25th Annual Masters of Logistics

Indecision revolving around three complex supply chain elements—transportation, technology and organizational structure—finds many companies waiting to commit to a strategic path. However, waiting too long will only result in a competitive disadvantage that will be difficult to overcome in today’s fast-paced, global economy.

Latest Logistics News

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources Transportation Best Practices/Trends: Private fleet growth soars Cold Chain: Despite challenges, continues to evolve Freight Audit and Payment Update: Take what you need 2018 Ocean Cargo Roundtable: Unsettled seas More Transportation TrendsE-commerce. Remember when the discussion centered on how to correctly spell it? Today, the conversation among logistics and supply chain management professionals has matured and is now focused on how to best manage this growing phenomenon.

For many companies, the growth of e-commerce has drastically changed how they manage this distribution channel, and they’ve worked towards creating a unified and coherent omni-channel strategy.

And as many have learned, omni-channel is not just another distribution option to be added to the other independent networks managed by the company. It requires an integrated strategy to create and deliver value for all members of the supply chain—regardless of where the customer is shopping, what device they’re using, and how often they login/out of the system.

Register for the related Webcast!

E-commerce: Time for shippers to commit to a strategic direction

Date/Time

Thursday, September 22, 2016 2:00PM

Moderator

Michael Levans, Group Editorial Director, Supply Chain Group, Peerless Media LLC.

Panelists

Mary Collins Holcomb, Ph.D., University of Tennessee

Karl B. Mandrodt, Ph.D., Georgia College and State University

Tommy Barnes, President, Project 44

Double-digit growth in e-commerce is placing increased pressure on companies to develop efficient and effective supply chain solutions to manage this part of the business portfolio. Remember, this is not just an e-commerce issue.

Competitive pressure to reduce order fulfillment lead times is intensifying for all channels of distribution and for all members of the supply chain—from Tier 1 suppliers to retailers. In fact, the results of the “25th Annual Trends and Issues in Transportation and Logistics” indicate that efficiency has become even more important as financial performance is essentially flat year-over-year for a large percentage of this year’s respondents.

And as we’ve found over the years, flat financial performance drives firms to find ways to either make more sales or cut costs. Participants in this year’s study report that “cost to serve” is the biggest factor causing them to change the way they manage supply chain processes and activities. For small (annual revenues <$500 million) and medium-sized (annual revenues $500 million to $3 billion) companies, dealing with “demand uncertainty” has also produced alterations to the methods by which they manage their business.

These are only a few of the operating circumstances that have companies in a state of indecision as they figuratively wait at a crossroads of indecision. Which factor, or combination of factors, will make an impact on their supply chain processes and activities the most?

The results of the 2016 annual study suggest that three factors are at the forefront of the indecision: transportation, technology, and organizational structure. These significant forces are blurring the strategic direction they need to take to produce desired bottom line financial performance.

Make the commitment

Logistics, transportation and supply chain professionals are under considerable stress to continually reduce costs. With that said, it’s no surprise that reducing costs is still the primary objective, as reported by 36% of the study participants. In comparison, reducing costs surpassed increasing customer satisfaction by approximately 11 percentage points.

But, how do you get the needed service from your suppliers while at the same time you’re hammering them on costs? Unfortunately, as demonstrated by large retailers in the news recently, firms are taking a hard stance with their suppliers to meet contractual service levels. Using purchasing power may work in the short term, but that approach hampers the building of a collaborative network that could reduce costs and maximizes opportunities for both shippers and service providers.

While many supply chain professionals think that today’s shift to a new digital market is dramatic, it’s not as pronounced as the move to a deregulated market in the 1980s. Lessons learned from deregulation and other disruptors since that time emphasize the point that, if anything, now should be the moment for carriers and shippers to improve their working relationship.

Indeed, business is undergoing dramatic change. The average corporate life span in 1958 was 61 years. In 2011 it was just 18 years. At the present rate, 75% of the S&P 500 will be gone by 2027. As Ray Kroc was fond of saying: “None of us is as good as all of us.” Survival will require carriers and shippers to work together as an omni-channel market driven by empowered consumers

Perhaps a reminder from the past would be helpful. The regulated environment that carriers operated under prior to 1980 resulted in transportation services that were considered to be neither effective nor efficient—but it didn’t need to be. After deregulation, rates plummeted as carriers were permitted to compete with each other to meet the needs of shippers at prices they determined. However, many carriers did not survive the transition to a new deregulated market.

Subtle shift in transportation spending

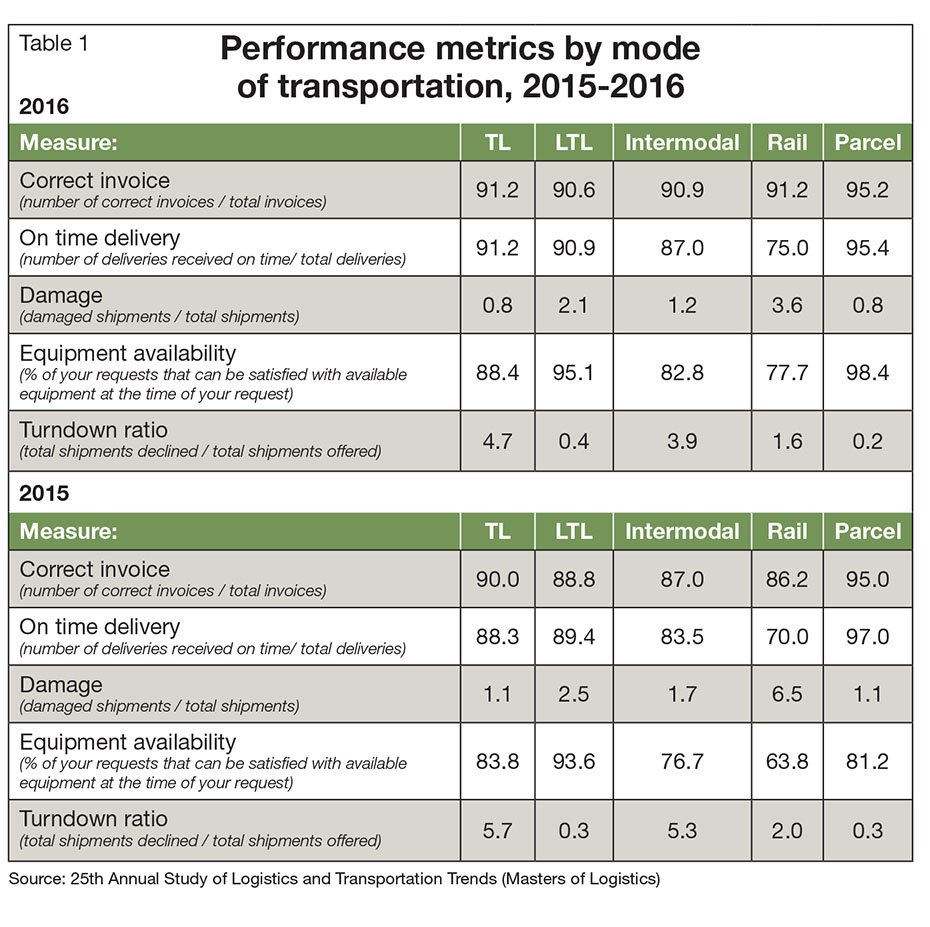

Awarding winning author Kate Vitasek is fond of talking about watermelon scorecards—green scores, but red faces. Although everyone performed well, no one is satisfied. The same could be said of transportation service performance scores for 2016.

Overall, service levels for all modes improved compared to 2015, except for parcel on time deliveries. While improvements in service were posted this year compared to 2015, none were higher than performance levels observed over the past five years.

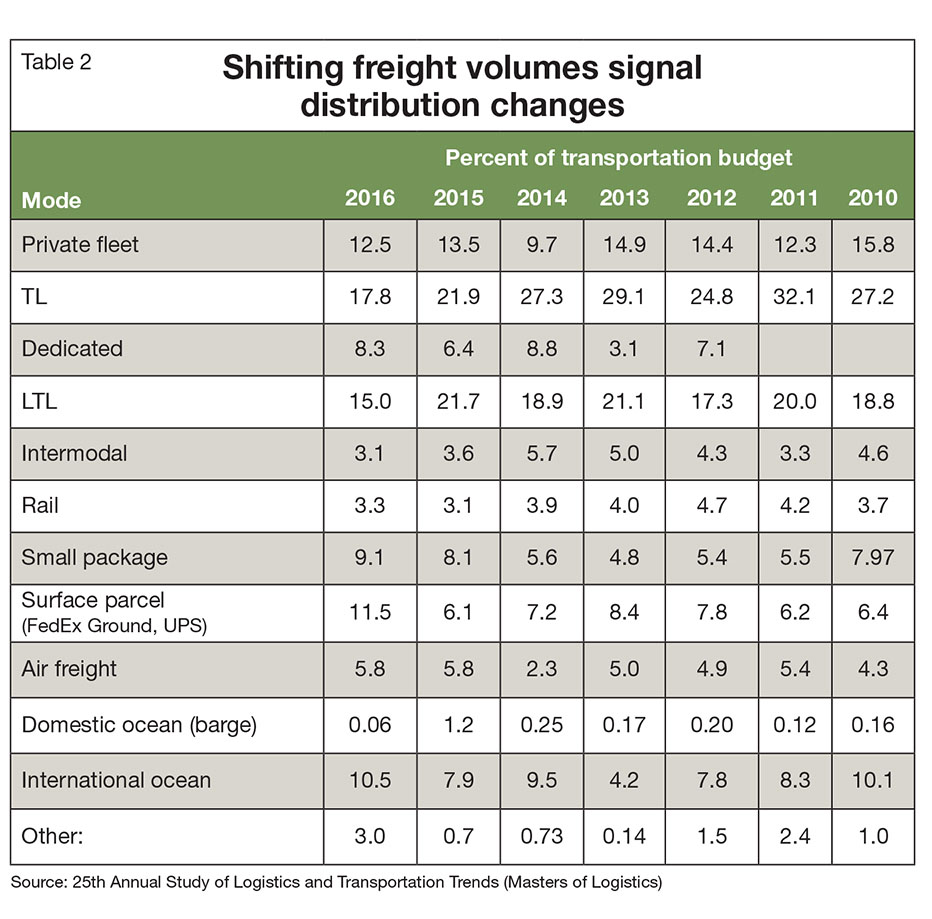

While performance for most modes is statistically flat when compared to the previous year, the same cannot be said for how managers are spending their transportation budgets. For the first time in this study, surface parcel and small package account for just over 20% of spend.

Both truckload (TL) and less-than-truckload (LTL) reported their lowest percent of spend in the past six years, with TL dipping below 20% for the first time. In 2016, freight moving by LTL represented 15% of transportation spend as compared to 22% in 2015.

Some may look at the numbers and suggest that the change from TL to parcel will solve the driver shortage. Not so fast. This assumes that an over-the-road driver is also the right person to deliver to your customer’s home.

25th Annual Study of Logistics and Transportation Trends: By the numbers

More than 380 domestic and global logistics, transportation, and supply chain professionals participated in this year’s study, offering insights on trends and issues relevant to today’s busy managers. Participants accounted for an estimated $14.33 billion in domestic transportation expenditures.

Large companies with annual revenue of more than $3 billion represented 17.3% of the study participants. Medium sized firms, with between $500 million and $3 billion in annual revenue were 16.2% of respondents. The majority of respondents (66.5%) were smaller firms with reported annual revenue less than $500 million.

Respondent companies represent a broad and diverse set of 15 industry sectors ranging from pharmaceuticals to food. Since the beginning of the study, the core group of participants has been in the manufacturing sector—this year they made up 34.9% of the total.

General manufacturing companies represent the largest sub-sector of that group at 9.7% followed by industrial at 8.1%. Over the past several years, we’ve strived to increase the participation of transportation providers in the study in order to more fully understand this perspective. This year that sector comprised 20.9% of all participants, which enabled us to do some comparative group analysis.

Trucking executives have long explained that just because a driver is good at inbound freight doesn’t mean that driver will be good on the outbound side. And, when additional value-added services like assembly or installation becomes part of the mix, it has been speculated that the driver shortage will become even more intense and problematic.

An emblematic pothole at the crossroads

Facing new challenges in a changing, dynamic business environment is not a new circumstance for logistics, transportation and supply chain professionals. What makes it different this time? In part, there’s been an explosion of technology and technology firms, and that’s making it difficult to determine the right approach or partner to choose.

Who will survive? Just as there were many automotive choices at the turn of the 20th century, not all survived. What technology do you pick? Will your technology become a Studebaker? A Stutz? A Kaiser-Frazer? A Packard? Or maybe just a plain black Ford. Unfortunately, unlike these automobiles, a failed technology has no future value.

Despite dramatic advances in technology, companies are still sharing data with key suppliers and customers using EDI—which was developed during the Berlin Airlift. In addition, companies have invested in best-of-breed software that’s installed on premise or a solution that’s a module that’s “plugged” into their ERP. The encouraging news is that hosted and cloud solutions are increasing, and manual methods are declining.

This move to more flexible, easy to implement changes to data inputs/outputs is absolutely necessary to support an integrated supply chain strategy. Yet, supply chains can only move as fast as the data feeds—like EDI—allow.

“There is a lot of tactical, detailed information that accompanies each and every shipment,” notes Tommy Barnes, president of project44, a supporter of this year’s survey. “It may look as simple as having a driver pick up something, dropping it off and the driver leaves. The granular reality is much more complex—and solving that complexity is what will separate the winners and losers in this digital economy.”

Waiting at the crossroads

The findings from the “25th Annual Trends and Issues in Transportation and Logistics” suggest that three complex, interrelated supply chain elements—transportation, technology, and organizational structure—are major contributors to the indecision of committing to a direction. However, waiting too long at the crossroads will only result in a competitive disadvantage that will be difficult to overcome in a global economy.

Symbolically, a crossroads signifies dealing with choice and the consequence of making a decision about future direction. What often gets overlooked in the angst of making the “right” decision regarding direction is the perspective of being at a point of potential. In this case, the potential of gaining competitive advantage from being a “first mover” or “early adopter” should be considered. This entails doing your homework, looking at the signals in the market, and setting a path that supports the firm’s strategy and objectives.

In the earlier years of the study, statistical analysis revealed that certain companies were able to utilize their considerable size (as measured by annual sales revenues) to create a competitive advantage over lesser-sized companies. Coined the “Masters of Logistics,” companies with annual revenues of >$3 billion used these deep financial pockets to acquire technology—including supply chain related software—that was largely unavailable to other companies due to the enormous financial investment that was required.

The Masters of Logistics were also at the forefront of leveraging their considerable transportation volumes to gain significant improvements in efficiency and effectiveness. Recognizing the strategic importance of logistics and transportation activities on firm performance, the Masters elevated these areas to prominence in their organizations as indicated by titles such as vice president or senior director of logistics.

The insights that were gleaned from the Masters over the years of conducting our study revealed best practices in logistics and transportation that consistently resulted in increased efficiency and effectiveness. Fortunately, time and innovation has a way of leveling the playing field, even in business.

Over the past few years, supply chain software hosted via cloud technology, a phenomenal growth in e-commerce, and evolving organizational structures to manage transportation as a value-added activity have made it possible for any size company to create an advantage over their competitors—that is, if they act.

The 2016 study showed that the Masters of Logistics reported “better” to “much better” profitability than their competitors over the past year. Three factors that contributed to creating their competitive advantage years ago are still the same three factors that exist today. We believe that these factors provide critical insights for companies that are waiting at the crossroads and looking for a path forward.

- Technology must enable an integrated supply chain strategy. The Masters have learned how to deal with demand uncertainty better than other size firms. Developing this capability is difficult, as it requires timeliness of data that’s only possible through end-to-end supply chain visibility.

The foundation is supply chain technology that supports both of these conditions. Future competitive advantage will belong to those companies that move from static reports with stale information to real-time, granular data with prescriptive analytics that enables them to determine the best course of action.

Without this technological capability, companies will continue to manage discrete networks for their distribution channels rather than the ideal integrated network that supports a unified supply chain strategy. The 2016 study results indicate that the Masters are making more progress in developing the technological infrastructure to create this ability as “demand uncertainty” dropped out of the top five factors driving managerial changes for this group while it remained as the second biggest challenge for other sized companies.

- Transportation should be a shared strategic activity and responsibility. The challenges facing carriers and shippers today require the collective efforts of internal and external functional areas to achieve the desired results. The procurement of transportation services necessitates the expertise of both domains. According to the 2016 results, the Masters of Logistics are investing in building internal partnerships to co-manage this key strategic activity and are including their strategic carriers in this process to ensure that short-term savings do not derail long-term strategic goals.

Supply chain must be part of the C-suite. While there has been a noticeable increase in the percentage of companies that have a chief supply chain officer (CSCO) as part of their key leadership team, a majority of companies don’t have a person with this title. Our analysis showed that the Masters, however, have statistically significant more CSCOs than either medium- or small-sized companies. Crafting an integrated supply chain strategy that leads to better firm performance necessitates that this area have a seat at the C-suite table and access to the board of directors.

The macro- and micro-level issues facing companies today are neither simple nor straightforward. It has been seven years after one of the worst global recessions since World War II, and uncertainty still surrounds global and domestic economies. The direction to take is not as uncertain as many believe; so, our suggestion is to stop waiting at the crossroads. The Masters are already navigating the path ahead. Now is the time to commit to a direction to join them.

Article Topics

Transportation Trends News & Resources

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources Transportation Best Practices/Trends: Private fleet growth soars Cold Chain: Despite challenges, continues to evolve Freight Audit and Payment Update: Take what you need 2018 Ocean Cargo Roundtable: Unsettled seas Trucking Regulations: Washington U-Turns; States put hammer down Transportation Trends and Best Practices: The Battle for the Last Mile More Transportation TrendsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources