 2018, as in past years, both UPS and FedEx announced a 4.9% average increase, and many accessorials took a large increase.

UPS shippers especially need to be paying attention, as a few surcharges such as additional handling for packages weighing more than 70 pounds and large package surcharge for residential deliveries will see a secondary increase on July 8, 2018, after seeing initial increases in December of 2017. After July 8, these surcharges will have seen increases of 75% and

29% respectively.

Even delivery area surcharges saw double-digit percentage increases. However, the largest increases in 2018 could be reserved for FedEx SmartPost shippers as FedEx will be begin applying a 139 dimensional weight (DIM) divisor to SmartPost shipments for the first time. Some SmartPost shippers could see increases on certain packages anywhere from 10% to north of 50%.

LM: Now that DIM divisors have switched to 139, what have been the biggest changes for shippers for better or for worse?

Ross: In the long run, we believe that it will be better for everyone. Shippers will be forced to optimize their product design and packaging, and anything that can’t be squeezed out should ultimately be passed onto the customer, because the product was underpriced when it had lower shipping costs. Carriers get to better match costs with revenues, so they’ll see the immediate benefit.

Martinez: Package efficiency is more important than ever. Shippers of small boxes need to take a close look at their package dimensions and weights and either make operational changes or aggressively negotiate an improved divisor with their carrier. SmartPost shippers need to play the closest attention since that service is now subject to dimensional pricing for the first time ever. Shippers are wise to consider alternative carriers including the U.S. Postal Service and regional parcel carriers that offer more shipper-friendly dimensional pricing policies.

Hempstead: David and Rob are both right on. I will add that the simple answer is “increased shipping cost.” Changes in the dimensional divisor are the largest single hit the shipping public has faced over the past few years. Some savvy shippers have been able to negotiate exceptions to the dim changes, but many of those firms have had diminishing divisors over time and the carriers are obviously trying to ween these shippers off the exceptions. My suspicion is that we are not done yet in seeing a reduction of the dim divisor.

LM: How are market conditions affecting service, and what role is an improving U.S. economy playing?

Hempstead: Every carrier has had to invest in terminals, drivers, hubs and vehicles, which bring reliable and predictable service in the minimum price of admission to the transport game. Overall, service throughout the year was extremely good and there were only a few major weather events that were disruptive in 2017.

The growth in the economy is raising all ships, and the carrier investments over the last few years have provided a platform in which package growth was easily absorbed into the networks and service was not negatively affected. Growth is being seen in both B2B and B2C, which is healthy. Keep in mind that increased delivery density is also helping the service numbers go up.

Ross: For sure, favorable market conditions—package volume growth—certainly challenge service levels, but the major carriers have all been investing heavily in their networks to maintain and improve service, and the numbers show it.

LM: What’s your take on Amazon’s impact today and into the future?

Martinez: Any way you look at it, Amazon is making an impact on the marketplace. As they continue to deliver their own packages and rely less on FedEx and UPS, market share will continued to shift. But it remains to be seen whether they will become a larger player in the future.

Ross: We’ve written extensively on this, but to sum it up, we believe Amazon will continue to do more in logistics, but we don’t believe that Amazon wants to be another FedEx or UPS—they don’t want to own the assets. However, we do think that they want to control the assets, and they will likely do that through a combination of strong relationships with carriers due to their volumes, increasing investments in technology, and the use of a multi-sourcing strategy that involves all major carriers, many minor carriers, its own airline and its own independent contractor delivery network.

Hempstead: Amazon is in the business of taking care of Amazon. They’ve built a tremendous infrastructure of fulfillment centers as well as logistics centers, and they’re using many methods and means to accomplish delivery. They have their own route drivers, some of which are contracted drivers; they use the regional carriers; they use the USPS for last-mile services; and they use UPS and DHL. Their primary interest is in fulfilling delivery to those consumers that use the Amazon portal for acquisition.

To this end, Amazon has been tightening the time from click to customer gratification. We’re even seeing Prime Now delivering within a few hours—for free. There has been a buzz that Amazon may offer delivery service to firms outside of their own fulfillment, but details on an offering are pure speculation at this point. Of greater interest is that CVS has announced delivery of prescriptions, and Target and Costco are also investing in delivery.

LM: How are carriers adjusting to the many new last-mile competitors?

Hempstead: The commercial carriers are keeping an eye on the regional last-mile players, but to date I have not observed any effort to thwart their invasion into their turf. The regionals attract business with pricing propositions that can save a shipper a lot of money—if the shipper can carve out portions of their business and divert it to a regional.

The primary tool the big carriers use is by revenue dependent discounting. If you carve out business to divert then your revenue goes down, therefore lowering the discount you receive on the business you do tender, and if managed right it can make the diversion economically untenable. For the big guys they just don’t want to play down to the pricing levels offered by the regionals.

Martinez: We’re in the early stages of new entrants into the market. Businesses are now very aware that efficient, last-mile deliveries result in cost savings, as well as reduced lost or stolen packages. Not only are businesses using their own employees for package delivery, but they’re also outsourcing to independent contractors. Remember that Walmart acquired Parcel and Target acquired Grand Junction for the launch of same-day delivery programs in 2017. Meanwhile, more small businesses are getting into the game and making their own last-mile deliveries.

Ross: The large carriers and the regionals continue to invest in their networks and improve service. New competitors are not even registering on the radar at this point, so there is little in the way of competitive response.

LM: How are carriers adjusting their services to stay ahead of these new players in last-mile?

Martinez: There’s no doubt that the major carriers have responded. FedEx has adjusted with the introduction of the “Ship&Get” locker, and the pick up and drop off for FedEx Express/FedEx Ground are Walgreens stores. UPS offers “UPS Access Point” lockers with pickup locations at local businesses, grocery stores, and UPS Store locations. Although not yet a major carrier, it’s worth noting that Amazon offers “Amazon Lockers” at multiple locations for customer pickup.

Hempstead: The integrators, for the most part, are taking a wait-and-see attitude regarding the regionals. The carriers always can price down to the offers being proposed by the regionals and prevent account attrition. But when the integrators lose business to a regional, it’s the integrators fault. They think they will lose money handling traffic at the prices offered by the regionals, but they make no money at all on business they lose. Everyone is doing so well right now that the integrators don’t need more low-priced business.

Ross: I’ll add that the big carriers have massive density advantages and strong service levels, so they’re making no real adjustments. However, they continue to invest in customer-facing technology to improve the user delivery/return experience.

LM: What advice do you have for parcel shippers in 2018?

Ross: Our advice is to know your product, make sure packaging is appropriate without much excess air, and get multiple bids on your freight to get the best price.

Hempstead: The greatest advice I can offer is to mine your data because it’s all about the details. The carriers offer all kinds of reporting to help you manage your business, but few shippers take advantage of what’s available.

One must also be aware that in the coming year, the size of your packages matters. In every case, dimensions must be weighed in the mode selection as does those larger transactions that are going to have a large package—oversize—surcharge. Look at your packaging and make sure you’re not paying to ship air inside a box.

Martinez: As Jerry just alluded to, data is king. Analyze, analyze, analyze. We consistently evaluate client programs and find nine out of 10 carrier programs aren’t optimized for rates. With that mind, shippers should do everything in their power to truly understand what their parcel cost

drivers are and then they should

act accordingly.

Shippers should always be evaluating their packaging to ensure that they’ve driven out as much DIM impact as possible, as this puts them in a much stronger negotiating position with the carriers. Negotiate where appropriate, but also look to diversify to any degree possible. Also, today, it’s essential to review invoices for rate validation. We see a lot of rating errors from both carriers. And in the meantime, e-commerce shippers should really be looking at alternatives such as USPS.

Article Topics

3PL News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates More 3PLLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources