2022 Less Than Truckload Study: Trials and tribulations of rising rates

Faced with more moving parts than at any other time, the current state of the less-than-truckload market has carriers riding high, with shippers looking to lock in strong pricing and balance their network operations and priorities.

The last two years have been anything but normal, and when considering the state of the less-than-truckload (LTL) market that fact couldn’t be truer for shippers and carriers.

And while things appear to be improving on the pandemic front, a host of issues continue to linger over the LTL sector, including inflation, continued capacity issues and rising diesel prices. Now, that’s not to say that the LTL market is flailing—far from it.

In fact, on the carrier side, many are reporting record profits as the pricing power now comfortably rests in their hands. On the flip side, shippers are bearing the brunt of all of these challenges in order to efficiently and effectively serve customers while keeping a close eye on costs.

These are among the many takeaways in Logistics Management’s (LM) “First Annual LTL Study” which was recently conducted for LM by Peerless Research Group (PRG). Data for the study was based on feedback from more than 180 buyers of logistics and freight transportation services. Here’s what we found.

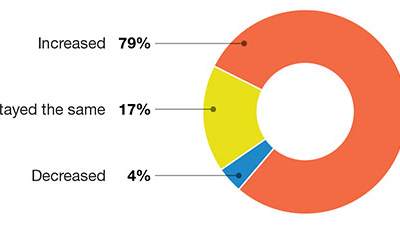

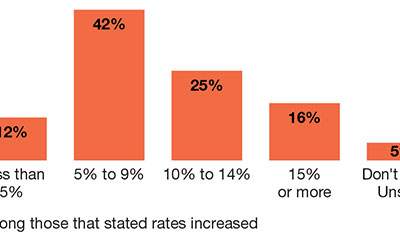

Yes, rates are going up

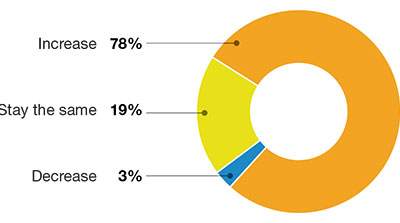

A key finding in the study focused on LTL contract rates, with 78% of respondents noting they expect rates to increase from 2022 to 2023, with 19% expecting them to stay the same, and a mere 3% expecting a decrease.

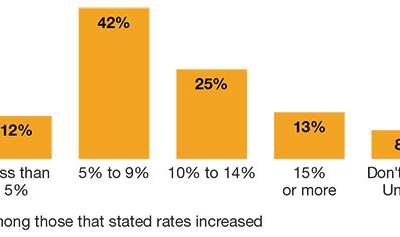

What’s more, nearly 40% of respondents expect double-digit increases, with 25% expecting a 10% to 14% increase and 13% expecting an increase of 15% or more. The largest group of respondents—at 42%—expect an increase in the 5% to 9% range, and 12% expect an increase of less than 5%, while 8% indicated that they did not know or were unsure.

Reasons cited for expected LTL rate gains were plentiful and understandable, including demand exceeding capacity; fuel increases and fuel surcharges; labor and the driver shortages; inflation; equipment and asset expenses; tightening capacity driven by e-commerce; supply chain backlogs and bottlenecks; rate increases implemented by large national LTL carriers that were followed with similar efforts by regional carriers; and increased overhead for LTL carriers.

Managing capacity

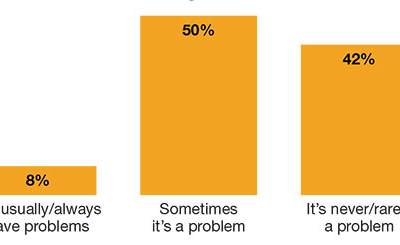

When it comes to securing LTL capacity, 50% of respondents said that it’s “sometimes a problem,” while 42% indicated that it’s “rarely or never a problem,” and 8% said they “usually or always have problems.”Managing capacity

The survey’s respondents laid out a number of factors relating to issues with securing capacity, including carrier availability; unauthorized accessorial charges; carriers missing same-day pickups and moving them to the next day; delays in expected delivery time and dates; driver and terminal labor shortages and delays; high levels of demand; and difficulties in finding carriers to support surge capacity, which requires looking at spot quotes.

As for best practices and initiatives related to securing LTL capacity, respondent feedback varied from the basic—including booking out as far as possible and better forecasting—to the more sophisticated, including a push for shippers to do things like implement core carrier programs; arranging needs earlier in the day; dropping trailers with multiple carriers; partnering with brokers as well as asset-based suppliers; and sharing lane forecast and demands with carrier partners.

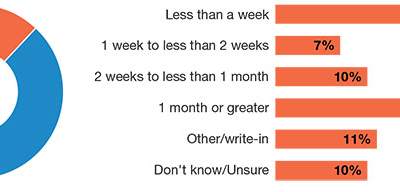

While many LTL shippers said they’re working with carriers on a contractual basis, LTL spot market activity is more active than many would presume, with 37% of respondents indicating they secure loads and capacity via the spot market. As to what degree, though, sees some variation, with 36% indicating it’s less than once a week, with another 26% noting that it’s once a month or more, and 10% saying it ranges from two weeks to less than one month.

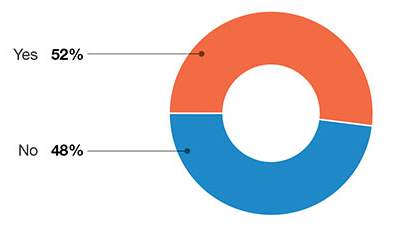

Carrier partnerships were also a focus of the study, with 58% of respondents saying that they have taken steps to partner with LTL carriers, with the remaining 42% indicating that they haven’t done so.

Benefits of these partnerships include things like better pricing, more visibility and more success in securing capacity. Other positive elements to partnering with carriers mentioned by respondents were reliable solutions when problems arise; better pickup times; better communications; a better understanding of the shippers’ needs; and smoother scheduling.

Market perspectives

LTL industry stakeholders offered up their respective analyses on the current state of the LTL market from their unique perspectives.

Mike Regan, co-founder and chief relationship officer at freight payment and audit firm TranzAct Technologies, explains that there are a few concurrent themes that underscore the realities of what’s happening in the LTL market.

Calling the current state of the market “the new normal,” Regan says that comes with the caveat that the pandemic did not trigger the situation. Instead, he claims the environment is based on the fact that LTL carriers are starting to understand the power of scarcity. The specific reason, he says, is that in an environment where scarcity, or tight capacity, is a reality, carriers have the luxury of telling shippers that they’re no longer going to absorb the costs of shipper customers’ inefficiencies.

Taking that a step further, Regan says that in a recent conversation with a CEO of a mid- to large-size carrier about being a shipper of choice, he explained how TranzAct conducts an internal carrier yield exam, which he says some, but not enough shippers participate in.

“He said how it’s always interesting that the shipper has time to give carriers a scorecard, but they don’t have the time for the carrier to give them their scorecard,” says Regan. “In an environment where you’re talking about transparency and mutual commitment, I thought that was

a telling sign.”

Looking at the economy as it relates to the LTL market, Dave Ross, executive vice president for Roadrunner Freight, a Downers Grove, Ill.-based national LTL services provider, observes that LTL’s sweet spot, the industrial economy, has held up stronger than the retail sectors, which is more reflective of truckload freight activity. What’s more, he says that even with some manufacturing softening as of late, it’s still likely to be stronger than retail, with lean inventories serving as a tailwind.

“The structural set up in LTL is better than truckload because there are just fewer players and they have more pricing discipline—and their costs are going up,” says Ross. “Labor, which is the single biggest cost component of LTL, is under significant pressure. That’s where most of the pricing is going for LTL carriers. Real estate and equipment are also getting more expensive, as is fuel.”

With nearly 40% of the study’s respondents expecting double-digit pricing gains in 2023, Ross says that includes some moving parts. While there are the usual factors, like capacity constraints, demand levels, and fuel, he adds that a key underlying factor circles back to demand continuing to eclipse supply, as well as strong demand and limits on supply for things like labor, equipment, and real estate.

And regarding efforts focusing on attaining LTL capacity, Ross cites efforts like investing in better tools and focusing on things like better communications with carriers as well as advanced planning.

“Some shippers say they attack it by having fewer carriers to rely on, while others say they need more carriers to rely on, and some use brokers and some don’t,” says Ross. “It shows that there’s more than one way to skin a cat. Benefits from a closer partnership with carriers showed that in this market—and in any market with these tight cycles. They should encourage better partnerships between shippers and carriers, but it has always been an antagonistic relationship because they feel it has to be a power struggle.”

Jason Seidl, managing director of industrials, airfreight and surface transportation at investment banking house Cowen, points out how LTL demand is much different than TL demand, in that LTL is positioned as more of a network-type business, which is less capacity-constrained by its tightest pinch point—whether that be trucks, assets, door space, yard space or dock workers.

“The LTL market is also really more of an oligopoly on the for-hire side, and it has gotten smaller this year with the bankruptcy of Central Freightways [CF],” says Seidl. “CF was around the 20th or 21st largest LTL carrier, but the LTL market on the for-hire side is small to begin with. In terms of available capacity, you could argue that it was less in 2021 than it was in 2020. CF’s business got quickly gobbled up in the marketplace

As for LTL pricing, Seidl says that prices should remain strong, at least in the near-term, given the strength in pricing at the present time.

“Even if we do get a downturn, I’m not expecting pricing to get negative,” Seidl adds. “I think the rate of increases would slow if we went into an economic downturn. But, I don’t think we’ll see a slowing in the rate of increase just yet—it’s too soon. One month of sluggish performance is not going to drive the carriers to reduce pricing.”

Article Topics

Photos News & Resources

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources 2023 LTL Study: Partner for reliability 2023 Logistics Salary Survey: Strong numbers, high demand 2023 Warehouse Equipment Survey: Tighter budgets prompt targeted spend 2022 Less Than Truckload Study: Trials and tribulations of rising rates 38th Annual Salary Survey: Salaries begin to rebound 2021 Warehouse/DC Equipment Survey: Preparing for post-pandemic volumes More PhotosLatest in Logistics

Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources