Cold Chain: Despite challenges, continues to evolve

Gone are the days when cold chain shippers could rely on consistent, reliable supply chains and solid customer import forecasts. Today, temperature-controlled service providers are making massive investments in facilities, locations and automation to ease the strain and bring back a level of dependability.

Like other aspects of the supply chain, cold chain managers continue to face many challenges that include rising costs, tight container capacity, and limited warehouse space. Retailer, food supply distributors, and manufacturers all have been stretched by the pandemic and are under pressure to make sure the right product is in the right place at the right time.

“Over the last two years, the cost of an individual import container has skyrocketed, and the ancillary costs associated with importing—such as demurrage, per diem, chassis and fuel—have also risen and contributed to declining margins,” says Kevin Daly, chief commercial officer at East Coast Warehouse & Distribution.

For many years, firms relied on consistent and reliable supply chains and solid customer import forecasts. However, today companies find it difficult to make forecasts given difficulties in making container bookings. Contributing to these problems are the number of container ships at anchor, particularly off the West Coast.

“They are waiting longer to unload,” says Daly. “And when space does become available, importers are taking what they can to get their products into the United States, regardless of the port of entry.” And as a result, warehouse space is at a premium and limited especially in and around seaports.

“Available warehouse space at ports is almost nonexistent,” adds Daly. “Importers are having to look further inland to solve their warehousing needs, which presents additional challenges and costs.” Those include traffic congestion and truck driver shortages. And this leads to orders not being shipped and delivered on time, resulting in out-of-stock items on grocery stores’ shelves—a story all too common over the last couple years.

Shifting demands

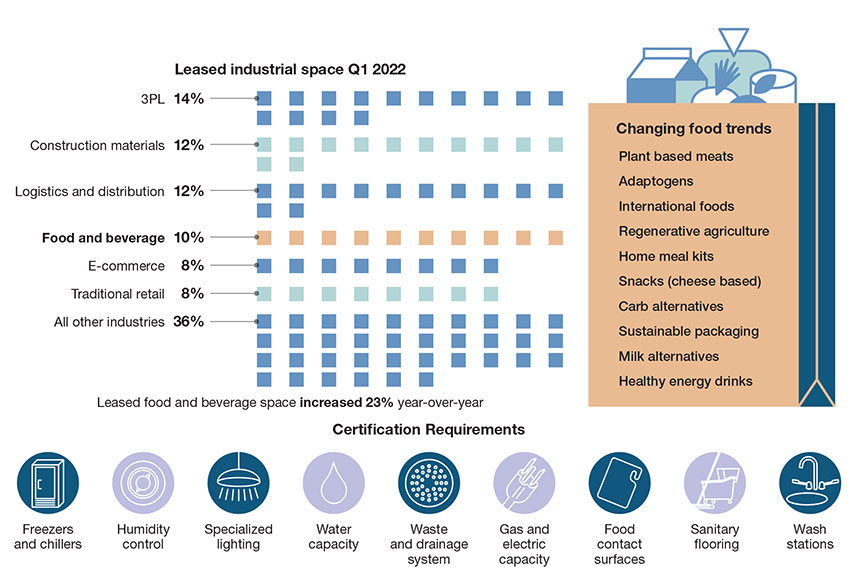

Meanwhile, other dynamics are taking place. “Consumers are shifting to fresh, not frozen, and processors are adding more and more space to their operations,” says Ken Reiff, co-lead of Cushman & Wakefield’s Food and Beverage Group.

An example is Tyson’s recent $90 million expansion of its poultry processing plant in Forest, Miss., a location that aims to increase the company’s capacity to serve a growing global consumer base. “Chicken sales are going through the roof,” says Reiff. “All different types of chicken are going through grocery stores, restaurants, and fast-food establishments—and it’s hard to keep up with.”

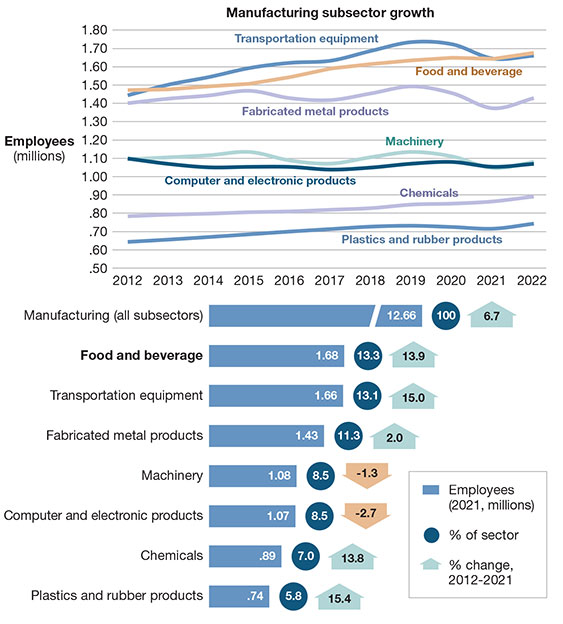

Chad Buch, research manager, industrial, at global commercial real estate services company JLL, finds that consumer demand for meat, seafood and for fresh, organic, exotic and prepared foods as well as traditional staples like frozen French fries and pizza are also driving demand for refrigerated warehouse space. In fact, JLL research indicates that food and beverage is now the largest manufacturing sector in the United States.

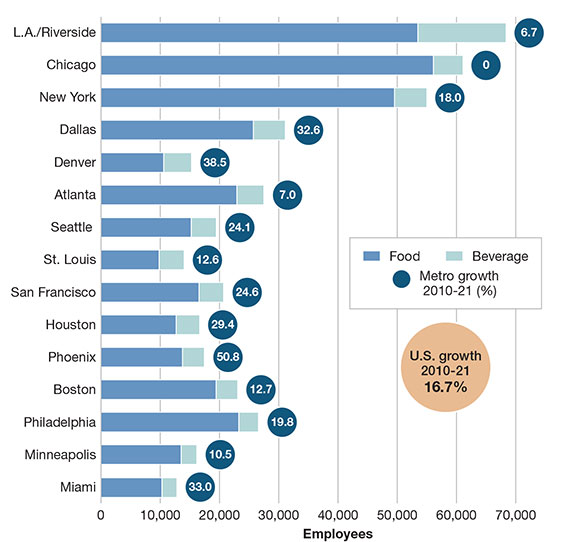

“In addition, consumer spending is growing in the restaurant sector,” Buch says. “Restaurant suppliers are also a strong source of demand for refrigerated warehouse space.” Not surprising, recent JLL research also shows that the largest markets for food and beverage are in key population centers.

Food and beverage is now the largest manufacturing subsector in the United States

Consequently, warehouse services executives see the warehouse market continuing to grow, but not as linearly as it has in past years. “The growth can be hard to recognize with all the bunching of import containers and varying supply chain priorities as manufacturers work to ensure that they have ample inventory for the upcoming peak season,” adds Daly.

More speculative space

Real estate experts note how construction for new cold storage warehouses has leveled off. “It was hot a couple of years ago, but has calmed down from the panic when everyone was trying to solve supply chain issues during the pandemic,” says Reiff.

Christopher Copenhaver, also co-lead of the Food and Beverage Group at Cushman & Wakefield, agrees with Reiff’s assessment. “The demand is steady instead of peaking and dropping, peaking and dropping,” he says.

On top of this, much of today’s inventory of cold chain warehouse space is rapidly aging due to new innovations and other issues that make the space increasingly difficult and costly to build. “A lot of companies have spent their capital expanding warehouses and building new ones,” Copenhaver says.

Consequently, much of today’s development has shifted to speculative space that’s not being built for a specific customer, but can be adapted for several uses requiring variations of refrigeration and freezer areas. “As a result, big projects are underway,” adds Copenhaver.

Chicago, N.Y. and L.A. are the largest centers for the food and beverage industry–Sun Belt metros are the fastest growing

According to Cushman and Wakefield, the strongest markets are in core population centers such as New Jersey and the New York Metro area; Dallas/Fort Worth; Columbus, Ohio; Pennsylvania’s Lehigh Valley; Phoenix; and California.

Several developers are active in the cold storage real estate market. “Saxum, Karis Cold Storage, and Scout Cold are the three most successful,” says Copenhaver. “Saxum is the largest with the other two on its heels.”

On July 21, Arcadia Cold Storage and Logistics broke ground on a property purchased from Saxum—a 227,500-square-foot distribution center in Hazleton, Pa. The facility will offer 30,884 pallet positions, an inside temperature ranging from -10 degrees to 38 degrees, along with convertible rooms, dock space and doors to manage an array of distribution and fulfillment services. Arcadia reports that the facility is being built to accommodate food manufacturers, retailers and foodservice companies looking for consolidation opportunities to reduce transportation costs.

However, competing market dynamics continue to afflict the industry. Broad-based demand for cold storage capacity is being offset by rising interest rates and higher construction costs.

“The question is what price the market will pay for additional capacity,” says Mathew Moore, vice president of market development at Americold, one of the leading temperature-controlled warehousing and transportation companies in the U.S. “Rising interest rates will reduce the attractiveness of spec building due to increasing costs to build and the decreasing value of assets once they are built.”

Food and beverage is one of the top five industries driving heightened demand for industrial space

From an investment standpoint, Moore maintains that dedicated facilities with long-term customer commitments—which is Americold’s core business—will continue to be attractive because they’re more insulated from interest rates and inflation.

“What’s unique about our business is we service both suppliers and distributors,” Moore says. “This means understanding their businesses and supply chains to ensure that food moves safely and efficiently to its next destination. We’re continually investing in our people and developing a culture and environment that allows us to attract and retain the best talent.”

M&A is the way to grow

Companies are also finding that by expanding via mergers and acquisition (M&A), they can better serve customers across the nation. “It’s faster to acquire smaller regional distributors and plug holes in distribution systems through M&As than build more facilities,” says Reiff.

Large cold chain companies such as Lineage Logistics and Americold have been especially active in M&As. “Indeed, the bigger players are getting bigger,” Reiff adds.

For example, during 2021, Americold completed approximately $766 million of acquisitions and added 14 facilities totaling 66 million cubic feet to its global network, including Liberty Freezers in Canada, Bowman Stores in the UK, KMT Brrr! and Newark Facility Management in New Jersey, ColdCo Logistics in Missouri, and Lago Cold Stores in Australia.

“We also announced approximately $168 million of expansion and developments, including projects in Atlanta; Dunkirk, N.Y.; Dublin, Ireland; Spearwood, Australia; and Barcelona providing additional visibility for cash flow growth in the coming years as these projects are completed and brought online,” wrote Americold CEO and Trustee George Chappelle Jr. in a recent shareholders statement.

Automation remains hot

And besides warehousing space, expensive state-of-the-art automation systems are essential to ensure food safety and quality and to keep overhead costs as low as possible. This includes automation solutions such as palletizers, automated storage and retrieval systems (ASRS), conveyors, automated picking solutions, and more.

Large cold storage companies such as Americold and Lineage continue to build sophisticated automated warehouses that require much capital. “They’re mostly building these projects for themselves,” says Copenhaver. “Very few are speculative.”

One such facility is the fully automated, next-generation distribution center in Olathe, Kan., designed and built by Lineage Logistics for Smithfield Foods. The facility, which opened this April, features industry-leading technology that combines innovations in robotics, numerical simulation, thermodynamics,

algorithms, computer vision and software to enable reliable and efficient access to food. The DC spans nearly 20 million cubic feet with more than 62,000 pallet positions. At its core are 18 automated cranes that move inventory into, out of and within the facility.

Sustainability in cold chain is now top priority

Technology is hot, but sustainability is now critical to cold storage developers and operators as companies confront costs, set energy use goals, and seek ways to operate at top efficiency.

Temperature-controlled service provider United States Cold Storage (USCS) recently posted that sustainability is “achieved through state-of-the-art warehouse design and construction, the use of eco-friendly refrigeration technology, and utilization of energy efficiency materials and technologies.”

The company states that its goal is to be “best in cold” while achieving a 1.5% year-over-year reduction in its carbon footprint.

“A lot of corporations are trying to be good ‘green’ corporate citizens,” notes Christopher Copenhaver, a co-lead of Food and Beverage Group at Cushman & Wakefield. “Environmental, Social and Governance [ESG] investing is the new priority for investors and investor funds, and companies need to have those systems in place.”

Over the past five years, USCS reports that it has reduced its greenhouse gas (GHG) emissions by 12% while increasing its cubic capacity by 31%.

Last year, 203 Americold sites were recognized for driving energy excellence in temperature-controlled warehousing by the Global Cold Chain Alliance (GCCA) under its Energy Excellence Recognition Program.

GCCA developed and launched the program to focus on motivating refrigerated warehouse operators to establish, maintain and enhance their “energy conservation culture.” According to GCCA, warehouse energy usage is the second highest cost in the cold storage industry behind labor.

The DC also features one of the largest temperature-controlled, layer-picking systems in the world. Layer-pickers disassemble and reassemble pallets of goods, a process previously performed manually. As a result, the robotics and software fully automate more than 97% of the product movement through the facility.

In addition, Lineage has installed its patented blast cell technology that reduces freeze time and energy use by approximately one-half relative to traditional blast cells. This aligns with Smithfield’s sustainability, customer satisfaction and efficiency goals. Smithfield has pledged to become carbon negative, reduce GHG emissions 30% and halve food waste in its U.S. company owned operations by 2030.

Article Topics

Transportation Trends News & Resources

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources Transportation Best Practices/Trends: Private fleet growth soars Cold Chain: Despite challenges, continues to evolve Freight Audit and Payment Update: Take what you need 2018 Ocean Cargo Roundtable: Unsettled seas Trucking Regulations: Washington U-Turns; States put hammer down Transportation Trends and Best Practices: The Battle for the Last Mile More Transportation TrendsLatest in Logistics

Amid ongoing unexpected events, supply chains continue to readjust and adapt Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources