2022 in Review: Who’s most responsive to change?

It has been a very volatile year, complicated by general political and economic instability around the globe. For logistics and supply chain professionals and carrier executives, it’s time to respond and build a coherent, cohesive, flexible and resilient strategy in the face of rapid and continuous change.

The “Year in Review” is a new feature for Logistics Management’s December issue. And while it’s certainly not a unique concept, we felt it was fitting to produce at this important time in history.

Indeed, 2022 has been a chaotic, topsy-turvy period that was quite unlike prior years. The pandemic had a deep and profound impact on most everyone, from carriers and shippers to the economy, government policies, and ultimately the consuming public. And while it’s just about gone, most feel it will loom in our rearview mirror for some time as the year when new patterns started to settle into the logistics landscape.

There were a few distinct changes in behavior stemming from the pandemic that are likely to remain with us: There was a major shift to e-commerce while people were housebound; there was a significant shift in work-a-day habits, with large numbers of people working from home; there were distinct and well-publicized problems in supply chains; and also fairly radical changes in transportation capacity at varying times—across all modes—that disrupted much of the supply chain.

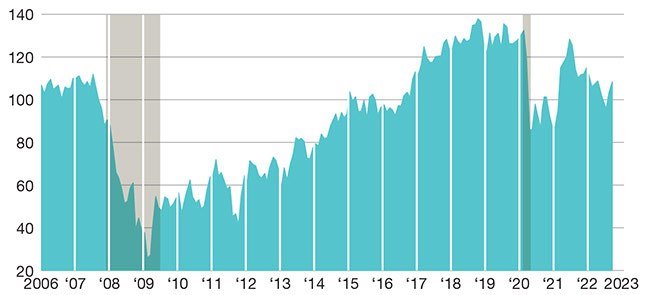

Consumer Confidence Index

Index 1985 = 100

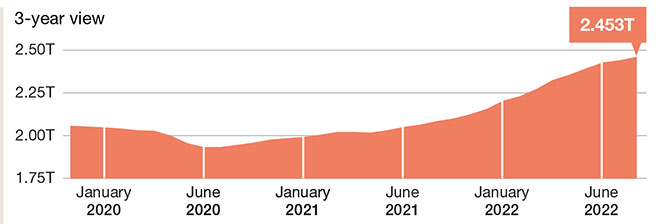

Inventory levels

3-year view

We also saw the difficulties and challenges of achieving virtually full employment, yet having hundreds of thousands of jobs unfilled. The search for talent is driving wages up and the cost of everything else—most notably fuel and the cost of transportation—spiked. This helped drive up the cost of most consumables, from standard lumber to groceries and energy, leading us into a period of rapid inflation we’ve not seen in decades.

On top of this, the change in administration in 2020 saw us commit to major investments in infrastructure, which has been sorely needed. The American Society of Civil Engineers (ASCE) gives an annual grade on how we’re doing. In 2022 it was a C- across all components, with roads receiving a D. There were a couple of bright spots, with ports receiving a B- and rail a B. This was a leap forward from five years ago, in 2017, when the overall grade was a D+, the same as it was in 2001.

Much of supply chain resilience hinges on our infrastructure capabilities, which have suffered from malnutrition for a very long time. While there has been much discussion—and effort—to make supply chains more resilient, we came to realize the various supply chains were far more brittle than we imagined or hoped—and those circumstances have not yet resolved themselves to an acceptable level.

Optimization is a word that gets thrown around with abandon in many instances. As professor Rob Leachman of the University of California, Berkeley, puts it: “The sum of local optimums is far from the global optimum.” While many organizations claim to have “optimized” their supply chain, it is typically a parochial view focused on the world they can see close-up, rather than true end-to-end performance and cost.

For example, ocean carriers may have optimized their efficiency with the mega-ships now plying the major trade lanes, but that has not had a positive effect on ports and inland transportation providers, such as draymen, chassis providers, third parties and railroads. End-to-end supply chain cost and performance remains difficult to truly optimize, so latent cost and service issues remain with us.

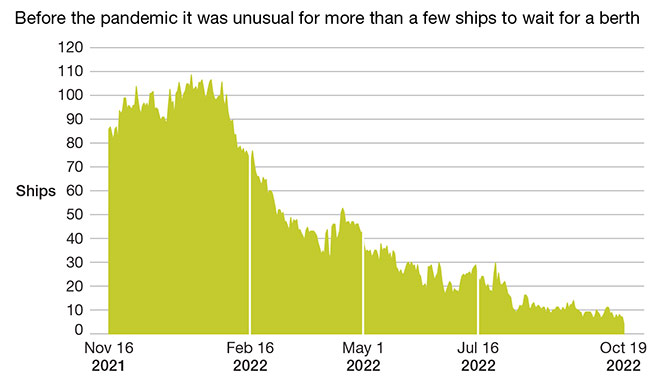

Daily backup of container ships waiting off the ports of Los Angeles and Long Beach

Before the pandemic it was unusual for more than a few ships to wait for a berth

Factors to consider from 2022

First things first: The consuming public’s behavior is a complicated beast, driven by a number of factors like inflation, interest rates, employment, wage rates, and consumer confidence. Much of what has been occurring in 2022—and what it portends for 2023—appears counterintuitive from reading the tea leaves just a year or two ago.

A few important notes:

- More stores opened than closed in 2022, with vacancy rates the lowest in 15 years.

- Loaded container imports rose 5% in the first eight months of 2022, compared to the same time in 2021. This is 34% above 2020 and 27% above 2019.

- Truck spot rates have fallen 24% since the February 2022 peak and contract rates have fallen 7% since the May 2022 peak.

- Inventories spiked during the pandemic and now companies find themselves awash in excess product.

- Peak season has largely disappeared as an annual rite of passage.

- Investment in Cloud technology ratcheted up from $145 billion in 2017 to about $397 billion in 2022, which is increasingly critical with remote working.

- IoT implementation slowed during 2020, but investment is expected to ramp up from the 8.2% rate in 2020 to greater than 11% for 2022 and beyond, as reported by Unleashed.

- Growth in third-party service providers is continuing, with expected CAGR of 7.1% through 2027, according to Allied Market Research.

There’s growing fear of a recession in the face of rising prices and inflation, which is making an impact on consumer confidence, although it remains relatively strong after the pandemic slide. Will it sustain reasonable strength in 2023 and beyond as we wrestle with an array of daunting factors, like energy costs, war and conflict in multiple places and how soon we can stem or reverse the rate of inflation?

Inventory management

Inventory growth has been on a tear since hitting a low point in mid-2020, as consumer demand ratcheted up through the pandemic. In fact, there’s currently much consternation about excess inventory in the pipeline, with many retailers having stocked up on items, only to see demand flagging as the pandemic has ebbed.

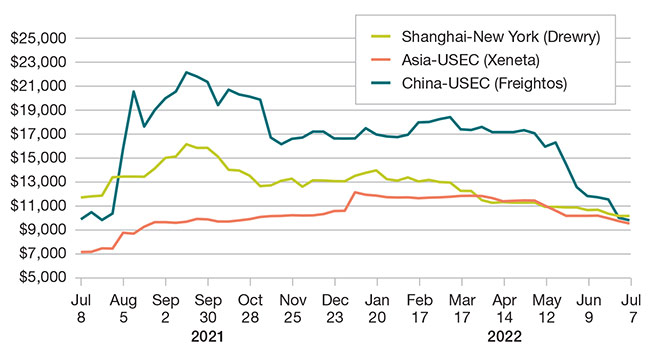

Asia-U.S. East Coast spot rates declining in 2022

Trans-Pacific eastbound, spot container freight rates, in USD per FEU

The surge to build inventories for hungry consumers led to a flood of import cargo and large-scale tie-ups, particularly at the West Coast ports, as the infrastructure strained to keep up. The glut of inventory is leading to a slow-down in buying, with the consequent drop in shipment volumes. The backlog of ships waiting for berth space at LA/Long Beach reached 109 vessels in January of this year before declining drastically.

The problem can’t be pinned on any single source. There were issues berthing ships because there were issues decongesting the ocean terminals as there was a shortage of haul-away draymen and rail capacity to move the boxes.

This was due in part because inland terminals, like Chicago, were congested because containers and chassis that were hauled to DCs had extended turn-times because DCs couldn’t unload fast enough. So, they were congested with cargo they couldn’t move because they couldn’t get enough road and rail capacity—and the domino effect continued.

Meanwhile consumers were thrashing around retail outlets in search of product and finding empty shelves. This dramatic surge in demand drove ocean rates to the highest levels ever and led to some retailers chartering their own ships to gain capacity to move their freight.

Imports

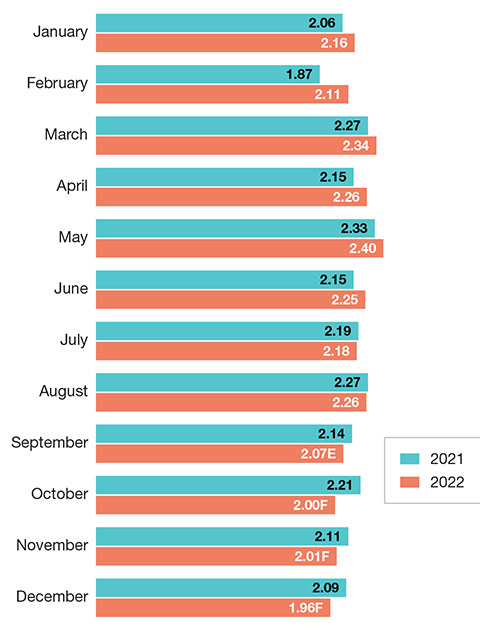

If you look at the dispersion of container imports, according to Port Tracker from the National Retail Federation (NRF) and Hackett Associates, the seasonal spikes you would expect to see just aren’t there.

Last year looks pretty much like this year, just a bit smaller. The Wall Street Journal recently reported: “Americans are spending instead on vacations and dining out and are more tightly holding on to their pocketbooks because of soaring inflation.”

Container imports in September were down 12.4% from August, an unusually sharp drop for peak season, according to research from Descartes Datamyne. Rail and trucking volumes are falling too, forcing freight operators to drop peak season surcharges and forecast lower earnings expectations.

Interestingly, NRF predicts that “imports are expected to fall to the lowest level in nearly two years, even as retail sales continue to grow.” This is in large part being driven by domestic retailers working feverishly to shrink excess on-hand inventory, along with fear of inflationary impact on spending.

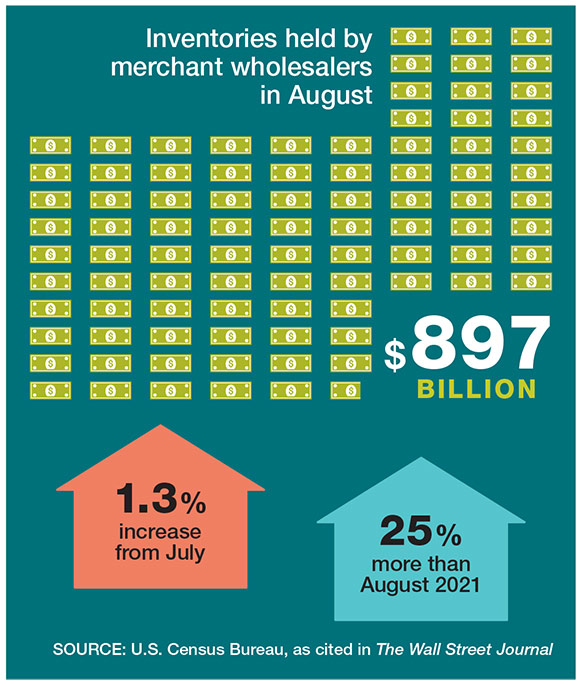

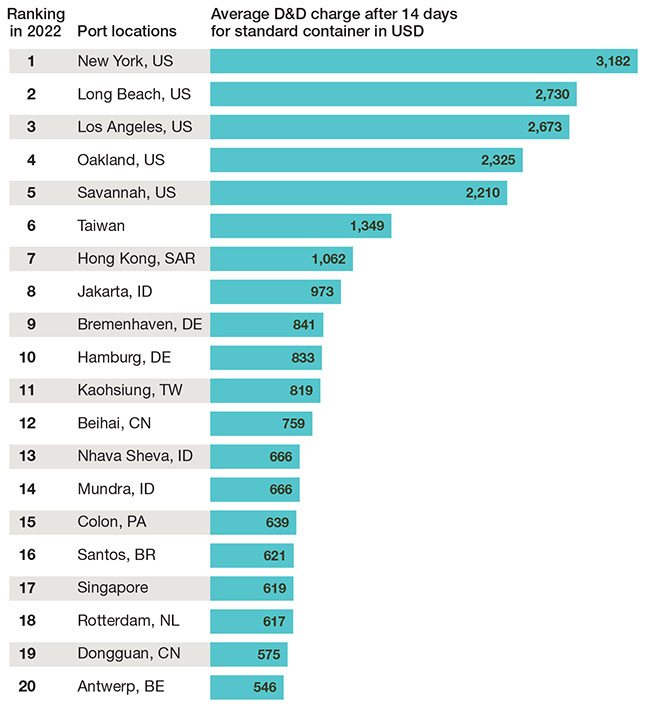

D&D

Another aggravating factor for beneficial cargo owners/importers is demurrage and detention (D&D), which is assessed on boxes left too long in the terminal (demurrage) or too long at the DC (detention).

In the past, this was generally an annoyance and minor percentage of the cost of goods sold. The COVID-related blast of business that accumulated in U.S. ports changed all that. These charges mushroomed significantly so that now five U.S. ports are seeing the highest in the world.

This is leading to a growing trend of behavior modification as shippers change the way they manage inland moves. Ocean carriers are reducing free-time and increasing D&D charges because they want and need the boxes returned rapidly for the next round of shipments.

At the same time, there have been a number of instances where vessels left Asia less than full. This was not because there was a dearth of freight, but rather because there was a shortage of available boxes to load, with so many stranded in the United States.

Monthly retails imports 2021-2022

TEU, millions - E = estimated F = forecast

Cross-docking from international containers into domestic cans—or trailers—can alleviate much of the problem. Another recent strategy is “dray-offing” cargo by taking boxes to drop lots outside the terminals where consignees can more readily pick them up, which is designed to incent and improve turn times.

Trucking

Trucking has had its own issues, from finding enough drivers, to matching capacity to demand, all with fuel costs reaching unprecedented levels. It’s no surprise that fuel has gone rogue, what with the calamitous events in Europe and the scramble to find replacement fuel sources.

Fuel cost is volatile under the best of circumstances, with daily market

fluctuations and the attempts by the key players—producers, wholesalers and retailers—to gauge what pricing should be. Despite all the political blathering on the matter, most of which is ignorant or il-informed, we’re playing in a global market, one which we can have some influence on, perhaps, but certainly can’t control.

Rates are another matter, with spot-market rates jumping around as shippers tried to ensure sufficient capacity to move new mountains of cargo. Contract pricing only takes you so far, and then you’re in the same barrel as everyone else, “dialing for diesels.”

The large influx of e-commerce has been driving a marked shift to parcel during the pandemic as B2C became much more prevalent. U.S. parcel volume grew 6% in 2021, reaching a record high of 21.5 billion, up from 20.3 billion in 2020, according to a Pitney Bowes survey. They forecast U.S. volume to reach 25 billion to 40 billion by 2027, with a 5% to 10% CAGR from 2022 to 2027.

There were 159 billion parcels shipped worldwide in 2021, according to Pitney Bowes. The figure more than tripled in the past seven years, with the U.S. remaining the largest by parcel spend ($188 billion of $491 billion globally). The world’s three biggest markets—China, the United States and Japan—accounted for 87% of global parcel volumes in 2021.

What does it all mean? The world keeps changing and the pace of change keeps quickening. The strong shift to parcel will likely abate somewhat, but is unlikely to return to normal, whatever that may be. Other factors putting pressure on parcel will be the “hidden” costs of reverse logistics related to on-line shoppers. There is also a bit of a shift back to brick-and-mortar buying for those who like the act of physical shopping.

Rail

The rail industry has generally fared well financially through the pandemic. Railroads have always excelled at cost cutting, harking back to the days of regulation. The new mantra of “precision scheduled railroading” is suffering from being neither very precise nor very scheduled, so perhaps we should just refer to it as “railroading.”

Management focus has been on the “cult of the OR,” where Wall Street has rewarded carriers for reducing their operating ratio—the ratio of expenses to revenue. During the volume lull brought on by the pandemic, railroads could reduce costs significantly by cutting jobs, closing yards, storing locomotives and cars, reducing train starts and consolidating freight into much larger trains.

All of this improved ORs significantly, earnings did well, and it didn’t hurt service appreciably, as volumes were lower and the networks remained fluid. Many, however, view it as trading long-term growth for short-term financial benefits. Operating ratios have been improving for years and are down 10.4 points since 2012.

This is small comfort to shippers, who have seen a rise in pricing at the same time service was suffering. The recent resurgence in demand, both intermodal and carload, has been outstripping the ability of the railroads to recover, particularly in the recall of furloughed operating employees and hiring of new ones.

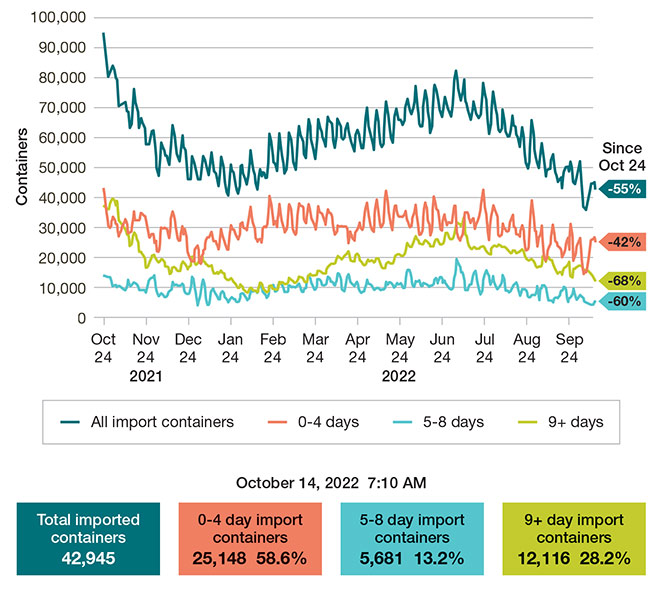

Import containers by dwell time

All Port of Los Angeles terminals

This same resurgence has impelled some carriers to begin reopening idled freight yards and adding back mainline track capacity, removed to cut costs. For the first time in recent memory, we’ve seen two of the western carriers embargo traffic at certain times to places like Chicago due to capacity constraints. While a good portion of difficulties were present beyond the end-points of the carriers, capacity and ability to serve remain problematic.

And keep in mind that there’s still the looming possibility of a strike. While most of the issues have been resolved—at least for now—there are still hold-outs, and a strike, even a short one, would have a significant impact on the economy at a particularly difficult time.

Fuel

Fuel cost is on everyone’s mind, due to spiking cost. According to the U.S. Energy Information Administration, U.S. diesel inventories fell to 25.9 days of supply for the week ending October 21, 2022. The tight inventory has led some market commentators and analysts to announce a diesel shortage in the United States, especially along the East Coast in Petroleum Area Defense District 1.

“While we do expect diesel inventories will remain tight for the East Coast through winter, we don’t expect there to be prolonged diesel supply outages or extended shortages at truck stops and fuel terminals at this time,” says Matt Muenster, chief economist at data provider Breakthrough Fuel. “We do, however, expect tight diesel inventories to lead to elevated prices and a continuation of volatility in the market.”

D&D charges globally

Shippers and carriers should continue analyzing the past 12 months and examine energy cost expectations as motivation to improve their transportation network strategy. “Opportunities exist to create or maintain a competitive advantage while navigating one of the most challenging energy markets in decades,” adds Muenster.

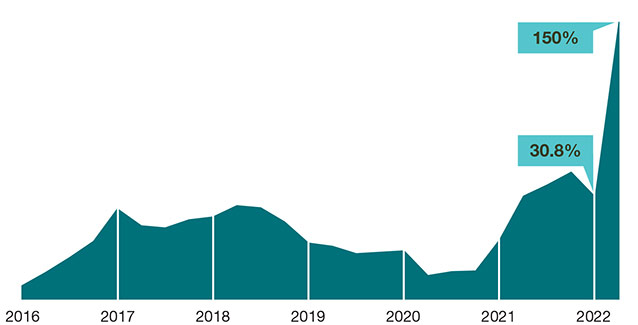

Diesel

Year-over-year change

Final analysis

In the final analysis, 2022 has been a very volatile year, complicated by the general political and economic instability around the globe. For both supply chain professionals and carrier executives, it’s very difficult to build a coherent, cohesive strategy in the face of rapid and continuous change.

In this age of “e-everything,” the transportation sector still lags behind in broadly adopting ways of seamlessly interchanging shipping and performance data in a timely, accurate and useable fashion. Blockchain was thought to be the solution, but has yet to become a dominate force, particularly in complex, multi-player international trade, where data formatting, quality, protocols, availability and accuracy vary widely. This needs to improve substantially before overall supply chain improvement can be achieved.

The best advice available: Maintain a timely and accurate pulse of the markets and take whatever steps possible to align with the shifts as far in advance as you can see them. This likely means evaluating mode shifts on a more dynamic basis and thinking “outside the box” in terms of altering operations to fit the new reality, with a continuing focus on improving service to customers. For some, this means investing in more current enabling technologies to add these capabilities.

Article Topics

Motor Freight News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates Preliminary March North America Class 8 net orders see declines National diesel average heads down for first time in three weeks, reports EIA Trucking industry balks at new Biden administration rule on electric trucks: ‘Entirely unachievable’ More Motor FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources