Air Cargo: Volatility lingers

Even with a strong recovery in revenue, the IATA maintains that air cargo did not meet its full growth potential last year. In the meantime, tight capacity, labor shortages, infrastructure shortfalls—and now the Russian invasion of Ukraine—continue to cloud the forecast in this vital sector.

Beginning with the pandemic, air cargo has been experiencing a wrath of fundamental pressures: record high rates, tight capacity, mounting congestion at key gateways, and ever-present labor issues. However, the Russian invasion of Ukraine now takes the industry into unprecedented territory.

Prior to the invasion, indicators pointed to prevailing optimism, with tight capacity conditions loosening. Executives believed that this year, particularly in the second half, passengers would return to air travel, which would mean additional passenger (PAX) flights.

Given that 50% of all air cargo is flown on PAX flights, capacity would become available for additional belly freight. The air cargo market has been operating at a 10% capacity deficit because of reduced passenger flights due to COVID, and more capacity would, technically, lower rates.

“Now the return of passengers is still a big question mark,” says Niall van de Wouw, managing director of CLIVE Data Services. “Airfreight market conditions feel insignificant when you see what’s happening in Ukraine since Russia’s invasion.”

The war in Ukraine presents another big question mark, particularly for Europe-Asia trade flows. “It’s difficult to overestimate what this could mean down the line,” says Wouw. “War in Europe and its resulting sanctions could turn the industry upside down once again, just at the time when the pandemic impact was looking more under control.”

Rates, capacity pressure

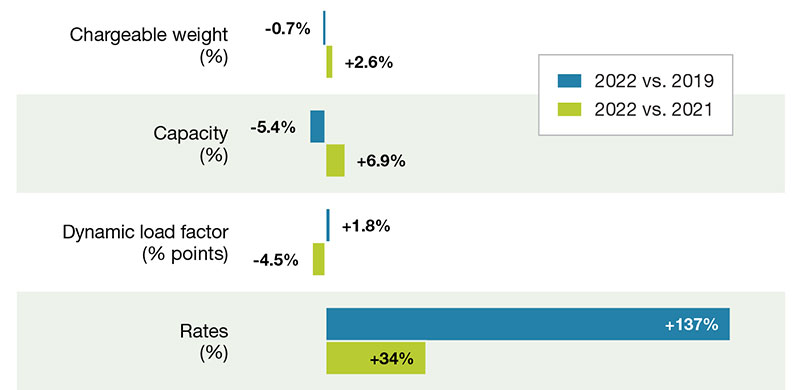

Rates and capacity issues remain a big concern. CLIVE Data Services found that in February freight volumes, capacity and load factors stabilized close to 2019’s performance, with rates also slowly trending downwards. Chargeable weight in February was at -0.7% to the pre-COVID level in 2019, and +2.6% compared to February 2021, with capacity in the market standing at -5.4% and +6.9% to the respective 2019 and 2021 figures.

Market eased close to pre-pandemic levels in February 2022

February 2022 global air cargo volumes, capacity load factor and rates developments (weeks 5-8 of 2022 compared to same weeks in 2021 and 2019)

Source: CLIVE Data Services, now part of Xeneta

During the height of the peak season in November-December when average airfreight rates increased by as much as 168%, CLIVE data found that rates eased with quieter market conditions in January and slowly wound down in February to +137% versus 2019. Nevertheless, Dorothea von Boxberg, CEO of Lufthansa Cargo, surmised: “The issue of scarce capacity will continue to occupy us and our customers this year.”

Aviation industry intelligence firm IBA predicts that demand for trans-Atlantic flights could recover to 2019 levels this year—a particularly positive development for the carriers that operate on that route. Air Canada has announced an expanded Summer 2022 international schedule with 34 routes relaunching across the Atlantic and Pacific. Its cargo arm has increased handling capacity at its Frankfurt hub by 35% in preparation for the start of service to the airport by Boeing 767-300ER freighters later this year.

IAG Cargo now offers more than 250 weekly services utilizing wide-body aircraft to most destinations in Latin America that it operated pre-pandemic, while American Airlines Cargo (AA Cargo) is also moving ahead with growth plans. “We’ve recently added some of the new routes we’ve been talking about for some time,” said Roger Samways, vice president,

commercial for AA Cargo.

However, major concerns now loom overhead. European carriers prohibited from flying over Russian airspace now must lengthen their flight routes when flying to and from East Asia. This places them at a competitive disadvantage to Chinese airlines to whom Russian airspace is still open, says IBA.

For example, Lufthansa Cargo must fly an extra 1.5 hours to 2.5 hours on a southerly route, which causes it to lose 10% in shipping capacity because the extra distance requires aircraft to carry more fuel. “It’s a route where capacity is already tight,” says Boxberg, who adds that the extra fuel displaces about 10% of Lufthansa’s available freight capacity that can be carried within the maximum allowable takeoff weight.

IBA analysts expect the Middle East “super connector” airlines Emirates, Qatar Airways, Etihad and Turkish Airlines to benefit since their flight paths more easily avoid Russian airspace.

However, carriers operating from North America won’t feel much of an impact. IBA analysts expect North American air operators to recover quicker and reach or approach pre-pandemic levels in 2022. Capacity at Delta and United Airlines is predicted to reach 90% and 105% respectively, it said. But airlines in the Asia Pacific region will recover slower than the industry average. Qantas Group’s capacity is expected to reach 45% of 2019 levels in 2022. Singapore Airlines was at 43% in December 2021.

But many industry stakeholders will feel the impact of the tragic situation in Ukraine. “At this point in time, we forecast that this will delay the industry’s recovery from the pandemic by at least two months,” says Phil Seymour, president of IBA.

New year, same story…

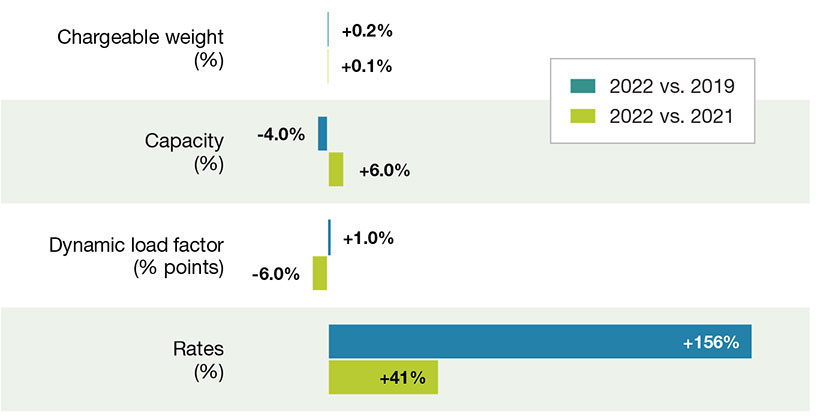

January 2022 global air cargo volumes, capacity load factor and rates developments (weeks 1-4 of 2022 compared to same weeks in 2021 and 2019)

Air cargo continues digital journey

The air cargo industry has long been criticized for its lack of customer-centric services and slowness to adapt digital integration. Pressures caused by COVID-19 changed that.

AACargo, for one, has plans on the near horizon to make services more accessible in an array of different ways.

“We want our customers to find us wherever they’re looking,” says Roger Samways, vice president commercial, at AA Cargo. “Overall, we’re focused on moving in the direction of real-time data, seamless connectivity, and transparency in pricing and capacity that makes it easier for customers to do business with us and keep our teams equipped and ready to adapt to changing customers’ needs.”

Jannie Davel, managing director, commercial, at Delta Cargo, notes that digitalization will be a key component within the technology evolution process. Already, Delta’s e-Freight program offers customers the opportunity to submit air waybill information electronically.

Lufthansa Cargo, one of the early adopters of digitalization, went completely paperless on March 27, 2022, with e-air waybills. In addition, it introduced a “paper-to-eAWB” service, through which the few remaining paper-based AWBs are digitized at shipment acceptance then accompany shipments as an eAWB.

Financial growth

Positive earnings continued in 2021 due to market conditions caused by high demand and tight capacity.

Lufthansa Cargo almost doubled its adjusted EBIT year-on-year to €1.5 billion—the best result in its history. Its revenues topped €3.80 billion over €2.76 billion in fiscal year 2020. The average load factor improved by 1.7 percentage points year-on-year to 7%, while the supply of capacity increased by 8.7% to 10.1 billion freight ton kilometers offered.

IAG Cargo reported record financial results with annual revenues of €1,673 million for 2021 for an increase of 30% versus 2020. It also reported fourth quarter revenue of €499 million, an increase of 25.7%over 2020.

Good revenues are also allowing carriers to expand fleets and further product offerings. Qatar Airways has ordered 34 of Boeing’s new 777-8 Freighters—the largest, longest-range and most capable twin-engine freighter in the industry. It has options for 16 more.

With payload capacity nearly identical to the 747-400 Freighter and a 25% improvement in fuel efficiency, emissions and operating costs, the 777-8 Freighter is a more sustainable and profitable aircraft for carriers to operate.

AACargo is positioned to take delivery of more Boeing 787 aircraft over the next few years, a move that will help support further capacity growth across its network. “This year, we’ve already planned for nearly all our widebody fleet to be dedicated to long-haul international routes which is ideal for our cargo business and the strong international demand in the market,” says Samways.

Last year, Lufthansa Cargo completed its fleet modernization program. The fleet is now comprised of 15 Boeing 777F aircraft, two of which were newly flown last year. The twin-engine B777F is considered the most efficient, modern freighter in its class.

To address the need for capacity for cross-border e-commerce, Lufthansa Cargo is also adding converted A321 medium-haul freighters to its fleet and announced plans to lease the two short-haul aircraft in July 2021 for freight operations within Europe.

“With the added medium-haul freighters, we’re opening up a whole new strategic business segment,” says Ashwin Bhat, chief commercial officer at Lufthansa Cargo. “In the future, the A321F will offer attractive, same-day and e-commerce solutions within Europe and to selected medium-haul destinations. The new network represents a major step towards the fast-growing e-commerce segment.”

Lingering issues

Still, the International Air Transport Association (IATA) maintains that air cargo did not meet its full growth potential last year. The reason: Insufficient capacity and the fact some available capacity was located in the wrong place. Other factors include congestion at some key airports, labor shortages, and quarantined crews.

Cargo congestion particularly escalated at major U.S. airports such as Chicago (ORD), Los Angeles (LAX), Atlanta (ATL), and New York (JFK) where illness due to the pandemic resulted in staffing shortages and long processing times. Warehousing space was, and remains, tight.

Some flights were rerouted or shifted to secondary airports such as Chicago-Rockford International Airport (RFD), which ended 2021 with a record-breaking 25% growth in cargo and over 3.4 billion pounds of landed weight compared to

2.7 billion pounds in 2020. Driving that growth was the sheer increase in cargo flights and new international cargo operators serving RFD.

Jannie Davel, managing director, commercial at Delta Cargo, earmarked two other issues that continued to linger over the industry into 2022. One is manpower, or the ability to find the right people for the appropriate roles, and second is infrastructure, including warehouse space for improved last-mile delivery.

“Cargo is a niche and ever-evolving industry, so finding qualified people to fill some of the unique and diverse roles can be challenging,” says Davel. “Having access to adequate and consistent equipment throughout the supply chain to allow effective cargo flow to final delivery will continue to be a significant issue that the industry faces throughout the rest of 2022.”

Davel contends that both issues are important because the industry is truly an end-to-end and cyclical process. “If not maintained resourcefully, issues such as congestion can snowball very quickly,” he adds. •

Article Topics

Air Freight News & Resources

2024 Air Cargo Update: Cleared for take off Supply Chain Currents Part I: Is there a different way to move freight more effectively? Global 3PL market revenues fall in 2023, with future growth on the horizon, Armstrong report notes UPS fourth quarter earnings see more declines GRI Impact Analysis: Getting a Handle on Parcel Costs Averitt’s ‘State of the Supply Chain Survey’ presents an optimistic tone for 2024 2024 Transportation Rate Outlook: More of the same? More Air FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources