Cold Chain 2020: Connect, Communicate, Collaborate

Now more than ever, the international cold chain community feels a need to come together to evaluate the lessons learned from the pandemic. At the same time, stakeholders are rethinking industry fundamentals and examining the role digitalization, automation and other technology innovations will play in the future.

The growth rate of e-commerce and direct-to-consumer delivery of chilled and frozen products was judged to be rapidly expanding even before the onset of the pandemic—but now the trend is downright explosive.

A recently published survey conducted by The Global Cold Chain Alliance (GCCA) finds that even stronger demand for data and predictive analytics is expected in the future, and respondents are optimistic that the growth rate of the industry as a whole will be even more significant because of the pandemic.

“Conversely, 73% of respondents believe that global trade opportunities will either decrease or remain the same relative to pre-COVID expectations,” says Jason Troendle, director of market intelligence and research at the GCCA and author of the report “2020 COVID-19 Cold Chain Business Impact Survey Summary.” GCCA members store over 260 billion pounds of perishable foods each year, with an economic impact of $6.1 billion annually.

“Conversely, 73% of respondents believe that global trade opportunities will either decrease or remain the same relative to pre-COVID expectations,” says Jason Troendle, director of market intelligence and research at the GCCA and author of the report “2020 COVID-19 Cold Chain Business Impact Survey Summary.” GCCA members store over 260 billion pounds of perishable foods each year, with an economic impact of $6.1 billion annually.

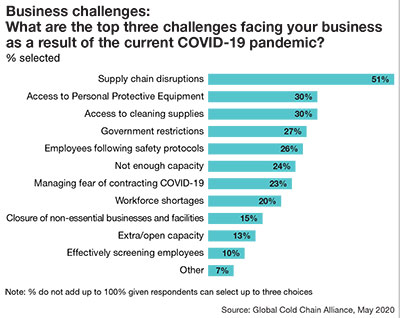

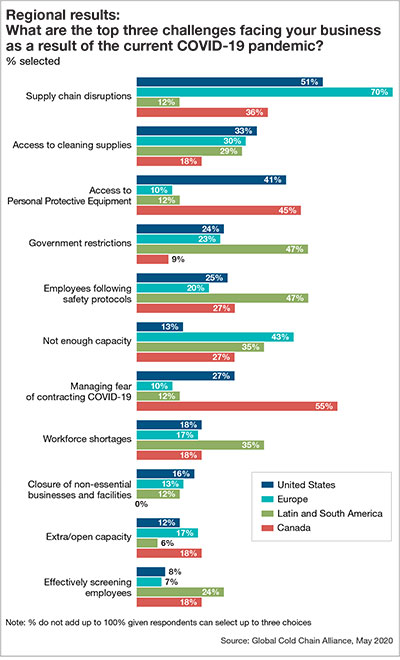

According to Troendle’s findings, near shoring and onshoring will gain traction over the next year, but he notes that the over 50% of respondents selected supply chain disruptions—keeping up with demand surge, slowdowns in food service, and production and manufacturing hurdles—as the biggest challenges in the cold chain.

Furthermore, the top COVID-19 response was to take extra measures to protect the workforce (e.g. staggered shifts, social distancing, remote working), while the next-highest issues were maintaining overall business continuity and workforce morale.

Comparing actual revenue for the first half of 2020 versus pre-crisis revenue expectations, 54% of all respondents reported some type of a decrease, 11% saw no change, and 35% reported an increase in revenue. Respondents believe the next six months may look very similar to the past few months.

Seafood: Blockchain enhances cold chain

IBM and the Norwegian Seafood Association recently announced a new cross-industry collaboration to use blockchain technology to share supply chain data throughout Norway’s seafood industry to provide safer, fresher seafood to consumers worldwide.

IBM and the Norwegian Seafood Association recently announced a new cross-industry collaboration to use blockchain technology to share supply chain data throughout Norway’s seafood industry to provide safer, fresher seafood to consumers worldwide.

Several Norwegian seafood companies are now in the process of putting data onto the network. One of these companies is Kvarøy Arctic, a leading provider of naturally sea farmed salmon, who will soon begin delivering products to leading retailers in the United States and Canada using the tracking and provenance technology.

BioMar, a leading provider of high-grade fish feed, has also joined the network allowing Nordic seafood companies to provide insight into the origin and quality of seafood as well as the quality of feed the fish consume.

“It’s important for our customers to know that the seafood they eat is not only safe but produced in a sustainable and healthy manner,” says Alf-Gøran Knutsen, CEO of Kvarøy Arctic. “Blockchain lets us share the fish’s journey from the ocean to the store. This is now more timely than ever, as consumers want more information about where the food they eat comes from.”

Norway exported more than 2.7 million tons of seafood in 2019—the equivalent of 25,000 meals per minute. At the same time, monitoring where the fish comes from, its growing and storage conditions, and reducing food waste remain of critical concern to seafood consumers who care deeply about sustainability.

“Norwegian seafood is known for its quality,” says Robert Eriksson, CEO of the Norwegian Seafood Association. “Yet we still don’t have the ability to trace where the fish came from, how it was grown or how it was stored.”

Eriksson adds that this technology partnership can help seafood producers create a “single version of the truth” about supply chain events, allowing consumers to trace their seafood products directly back to the source and enabling producers to tell stories about the products, where they come from, and how to prepare them.

“The private blockchain network records data about catch location and time, supply chain events like shipping updates and customs clearance, and even temperature, which can then be shared with permissioned parties,” concludes Eriksson.

In the meantime, approximately 80% of respondents indicated an increase in costs, with the most common uptick between a 1% to 5% increase. And respondents indicated access to PPE and cleaning as the top priorities they would like to see governments focused on, followed closely by financial support for employees as well as employers in the cold chain industry.

Finally, measures taken to reduce person-to-person contact to slow the spread of the virus caused operational changes across the cold chain. While these measures were done out of necessity, the changes also provided an opportunity to adjust or try new processes or controls that, if effective and efficient, may remain in place after the pandemic is over. Along those lines, 53% of respondents believe the percent of employees working remotely will increase.

Surprising findings

Among the surprises revealed in this research were that food services did not feel a significant impact in relation to other market segments—although, about 55% indicated at least some revenue loss due to the pandemic.

Among the surprises revealed in this research were that food services did not feel a significant impact in relation to other market segments—although, about 55% indicated at least some revenue loss due to the pandemic.

“Across revenue for distribution, retail, food service, and food processing warehouse respondents, we would have anticipated food service members being more significantly impacted, but only observed them as slightly more impacted than other market segments,” says Troendle. “Our members were very optimistic about the future of the industry, with 57% believing the pandemic will increase the expected growth rate of the cold chain industry compared to only 6% believing it would decrease the rate of growth.”

Although researchers did not specifically ask about technological solutions for COVID, the number one priority in terms of a response to the pandemic was workforce protection such as staggered shifts, physical distancing, and remote working.

“This was reinforced by the fact that many members identified as one of the top three options access to personal protective equipment and cleaning supplies,” says Troendle. “We have also heard across some additional calls that touchless timecard systems, temperature or self-check screening has been utilized.”

On another positive note, Troendle notes that cold chain shippers are constantly finding ways to increase value to their end consumers and a market disruption provides the opportunity for them to continue to demonstrate that they’re a critical role in the food supply chain.

“Seventy-four percent predict an increase in e-commerce and direct to consumer delivery of temperature-controlled product,” Troendle says, “and 33% of respondents stated that they believe they will see an increased diversity within their customer base in the future as a result of pandemic. Only 3% indicated that customer diversity would decrease post-pandemic.”

According to Troendle, the main takeaway for the GCCA is this: Twenty-seven percent of respondents reported that they see an opportunity to increase the range of value-added services to their customers, while only 3% expect the range of value-added services to decrease.

Cold Chain Performs in a Crisis

With the ongoing pandemic crisis, it’s heartening to learn that new strides in supply chain management are being made by leading providers of national distribution services.

At the forefront of this effort is the American Logistics Aid Network (ALAN) that has been aiding the Arkansas Foodbank by giving it over 2 million extra pounds of perishable and non-perishable food donated by suddenly overstocked restaurant suppliers.

Core-Mark’s regional distribution center in Forrest City, Ark., is donating the use of several of its drivers, trucks and temperature-controlled trailers to deliver the donated food.

Currently, the Core-Mark team regularly transports the donated food from Arkansas Foodbank’s warehouse in Little Rock to food pantries, soup kitchens, churches and other centers in a 33-county service area.

“Climate-controlled units and transportation services are always hugely valuable commodities, but especially at times like these when so many additional families need food,” says Kathy Fulton, the executive director of ALAN. “We’re so pleased when Core-Mark agreed to assist with this project, and we are grateful for their partnership and commitment to serving communities in need.”

In a recent interview with Logistics Management, Fulton, shared these insights on the current state of cold chain services.

Logistics Management (LM): How have your members leveraged new cold chain services to reach those most in need?

Kathy Fulton: Certainly not new technology, but refrigerated technology is playing a huge role right now. The majority of products at food banks and pantries are shelf stable, and the facilities have small amounts of chilled or frozen space.

The products being distributed by USDA programs like Coronavirus Food Assistance Program are primarily perishables like proteins, dairy, and fruits and vegetables. The need for temporary cold storage—whether in refrigerated trailers, containers or available warehouse space—has increased dramatically during the pandemic.

LM: Where does quality infrastructure play the biggest role?

Fulton: During the height of the stay-at-home orders, it was very interesting to talk with shippers and transportation providers who loved the lack of traffic on roadways. For those who needed to transit areas that are notorious transportation bottlenecks, the reduced congestion increased the velocity of their supply chains.

LM: How has ALAN’s past performance helped during this current emergency?

Fulton: When you consider the extreme demand spikes for many products, that probably helped keep some of the more fragile supply chains from even more distruption. We already know our supply chains struggle when we have a weather-related disaster that increases demand, but closes roads and bridges, and power, water, wastewater, and other public infrastructure.

LM: So what do you regard as “the perfect storm?”

Fulton: Those traditional disasters are typically isolated to a geographic region. If we have some type of additional stressor with supply chains everywhere still stretched as they are due to the pandemic, it causes infrastructure challenges and we won’t be able to surge support from elsewhere. Suddenly a disaster becomes a truly catastrophic scenario.

Article Topics

Motor Freight News & Resources

XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates Preliminary March North America Class 8 net orders see declines National diesel average heads down for first time in three weeks, reports EIA Trucking industry balks at new Biden administration rule on electric trucks: ‘Entirely unachievable’ New Breakthrough ‘State of Transportation’ report cites various challenges for shippers and carriers in 2024 More Motor FreightLatest in Logistics

Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources