Emerging Markets: Infrastructure in a post-COVID world

There’s renewed optimism for global trade with the pandemic waning and borders beginning to open. Because of this upbeat projection, companies are continuing to invest in emerging markets—and those regions are getting ready for increasing volumes.

As the world begins to recover from the global COVID-19 pandemic, trade barriers, labor shortages, and now shortages in raw materials continue to be risks to the global supply chain. With many countries now opening again, new trade lanes will become exponentially more important in the global economy.

Expansion of emerging markets had occurred prior to the pandemic, thanks to increased access to capital and more robust automation systems. Despite the struggles over the past 18 months from the contraction of the global economy due to COVID-19, the “global logistics market has reached $5.2 trillion in 2020 and is expected to reach $6.9 trillion USD by 2026,” according to a recent report by IMARC Group.

The impact of the COVID-19 pandemic on annual logistics growth rates within emerging market countries has turned out to be unique across the board. E-commerce increased 13% during 2020, however both the Eurozone and Asian economies contracted by 7% and 2.6% respectively.

With continued focus on infrastructure development, as people get back to work, projections will likely continue to show good growth. In the United States, GDP reduced approximately 4.9%, which pales in comparison to China’s rise in GDP of 1.9% during that period. Additionally, contract logistics shrunk approximately 3.7% in 2020.

Companies are looking to expand and are now seeking top-tier talent as the global economy continues to recover from the disruptions of 2020. There’s renewed optimism for global trade, with the pandemic seemingly waning and borders beginning to open up. And because of this up beat projection, companies are continuing to invest in emerging markets.

Thailand

To meet these demands, countries are revising their plans for their logistics infrastructure for the future. As an example, Thailand has been able to improve access to domestic market growth, considering the current global trade environment. At the end of 2020, the pandemic “affected both imports and exports negatively, and this led imports to fall by 12.4% and exports to contract to 6.01%,” according to the Thailand Board of Investment.

Vietnam

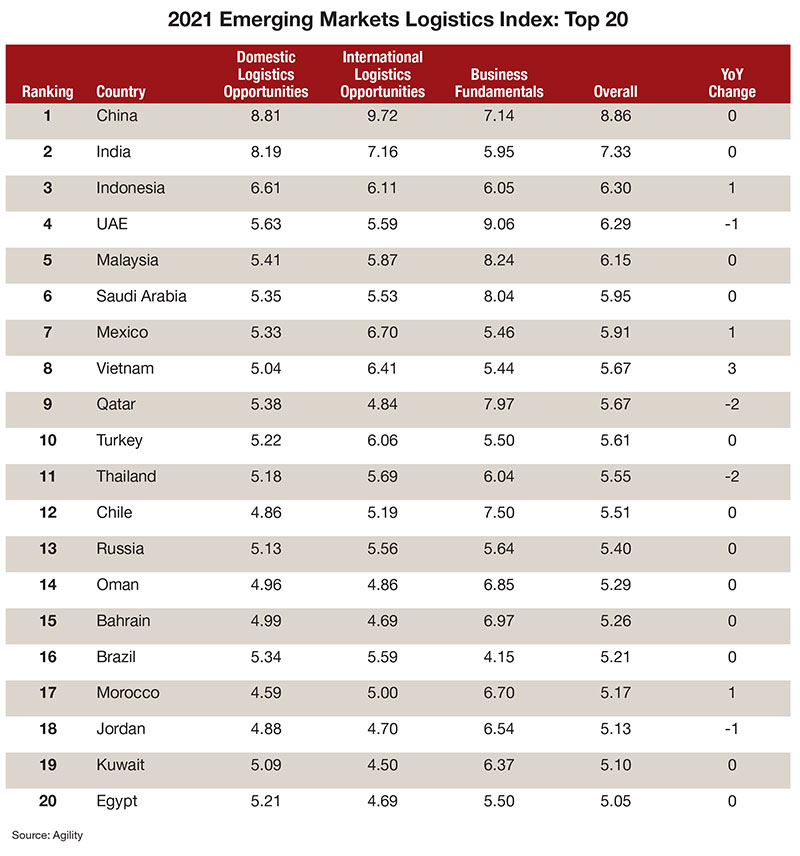

The growth in online shopping, which has increased exponentially in 2020, has required countries in emerging markets to improve their logistics infrastructure. For instance, Vietnam has continued to invest and expand their roads, bridges, railways and ports. Because of the added expansion, Vietnam fared quite well during the pandemic lockdowns, with global third-party logistics provider Agility raising the country’s rankings on their Emerging

Markets Logistics Index to 8th overall.

Mexico

Mexico was affected quite significantly during COVID-19. According to Mexico Business News, “the country has been in recession since 2019, and, in 2020, lapsed into its steepest decline since the 1930s.” This led the Mexican economy to contract 8.6% in 2020. Overall, the sentiment for Mexico is that the worst is behind them, and due to technological advancement and the partnership with their North American neighbors through the new United States-Mexico-Canada Agreement (USMCA) agreement, they anticipate growth for 2021 to be near 5.3%.

India

According to recent data from the India Brand Equity Foundation, India is continuing to improve road and highway infrastructure with an increase in spending over the original announced investment of $777.7 billion for infrastructure improvements by 2022. And opportunities still abound for outside investment in India related to road and highway infrastructure development.

Government policies such as the “Housing For All” and “Smart City Mission” have attracted investments from major global investment groups. The Indian government is still prioritizing a strong infrastructure growth plan that includes urban transport development, as well as highway infrastructure improvements. Post pandemic results for India came in with expansion of relocated supply chains of approximately 17.4%, which led a strong rebound and allowed Asia-Pacific countries opportunity to recover by the end of 2021.

Indonesia

Indonesia’s infrastructure development in railways, warehousing and transport logistics investment continued throughout 2020, despite corrections in the estimated growth rate. Demand for domestic trucking has continued to favor growth and expansion of international and ocean freight movement in Indonesia.

These trends yielded increases in e-commerce markets, making the major opportunity through the pandemic contraction period. This trend grew e-payments 122.16% in Indonesia in 2020. With infrastructure reforms made over the past five years, Indonesia reduced its logistics costs from 27% in 2015 to 22% in 2020. Therefore, while the market contraction affected the region, Indonesia’s infrastructure development allowed them to move to an e-commerce fulfillment model quickly and the region is poised to rebound from the contraction in 2021.

Malaysia

Malaysia has seen a similar experience to that of Indonesia, as road freight transport has seen an increase in utilization. Despite COVID, Malaysia sees expansion and infrastructure development going forward. Over the last year, these developments in the e-commerce fulfillment marketplace have improved Malaysia’s standing on the Agility index to No. 5.

With the diversification of supply markets due to disruptions in supply out of China, Malaysia has been on the top of the list for companies wanting to ensure security of supply throughout the region. In addition to the advent of digital tools and technology adoption of e-commerce and fulfillment platforms, these trends seem likely to continue for the foreseeable future.

Looking ahead

After experiencing the COVID-19 impact in 2020 and early 2021, the logistics industry does not foresee a global economic recovery until 2022 or beyond, despite an expectation that Asia, North America and Europe will rebound this year from the downturn triggered by the pandemic.

Overall, the common theme of the global logistics industry is that COVID-19 has affected growth. With the increase in global vaccinations and decrease in new cases, development continues to move forward as emerging markets continue to put a significant amount of investment into infrastructure of roads, railways, maritime and ports. The Trade Blocs Act and an increased investment in technology has also enabled cross-border commerce, which in turn has created an opportunity to reduce transport and associated logistics costs.

With shippers pivoting toward more and more emerging markets, supply chains need to be redesigned with economic diversification in mind. And according to a recent report from the Oxford Business Group, “this diversification has proven important not only in terms of GDP makeup, but also for trade routes and supply chains.”

The question remains: Will the pace of diversification and modernization be effective enough to minimize trade imbalances, reduce economic headwinds and avoid significantly increasing supply chain complexity leading to lengthier and costlier global trade?

Article Topics

Global Trade News & Resources

UPS reports first quarter earnings decline Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations Descartes announces acquisition of OCR Services Inc. More Global TradeLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources